|

市場調查報告書

商品編碼

1636206

北美電子廢棄物管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)North America E-Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

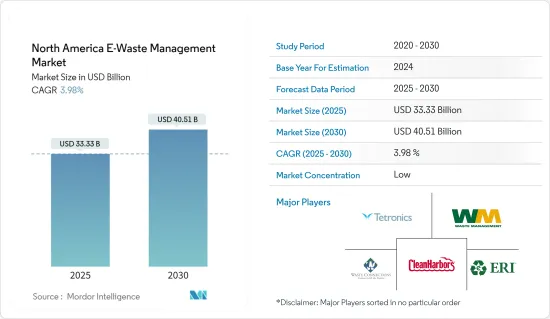

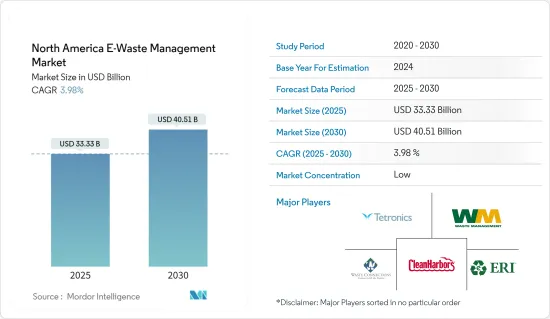

預計2025年北美電子廢棄物管理市場規模為333.3億美元,2030年將達405.1億美元,預測期間(2025-2030年)複合年成長率為3.98%。

北美正在透過加強回收技術和舉措來加強電子廢棄物管理。 2024 年 4 月,明尼蘇達州提案了一項修改電子廢棄物法的法案,著眼於為居民免費回收。該法案旨在透過對電子產品徵收 3.2% 的零售費來減少垃圾掩埋廢棄物並回收有價值的材料。

同時,企業正在增加電子廢棄物的回收和再利用,同時關注其碳排放。 2024 年 7 月,BetterWorld Technology 與 PCs for People 合作,加強電子廢棄物回收工作和社區外展,並強調遵守嚴格的環境規範。

戴爾 2024 年 3 月在西南偏南 (SXSW) 展會上的展示透過由電子廢棄物製成的令人印象深刻的 3D QR 碼安裝突出了這一趨勢。此安裝會將使用者引導至戴爾網頁,該網頁透過預付費運輸標籤簡化了回收流程。該公司還倡導戴爾和其他品牌產品的以舊換新和回收解決方案。

這樣的集體努力凸顯了北美地區對開創性回收解決方案的重視,同時專注於提高消費者意識和支持永續技術實踐。

北美電子廢棄物管理市場趨勢

美國優先考慮國內電子廢棄物回收以打擊仿冒品並加強安全

2022年,美國將排放約719萬噸電子廢棄物,成為全球第二大、北美第一大排放。環保署與國際政府和環境當局在電子廢棄物管理方面合作,以改善回收實踐。

2022 年《美國競爭法案》包括為國內半導體生產提供資金並禁止電子廢棄物出口。它納入了 HR3559《安全電子廢棄物出口和回收法案》(SEERA) 的要素,該法案旨在加強國內電子廢棄物回收,以應對氣候變遷、加強國家安全並促進美國經濟。

美國作為電子廢棄物主要生產國,正在提高回收能力,以防止假冒產品重新進入供應鏈,並避免向中國和其他國家出口電子廢棄物。關注國內回收將有助於降低與仿冒電子產品相關的風險,提高電子廢棄物管理產業的標準,並確保高效、安全的電子廢棄物處理。

SSC 推廣永續技術和電子廢棄物管理將促進加拿大的循環經濟

2022年加拿大廢棄物量將增加50萬噸,達到2,662萬噸的歷史新高。自 2023 年 10 月起,加拿大共享服務 (SSC) 致力於為加拿大政府僱員提供永續且安全的技術。 SSC 的行動裝置回收計畫著重於透過維修、再利用、回收和捐贈舊的商務用行動裝置來防止電子廢棄物進入垃圾掩埋場。

