|

市場調查報告書

商品編碼

1637761

下一代儲存:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Next-generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

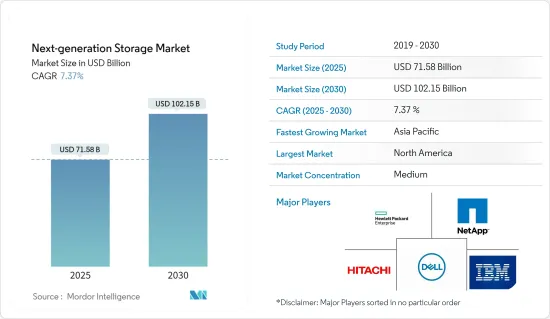

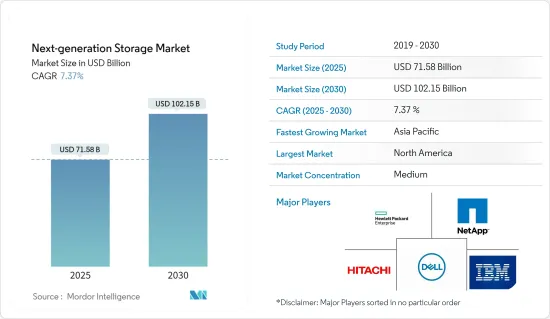

下一代儲存市場規模在 2025 年預計為 715.8 億美元,預計到 2030 年將達到 1021.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.37%。

隨著數位化社會的快速發展,行動服務、巨量資料、雲端處理和社交網路應用的發展不斷加速。新一代儲存技術提供先進的產品和解決方案組合,幫助包括 IT 公司、汽車公司和資料中心在內的各類終端用戶產業儲存資料。由於檔案大小不斷增加、大量非結構化資料以及巨量資料,IT公司在資料管理方面面臨許多問題。

主要亮點

- 傳統的資料儲存技術無法處理大量的日常資料。新一代資料儲存基礎設施提供可靠、快速且經濟高效的解決方案,以滿足不斷成長的資料儲存需求。

- 此外,下一代儲存技術市場正在擴展到資訊技術領域,具有廣泛的應用,例如巨量資料儲存、企業資料儲存和其他雲端基礎的服務。儲存以及如何處理儲存可能會對您的營收和利潤產生很大的影響。預計 IT 部門將更積極地從投資安全儲存轉向投資有利於業務的新技術。

- 2023 年 4 月,Vast 資料宣布惠普企業 (HPE) 已將 Vast 資料領先的檔案軟體平台納入新的 HPE GreenLake 檔案儲存服務。全新 HPE GreenLake 文件儲存利用 Bast 資料獨特的創新橫向擴展軟體架構,使企業客戶能夠大規模管理非結構化資料,並更快地獲得資料洞察。

- 然而,雲端基礎的儲存存在許多安全性問題,包括配置錯誤、資料管治不善和存取控制不足。此類雲端儲存安全問題可能會將公司資料暴露給未經授權的第三方,從而限制了市場的成長。

- 新冠疫情對下一代儲存市場,尤其是雲端儲存中使用的解決方案產生了積極影響。儲存供應商正在免費提供部分硬體和軟體技術,以幫助研究人員、企業、在家工作和合作夥伴在 COVID-19 冠狀病毒爆發期間開展業務並遠端工作。

下一代儲存市場趨勢

直接附加儲存 (DAS) 經歷顯著成長

- 直接附加儲存(DAS)是最古老和最傳統的資料儲存系統,它直接連接到電腦,例如 PC 或伺服器,與其他儲存系統透過網路連接到電腦不同。

- 與其他儲存系統相比,DAS 具有某些優勢,例如高效能、易於設定和配置、快速存取資料以及低成本,在許多組織的儲存策略中發揮重要作用。

- DAS 可以為使用者提供比網路儲存更好的效能,因為伺服器不必穿越網路來讀寫資料。出於這個原因,許多組織都轉向使用 DAS 來開發需要高效能的應用程式。 DAS 也比基於網路的儲存系統簡單一些,因此更容易部署和維護,且成本更低。

