|

市場調查報告書

商品編碼

1686178

歐洲能源管理系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

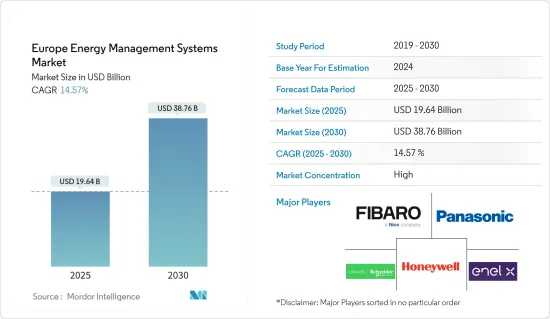

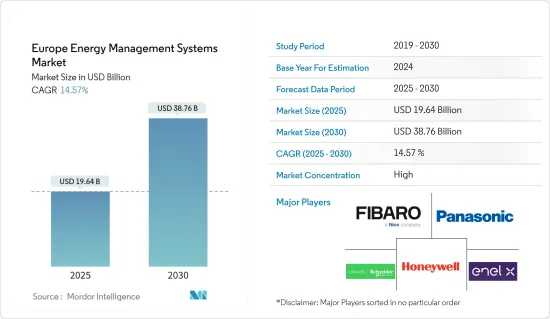

歐洲能源管理系統市場規模預計在 2025 年為 196.4 億美元,預計到 2030 年將達到 387.6 億美元,預測期內(2025-2030 年)的複合年成長率為 14.57%。

主要亮點

- 智慧電網革命推動市場成長:受智慧電網技術和智慧電錶的採用推動,歐洲能源管理系統 (EMS) 市場正在強勁擴張。這些技術進步正在改變能源產業,歐洲各地正在進行大量投資以實現電網現代化。

- 智慧電網投資:歐洲智慧電網基礎設施投資將達到 2021 年的 567 億美元,高於 2017 年的 487 億美元。

- 智慧電錶部署:歐盟的目標是到2024年安裝2.25億塊智慧電錶和5,100萬塊燃氣表,目標是讓80%的消費者配備智慧電錶。

- 英國智慧電錶安裝 在英國,主要能源供應商安裝的智慧電錶數量從 2020 年第二季的 135,090 台急劇增加到 2021 年第二季的 979,752 台,反映出採用率迅速。

- 能源效率成為焦點:隨著政府和企業認知到最佳化能源使用的好處,對能源效率的投資正在增加,從而推動了對 EMS 解決方案的需求。

- 歐盟能源效率目標:歐盟(EU)已設定到2030年將能源效率提高至少32.5%的目標,增加了對節能解決方案的需求。

- 德國的效率驅動:德國計劃在 2030 年將初級能源消費量在 2008 年的基礎上減少 30%,這將推動對先進 EMS 技術的需求。

- 土耳其效率投資:土耳其計劃未來十年在能源效率方面投資超過 100 億美元,預計到 2033 年可節省 300 億美元。

- 人口成長推動 HVAC 需求激增:人口成長和氣候條件的變化推動了對暖氣、通風和空調 (HVAC) 系統的需求激增,為 EMS 提供者創造了新的市場。

- 人口成長:歐洲人口到2022年將成長到7.435億,比2012年增加460萬。

- HVAC需求:2021年歐洲對空調設備的需求將達到890萬台,其中俄羅斯以190萬台的需求領先。

- 投資新暖通空調工廠:三菱電機已向其位於土耳其的空調製造廠投資 1.13 億美元,將年產能提高 10 萬台。

- 競爭格局決定市場動態:歐洲 EMS 市場競爭激烈,老牌企業和新興企業都在競爭市場佔有率。

- 主要市場主要企業包括Schneider ElectricSE、Honeywell國際、Panasonic、Enel X Srl 等。

- Schneider Electric的優勢Schneider Electric擁有 135,000 名員工,是提供綜合能源管理軟體的行業領導者。

- 新興企業:Green Energy Options Limited 和 Efergy Technologies SL 等新興企業以家用能源監控設備引領住宅EMS 市場。

