|

市場調查報告書

商品編碼

1636208

亞太地區塑膠廢棄物管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia-Pacific Plastic Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

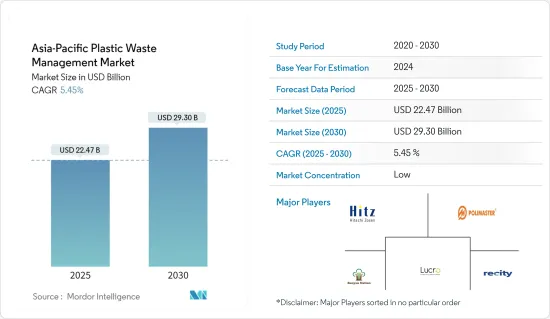

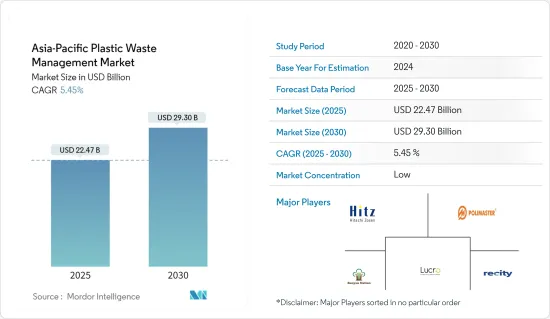

預計2025年亞太地區塑膠廢棄物管理市場規模為224.7億美元,2030年達293億美元,預測期間(2025-2030年)複合年成長率為5.45%。

亞太地區快速的都市化和工業擴張正在推動塑膠消費和廢棄物產生的急劇增加。特別是中國和印度等國家的都市區是塑膠廢棄物的主要來源。亞太地區各國政府正採取越來越嚴格的措施來應對。這包括禁止使用一次性塑膠、引入生產者延伸責任 (EPR) 計劃以及鼓勵回收的獎勵。例如,中國實施了塑膠廢棄物進口禁令,印度也推出了自己的塑膠廢棄物管理法規。

從先進的分類系統到化學回收再到生物分解性的回收,回收技術的進步正在重塑塑膠廢棄物管理的模式。同時,數位廢棄物追蹤和管理解決方案的採用趨勢正在增加。隨著社會越來越意識到塑膠污染帶來的環境問題,消費者需要更永續的產品和負責任的廢棄物管理。因此,公司正在做出更環保的努力,並大力投資回收基礎設施。

亞太地區塑膠廢棄物管理市場的經濟潛力巨大,特別是在收集、分離、回收和廢棄物轉化能源技術等領域。因此,對回收基礎設施和廢棄物管理設施的投資正在增加。然而,一些亞太國家仍面臨挑戰,包括廢棄物管理基礎設施不足、回收率低以及廢棄物普遍存在。應對這些挑戰需要基礎設施升級並提高公眾對廢棄物分類的認知和承諾。

亞太地區塑膠廢棄物管理市場趨勢

快速都市化加劇了亞太地區的塑膠問題

擁有約 40 億人口的亞太地區 (APAC) 正在經歷快速都市化,加劇了日益嚴重的塑膠問題。根據聯合國報告,亞太地區已有 28 個特大城市,估計每天有 12 萬人搬遷到該地區的都市區。據預測,到 2050 年,亞太地區將有 33 億人居住在城市。這一波都市化正在刺激消費,並急劇增加對一次性包裝的需求,特別是在軟質塑膠領域。如果這一趨勢持續下去,到 2030 年,亞太地區將產生 1.4 億噸塑膠廢棄物。

鑑於世界上許多人口最多的國家都位於亞太地區,快速的都市化伴隨著生活方式的改變和對包裝商品日益成長的需求。包裝的靈活性已成為亞太地區的關鍵問題。相關成本較低,增強了該地區生產(尤其是食品業)的吸引力。 2023年,亞太地區佔據軟包裝市場52.2%的佔有率。 Uflex 和 Fuji Seal International 等著名公司正在加強該行業在該地區的地位。亞太地區對一次性塑膠包裝的偏好,特別是小袋和小袋包裝(例如印度的單份水包裝),很大程度上是由於這些材料提供的成本優勢。

印尼的一次性塑膠袋案例清楚地說明了亞太地區法規的有效性。在23個城市試驗成功後,雅加達於2020年7月實施了全面禁止塑膠購物袋的政策。儘管最初遭到企業的反對,但這些規定得到了維持,違規者現在面臨罰款,屢犯者面臨吊銷許可證的風險。

報告的結果顯示禁令的成功。 2018年,雅加達每年的塑膠購物袋消費量估計為240-3億個。到 2021 年,這一消費量下降了 42%,從 11,192 噸減少到 6,452 噸。

在全球範圍內,孟加拉率先在2002年實施了全國範圍內的塑膠購物袋禁令。中國於 2020 年開始實施禁令,最終階段定於 2025 年。印度也加入了這項運動,將於 2022 年實施一次性塑膠禁令。