- 此外,虛擬技術的進步為 DAS 注入了新的活力,尤其是市場上的超融合式基礎架構(HCI) 系統。 HCI系統由多台伺服器和DAS儲存節點組成,儲存聚合成邏輯資源池,提供比傳統DAS更靈活的儲存解決方案。

- DAS 通常為其直接連接的電腦系統提供高儲存效能,利用 SAS 或 SATA 等高速電腦匯流排介面,並將資料放置在更靠近系統 RAM 和處理器的位置。

- 2022 年 5 月,TerraMaster 為需要一個中心位置儲存大量資料的客戶發布了一款新的 8 托架 DAS(直接連接儲存)設備。與 NAS 不同,DAS 透過電纜直接連接到 PC 或其他設備在本地使用。新款TerraMaster D8-332 是一款商務用RAID 存儲,容量高達 160TB。

- DAS 的一個常見應用是資料中心。 DAS 用於網頁寄存等應用,客戶希望將專用儲存裝置連接到專用伺服器。 DAS 也常用於資料中心作為啟動作業系統和虛擬機器管理程式的儲存。

北美佔有最大市場佔有率

- 由於全球供應商和消費者的區域集中度不斷提高,北美下一代儲存市場預計將經歷強勁成長。

- 美國是全球資料中心的主要市場之一。谷歌也於2022年4月宣布,計劃在全國投資95億美元建造資料中心和辦事處。該巨頭計劃在美國喬治亞、德克薩斯州、紐約州和加利福尼亞州等各州建設和擴建 14 個資料中心。資料中心投資的增加為市場創造了巨大的成長機會。

- 此外,資料密集型物聯網(IoT)設備構成了下一代儲存的另一個新興市場。這些應用非常廣泛。工廠4.0形式的工業自動化就是這樣一個領域。然而,物聯網還包括穿戴式裝置、醫療保健、航空、以及智慧家居、智慧農場、智慧電錶、智慧物流以及任何以智慧開頭的東西。

- 根據史丹佛大學和Avast的研究,北美家庭的物聯網設備密度居全球最高。值得注意的是,該地區 66% 的家庭擁有至少一台物聯網設備。此外,25%的北美家庭擁有三台或更多台設備。

- 此外,網路流量和用戶生成資料的增加也促進了市場成長,其中北美的 IP 流量最高。據思科稱,到 2022 年該地區的 IP 流量將達到每月 108.4 EB。

- 根據愛立信的報告,到 2028 年,北美每部智慧型手機的每月平均行動資料使用量預計將達到 55GB。改進的 5G 網路和無限資料方案預計將吸引該地區更多的 5G用戶。基於影片的應用程式、虛擬/擴增實境和遊戲會產生大量的資料流量。該公司預測,到 2028 年,北美將佔全球 5G 用戶的 90% 以上,是所有地區中最高的。

下一代儲存產業概況

下一代儲存市場已基本固體,由少數幾家主要企業組成。從市場佔有率來看,目前市場主要被幾家主要企業所佔據。然而,隨著記憶體封裝技術的創新,許多公司正在將業務擴展到新興國家尚未開發的新興市場。

- 2023 年 5 月 - NetApp 宣布推出新的現代區塊儲存產品和保證,凸顯 NetApp 在從勒索軟體攻擊中恢復方面的一流能力。透過此公告,NetApp 旨在解決客戶面臨的主要挑戰,包括有限的 IT 預算、日益增加的 IT 複雜性、永續性緊迫的永續發展以及網路威脅的持續擴散。

- 2023 年 4 月-Pure Storage 推出其新一代統一區塊和檔案儲存服務。這項新的儲存服務允許從單一全域資源池存取本機區塊和檔案服務。統一儲存架構支援區塊和檔案儲存格式,為企業提供更多儲存和檢視資料的方式。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 產業影響評估

- 技術簡介

- 磁性儲存

- 固態儲存

- 軟體定義儲存 (SDS)

- 雲端儲存

- 統一儲存

- 其他儲存技術

第5章 市場動態

- 市場促進因素

- 數位資料量不斷增加

- 固態設備的應用日益廣泛

- 智慧型手機、筆記型電腦和平板電腦日益普及

- 市場限制

- 雲端和基於伺服器的服務缺乏資料安全性

第6章 市場細分

- 按儲存系統

- 直接附加儲存 (DAS)

- 網路附加儲存 (NAS)

- 儲存區域網路 (SAN)

- 依儲存架構

- 基於檔案物件的儲存 (FOBS)

- 區塊儲存

- 按最終用戶產業

- BFSI

- 零售

- 資訊科技和電訊

- 衛生保健

- 媒體與娛樂

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Dell Inc.

