|

市場調查報告書

商品編碼

1636591

歐洲堆垛機:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Europe Palletizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

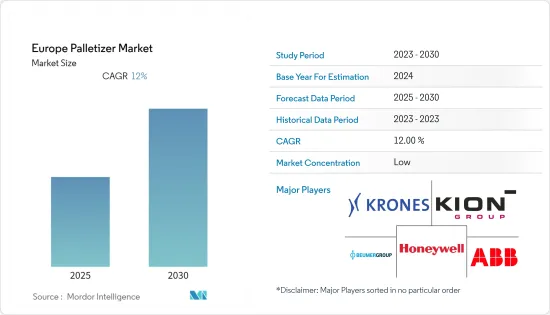

預計預測期內歐洲堆垛機市場複合年成長率將達到 12%。

主要亮點

- 堆垛機是任何先進的自動化物料輸送系統中最重要的設備之一。企業對勞動力的靈活性和安全性的期望越來越高,營運也正在從手動轉向自動化。

- 根據具體情況,物流中心、倉庫和工業設施可以使用機器人或傳統的堆垛機來自動化托盤堆疊過程。根據應用情況,整合不同的技術,使製造商能夠打造完美的托盤。

- 此外,德國的工廠關閉也增加了對食品生產能力的需求,迫使製造工廠加快生產速度,預計這將提振堆垛機市場。提高生產能力也將增加對自動化和先進機械的需求。

- 製藥業在堆垛機產業中也發揮著不可或缺的作用。全自動堆垛機用於藥品的無人化生產。在歐洲製藥業的支持下,該產業正在蓬勃發展。

- 歐洲對認證美容產品的興趣和需求日益成長,推動了化妝品行業堆垛機的成長。個人護理領域的堆垛機發展受到韓國美容潮流及其異想天開和創新的包裝的推動。

- 在研究期間,維護成本預計會限制機器人堆垛機的發展。機器人碼堆垛機的採用,包括高昂的轉換成本,以及維護和部署自動化系統的高成本,對堆垛機市場的成長構成了進一步的挑戰。

- 新冠疫情的爆發使快速消費品產業的許多生產工廠面臨越來越大的壓力,迫使它們加快加工生產。根據Packaging Europe 進行的一項調查,87% 的受訪者表示,他們已經開始以不同的方式轉移生產,以保持供應鏈中的生產力和社交距離,而22% 的受訪者已轉向自動化來維持流程。這表明,疫情導致這個市場呈指數級成長。

歐洲堆垛機市場趨勢

食品飲料業佔比大

- 在食品和飲料包裝行業,堆垛機由於成本低、吞吐率高、佔地面積小而最受歡迎且效益最佳。堆垛機包裝因重量輕且能長期保存食物而受到消費者和零售商的青睞。它服務於產品線的末端,因此對於所有行業都至關重要。

- 食品和飲料行業對堆垛機的需求正在上升,該行業可能會對市場收益產生重大影響。隨著政府監管日益嚴格以及零售商在市場上的競爭力不斷增強,食品和飲料行業對自動化和堆疊機器人的需求正在迅速成長。

- 此外,人們對環保包裝的興趣也越來越大。食品和非酒精飲料的消費者物價指數也在上漲,大大增加了食品和飲料產業對自動化機械的需求。

- 此外,ABB 還提供一系列測量產品、控制系統、驅動器、PLC 和電源調節器,以確保食品和飲料行業整個包裝和堆疊操作的靈活性和協調性。 ABB持續專注於堆疊自動化解決方案中包裝技術的開發。

- 製造業的成長增加了對自動化的需求,而這又需要靈活的機器。歐洲食品和飲料產業受到歐盟和國家關於食品營養、健康、安全、創新、進出口的各種法規的約束。該行業在吸引高技能員工方面也面臨挑戰。這些因素是食品和飲料行業採用自動化的驅動力。

- 這一領域的成長主要得益於對藥品和食品的巨大需求,以及沿岸地區等新興經濟體政府對藥品 CRP(兒童安全包裝)的規定,例如食品飲料、乙醯胺酚、阿斯匹靈和避孕藥等正在推動英國對堆垛機和食品包裝器材的需求。