儘管取得了這些進步,亞太地區部分地區仍難以跟上。根據韓國零廢棄物運動網的報告顯示,韓國每年消耗190億個塑膠購物袋。另一方面,根據泰國政府的調查,每年大約消耗2000億個塑膠購物袋,這意味著每人平均每天消耗8個塑膠購物袋。海洋保護協會將泰國列為世界第六大海洋廢棄物排放。

總之,儘管亞太地區國家在塑膠監管方面取得了重大進展,但該地區仍需要克服塑膠消費和廢棄物管理方面的重大挑戰。嚴格的執法和創新的解決方案對於解決這個問題至關重要,特別是考慮到該地區快速的都市化。

中國在廢棄物管理方面取得了長足進步

2023年,由浙江省6000多名個人和200家企業主導的一項中國計劃因其在解決海洋塑膠廢棄物上的突破而被授予聯合國環境最高獎。該計劃使海洋塑膠回收過程更加透明,幫助當地漁民,並顯著減少沿海水域的污染。自計劃啟動以來,已有超過61,600人參與,收集了約10,936噸海洋垃圾。

中國對廢棄物管理的承諾透過對基礎設施和技術的大量投資可見一斑。我們正在努力減輕垃圾掩埋場的負擔,包括廢棄物焚化發電廠和最先進的回收中心。中國東部的浙江省宣布了浙江省外帶塑膠廢棄物零計劃,旨在減少和回收外帶塑膠。該舉措旨在2023年終建立食品配送塑膠「零廢棄物」模式,特別是在大學等關鍵部門。到 2025 年,這個模式將推廣到學校、商業空間和當地社區。

浙江的策略包括協同努力,聯合宅配平台、商家、大學、廢棄物處理公司和回收協會等相關人員,形成反對馬蘇宅配塑膠垃圾的統一戰線。浙江還計劃在塑膠垃圾高發地區設立廢棄物收集設施,並將要求宅配平台在大學宿舍、咖啡簡餐店等場所設置此類設施並進行維護。

總體而言,中國解決廢棄物問題的努力體現了中國在應對塑膠污染方面的創新和協作努力,浙江省的零塑膠廢棄物計畫就反映了這一點。這些舉措具有開創性,為更廣泛的亞太地區制定了藍圖。

亞太地區塑膠廢棄物管理產業概覽

亞太地區塑膠廢棄物管理市場高度分散,既有本地企業,也有全球企業。這種多樣性是由於各國獨特的廢棄物管理要求和法規結構不同而造成的。該領域的主要企業有日立造船、Polimaster、Banyan Nation、Lucro、Recity等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 塑膠消費量增加

- 加強法規和政策以減少塑膠廢棄物

- 市場限制因素

- 與建立和維護設施相關的高成本

- 市場機會

- 回收技術創新

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- PESTLE分析

- 對市場創新的見解

第5章市場區隔

- 由聚合物

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚氯乙烯(PVC)

- 對苯二甲酸酯 (PET)

- 其他聚合物

- 按來源

- 住宅

- 商業的

- 工業的

- 其他(建築、醫療保健等)

- 透過加工

- 回收

- 化學處理

- 垃圾掩埋場

- 其他加工

- 按國家/地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

第6章 競爭狀況

- Market Concetration Overview

- 公司簡介

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc.

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co. Ltd

第7章 未來趨勢

The Asia-Pacific Plastic Waste Management Market size is estimated at USD 22.47 billion in 2025, and is expected to reach USD 29.30 billion by 2030, at a CAGR of 5.45% during the forecast period (2025-2030).

Rapid urbanization and industrial expansion in Asia-Pacific are fueling a surge in plastic consumption and waste production. Notably, urban centers in countries like China and India stand out as primary plastic waste generators. Governments in the APAC region are responding with increasingly stringent measures. These include bans on single-use plastics, the introduction of extended producer responsibility (EPR) programs, and incentives to promote recycling. For instance, China has enforced a ban on plastic waste imports, while India has rolled out its own set of plastic waste management regulations.

Technological advancements in recycling, spanning from sophisticated sorting systems to chemical and biodegradable recycling methods, are reshaping the plastic waste management landscape. Simultaneously, there is a rising trend in adopting digital waste tracking and management solutions. As public awareness of environmental issues surrounding plastic pollution grows, consumers demand more sustainable products and responsible waste management. This, in turn, pushes companies toward eco-friendly practices and substantial investments in recycling infrastructure.

The economic potential of the plastic waste management market in Asia-Pacific is vast, especially in areas like collection, sorting, recycling, and waste-to-energy technologies. As a result, investments in recycling infrastructure and waste management facilities are rising. However, challenges persist, including inadequate waste management infrastructure in several APAC nations, low recycling rates, and the prevalence of mixed and contaminated plastic waste. Addressing these challenges will require infrastructure upgrades and heightened public awareness and engagement in waste segregation.

Asia-Pacific Plastic Waste Management Market Trends

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

With a population of approximately 4 billion, Asia-Pacific (APAC) is witnessing rapid urbanization, exacerbating its escalating plastic predicament. A UN report highlights that APAC already hosts 28 megacities, and an estimated 120,000 individuals are relocating to urban centers in the region daily. Projections suggest that a staggering 3.3 billion people will live in cities in Asia-Pacific by the year 2050. This surge in urbanization has fueled consumption, notably spiking the demand for single-use packaging, especially in the flexible plastic segment. If the current trajectory persists, APAC is set to generate a colossal 140 million tonnes of plastic waste by 2030.