- Hewlett Packard Enterprise Company

- NetApp Inc.

- Hitachi Ltd

- IBM Corporation

- Toshiba Corp.

- Pure Storage Inc.

- DataDirect Networks.

- Scality Inc.

- Fujitsu Ltd.

- Netgear Inc.

第8章投資分析

第9章:市場的未來

The Next-generation Storage Market size is estimated at USD 71.58 billion in 2025, and is expected to reach USD 102.15 billion by 2030, at a CAGR of 7.37% during the forecast period (2025-2030).

With the sizeable and exponential growth in the digital world, there has been an accelerating development in mobile services, Big Data, cloud computing, and social networking applications. Next-generation storage technology deals with an advanced portfolio of products and solutions, which help store data across various end-user industries, including IT firms, automotive companies, and data centers. With the increasing file sizes and a massive amount of unstructured and Big Data, IT companies face plenty of problems while dealing with data management.

Key Highlights

- Conventional data storage technologies cannot handle a large amount of everyday data. The next-generation data storage infrastructure offers a reliable, faster, and cost-effective solution to meet the growing data storage demands.

- Further, the next-generation storage technology market is moving into the information technology sector, with an extensive range of applications across Big Data storage, enterprise data storage, and other cloud-based services. Storage and how it is addressed can significantly impact the top and bottom lines. IT organizations are expected to be more willing to move from making a safe storage investment to investing in new technologies that can benefit the business.

- In April 2023, VAST Data announced that Hewlett Packard Enterprise (HPE) had incorporated VAST Data's leading file software platform into the new HPE GreenLake for File Storage service. By leveraging VAST's unique and innovative scale-out software architecture for the new HPE GreenLakefor File Storage, enterprise customers can manage unstructured data with massive performance and achieve faster data insights.

- However, many security issues are associated with cloud-based storage, such as misconfiguration, insufficient data governance, and poor access controls, among others. Such cloud storage security issues that can expose enterprise data to unauthorized parties can act as a restraint on market growth.

- The COVID-19 pandemic outbreak positively impacted the next-generation storage market, especially solutions used in cloud storage. Storage vendors were making some of their hardware and software technology available for free to help researchers, businesses, work-from-home users, and partners run their businesses and work remotely during the COVID-19 coronavirus pandemic.

Next-generation Storage Market Trends

Direct Attached Storage (DAS) to Witness Significant Growth

- Direct Attached Storage (DAS) is the oldest and most conventional data storage system connected directly to a computer, such as a PC or server, unlike other storage systems connected to a computer over a network.

- DAS offers specific benefits compared to other storage systems that play an essential role in many organizations' storage strategies: high performance, easiness during the setup and configuration, fast access to data, and low cost.

- DAS can provide users with better performance than network storage because the server does not have to traverse the network to read or write data. For this reason, many organizations utilize his DAS for applications that require high performance. DAS is also less complex than network-based storage systems, making them easier to implement and maintain and less expensive.

- Moreover, growing advances in virtualization technology are breathing new life into DAS, especially in the market's hyper-converged infrastructures (HCI) systems. The HCI system consists of multiple servers and DAS storage nodes, and the storage is aggregated into logical resource pools, providing a more flexible storage solution than traditional DAS.

- Generally, DAS offers high storage performance to the computer system it is directly attached to, owing to the advantage of fast computer bus interfaces, such as SAS and SATA, and the close location of data to the system's RAM and processor.

- In May 2022, TerraMaster recently released a new 8-bay Direct Attached Storage (DAS) appliance for customers who need a central location to store large amounts of data. Unlike NAS, DAS is used locally via a cable connected directly to a PC or other device. The new TerraMaster D8-332 is professional RAID storage with up to 160TB capacity.

