|

市場調查報告書

商品編碼

1637803

中東和非洲的能源管理系統 -市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

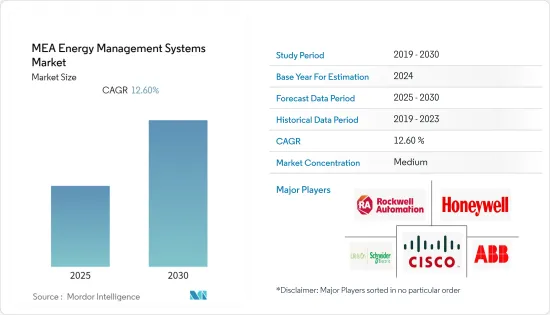

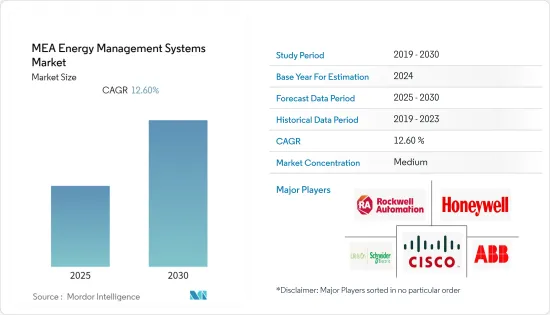

中東和非洲能源管理系統市場預計在預測期內複合年成長率為 12.6%

主要亮點

- 商業和住宅領域擴大使用太陽能電池板系統等再生能源來源,預計將推動該地區對能源管理系統的需求。此外,越來越多的可信任資訊技術平台可以控制和最佳化可用資源,並為糾正措施和更好地監控節能解決方案提供客製化的相關資料,這已成為市場成長的主要驅動力。

- 微訊號分析等最新 EMS 技術的發展正在增加節能系統的數量並減少碳足跡。 IBM 公司、霍尼韋爾國際公司和施耐德電氣等公司正在將這些開發成果整合到其目前的 EMS 模組中,以實現有效的資料監控。

- 隨著環境問題的日益嚴重,中東透過永續發展不斷提高能源使用和效率。例如,杜拜實施了能源策略 203,以有效管理能源使用,並在 2030 年之前大幅減少碳排放。預計沙烏地阿拉伯和約旦也將實施類似舉措,建立鼓勵全部區域清潔、實用和節能發展的法律體制。

- 此外,由於近期新型冠狀病毒肺炎(COVID-19)疫情的爆發,2020年第一季工業能源消耗大幅下降,而住宅用電部門因隔離而大幅成長。此外,許多中東國家計劃中的能源計劃預計將被推遲,導致開發商錯過在該國的部署並遭受經濟處罰。

中東和非洲能源管理系統市場趨勢

家庭能源管理系統的需求正在上升

- 隨著智慧電網、網路通訊、資訊基礎設施、雙向通訊介質、節能方法和各種技術的快速完善,家庭區域網路(HAN)在節能等電力消耗的各個領域越來越受歡迎。使用模式正在經歷革命性的變化。

- 由於人們對能源效率的興趣日益濃厚,該地區正專注於在家庭中安裝節能設備。無論一個國家的能源價格、使用情況或氣候如何,能源管理系統在幾乎所有住宅結構中都是具有成本效益的。因此,它在家庭中越來越受歡迎。

- 例如,沙烏地電力公司(SEC)宣佈在不到14個月的時間內完成了1,000萬個智慧電錶的安裝。這是該公司未來電網現代化和數位轉型舉措的基礎。此外,由於沙烏地阿拉伯力求最大限度地減少對技術進口的依賴並創造就業機會,安裝的 1,000 萬台設備中有 400 萬台是在國內製造的。

提高住宅和商業應用能源效率的舉措

- 中東地區的能源效率和向替代能源的過渡正在穩步推進。最近的事態發展導致一系列聲明強調了地區當局對實現永續發展的關注和承諾。杜拜2030年能源戰略的目標是到2030年將能源消費量和碳排放減少30%,同時透過安全的能源供應和高效的能源利用實現環境和永續性目標。

