|

市場調查報告書

商品編碼

1637857

德國垃圾焚化發電:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Waste-to-Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

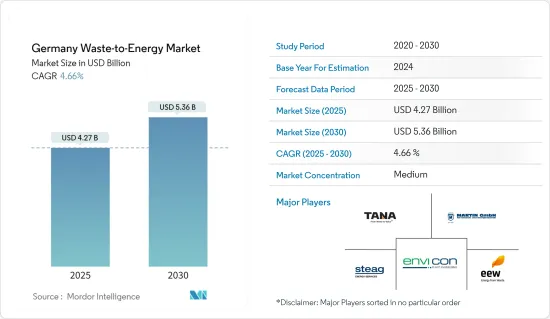

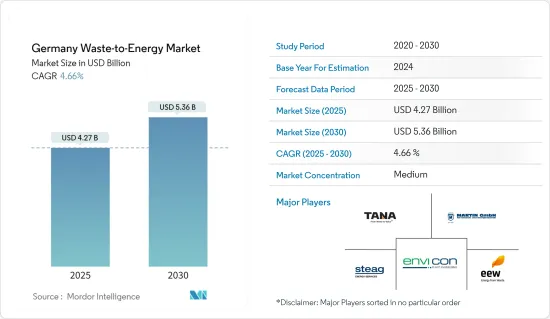

德國垃圾焚化發電市場規模預計到2025年為42.7億美元,預計2030年將達到53.6億美元,預測期間(2025-2030年)複合年成長率為4.66%。

主要亮點

- 大量廢棄物產生是該國的一個緊迫問題,廢棄物發電被認為是滿足該國不斷成長的電力和廢棄物管理需求的最有前途和永續的解決方案之一。廢棄物產生量的增加、為滿足永續城市生活需求而對廢棄物管理的興趣日益濃厚,以及對非石化燃料能源來源的日益關注,正在推動該國廢棄物能源市場的採用。

- 然而,德國的廢棄物回收率仍位居世界前列,廢棄物焚燒,這正在影響該國的市場成長。此外,歐盟委員會決定將歐洲轉變為更循環的經濟,並在 2035 年之前將城市固態廢棄物的回收率提高到 65% 以上,預計將對馬蘇垃圾焚化市場產生影響。

新興的垃圾焚化發電技術,例如 Dendro Liquid Energy (DLE),其效率提高了四倍,並且具有工廠無排放氣體或廢水問題等其他優點,預計將在未來幾年繼續相關人員。的機會。

德國廢棄物發電市場趨勢

基於熱的廢棄物能源轉化主導市場

- 在熱力或都市垃圾焚燒方法中,燃燒廢棄物會產生廢氣。這些廢氣產生蒸氣用於發電以及區域供熱和製冷。

- 焚燒過程的主要目的是減少都市固態廢棄物(MSW)的體積和質量,並使廢棄物在燃燒過程中保持化學惰性,而不需要額外的燃料。如果過程中收集的廢棄物的熱值超過 7 MJ/kg,則認為使用焚化爐既經濟又有效率。

- 就技術而言,熱處理在垃圾發電市場中最為普遍。在熱條件下,焚燒是最廣泛和核准的技術。根據聯邦統計局(Destatis)統計,截至 2021 年,德國有超過 156 座廢棄物正在運作。然而,較低的初始投資、資本成本和每噸運行維護成本使得協同處理和氣化成為經濟的選擇。德國未來的廢棄物流將根據可用於熱處理的廢棄物和殘留物的出現和可用性以及能源回收設施的能力發展來確定。

- 目前,焚燒是最知名的垃圾焚化發電技術。氣化和熱解過程產生可燃合成氣(syngas),用於發電或進一步精製和提煉用於燃氣渦輪機和引擎中直接髮電。

- 根據國際可再生能源機構預測,2022年德國生質能源裝置容量將為9,880兆瓦,高於2021年的9,825兆瓦。因此,德國垃圾焚化發電市場預計將隨著生質能源能的增加而成長。

- 另一方面,德國在處理城市廢棄物方面已將重點從處置轉向預防和回收。都市廢棄物僅佔該國產生的所有廢棄物的 10% 左右,但預防城市固體廢棄物可以減少整個廢棄物轉化階段和所消費產品的生命週期對環境的影響。

