|

市場調查報告書

商品編碼

1639428

北美下一代儲存:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Next Generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

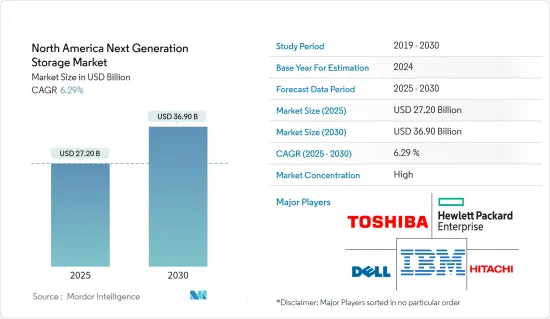

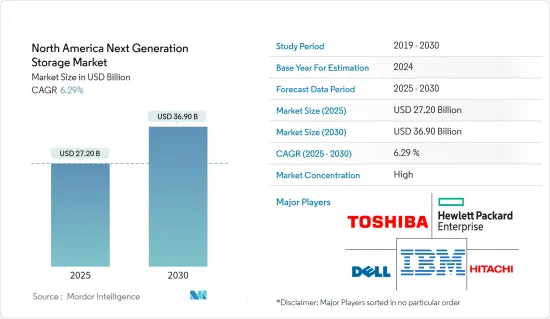

北美下一代儲存市場規模預計在2025年為272億美元,預計到2030年將達到369億美元,預測期內(2025-2030年)的複合年成長率為6.29%。

主要亮點

- 由於全球供應商和消費者在美國高度集中,下一代儲存市場在美國顯示出成長跡象。

- 全球範圍內雲端運算公司和社交網路供應商使用的超大規模資料中心的數量正在成長。北維吉尼亞的資料中心庫存量位居美國第一,約 2,060 兆瓦。

- 該地區佔據智慧零售市場的很大佔有率,產生大量資料,從而增加了對儲存解決方案的需求。根據美國人口普查局統計,2022年1月至3月美國零售電商銷售額約2,500億美元,較上季成長2.4%。

- 根據Internet World統計,美國地區網路用戶約有3.48億。這是世界上最高的採用率之一。網路使用者的增加與資料產生的增加直接相關,進而影響下一代儲存市場。智慧型手機普及率亦最高,達93.4%。愛立信表示,該地區還擁有最高的5G網路覆蓋率,5G用戶滲透率為41%。

北美下一代儲存市場趨勢

智慧型手機、連網型設備和電子設備的興起將推動市場的發展。

- 許多設備,包括智慧型手機、筆記型電腦和平板電腦,都會以影片和影像的形式產生資料。低成本智慧型手機和平板電腦的普及正在推動下一代儲存設備的採用。美國消費者擴大透過智慧型手機和其他行動裝置與數位資訊世界建立聯繫。越來越多的人將智慧型手機作為家中主要的上網設備。

- 在美國,消費者對 5G 智慧型手機的需求持續成長,許多人渴望升級行動電話以利用這項新技術。據消費技術協會稱,美國智慧型手機銷售正在蓬勃發展。 2021年智慧型手機銷售額將達730億美元,2022年將增加至747億美元。

- 根據國際電信聯盟和美國聯邦通訊委員會的報告,美國擁有全天寬頻網路存取的家庭數量持續成長,預計到2020年將達到1.2億戶,使美國成為全球最大的線上市場。 。

- 行動資料使用量的快速成長產生了大量的資料流量,進一步增加了對強大的下一代儲存解決方案的需求。預計到 2028 年,北美的用戶平均數據消費量將最高,達到 58 GB。

雲端儲存佔據主要市場佔有率

- 近年來,雲端平台正在實現新的複雜的經營模式,並協調更多全球一體化的網路。在雲端上部署儲存解決方案可以降低整體擁有成本並提高便利性,因為服務供應商負責提供最長的執行時間、資料安全性和定期更新。

- 當前的市場趨勢,例如計量收費和 SaaS 模式,服務供應商負責維護資料和應用程式訊息,進一步推動了這些解決方案的採用。

- 此外,由於它減少了內部建設必要基礎設施所需的資本支出,因此越來越多中小型企業開始採用它。這一持續的趨勢為市場成長提供了巨大的推動力。

- 雲端還可以作為 IT 轉型的催化劑,讓您可以靈活地將您首選的雲端與現有的內部部署基礎架構按照最適合您工作負載的比例相結合。

- 此外,對成本最佳化和業務敏捷性的日益關注也導致了雲端資料中心的擴張。雲端服務還能輕鬆適應不斷變化的條件以滿足新的需求。這使得客戶能夠專注於他們的核心競爭力,最終實現整體成長。