- One common application of DAS is in data centers. Applications like web hosting use DAS, where customers want their private storage devices connected to their dedicated server. DAS is also commonly utilized in data use centers as storage for booting operating systems and hypervisors.

North America Occupies the Largest Market Share

- The country's next-generation storage market will witness a high growth rate due to the increasing regional concentration of global vendors and consumers.

- The United States remains one of the top markets for data centers globally. Also, in April 2022, Google announced plans to invest USD 9.5 billion in data centers and offices nationwide. The tech giant will be building or expanding 14 data centers in the US states like Georgia, Texas, New York, and California, among others. Such increasing investments in data centers are also creating considerable growth opportunities for the market.

- Moreover, the data-heavy Internet of Things (IoT) devices constitute another emerging market for next-generation storage. These applications primarily cover a wide range. Industrial automation in the form of Factory 4.0 is one segment. Still, the IoT also includes wearables, healthcare, aviation, plus about anything that begins with smart, such as smart homes, smart farms, smart metering, and smart logistics, among others.

- According to a Stanford University and Avast study, homes in the North American region have the highest density of IoT devices installed worldwide. Notably, 66% of households in the region have at least one of her IoT devices. Additionally, 25% of North American homes have three or more devices.

- Additionally, increasing Internet traffic and user-generated data contribute to the market growth, with North America having the highest volume of IP traffic. According to CISCO, IP traffic in the region will reach 108.4 EB per month by 2022.

- According to Ericsson's report, the average monthly mobile data usage per smartphone is likely to reach 55 GB in 2028 in North America. The improved 5G network and unlimited data plans will attract more 5G subscribers in the region. Video-based apps, virtual/augmented reality, and gaming generate huge data traffic. In 2028, the company predicts that 5G subscriptions in North America will be more than 90%world's, the highest among all regions.

Next-generation Storage Industry Overview

The next-generation storage market is semi-consolidated and consists of some major players. In terms of market share, few of the key players currently dominate the market. However, with innovation in memory packaging technology, many companies are increasing their market presence across untapped new markets of emerging economies.

- May 2023 - NetApp announced a new modern block storage offering and a guarantee highlighting NetApp's best-in-class ability to recover from ransomware attacks. Through this launch, the company aims to address critical customer challenges, including restricted IT budgets, increasing IT complexity, increased urgency around sustainability, and the continued exponential growth of cyber threats.

- April 2023 - Pure Storage Inc. announced introducing a next-generation unified block and file storage service. This new storage service provides access to native block and file services from a single, global pool of resources. A unified storage architecture supports block and file storage formats, allowing organizations to store and view data in various ways.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

- 4.4 Technology Snapshot

- 4.4.1 Magnetic Storage

- 4.4.2 Solid State Storage

- 4.4.3 Software Defined Storage (SDS)

- 4.4.4 Cloud Storage

- 4.4.5 Unified Storage

- 4.4.6 Other Storage Technologies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of Digital Data

- 5.1.2 Rising Adoption of Solid-state Devices

- 5.1.3 Increasing Proliferation of Smartphones, Laptops, and Tablets

- 5.2 Market Restraints

- 5.2.1 Lack of Data Security in Cloud- and Server-based Services

6 MARKET SEGMENTATION

- 6.1 Storage System

- 6.1.1 Direct Attached Storage (DAS)

- 6.1.2 Network Attached Storage (NAS)

- 6.1.3 Storage Area Network (SAN)

- 6.2 Storage Architecture

- 6.2.1 File and Object-based Storage (FOBS)

- 6.2.2 Block Storage

- 6.3 End User Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare

- 6.3.5 Media and Entertainment

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 NetApp Inc.

- 7.1.4 Hitachi Ltd

- 7.1.5 IBM Corporation

- 7.1.6 Toshiba Corp.

- 7.1.7 Pure Storage Inc.

- 7.1.8 DataDirect Networks.

- 7.1.9 Scality Inc.

- 7.1.10 Fujitsu Ltd.

- 7.1.11 Netgear Inc.