- 對各種廢棄物管理方法的生命週期評估表明,與透過燃燒產生能量相比,廢棄物預防、再利用、回收和堆肥等替代策略可產生三到五倍的能量。

- 例如,在焚化爐中燃燒一噸紙會產生約 8,200 兆焦耳的能量。然而,如果回收相同的材料,將節省約 35,200 兆焦耳的能源。因此,包括德國在內的一些歐洲國家開始關注回收利用,這對研究市場來說是一種限制。

- 然而,德國廢棄物能源產出的增加被認為主要是由於 2005 年因甲烷排放增加而禁止掩埋。對掩埋的禁令可能會增加對垃圾焚化發電發電廠的需求,以容納最初掩埋的廢棄物。

- 基於上述情況,基於熱的廢棄物能源轉換預計將主導市場。

德國廢棄物回收率上升預計將抑制市場

- 德國的回收率很高:家庭廢棄物為67.6%,工業廢棄物和商業廢棄物為70%左右。此外,儘管廢棄物產生量迅速增加,但德國僅有156座熱廢棄物廠在運作,處理量超過2,500萬噸。此外,廢棄物的能源效率有限,預計將阻礙該國垃圾焚化發電市場的成長。

- 德國的廢棄物回收率仍位居世界前列,比廢棄物焚燒具有更好的經濟效益,影響該國的市場成長。

- 此外,歐盟委員會通過一項決議,將歐洲轉變為循環經濟,到2035年將城市固態廢棄物的回收率提高到65%以上,預計將對焚燒市場產生影響。

- 此外,固態燃燒殘渣的最終處理困難且昂貴,造成嚴重的環境問題。此外,垃圾焚化發電市場波動較大,長期缺乏穩定的市場環境也預計將限制其在預測期內的成長。

- 因此,鑑於上述幾點,預計由於德國廢棄物回收率的提高,市場將受到限制。

德國垃圾焚化發電產業概況

德國廢棄物市場適度細分。主要企業(排名不分先後)包括 Tana Oy、Martin GmbH、Envi Con &Plant Engineering GmbH、EEW Energy from Waste 和 STEAG Energy Services GmbH。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義與研究假設

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 產生大量生活廢棄物

- 日益關注非石化燃料來源

- 抑制因素

- 德國的廢棄物回收率

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 科技

- 身體的

- 熱

- 生物

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Tana Oy

- Martin GmbH

- Envi Con & Plant Engineering GmbH

- STEAG Energy Services GmbH

- EEW Energy from Waste GmbH

第7章 市場機會及未來趨勢

- 新興的廢棄物技術,如 Dendro Liquid Energy (DLE)

The Germany Waste-to-Energy Market size is estimated at USD 4.27 billion in 2025, and is expected to reach USD 5.36 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030).

Key Highlights

- With the high amount of waste generation becoming a pressing issue in the country, harnessing energy from waste is considered one of the most promising and sustainable solutions for the country's growing electricity and waste management needs. The increasing amount of waste generation, the growing concerns for its management to meet the need for sustainable urban living, and the increasing focus on non-fossil fuel sources of energy have been driving the adoption of the waste-to-energy market in the country.

- However, the recycling rate of waste in Germany remains among the highest in the world and also offers greater economic benefits than waste incineration, which has affected market growth in the country. Besides, the adoption of the resolution by the European Commission to turn Europe into a more circular economy and boost recycling of municipal solid waste to more than 65% by 2035 is expected to affect the market for incineration as well.

The emerging waste-to-energy technologies, such as Dendro Liquid Energy (DLE), which is four times more efficient in terms of electricity generation and has the additional benefit of no emission discharge or effluent problems at plant sites, are expected to create significant opportunities for the market players over the coming years.

Waste to Energy Germany Market Trends

Thermal Based Waste-to-Energy Conversion is Dominating the Market

- Thermal or municipal solid waste incineration involves waste combustion, which generates flue gases. These flue gases produce steam for electricity production and district heating or cooling.

- The primary goal of the incineration process is to reduce the volume and mass of municipal solid waste (MSW) and to make the waste chemically inert in a combustion process without the need for additional fuel. The utilization of the incineration facility is considered economical and productive when the waste collected for the process has a calorific value of more than 7 MJ/kg.