- 隨著先進技術的出現,企業越來越重視更新其儲存系統以跟上競爭的步伐。混合雲就是這樣一種趨勢,它正在推動市場大幅成長。然而,安全性和資料傳輸所需的網路頻寬不足對市場成長構成了挑戰。

北美下一代儲存產業概況

北美新一代儲存市場主要集中於科技巨頭,它們擁有最尖端科技和經驗。為了保持競爭力,公司經常推出具有創新和進步的新產品。為了保持競爭力,市場參與企業採用各種方法,包括收購、合作、投資、合併以及技術開發和採用。

2022 年 11 月,全球網路、儲存連接和基礎設施解決方案供應商 ATTO Technology, Inc. 宣布與內部資料儲存公司 AC&NC 合作,為電影和影像服務供應商5600°K productions 開發新的資料中心。宣布將提供預先建置的高效能儲存解決方案。該解決方案包括一個 JetStor 816FX 光纖通道儲存區域網路平台,該平台配備 16 個 12 TB SAS 硬碟和該公司的 Celerity 16 Gb/s 光纖通道主機匯流排適配器。

2022 年 6 月,以資料為中心的安全供應商 StorCentric 宣布其網路附加儲存 (NAS) Nexsan EZ-NAS 正式上市 (GA)。專為中小型企業 (SMB) 和企業邊緣部署而設計。該平台提供先進的企業級功能,例如 AD 支援、線上壓縮和靜態資料加密。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 的影響

第5章 市場動態

- 市場促進因素

- 數位資料量不斷增加

- 固態設備的應用日益廣泛

- 智慧型手機、筆記型電腦和平板電腦日益普及

- 市場限制

- 雲端和基於伺服器的服務缺乏資料安全性

第6章 市場細分

- 按儲存系統

- 直接附加儲存 (DAS)

- 網路附加儲存 (NAS)

- 儲存區域網路 (SAN)

- 依儲存架構

- 基於檔案物件的儲存 (FOBS)

- 區塊儲存

- 按最終用戶產業

- BFSI

- 零售

- 資訊科技和電訊

- 衛生保健

- 媒體與娛樂

第7章 競爭格局

- 公司簡介

- Dell Inc.

- Hewlett Packard Enterprise Company

- NetApp Inc.

- Hitachi Ltd.

- IBM Corporation

- Toshiba Corp.

- Pure Storage Inc.

- DataDirect Networks.

- Scality Inc.

- Fujitsu Ltd.

- Netgear Inc.

第8章投資分析

第9章:市場的未來

The North America Next Generation Storage Market size is estimated at USD 27.20 billion in 2025, and is expected to reach USD 36.90 billion by 2030, at a CAGR of 6.29% during the forecast period (2025-2030).

Key Highlights

- The next-generation storage market is showing signs of growth in the United States, owing to the regional concentration of global vendors and consumers in the country.

- The number of hyperscale data centers that cloud companies and social network providers use has increased globally. North Virginia recorded around 2060 megawatts of inventory of data centers in the United States.

- The region holds a significant smart retail market share, which generates a huge amount of data, in turn creating the demand for storage solutions. According to the U.S. Census Bureau, from January to March 2022, U.S. retail e-commerce sales amounted to approximately USD 250 billion, marking a 2.4% increase compared to the last quarter.

- The United States region has approximately 348 million Internet users, according to Internet World stats. This is one of the highest penetration rates in the world. The growth in Internet users is directly connected to growth in data generation and, in turn, influencing the next-generation storage market. The country also possesses the highest smartphone penetration, which is around 93.4%. The region also has the widest coverage of the 5G network, with a 5G subscription penetration of 41%, according to Ericsson.

North America Next Generation Storage Market Trends

Increasing Proliferation of Smartphones, connected devices and electronic devices will drive the market.

- Many devices, such as smartphones, laptops, and tablets, are generating data in the form of videos and images. The proliferation of low-cost smartphones and tablets provides increased potential for adopting next-generation storage devices. American consumers are increasingly connected to the world of digital information via smartphones and other mobile devices. A growing number of people are using smartphones as their primary online access at home.