- 例如,卡達和沙烏地阿拉伯正在推廣使用替代能源發電。這是企業實施最大限度減少總能源使用量的解決方案的一個令人信服的理由。

- 中東的許多公司正在採取動態策略方向,立即減少能源使用。為了滿足這一需求,能源效率趨勢不斷成長。隨著環保意識的增強,中東在能源最佳化、採用專業節能系統和應用永續能源技術方面有許多擴展和領先的機會。

- Wattics Ltd. 與杜拜的智慧永續服務 (SSS) 合作,為大型建築組合和營運的管理者、業主和營運商提供對其建築和業務的高度精細的洞察,為他們提供更多資訊。效率、最佳化、節約和控制。

中東和非洲能源管理系統產業概況

中東和非洲能源管理系統市場分為幾個部分:該市場的主要參與企業包括羅克韋爾自動化、霍尼韋爾國際、施耐德電氣、思科系統公司和 ABB。該領域的最新趨勢如下。

- 2021 年 6 月,羅克韋爾自動化與三個經銷商簽訂合作夥伴協議: 2021 年6 月,羅克韋爾自動化與三個經銷商簽署合作夥伴關係協議: 2021 年6 月,羅克韋爾自動化宣布將與Zubair 合作在中東開發其EMS 產品和服務我們與科威特、也門、阿曼等三家銷售公司簽署了夥伴關係協議:Electric、Naming Dome Trading and Contracting、Automatic Systems Company。

- 2021 年 3 月,伊頓公司宣布推出能源管理解決方案(硬體、軟體和服務的組合),展示了「建築即電網」的能源轉型方法。

- 2020 年 2 月,Honeywell推出了 Forge 能源最佳化系統,這是一種雲端基礎的閉合迴路機器學習解決方案,可將建築物的能源消費量更改為最佳節能設置,而不會影響居住者的舒適度。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 增加智慧電網和智慧電錶的使用

- 政府對能源效率的支持

- 市場限制因素

- 資料安全問題

第6章 市場細分

- 按解決方案類型

- 硬體

- 軟體

- 服務

- 按能源管理系統類型

- 家庭能源管理系統 (HEMS)

- 建築能源管理系統(BEMS)

- 工廠能源管理系統(FEMS)

- 按最終用戶產業

- 製造業

- 電力能源

- 資訊科技/電訊

- 醫療保健

- 公司

- 其他

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

第7章 競爭格局

- 公司簡介

- Rockwell Automation Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Cisco Systems, Inc.

- ABB Ltd.

- Eaton Corporation

- IBM Corporation

- Siemens AG

- Mitsubishi Electric Corporation

- Wrtsil Oyj Abp

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 47365

The MEA Energy Management Systems Market is expected to register a CAGR of 12.6% during the forecast period.

Key Highlights

- The growing usage of renewable energy sources, such as solar panel systems in business and residential sectors, is likely to boost demand for energy management systems in this region. Additionally, the growing number of dependable information technology platforms for controlling and optimizing available resources and providing customized and relevant data for corrective actions and better monitoring of energy-efficient solutions is a major driving factor for market growth.

- There has been a rise in energy-efficient systems and a reduction in carbon footprint due to developments in the newest technologies in EMS, such as tiny signal analysis. Companies including IBM Corporation, Honeywell International Inc., and Schneider Electric have integrated these developments into their current EMS modules for effective data monitoring.

- As environmental concerns have grown, the Middle East has made consistent improvements in energy usage and efficiency through sustainable development. Dubai, for example, has implemented Energy Strategy 203 to efficiently control energy usage and cut significant carbon emissions by 2030. Similar initiatives are anticipated to be implemented in Saudi Arabia and Jordan and develop legislative frameworks to encourage clean, practical, and energy-efficient developments throughout the region.

- Furthermore, due to the recent COVID-19 epidemic, the residential power sector experienced a considerable increase due to quarantines, while industrial energy consumption fell dramatically in the first quarter of 2020. Furthermore, numerous Middle Eastern nations are projected to have delays in their planned energy projects, causing developers to miss country deployment dates and incur financial penalties.