- 未來展望:整合與創新:歐洲 EMS 市場的未來一片光明,技術進步和與其他智慧系統的整合預計將推動進一步成長。

- 能源儲存成長:預計到 2030 年,歐盟的能源儲存容量將達到 187GW,到 2050 年將達到 600GW,需要先進的 EMS 解決方案。

- 擁抱人工智慧和機器學習:人工智慧和機器學習有望增強 EMS 能力,法國等國家已在其人工智慧戰略上投資 22 億歐元。

- 分散式能源系統:向分散式能源的轉變和可再生能源的日益普及將需要先進的 EMS 來管理更複雜的能源生態系統。

歐洲能源管理系統市場趨勢

建築能源管理系統 (BEMS) 部門推動市場成長

都市化和能源效率法規已將建築能源管理系統 (BEMS) 定位為歐洲 EMS 市場的最大部分。

- 市值預計 2022 年 BEMS 市場價值將達到 93.8 億美元,到 2028 年將達到 176.7 億美元,複合年成長率為 11.2%。

- 都市化的影響:歐洲都市化的加速和嚴格的能源效率立法正在推動對 BEMS 解決方案的需求。

- 智慧建築技術推動成長:由先進的軟體和硬體支援的智慧建築技術的採用日益廣泛,是 BEMS 領域的主要成長動力。

- 人工智慧的整合:政府對人工智慧的投資,例如法國 22 億歐元(24.6 億美元)的人工智慧策略,預計將進一步推動 BEMS 市場的成長。

- 技術創新:智慧建築技術正在加強能源管理,促進商業領域採用 EMS。

- 政府措施推動市場擴張:能源效率指令(EED)等監管要求迫使歐洲國家採用 EMS 解決方案,從而促進市場成長。

- 能源審核:EED 要求進行能源審核和 EMS 實施,迫使公司為商業客戶開發創新產品。

商業部門可望佔據主要市場佔有率

商業領域仍然是 BEMS 的主要採用者,建設活動的活性化推動了成長。

- 商業市場規模:商業 BEMS 市場規模預計在 2022 年達到 20.2 億美元,並以 12.3% 的複合年成長率成長,到 2028 年達到 40.4 億美元。

- 建築業提振:在英國,2022 年第三季私人商業建設訂單成長了 27.7%,進一步推動了 BEMS 的採用。

- 家庭能源管理系統 (HEMS):快速成長的領域

- 受智慧家庭趨勢的推動,HEMS 領域是歐洲 EMS 市場中成長最快的部分。

- 快速成長:HEMS 預計將從 2022 年的 46.1 億美元成長到 2028 年的 139.8 億美元,複合年成長率為 20.1%。

- 智慧家庭整合:網路智慧家庭技術的興起使得HEMS對消費者的吸引力越來越大。

- 技術進步推動應用:通訊媒體和智慧型設備的技術進步支持了 HEMS 的傳播。

- 家庭區域網路(HAN):雙向通訊技術正在推動家庭能源管理的發展,並促進對 HEMS 的需求不斷成長。

- 軟體解決方案引領潮流:軟體解決方案在 HEMS 市場中佔據主導地位,2023 年至 2028 年的複合年成長率為 22.0%,而硬體的複合年成長率為 18.9%。

- 策略夥伴關係加速市場擴張:與重點產業的夥伴關係正在擴大 HEMS 產品範圍並實現更廣泛的市場滲透。

- 伊頓與 LG夥伴關係:伊頓於 2022 年 2 月與 LG 電子建立的合作顯示了策略聯盟如何加強 HEMS 解決方案並推動市場成長。

歐洲能源管理系統產業概況

歐洲 EMS 市場由擁有強大市場地位和技術專長的全球參與者所主導。

市場領導Schneider Electric、Honeywell國際和Panasonic是主要企業,擁有全面的產品系列。

整合市場:EMS 市場正在整合,主要企業利用其研發投資和全球影響力來保持領先地位。

創新和技術力推動領導:創新是保持 EMS 市場領導地位的關鍵因素,領先的公司正在大力投資技術。

研發投資:Schneider Electric等公司在研發方面投入了大量資金,以開發先進的能源管理解決方案,確保其在市場上的地位。

夥伴關係推動創新:Schneider Electric與日立能源之間的夥伴關係關係正在幫助企業在可再生能源管理方面進行創新和擴張。

EMS 市場未來成功的策略:EMS 市場成功的關鍵策略包括智慧電網投資、基於物聯網的自動化和滿足能源法規。

關注智慧電網:越來越多的公司將智慧電網技術和建築自動化作為其 EMS 策略的一部分。

適應法規:滿足新的能源法規對於在不斷發展的 EMS 領域保持競爭力至關重要。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 技術進步

- 宏觀經濟因素如何影響市場

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業供應鏈分析

第5章 市場動態

- 市場促進因素

- 智慧電網和智慧電錶的使用日益增多

- 增加能源效率投資

- 人口快速成長導致住宅暖通空調需求激增

- 市場限制

- 初始安裝和維護成本高

- 中小企業缺乏意識

第6章 市場細分

- 按解決方案類型

- 建築能源管理系統

- 硬體

- 軟體和服務

- 按最終用戶

- 商業

- 衛生保健

- 教育

- 產業

- 其他最終用戶

- 家庭能源管理系統

- 硬體

- 軟體

- 建築能源管理系統

- 按銷售管道

- 直銷/合作銷售/零售

- 增值轉售商/系統整合

- 顧問/公用事業

- 按國家

- 英國

- 德國

- 法國

- 西班牙

- 比荷盧

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Fibar Group SA(Nice SpA)

- Honeywell International Inc.