- Consumer demand for 5G smartphones will continue to rise in the United States, with many people eager to upgrade their phones to take advantage of the new technology's benefits. According to the Consumer Technology Association, the United States is witnessing a surge in smartphone sales. In 2021, smartphone sales were USD 73 billion, which increased to USD 74.7 billion in 2022.

- According to ITU and Federal Communications Commission reports, the number of households in the United States with permanent internet access via broadband continues to climb, with the number of households with permanent internet access via broadband expected to reach 120 million by 2020, making the United States one of the largest online markets in the world.

- The surge in mobile data usage is generating a large volume of data traffic, which further needs a robust next-generation storage solution. North America is expected to have the greatest average consumption per subscriber in 2028, with 58 gigabytes per user.

Cloud Storage to Gain Significant Market Share

- Cloud platforms enabled new, complex business models and have been orchestrating more global-based integration networks in recent years. The deployment of storage solutions over the cloud offers greater convenience, as the service vendor is solely responsible for providing maximum uptime, data security, and periodic updates, thus decreasing the total cost of ownership.

- The current market trends, including the delivery of these solutions on the pay-as-you-go model and SaaS models, wherein the service vendors also assume the responsibility of maintaining data and application information, are further driving the adoption of these solutions.

- Moreover, this mode has recorded an increase in deployment in small-/medium-scale businesses, as it cuts down the capital expenditure involved in building the required infrastructure on their premises. This continuing trend is significantly driving the growth of the market.

- In addition, the cloud acts as a catalyst for IT transformation, providing the flexibility to combine the preferred clouds and existing on-premises infrastructure in the ratio best suited for the workload.

- Furthermore, the rising focus on cost optimization and business agility has led to the expansion of cloud data centers. Also, cloud services adapt easily to the changing landscape to meet new requirements. This allows the client organization to focus on its core competency, which, in turn, results in its overall growth.

- The foray of advanced technologies prompts companies to emphasize updating their storage system to match with the competition. The hybrid cloud is one such trend that provides a significant boost to market growth. However, security and the lack of network bandwidth for data transfer can challenge the market's growth.

North America Next Generation Storage Industry Overview

The North America next-generation storage market is essentially concentrated, with technology behemoths wielding dominance through cutting-edge technology and experience. Companies frequently introduce new products with innovations and advances to stay competitive. Major market participants use a range of techniques to stay competitive, including acquisitions, partnerships, investments, mergers, and technology developments and introductions.

In November 2022, ATTO Technology, Inc., a global network, storage connectivity, and infrastructure solutions provider, announced its collaboration with AC&NC, on-premise data storage, to offer a developed, high-performance storage solution to 5600 °K productions, a film and video services provider. The solution includes a JetStor 816FX Fibre Channel Storage Area Network platform along with 16 12 TB SAS drives and the company's Celerity 16 Gb/s Fibre Channel Host Bus Adapters.

In June 2022, StorCentric, a data-centric security provider, announced the general availability (GA) launch of Nexsan EZ-NAS, network attached storage (NAS). It is designed for small and medium-sized businesses (SMBs) and large enterprises' edge deployments. The platform offers advanced enterprise-class features such as AD support, in-line compression, and data-at-rest encryption.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of Digital Data

- 5.1.2 Rising Adoption of Solid-state Devices

- 5.1.3 Increasing Proliferation of Smartphones, Laptops, and Tablets

- 5.2 Market Restraints

- 5.2.1 Lack of Data Security in Cloud- and Server-based Services

6 MARKET SEGMENTATION

- 6.1 Storage System

- 6.1.1 Direct Attached Storage (DAS)

- 6.1.2 Network Attached Storage (NAS)

- 6.1.3 Storage Area Network (SAN)

- 6.2 Storage Architecture

- 6.2.1 File and Object-based Storage (FOBS)

- 6.2.2 Block Storage

- 6.3 End-User Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare

- 6.3.5 Media and Entertainment

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 NetApp Inc.

- 7.1.4 Hitachi Ltd.

- 7.1.5 IBM Corporation

- 7.1.6 Toshiba Corp.

- 7.1.7 Pure Storage Inc.

- 7.1.8 DataDirect Networks.

- 7.1.9 Scality Inc.

- 7.1.10 Fujitsu Ltd.

- 7.1.11 Netgear Inc.