Given that many of the world's most populous countries reside in the APAC region, the surge in urbanization is accompanied by shifting lifestyles and heightened appetites for packaged goods. Flexibility in packaging emerges as a focal concern in APAC. The region's allure for production, especially in the food sector, is bolstered by its lower associated costs. In 2023, APAC commanded a 52.2% share in the flexible packaging market. Noteworthy players like Uflex and Fuji Seal International fortify the industry's standing in the region. APAC's penchant for single-use plastic packaging, notably in pouches and sachets (e.g., single-serve water packages in India), is largely due to the cost advantage these materials offer.

The case of single-use plastic bags in Indonesia vividly illustrates the efficacy of APAC regulations. Following a successful trial in 23 cities and municipalities, Jakarta enforced a blanket ban on plastic bags in July 2020. Despite initial pushback from businesses, the regulation was upheld, with non-compliant companies facing fines and repeat offenders risking permit revocation.

The reported results indicate the ban's success. In 2018, Jakarta consumed an estimated 240-300 million plastic bags annually. By 2021, this consumption had dropped by 42%, from 11,192 tons to 6,452 tons.

On a global scale, Bangladesh led the way by implementing a national plastic bag ban in 2002. China initiated its ban in 2020, with the final phase set for 2025. India also joined the movement, implementing a ban on single-use plastics in 2022.

Despite these advancements, parts of the Asia-Pacific (APAC) region are struggling to keep pace. South Korea consumes a staggering 19 billion plastic bags each year, as reported by the Korea Zero Waste Movement Network. Meanwhile, Thailand's government survey revealed an annual consumption of around 200 billion plastic bags, translating to an average of eight bags per citizen per day. The Ocean Conservancy highlights Thailand as the sixth-largest contributor to global marine waste.

The conclusion is that despite notable progress in plastic regulation across various APAC nations, the region still needs to overcome significant plastic consumption and waste management challenges. Stringent enforcement and innovative solutions are imperative to address this, especially given the region's rapid urbanization.

China is Making Strides in Waste Management

In 2023, China's initiative, spearheaded by over 6,000 individuals and 200+ enterprises from Zhejiang, clinched the UN's top environmental accolade for its strides in tackling marine plastic waste. The program offers a transparent view of marine plastics' recycling journey, aiding local fishermen and notably curbing pollution in coastal waters. Since its inception, the project has engaged over 61,600 participants and collected approximately 10,936 tons of marine debris, 2,254 tons of which were plastic waste.

China's commitment to waste management is evident through substantial investments in infrastructure and technology. The nation is pioneering initiatives like waste-to-energy plants and cutting-edge recycling centers to slash landfill contributions. Zhejiang Province in eastern China unveiled the "Zhejiang Food Delivery Plastic Zero Waste Program," targeting reducing and recycling plastics used in food delivery. The initiative was aimed at establishing a "zero waste" model for food delivery plastics in key sectors, notably universities, by the end of 2023. By 2025, this model will be rolled out across schools, commercial spaces, and communities.

Zhejiang's strategy involves a collaborative effort, uniting stakeholders like food delivery platforms, merchants, universities, disposal firms, and recycling associations to form a unified front against plastic waste in food delivery. Zhejiang also plans to install waste collection facilities in areas with heightened plastic waste, tasking food delivery platforms with setting up these facilities in locations like university dorms and cafeterias, with the universities handling their maintenance.

Overall, China's commitment to tackling waste, which is evident in Zhejiang's "Plastic Zero Waste Program," showcases the nation's innovative and collaborative efforts to combat plastic pollution. These initiatives are pioneering and establishing a blueprint for the broader APAC region.

Asia-Pacific Plastic Waste Management Industry Overview

In Asia-Pacific, the plastic waste management market is highly fragmented, featuring a mix of local and global players. This diversity stems from the unique waste management requirements and regulatory frameworks that vary from country to country. Some of the key players in this sector are Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, and Recity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Plastic Consumption

- 4.2.2 Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Establishing and Maintaining Facilities

- 4.4 Market Opportunities

- 4.4.1 Innovations in Recycling Technologies

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights into Technological Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Polymer

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene (PE)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Terephthalate (PET)

- 5.1.5 Other Polymers

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Other Sources (Construction, Healthcare, etc.)

- 5.3 By Treatment

- 5.3.1 Recycling

- 5.3.2 Chemical Treatment

- 5.3.3 Landfill

- 5.3.4 Other Treatments

- 5.4 By Country

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

- 5.4.4 Australia

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.2 Polimaster

- 6.2.3 Banyan Nation

- 6.2.4 Lucro

- 6.2.5 Recity

- 6.2.6 SUEZ

- 6.2.7 Waste Management Inc.

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.9 Plastic Bank

- 6.2.10 Agilyx

- 6.2.11 GreenTech Environmental Co. Ltd