機器人堆垛機預計將佔據很大佔有率

- 隨著人事費用的上升、對安全工作環境的需求以及保持您的營運最尖端科技,機器人碼垛系統是提高準確性、可靠性和效率的明智選擇。機器人堆垛機有多種配置,以適應不同的產品類型、應用和不同的排放配置。

- 德國是工業 4.0 運動的關鍵市場之一,因為它跟隨其他歐盟國家在其製造工廠中實施自動化技術以提高效率。該計劃的目標是提供機器人碼垛選項。此外,該國正在開發靈活的機器人堆垛機,可以從不同級別的輸送機上挑選產品,並根據托盤的佈置一次處理一個或多個產品。機器人堆疊技術可以輕鬆適應各種托盤模式和產品品種。

- 此外, 堆垛機還提供專為高速、低距離、重載負載容量而設計的機器人模型。各種軟體選項允許使用者快速產生托盤模式並檢查堆疊系統的狀態。嚴格要求的應用包括將箱子、紙箱、袋子、瓶子、盒子等堆放於托盤上。

- 機器人堆垛機提供了一種實用的解決方案,可以節省營運成本並提高營運效率,幫助那些依賴人工進行裝載、卸載、包裝和堆疊貨物等重複過程的部門。由於全球食品飲料、醫療保健等行業的需求激增,市場前景看好。

- 與其他包裝相比,製藥、化妝品、個人護理和化學品等行業也更喜歡使用機器人碼垛。此外,多年來,機器人堆垛機市場一直由食品和飲料行業主導。

- 對食品和飲料產品日益成長的需求正在影響著全球運輸貨物的包裝。這些堆堆垛機可以輕鬆平衡負載,不會發生任何損壞或溢出,並且食品的動態運輸有望推動和增強市場對機器人堆垛機的需求。

歐洲堆垛機產業概況

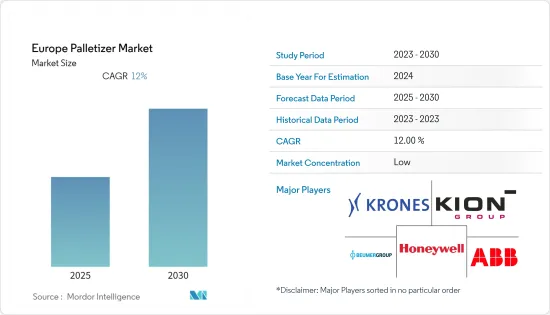

歐洲堆垛機市場競爭激烈,有許多國內外公司參與。 Abb Ltd、Beumer Group GmbH &Co. KG、Honeywell International Inc.KG、Honeywell International Inc.、KION Group AG、Krones AG、Sidel、安川電機株式會社、Barry-wehmiller Companies Inc.

- 2022 年 8 月 - 在 POWTECH 上,BEUMER 集團將展示其在建材、水泥和(石油)化學產品的輸送、裝載、填充、碼垛和包裝方面的專業知識。 Beumer 集團近期更新了其碼垛系列「paletpac」和拉伸罩包裝機「BEUMER」。模組化設計減少了零件數量,這對備件和交貨時間具有決定性的影響。

- 2022 年 6 月 - Aetna Group 透過其 Robopac 和 Ocme 業務部門收購了德國主要企業之一 Meypack。此次收購是安泰集團戰略成長計畫的一部分,該計畫旨在在製造國建立生產基地並擴大其在食品和個人護理領域的產品範圍。

- 2021 年 7 月-ABB 收購 ASTI 移動機器人集團 (ASTI)。 ASTI 是全球領先的自主移動機器人 (AMR) 製造商,其軟體套件支援的所有主要應用領域均擁有廣泛的產品組合。這擴大了 ABB 在機器人和自動化領域的足跡,使其成為唯一一家能夠提供下一代彈性自動化完整產品組合的公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 食品和飲料行業的需求不斷增加

- 對高品質消費品的需求不斷成長以及機器人堆垛機的採用

- 市場挑戰

- 維護和設備成本高

第6章 市場細分

- 按類型

- 傳統的

- 機器人

- 按行業

- 飲食

- 藥品

- 個人護理及化妝品

- 化學產品

- 按國家

- 德國

- 義大利

- 法國

- 英國

- 其他

第7章 競爭格局

- 公司簡介

- Beumer Group GmbH & Co. KG

- Honeywell International Inc.