從 2022 年 4 月到 2023 年 8 月,Shinsei Servicer 向 Computers for Schools Plus (CFS+) 計畫捐贈了 3,000 多台設備,並翻新了 1,600 台設備以便在政府內部重複使用。 Shinsei Servicer 與專業電子回收商合作,安全地清除、修復和重複使用裝置。該舉措支持綠色政府策略,新服務商因其永續電子採購實踐而獲得了全球電子理事會的獎勵。

透過延長設備的生命週期,新興服務商正在減少對新設備的需求,最大限度地減少資源開採,減少電子廢棄物的數量,並為循環經濟做出貢獻。 SSC 致力於減少對環境的影響,刺激電子廢棄物管理市場的成長和創新,並推廣更永續、更有效率的電子廢棄物處理方法。

北美電子廢棄物管理產業概況

北美電子廢棄物管理市場的特點是有多個主要企業,每個參與者都為該行業的成長和永續做出了貢獻。作為最著名的廢棄物管理公司之一,Waste Management Inc. 憑藉其廣泛的回收服務和設施發揮著至關重要的作用。 Waste Connections 也是綜合廢棄物收集、清除和處置服務(包括電子廢棄物管理)的領先提供者。

Electronics Recycling International 和 Republic Services Inc. 致力於根據環境法規和消費者期望進行永續的電子廢棄物處理和負責任的處置。這些公司共同採用技術創新、策略夥伴關係、監管合規和消費者教育等策略來增強其電子廢棄物管理能力並鞏固其在北美的市場地位。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 科技趨勢

- 洞察供應鏈/價值鏈分析

- 產業監管洞察

- 洞察產業技術進步

第5章市場動態

- 市場促進因素

- 電子垃圾數量增加

- 嚴格的政府法規和政策

- 市場限制因素

- 電子廢棄物的複雜性

- 市場機會

- 企業責任

- 循環經濟舉措

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 依材料類型

- 金屬

- 塑膠

- 玻璃

- 其他材料

- 按來源類型

- 家用電子電器

- 工業電子

- 其他來源

- 按用途

- 垃圾

- 回收

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- Waste Management Inc.

- Waste Connections

- Clean Harbors Inc.

- Tetronics

- Electronics Recycling International

- Republic Services Inc.

- Veolia Group

- GEEP(Global Electric Electronic Processing)

- Avnet

- Sims Recycling Solutions*

- 其他公司

第8章 市場機會及未來趨勢

第9章 附錄

The North America E-Waste Management Market size is estimated at USD 33.33 billion in 2025, and is expected to reach USD 40.51 billion by 2030, at a CAGR of 3.98% during the forecast period (2025-2030).

North America is bolstering its e-waste management with enhanced recycling technologies and initiatives. In April 2024, Minnesota proposed a bill to revamp its e-waste laws, eyeing free recycling for residents. The bill plans to finance this through a 3.2% retail fee on electronics, aiming to curb landfill waste and salvage valuable materials.

Concurrently, businesses are ramping up e-waste recycling and refurbishing while keeping a keen eye on their carbon footprint. In July 2024, BetterWorld Technology joined forces with PCs for People, intensifying their e-waste recycling efforts and community outreach and emphasizing adherence to stringent environmental norms.

Highlighting this trend, Dell's March 2024 showcase at South By Southwest (SXSW) featured a striking 3D QR code installation crafted from e-waste. The installation guided users to a web page by DELL that streamlines the recycling process with prepaid shipping labels. The company also advocates for trade-in and recycling solutions for products from Dell and other brands.

These collective endeavors underscore North America's pivot toward pioneering recycling solutions, with a dual focus on bolstering consumer engagement and championing sustainable tech practices.