MEA Energy Management Systems Market Trends

Demand for Home Energy Management Systems is on the rise

- Home area networks (HANs) have experienced a revolutionary change in multiple areas of power consumption domains, such as energy conservation at consumption premises and electricity usage patterns, due to rapid improvements in technologies such as smart grid, network communication, information infrastructures, bidirectional communication medium's, energy conservation methodologies, and various techniques.

- Owing to the growing concern about energy efficiency, there is a growing focus on installing energy-saving equipment in homes in this region. Regardless of national energy pricing, use, or climatic considerations, energy management systems are cost-effective in almost all residential structures. As a result, they're becoming more popular in households.

- For instance, The Saudi Power Company (SEC) has announced that it has completed the installation of 10 million smart electricity meters in less than 14 months. This will assist provide the groundwork for the company's future grid modernization and digital transformation initiatives. Furthermore, the utility claims that 4 million of the 10 million devices installed were made domestically due to Saudi Arabia's attempts to minimize its dependency on technology imports and generate jobs.

Initiative Taken for Energy Efficiency specifically in Residential and Commercial Application

- The Middle East is steadily moving toward energy efficiency and alternate energy sources. In recent years, a number of statements have been released underlining regional authorities' concerns and commitment to achieving sustainable development. Dubai's Energy Strategy 2030 intends to cut energy consumption and carbon dioxide emissions by 30% by 2030 while also satisfying environmental and sustainability goals through secure energy supply and efficient energy usage.

- Qatar and Saudi Arabia, for example, are pushing the use of alternative energy in electricity generation in power generation. This is a compelling reason for companies to implement solutions that minimize total energy use.

- Many firms in the Middle East have adopted a dynamic strategy direction to reduce energy use immediately. To meet this need, the trend toward energy efficiency will only continue to expand. With rising environmental consciousness, the Middle East has a lot of opportunities to expand and lead in terms of energy optimization, the introduction of specialized energy-saving systems, and the application of sustainable energy technology.

- Wattics Ltd. has partnered with Dubai's Smart Sustainable Services (SSS) to deliver an EMS integrated solution that will provide managers, owners, and operators of large building portfolios and businesses with highly granular insight into building and operational performance, allowing for better resource efficiency, optimization, savings, and control.

MEA Energy Management Systems Industry Overview

The Middle East and Africa Energy Management Systems Market is partially fragmented. Some of the major players in the market are Rockwell Automation Inc., Honeywell International Inc., Schneider Electric SE, Cisco Systems, Inc., ABB Ltd. Recent Developments made in this sector are:

- In June 2021, Rockwell Automation signed a partnership deal with three distributors names: Zubair Electric, Naming Dome Trading and Contracting, and Automatic Systems Company for exploring the company's EMS products & services in the Middle East countries such as Kuwait, Yemen, and Oman.

- In March 2021, Eaton Corporation debuted its Energy management solution (which combines hardware, software, and services) to demonstrate its' Buildings as a Grid' approach to the energy transition, which aims to help customers increase resilience, accelerate decarbonization, generate new revenue streams, and lower energy costs.

- In February 2020, Honeywell introduced its Forge Energy Optimization systems (a closed-loop, cloud-based machine learning solution) to constantly monitor a building's energy consumption changes to optimal energy-saving settings without affecting occupant comfort levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Smart Grids and Smart Meters

- 5.1.2 Government Support Towards Energy Efficiancy

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Security

6 MARKET SEGMENTATION

- 6.1 By Solution Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Type of Energy Management System

- 6.2.1 Home Energy Management System (HEMS)

- 6.2.2 Building Energy Management System (BEMS)

- 6.2.3 Factory Energy Management Systems (FEMS)

- 6.3 By End-User Industry

- 6.3.1 Manufacturing

- 6.3.2 Power and Energy

- 6.3.3 IT & Telecom

- 6.3.4 Healthcare

- 6.3.5 Corporate

- 6.3.6 Others

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

- 6.4.4 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Honeywell International Inc.

- 7.1.3 Schneider Electric SE

- 7.1.4 Cisco Systems, Inc.

- 7.1.5 ABB Ltd.

- 7.1.6 Eaton Corporation

- 7.1.7 IBM Corporation

- 7.1.8 Siemens AG

- 7.1.9 Mitsubishi Electric Corporation

- 7.1.10 Wrtsil Oyj Abp

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219