- ABB Ltd

- KION Group AG

- Krones AG

- Kuka AG

- Concetti SPA

- Aetnagroup Spa

- Fuji Robotics Americas

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 57297

The Europe Palletizer Market is expected to register a CAGR of 12% during the forecast period.

Key Highlights

- Palletizer is one of the significant pieces of equipment among the primary advanced automated material handling systems. Organizations are raising their expectations for workforce flexibility and safety; a shift is happening from manual to automation in operations.

- In distribution centers, warehouses, and industrial facilities, the pallet construction process is automated using robotic or traditional palletizers, depending on the situation. Different technologies are integrated according to usage, which enables manufacturers to create optimal pallets.

- Additionally, the lockdown in Germany is causing a rise in the demand for grocery capacity, which is anticipated to boost the palletizer market because manufacturing facilities were forced to speed up production. An increase in capacity will also increase the need for automation and sophisticated machinery.

- The pharmaceutical sector also plays an essential role in the palletizer industry. Fully automatic palletizers are used for unattended pharmaceutical production. Supported by the European pharmaceutical industries, the sector is booming.

- The growing interest and demand for certified beauty products in Europe drive the growth of palletizers in the cosmetic industry. The development of palletizers in the personal care sector is fueled by the K-beauty trends with its whimsical and innovative packaging.

- The maintenance cost is anticipated to constrain the development of robotic palletizers during the study period. The adoption of robotic palletizers, which includes high switching costs, and the high cost of maintaining and deploying automation systems, present further challenges to the growth of the palletizer market.

- Due to the breakout of the COVID-19 pandemic, many manufacturing facilities in the FMCG sector have undergone increased pressure, and they had to speed up their process production. According to a survey done by Packaging Europe, 87% of the respondents answered that to maintain the supply chain productivity and social distancing, they had started different shifts, and 22% claimed that they had to incorporate automation to keep the process. This shows that the pandemic helped this market to grow exponentially.

Europe Palletizer Market Trends

Food and Beverage Industry to Hold a Major Share

- In the food and beverage packaging industry, palletizers are most preferred and beneficial due to their low cost, high throughput rate, and small footprint. The packaging is preferred among consumers and retailers as it is less weight and can preserve food for a long; the perishable rate is relatively low in palletizer packaging. It is vital for every industry as it is helpful at the end of the product line.

- The need for palletizers in the food and beverage sector is growing, and this sector will significantly impact market revenue. As government regulations tighten over time and retailer rivalry in the market increases, the demand for automation and palletizing robots is rising quickly in the food and beverages industry.

- Additionally, people are now highly concerned about environmentally friendly packaging. The Consumer Price Index for food and non-alcoholic beverages is also increasing, significantly increasing the need for automation machinery in the food and beverage sector.

- Moreover, ABB provides various measurement products, control systems, drives, PLCs, and power conditioning to ensure flexibility and coordination throughout packaging and palletizing operations in the food and beverage industry. ABB has been continuously focusing on developing packaging technologies in palletizing automation solutions.

- The growth in the manufacturing industries is helping the demand for automation to increase, resulting in the need for flexible machinery. The European beverage and food industry is subjected to various EU and national regulations concerning food nutrition, health, safety, innovation, import, and export. The industry is also facing issues in getting high-skilled staff. These factors are responsible for adopting automation in the food and beverage industry.

- The growth of this segment is driven by emerging economies, i.e., Gulf Region, where the demand for pharmaceuticals and food is very high, moreover the government regulations regarding CRP (Child-resistant Packaging) for drugs. i.e., food and beverages, paracetamol, aspirin, and contraceptives are boosting the demand for palletizers and food packaging machinery in the United Kingdom.

