|

市場調查報告書

商品編碼

1637744

精密陶瓷:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Advanced Ceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

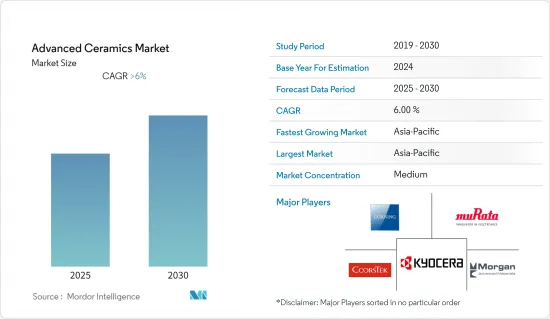

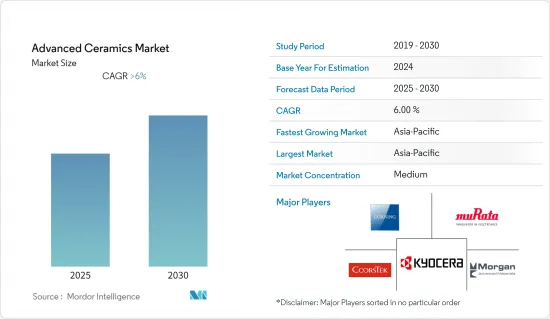

預計預測期內精密陶瓷市場複合年成長率將超過 6%。

主要亮點

- COVID-19 疫情對市場的影響明顯是負面的,不過,市場目前已恢復至疫情前的水平,預計在預測期內將實現穩步成長。

- 中期推動市場發展的關鍵因素是這些材料作為金屬和塑膠的替代品的使用越來越多,以及醫療產業的需求不斷成長。

- 另一方面,設備和化學製程的高資本支出以及氣候變遷、能源和環境法規和政策的不確定性正在削弱市場。

- 然而,碳化矽(SiC)、氮化鎵(GaN)的應用不斷擴大以及奈米技術領域的成長機會可能很快為全球市場提供有利的成長機會。

- 電子電氣產業佔據市場主導地位,由於精密陶瓷具有廣泛的電學特性,例如絕緣、半導體、超導性、壓電和磁性,預計在預測期內該行業將實現成長。

- 亞太地區佔據全球市場主導地位,其中中國和日本等國家佔最大的消費量。

精密陶瓷市場趨勢

電子電氣產業可望主導市場

- 預計未來幾年碳化矽將成為電氣和電子產業最大的應用之一。它們具有廣泛的應用,包括電動車、高功率和高壓功率設備、半導體、太陽能逆變器和 LED 照明。

- 氮化鋁具有高導熱性和優異的電絕緣性,使其可用於半導體、消費性和家用產品的散熱應用。同樣,氮化矽和氮化硼也用於各種電氣和電子應用。

- 亞太地區是世界上一些最大的電子產品製造商的所在地。它佔全球電子產品產量的70%以上,其中韓國、越南、印度和中國等國家佔據主導地位。

- 在歐洲,德國的電子產業是該地區最大的。電氣電子工業佔德國工業總產值的11%。根據德國電氣電子工業協會 (ZVEI) 的數據,全球電子市場規模預計將在 2021 年增至 4.6 兆歐元(約 4.82 兆美元)。