- Panasonic Corporation

- Enel X SRL(Enel SpA)

- Uplight Inc.

- SAP SE

- British Gas Services Limited(Centrica PLC)

- Green Energy Options Limited

- Efergy Technologies SL

第8章:未來市場展望

The Europe Energy Management Systems Market size is estimated at USD 19.64 billion in 2025, and is expected to reach USD 38.76 billion by 2030, at a CAGR of 14.57% during the forecast period (2025-2030).

Key Highlights

- Smart Grid Revolution Drives Market Growth: The Europe Energy Management Systems (EMS) market is undergoing significant expansion, driven by the adoption of smart grid technologies and smart meters. These innovations are transforming the energy sector, with substantial investments being made to modernize grids across Europe.

- Smart grid investment: Investment in Europe's smart grid infrastructure reached USD 56.7 billion in 2021, showing notable growth from USD 48.7 billion in 2017.

- Smart meter adoption: The European Union aims to install 225 million smart electricity meters and 51 million gas meters by 2024, with 80% of consumers targeted to be equipped with smart meters.

- UK smart meter installations: In Great Britain, the number of smart meters installed by large energy suppliers surged from 135,090 in Q2 2020 to 979,752 in Q2 2021, reflecting rapid adoption rates.

- Energy Efficiency Takes Center Stage: Rising investments in energy efficiency are fueling the demand for EMS solutions as governments and businesses recognize the benefits of optimized energy use.

- EU energy efficiency target: The European Union has set a goal of increasing energy efficiency by at least 32.5% by 2030, driving demand for energy-efficient solutions.

- Germany's efficiency drive: Germany aims to cut primary energy consumption by 30% by 2030 compared to 2008, pushing demand for advanced EMS technology.

- Turkey's efficiency investments: Turkey plans to invest over USD 10 billion in energy efficiency over the next decade, with projected savings of USD 30 billion by 2033.

- HVAC Demand Surges Amid Population Growth: Demand for Heating, Ventilation, and Air Conditioning (HVAC) systems is growing rapidly, driven by population increases and changing climate conditions, creating a new market for EMS providers.

- Population growth: Europe's population grew to 743.5 million in 2022, up by 4.6 million since 2012, increasing demand for new housing and HVAC systems.

- HVAC demand: The demand for air conditioning devices in Europe hit 8.9 million units in 2021, with Russia leading in sales at 1.9 million units.

- New HVAC plant investment: Mitsubishi Electric Corporation invested USD 113 million in a new air-conditioner production plant in Turkey, boosting production capacity by 100,000 units annually.

- Competitive Landscape Shapes Market Dynamics: The European EMS market is highly competitive, with both established players and startups working to gain market share.

- Key market players: Leading companies include Schneider Electric SE, Honeywell International Inc., Panasonic Corporation, and Enel X S.r.l.

- Schneider Electric's dominance: With 135,000 employees, Schneider Electric leads in providing comprehensive energy management software.

- Emerging players: Startups such as Green Energy Options Limited and Efergy Technologies S.L. are gaining traction in the residential EMS market with in-home energy monitoring devices.

- Future Outlook: Integration and Innovation: The future of Europe's EMS market looks bright, with technological advancements and integration with other smart systems expected to drive further growth.

- Energy storage growth: The European Union's energy storage capacity is expected to reach 187 GW by 2030 and 600 GW by 2050, necessitating advanced EMS solutions.

- AI and machine learning adoption: AI and machine learning are poised to enhance EMS capabilities, as countries like France invest EUR 2.2 billion in AI strategies.

- Distributed energy systems: The shift towards decentralized energy and increasing adoption of renewable energy will require sophisticated EMS to manage more complex energy ecosystems.

Europe Energy Management Systems Market Trends

Building Energy Management Systems (BEMS) Segment Drives Market Growth

Urbanization and energy efficiency regulations have positioned Building Energy Management Systems (BEMS) as the largest segment in the Europe EMS market.

- Market value: BEMS was valued at USD 9.38 billion in 2022 and is projected to reach USD 17.67 billion by 2028, growing at a CAGR of 11.2%.

- Urbanization impact: The rise in urbanization and stringent energy efficiency laws across Europe drive the demand for BEMS solutions.

- Smart Building Technologies Fuel Growth: The increasing adoption of smart building technologies, which leverage advanced software and hardware, is a significant growth driver for the BEMS segment.

- AI integration: Government investments in artificial intelligence, such as France's EUR 2.2 billion (USD 2.46 billion) AI strategy, are expected to further fuel BEMS market growth.