North America E-Waste Management Market Trends

United States Prioritizes Domestic E-waste Recycling to Tackle Counterfeiting and Boost Security

In 2022, the United States generated approximately 7.19 million metric tons of electronic waste, making it the second-largest producer globally and the highest in North America. The Environmental Protection Agency collaborates with international governments and environmental officials on e-waste management to improve recycling practices.

The America COMPETES Act of 2022 includes funding for domestic semiconductor production and bans e-waste exports. It incorporates elements from the H.R.3559 - Secure E-waste Export and Recycling Act (SEERA), which aims to combat climate change, enhance national security, and strengthen the US economy by promoting domestic e-waste recycling.

As a major producer of electronic waste, the United States is enhancing its recycling capacity to prevent counterfeit goods from reentering its supply chains and to avoid exporting e-waste to China and other countries. Focusing on domestic recycling will help mitigate the risks associated with counterfeit electronics and drive higher standards within the e-waste management industry, ensuring efficient and secure e-waste processing.

SSC's Push for Sustainable Tech and E-Waste Management Boosting Canada's Circular Economy

Waste disposal in Canada increased by 0.5 million tonnes in 2022, reaching a record high of 26.62 million tonnes. As of October 2023, Shared Services Canada (SSC) is dedicated to providing Government of Canada employees with sustainable and secure technology. SSC's Mobile Devices Recycling Program focuses on deterring electronic waste from ending up in landfills by refurbishing, reusing, recycling, or donating old work mobile devices.

Between April 2022 and August 2023, SSC donated over 3,000 devices to the Computers for Schools Plus (CFS+) program and refurbished 1,600 devices for reuse within the government. SSC collaborates with specialized electronics recyclers to securely wipe, repair, and repurpose devices. This initiative supports the Greening Government strategy and has earned SSC recognition from the Global Electronics Council for its sustainable electronics procurement practices.

By extending device lifecycles, SSC contributes to a circular economy, reducing the demand for new devices, minimizing resource extraction, and decreasing the volume of e-waste. SSC's efforts lower environmental impact and stimulate growth and innovation in the e-waste management market, promoting a more sustainable and efficient approach to electronic waste handling.

North America E-Waste Management Industry Overview

The North American e-waste management market is characterized by several key players, each contributing to the sector's growth and sustainability efforts. Waste Management Inc., one of the most prominent waste management players, plays a pivotal role with its extensive recycling services and facilities. Waste Connections is another major player, offering comprehensive waste collection, transfer, and disposal services, including e-waste management.

Electronics Recycling International and Republic Services Inc. emphasize sustainable e-waste processing and responsible disposal, aligning with environmental regulations and consumer expectations. Collectively, these companies adopt strategies such as technological innovation, strategic partnerships, regulatory compliance, and consumer education to enhance their e-waste management capabilities and reinforce their market positions in North America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights into Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Volume of E-Waste

- 5.1.2 Stringent Government Regulations and Policies

- 5.2 Market Restraints

- 5.2.1 Complexity of E-Waste

- 5.3 Market Opportunities

- 5.3.1 Corporate Responsibility

- 5.3.2 Circular Economy Initiatives

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.1.3 Glass

- 6.1.4 Other Materials

- 6.2 By Source Type

- 6.2.1 Consumer Electronics

- 6.2.2 Industrial Electronics

- 6.2.3 Other Sources

- 6.3 By Application

- 6.3.1 Trashed

- 6.3.2 Recycled

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

- 6.4.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Waste Management Inc.

- 7.2.2 Waste Connections

- 7.2.3 Clean Harbors Inc.

- 7.2.4 Tetronics

- 7.2.5 Electronics Recycling International

- 7.2.6 Republic Services Inc.

- 7.2.7 Veolia Group

- 7.2.8 GEEP (Global Electric Electronic Processing)

- 7.2.9 Avnet

- 7.2.10 Sims Recycling Solutions*

- 7.3 Other Companies