日本可望主導亞太市場

- 日本的電氣電子產業是世界領先的產業之一。日本在電腦、遊戲機、行動電話以及其他各種關鍵電腦零件的生產方面處於世界領先地位。

- 家電佔日本經濟產出的三分之一。日本專門製造電子元件和設備,包括被動元件、互連裝置、電子基板和液晶設備。

- 隨著數位化的進步拉動需求、擴大出口,日本電子設備和IT企業的全球產值預計將在2021與前一年同期比較增8%,達到37.3兆日圓(約2,720.2億日圓)。

- 日本的航太工業為民航機和國防飛機製造飛機零件。近年來,由於貨運需求的增加,民航機的產量增加。

- 日本在波音767、777、777X、787等飛機以及V2500、Trent1000、GEnx、GE9X、PW1100G-JM等引擎的研發中也扮演主導角色。

- 根據厚生勞動省統計,日本生產了所有外科醫療設備的25%以上,包括無菌血管管和導管、手術器械和無菌輸血器。

- 日本人口快速老化導致患有慢性病和文明病疾病的患者數量增加,全民健康保險制度和監管措施正在推動該國醫療設備市場的發展。

精密陶瓷產業概況

精密陶瓷市場本質上是部分分散的,前五大公司佔據所研究市場的大部分佔有率。主要市場參與者(不分先後順序)包括京瓷、康寧、村田製造、CoorsTek 和摩根先進材料。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大用作金屬和塑膠的替代品

- 醫療產業需求不斷成長

- 環保且可靠

- 限制因素

- 受新冠肺炎疫情影響而產生的不利情況

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

- 定價分析

第 5 章 市場區隔(以金額為準的市場規模)

- 依材料類型

- 氧化鋁

- 鈦酸鹽

- 鋯石

- 碳化矽

- 氮化鋁

- 氮化矽

- 矽酸鎂

- 熱解

- 其他材料類型

- 依班級類型

- 單片陶瓷

- 陶瓷基質複合材料

- 陶瓷塗層

- 按最終用戶產業

- 電氣和電子

- 運輸

- 醫療

- 工業

- 國防和安全

- 化學

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M(Ceradyne Inc.)

- AGC Inc.

- Applied Ceramics Inc.

- Blasch Precision Ceramics Inc.

- Ceramtec

- COI Ceramics Inc.

- Coorstek Inc.

- Corning Incorporated

- International Ceramics Inc.

- Kyocera Corporation

- MARUWA Co. Ltd

- Materion Corporation

- McDanel Advanced Ceramic Technologies

- Morgan Advanced Materials

- Murata Manufacturing Co. Ltd

- Rauschert GmbH

- Saint-Gobain

- Small Precision Tools Inc.

- Vesuvius

- Wonik QnC Corporation

第7章 市場機會與未來趨勢

- 碳化矽 (SiC) 和氮化鎵 (GaN) 的應用不斷擴大

- 擴大奈米技術的應用

簡介目錄

Product Code: 46629

The Advanced Ceramics Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The impact of the Covid-19 pandemic on the market was largely negative, but the market has now reached pre-pandemic levels and is expected to grow steadily during the forecast period.

- Over the medium term, the major factors driving the market are the rise in use as an alternative to metals and plastics and the growing demand in the medical industry.

- On the flip slide, high capital investment for the equipment and chemical processes and uncertainty in regulative policies concerning climate change, energy & environment undermine the market.

- However, increasing applications of silicon carbide (SiC), gallium nitride (GaN), and growth in usage in nanotechnology would likely create lucrative growth opportunities for the global market soon.

- The electronics and electrical industry dominated the market, and it is expected to grow during the forecast period, owing to a wide range of electrical properties of advanced ceramics, including insulating, semiconducting, superconducting, piezoelectric, and magnetic properties.

- Asia-Pacific dominated the market globally, with the largest consumption from countries such as China and Japan.

Advanced Ceramics Market Trends

The Electronics and Electrical Industry is Expected to Dominate the Market

- Silicon carbide is estimated to have one of the largest applications in the electrical and electronics industry in the coming years. It has various applications in electric vehicles, high-power and high-voltage power devices, semiconductors, solar inverters, and LED lights.

- Aluminum nitride is used in heat removal applications because of its high thermal conductivity and excellent electrical insulation properties, making it useful in semiconductors and consumer and household products. Similarly, silicon nitride and boron nitride are used in various electrical and electronic applications.

- Asia-Pacific is one of the leading manufacturers of electronics in the world. It accounts for more than 70% of global electronics production, with countries like South Korea, Vietnam, India, and China leading.