- Technological innovation: Smart building technologies are enabling enhanced energy management, contributing to the adoption of EMS across commercial sectors.

- Government Initiatives Propel Market Expansion: Regulatory mandates like the Energy Efficiency Directive (EED) compel European nations to adopt EMS solutions, boosting market growth.

- Energy audits: The EED mandates energy audits and EMS adoption, pushing companies to develop innovative products for commercial customers.

Commercial Sector Segment is Expected to Hold Significant Market Share

The commercial sector remains a major adopter of BEMS, with rising construction activity driving growth.

- Commercial market size: Valued at USD 2.02 billion in 2022, the commercial BEMS market is expected to grow at a CAGR of 12.3% and reach USD 4.04 billion by 2028.

- Construction boost: The UK saw a 27.7% increase in private commercial construction orders in Q3 2022, further driving BEMS adoption.

- Home Energy Management Systems (HEMS): Fastest-Growing Segment

- The HEMS segment is the fastest-growing in the European EMS market, spurred by the smart home trend.

- Rapid growth: HEMS is projected to grow from USD 4.61 billion in 2022 to USD 13.98 billion by 2028, registering a CAGR of 20.1%.

- Smart home integration: The rise in networked smart home technologies has made HEMS increasingly attractive to consumers.

- Technological Advancements Drive Adoption: HEMS adoption is supported by technological advances in communication mediums and smart devices.

- Home area networks (HANs): Bi-directional communication technologies are advancing home energy management, contributing to the rising demand for HEMS.

- Software solutions lead: Software solutions dominate the HEMS market, with a projected CAGR of 22.0% from 2023 to 2028, compared to hardware's 18.9%.

- Strategic Partnerships Accelerate Market Expansion: Key industry partnerships are expanding HEMS offerings, enabling broader market penetration.

- Eaton and LG partnership: Eaton's collaboration with LG Electronics in February 2022 exemplifies how strategic partnerships enhance HEMS solutions and drive market growth.

Europe Energy Management Systems Industry Overview

The European EMS market is dominated by global players with strong market positions and technological expertise.

Market leaders: Schneider Electric, Honeywell International, and Panasonic Corporation are key players with comprehensive product portfolios.

Consolidated market: The EMS market is consolidated, with top players leveraging their R&D investments and global reach to maintain leadership.

Innovation and Technological Prowess Drive Leadership: Innovation is central to maintaining leadership in the EMS market, with top companies investing heavily in technology.

R&D investment: Companies like Schneider Electric invest significantly in R&D to develop advanced energy management solutions, securing their market positions.

Partnerships drive innovation: Collaborations, such as Schneider Electric's partnership with Hitachi Energy, are helping companies innovate and expand in renewable energy management.

Strategies for Future Success in the EMS Market: Key strategies for success in the EMS market include smart grid investments, IoT-based automation, and compliance with energy regulations.

Smart grid focus: Companies are increasingly focusing on smart grid technologies and building automation as part of their EMS strategies.

Regulatory adaptation: Adapting to new energy regulations will be critical for maintaining a competitive edge in the evolving EMS landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Advancements

- 4.3 Impact of Macro-economic Factors on The Market

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

- 4.5 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Smart Grids and Smart Meters

- 5.1.2 Rising Investments in Energy Efficiency

- 5.1.3 Surge in Demand for HVAC Housing Owing to Rapid Population Growth

- 5.2 Market Restraints

- 5.2.1 High Initial Installation Costs Coupled With Maintenance Costs

- 5.2.2 Lack of Awareness in Small and Medium-sized Businesses

6 MARKET SEGMENTATION

- 6.1 By Type of Solution

- 6.1.1 Building Energy Management System

- 6.1.1.1 Hardware

- 6.1.1.2 Software and Services

- 6.1.2 By End-User

- 6.1.2.1 Commercial

- 6.1.2.2 Healthcare

- 6.1.2.3 Education

- 6.1.2.4 Industrial

- 6.1.2.5 Other End-Users

- 6.1.3 Home Energy Management System

- 6.1.3.1 Hardware

- 6.1.3.2 Software

- 6.1.1 Building Energy Management System

- 6.2 By Distribution Channel

- 6.2.1 Direct/Partner Sales/Retail

- 6.2.2 Value-added Resellers/System Integrators

- 6.2.3 Consultants/Utilities

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Benelux

- 6.3.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Fibar Group SA (Nice SpA)

- 7.1.3 Honeywell International Inc.

- 7.1.4 Panasonic Corporation

- 7.1.5 Enel X S.R.L. (Enel SpA)

- 7.1.6 Uplight Inc.

- 7.1.7 SAP SE

- 7.1.8 British Gas Services Limited (Centrica PLC)

- 7.1.9 Green Energy Options Limited

- 7.1.10 Efergy Technologies SL