Robotic Palletizers is Expected to Hold Significant Share

- A robotic palletizing system is a wise choice to improve accuracy, dependability, and efficiency in light of rising labor costs, the requirement for safe working environments, and maintaining operations with the most cutting-edge technology. Robotic palletizers can be configured in many ways to accommodate various product types and applications and different infeed and discharge configurations.

- Germany, following other EU Countries is one of the leading markets in the industry 4.0 trend due to their adoption of automation technologies in manufacturing facilities to increase efficiency. The goal of this project is to offer robotic palletizing options. Additionally, the nation is creating a flexible robotic palletizer that can pick products off a conveyor on various levels and handle one or more units simultaneously, depending on pallet arrangement. Robotic palletizing technologies can easily accommodate different pallet patterns and product varieties.

- Moreover, The country is very interested in automation, Palletizer offers robot models specially designed for high-speed, low-range, and heavy payload palletizing. A variety of software options helps the user to quickly generate pallet patterns and check the status of the palletizing systems. It is a demanding application for stacking cases, cartons, bags, bottles, and boxes into pallets.

- Robotic palletizers benefit sectors that use a manual labor for repetitive processes like loading/unloading items, packaging, and palletizing by offering a practical solution to save operational costs and enhance job productivity. The market's future potential is growing as a result of the rapid rise in demand in industries including food and beverage, healthcare, and others around the world.

- Industries like pharmaceuticals, cosmetics, personal care, and chemicals also prefer Robotic palletizing over other packaging. In addition, for several years, the market for robotic palletizers has been dominated by the food and beverage sector.

- The usage of packaging for goods that have been shipped around the world has been influenced by the growing demand for food and beverage products. Because these palletizers can readily balance the loads, the dynamic shipment of food products without damage or spills raises the demand for robotic palletizers in the market, which is anticipated to drive that demand.

Europe Palletizer Industry Overview

The Europe palletizer market is competitive because of the presence of many players running their businesses within national and international boundaries. The market is highly fragmented with the presence of major players like Abb Ltd, Beumer Group GmbH & Co. KG, Honeywell International Inc., KION Group AG, Krones AG, Sidel, Yaskawa Electric Corp., Barry-wehmiller Companies Inc., among others.

- August 2022 - At POWTECH, the BEUMER Group will demonstrate its expertise in conveying, loading, filling, palletizing, and packaging of building materials, cement, and (petro)chemical products. The BEUMER Group has now redesigned its paletpac palletizing series and the BEUMER stretch hood packaging machine. The modular design reduces the number of components, which has a decisive influence on spare parts and delivery times.

- June 2022 - Aetna Group, one of the leading companies in the production of end-of-line packaging machines and systems (through its Business Units Robopac and Ocme), has acquired the German company Meypack. This operation is part of Aetna Group's strategic plan to grow externally, to establish a production presence in countries with a manufacturing vocation, and to expand the product range in the food and personal care sector.

- July 2021- ABB to acquire ASTI Mobile Robotics Group (ASTI), a leading global autonomous mobile robot (AMR) manufacturer with a broad portfolio across all major applications enabled by the company's software suite. This will expand ABB's robotics and automation offering, making it the only company to offer a complete portfolio for the next generation of flexible automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand from food and beverages Sector

- 5.1.2 Rising demand for high-quality consumer goods and adoption of robotic palletizers

- 5.2 Market Challenges

- 5.2.1 High maintenance and equipment costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Conventional

- 6.1.2 Robotic

- 6.2 By End-user Vertical

- 6.2.1 Food & Beverages

- 6.2.2 Pharmaceuticals

- 6.2.3 Personal Care & Cosmetics

- 6.2.4 Chemicals

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 Italy

- 6.3.3 France

- 6.3.4 United Kingdom

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Beumer Group GmbH & Co. KG

- 7.1.2 Honeywell International Inc.

- 7.1.3 ABB Ltd

- 7.1.4 KION Group AG

- 7.1.5 Krones AG

- 7.1.6 Kuka AG

- 7.1.7 Concetti S.P.A

- 7.1.8 Aetnagroup Spa

- 7.1.9 Fuji Robotics Americas

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219