- In Europe, the German electronics industry is the largest in the region. The electrical and electronics industry accounts for 11% of the total industrial production in Germany. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), the global electronics market is estimated to have risen to EUR 4.6 trillion (~USD 4.82 trillion) in 2021.

Japan is Expected to Dominate the Asia-Pacific Market

- The Japanese electrical and electronics industry is one of the world's leading industries. Japan is a world leader in the production of computers, gaming stations, cell phones, and various other key computer components.

- Consumer electronics account for one-third of the Japanese economic output. The country specializes in manufacturing electronic components and devices, such as passive components, connecting components, electronic boards, and liquid crystal devices.

- With the advance of digitalization boosting demand and expanding exports, global production by Japanese electronics and IT companies is expected to grow 8% year on year in 2021 to JPY 37,300 (~ USD 272.02) billion.

- The Japanese aerospace industry manufactures aircraft components for commercial and defense aircraft. Commercial aircraft production has been increasing over the past couple of years due to the increasing cargo demands.

- The country also plays a central role in the development of aircraft such as Boeing 767, 777, 777X, and 787 and engines such as the V2500, Trent1000, GEnx, GE9X, and PW1100G-JM.

- According to the Ministry of Health, Labour, and Welfare of Japan, the country produces over 25% of the total medical devices for surgical procedures such as sterile tubes and catheters for blood vessels, surgical procedures, and sterile blood transfusion sets.

- The rapidly aging Japanese population increases the number of patients with chronic and lifestyle-related diseases, and universal health insurance coverage and regulatory measures are driving the Japanese medical devices market.

Advanced Ceramics Industry Overview

The advanced ceramics market is partially fragmented in nature, with the top five players accounting for a major share of the market studied. The major market players (in no particular order) include Kyocera Corporation, Corning Incorporated, Murata Manufacturing Co., CoorsTek, and Morgan Advanced Materials, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Use as Alternative to Metals and Plastics

- 4.1.2 Growing Demand in the Medical Industry

- 4.1.3 Eco-friendliness and Reliability of Use

- 4.2 Restraints

- 4.2.1 Unfavorable Conditions Arising due to COVID-19 Impact

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

- 4.6 Price Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Alumina

- 5.1.2 Titanate

- 5.1.3 Zirconia

- 5.1.4 Silicon Carbide

- 5.1.5 Aluminum Nitride

- 5.1.6 Silicon Nitride

- 5.1.7 Magnesium Silicate

- 5.1.8 Pyrolytic Boron Nitride

- 5.1.9 Other Material Types

- 5.2 Class Type

- 5.2.1 Monolithic Ceramics

- 5.2.2 Ceramic Matrix Composites

- 5.2.3 Ceramic Coatings

- 5.3 End-user Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Transportation

- 5.3.3 Medical

- 5.3.4 Industrial

- 5.3.5 Defense and Security

- 5.3.6 Chemical

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M (Ceradyne Inc.)

- 6.4.2 AGC Inc.

- 6.4.3 Applied Ceramics Inc.

- 6.4.4 Blasch Precision Ceramics Inc.

- 6.4.5 Ceramtec

- 6.4.6 COI Ceramics Inc.

- 6.4.7 Coorstek Inc.

- 6.4.8 Corning Incorporated

- 6.4.9 International Ceramics Inc.

- 6.4.10 Kyocera Corporation

- 6.4.11 MARUWA Co. Ltd

- 6.4.12 Materion Corporation

- 6.4.13 McDanel Advanced Ceramic Technologies

- 6.4.14 Morgan Advanced Materials

- 6.4.15 Murata Manufacturing Co. Ltd

- 6.4.16 Rauschert GmbH

- 6.4.17 Saint-Gobain

- 6.4.18 Small Precision Tools Inc.

- 6.4.19 Vesuvius

- 6.4.20 Wonik QnC Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications of Silicon Carbide (SiC) and Gallium Nitride (GaN)

- 7.2 Growth in Usage in Nanotechnology

02-2729-4219

+886-2-2729-4219