- Regarding technology, thermal processing is among the most popular in the WtE market. Under thermal conditions, incineration is the most prevalent and approved technology. According to the Federal Statistical Office (Destatis), over 156 waste incineration plants were operational in Germany as of 2021. However, due to the lower initial investment, capital cost, and O&M cost per ton, co-processing and gasification are economical options. Future waste streams in Germany are determined by considering the emergence and availability of wastes and residues potentially usable for thermal treatment and the connected capacity developments of energy recovery facilities.

- At present, incineration is the most well-known WtE technology for MSW processing. The gasification and pyrolysis processes produce a combustible synthetic gas (syngas) that can either be used to generate electricity or further refined and upgraded for direct generation in a gas turbine or engine.

- According to International Renewable Energy Agency, in 2022, Germany's total bioenergy installed capacity accounted for 9880 MW, more significant than 9825 MW in 2021. Thus, with increasing bioenergy capacity, Germany's waste-to-energy market is expected to grow.

- On the flip side, Germany has significantly shifted its focus with respect to municipal waste disposal methods from disposal to prevention and recycling. Although municipal waste represents only around 10% of total waste generated in the country, its prevention can reduce the environmental impact during the waste conversion phase and through the life cycle of the products consumed.

- A life-cycle assessment of different waste management options indicates that three to five times more energy can be saved through alternative strategies, such as waste prevention, reuse, recycling, and composting, compared to generating energy by combustion.

- For instance, an incinerator can burn one ton of paper and generate about 8,200 megajoules of energy. However, recycling the same material saves about 35,200 megajoules of energy. As a result, several European countries, including Germany, have started to focus more on recycling, which is restraining the studied market.

- However, the increase in energy generation through waste in Germany could be primarily attributed to the banning of landfills in 2005 due to the rise in methane emissions. The ban on landfills will likely increase demand for waste-to-energy plants to accommodate the waste initially going into landfills.

- Thus, owing to the above points thermal based waste-to-energy conversion is expected to dominating the Market.

Increasing Recycling Rate of Waste in Germany Expected to Restrain the Market

- Germany has high % recycling rates of 67.6% for household waste and around 70% for industrial and commercial waste. In addition, there are only over 156 thermal waste incineration plants operational in Germany, with a capacity of over 25 million tons, while waste generation is increasing exponentially. Furthermore, there is the limited energy efficiency of waste incineration plants, which is expected to hinder the growth of the waste-to-energy market in the country.

- The recycling rate of waste in Germany remains among the highest in the world and offers more excellent economics than waste incineration, which has affected market growth in the country.

- In addition, the adoption of the resolution by the European Commission to turn Europe into a more circular economy and boost the recycling of municipal solid waste to more than 65% by 2035 is expected to affect the market for incineration as well.

- Moreover, the eventually difficult and expensive disposal of solid combustion residues raises severe environmental concerns. Besides, the insecurity and partly even the lack of long-term stable market conditions for the waste-to-energy market are expected to restrain the growth during the forecast period.

- Thus, owing to the above points, the increasing recycling rate of waste in Germany is expected to restrain the market.

Waste to Energy Germany Industry Overview

The German waste-to-energy market is moderately fragmented. Some of the key players (not in any particular order) include Tana Oy, Martin GmbH, Envi Con & Plant Engineering GmbH, EEW Energy from Waste, and STEAG Energy Services GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition and Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 MARKET DYNAMICS

- 4.5.1 Drivers

- 4.5.1.1 The High Amount of Waste Generation in the Country

- 4.5.1.2 The growing Focus on Non-Fossil Fuel Sources

- 4.5.2 Restraints

- 4.5.2.1 The Recycling Rate of Waste in Germany

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Physical

- 5.1.2 Thermal

- 5.1.3 Biological

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Tana Oy

- 6.3.2 Martin GmbH

- 6.3.3 Envi Con & Plant Engineering GmbH

- 6.3.4 STEAG Energy Services GmbH

- 6.3.5 EEW Energy from Waste GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Emerging Waste-to-Energy Technologies, Such as Dendro Liquid Energy (DLE)