|

市場調查報告書

商品編碼

1637900

碳管理系統 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Carbon Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

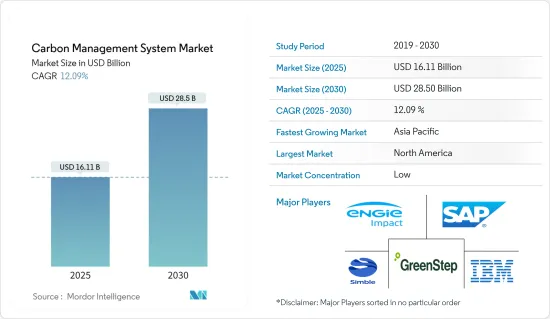

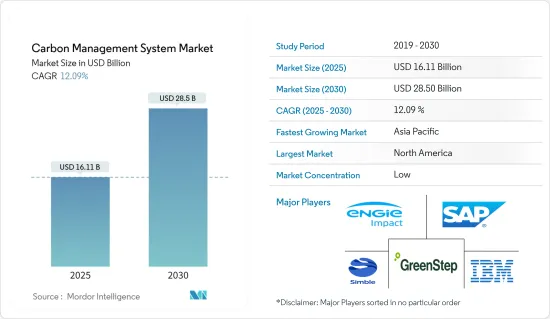

碳管理系統市場規模預計到 2025 年為 161.1 億美元,預計到 2030 年將達到 285 億美元,預測期內(2025-2030 年)複合年成長率為 12.09%。

由於更嚴格的氣候變遷法規、碳排放成本的增加以及碳管理相關技術的進步,對碳管理系統的需求持續增加。

採取碳排放措施是全球對碳管理系統需求不斷成長的關鍵因素。這些措施為碳管理系統的實施創造了有利的環境,包括排放目標、碳定價和課稅、合規性和監管要求。

將先進技術融入碳管理平台,可即時追蹤碳排放並有效採取必要措施,帶動碳管理系統的市場銷售。

此外,隨著企業越來越意識到永續性和企業社會責任的重要性,許多組織正在製定碳減排目標,並致力於實現碳中和,以符合國際氣候變遷承諾。因此,為了追蹤進展並確定要開發的領域,公司對碳管理系統的採用已大大增加。

不斷變化的法規環境使得公司很難比較和實施不同的系統。技術變革正在挑戰碳管理系統供應商跟上最新的技術趨勢,這限制了市場的成長。

為了保持永續性,市場參與企業正在透過碳管理領域的夥伴關係和聯盟來擴大其能力和影響力。例如,根據國際能源總署(IEA)的預測,為了在2050年實現淨零排放,全球每年對清潔能源的投資必須在2030年之前增加兩倍以上,達到約4兆美元。這項措施預計將創造許多新的就業機會,顯著提振全球經濟,並確保到本十年末每個人都能用上電力和清潔的烹飪方法。

由於 COVID-19 大流行,包括氣候變遷在內的全球環境挑戰變得更加明顯。隨著組織和政府專注永續性並減少環境足跡,對碳管理解決方案的需求不斷增加。此外,隨著疫情期間遠距工作成為必需,公司正在採用數位解決方案來管理環境資料並在永續性進行有效協作。

碳管理系統市場趨勢

石油和天然氣產業確認成長

- 石油和天然氣行業預計將為市場成長做出重大貢獻。作為世界上最大、碳排放最密集的行業之一,減少碳排放並邁向更永續的未來的壓力越來越大。

- 隨著石油公司製定更嚴格的排放目標,數位技術可能有利於範圍 1 和範圍 2 的排放。追蹤油井和管道的有害甲烷排放至關重要,機器學習可以幫助提高能源使用效率。來自無人機、感測器、衛星和攝影機的資料也很重要。

- 多家公司正在努力減少其工業營運的碳排放並加速向淨零過渡。例如,AVEVA 與 Aker Carbon Capture 密切合作,後者為水泥、鋼鐵、石油和天然氣等碳密集型產業的公司設計和建造設施。

- 隨著投資者要求增加溫室氣體排放,越來越多的數位公司正在發佈石油和天然氣生產商可以用來評估其碳排放的軟體。 2024年7月,加州資源公司宣布完成與Aera Energy LLC(Aera)的全股票合併。這項變革性的交易創造了巨大的規模和資產耐久性,以滿足加州不斷成長的能源需求,並提供先進的技術來幫助實現加州雄心勃勃的碳管理平台。

北美佔最大市場佔有率

- 北美啟動多項碳管理計劃,是機場碳認證成為機場碳管理全球標準的重要一步。該舉措啟動後,西雅圖-塔科馬國際機場成為北美第一個獲得認證的機場。

- 政府措施預計將推動市場需求。美國能源局(DOE) 啟動了負碳計劃,以響應政府在 2050 年實現淨零排放的目標。這是對碳去除途徑創新的集體呼籲,這些途徑從大氣中捕獲二氧化碳並將其以十億噸規模儲存,成本低於每淨噸二氧化碳當量 100 美元。

- 由於政府採取措施減少老化公共設施的能源排放,市場需求也增加。例如,美國總務管理局與 IBM 公司簽訂的合約將在州和聯邦政府擁有的 50 棟能源最密集的建築中安裝高效、智慧的建築技術。

- 根據美國能源資訊署 (EIA) 的數據,2023 年美國與能源相關的二氧化碳排放較 2022 年略有下降。儘管許多經濟產業的排放有所下降,但 2023 年美國能源相關二氧化碳排放量的 80% 以上發生在電力產業。這些減少主要是由於天然氣和太陽能發電在發電組合中所佔的比例越來越大,燃煤發電量下降。因此,政府對減少能源產業二氧化碳排放的關注可能在未來幾年積極支持市場需求。

碳管理系統產業概況

碳管理系統市場分散,許多參與企業提供管理和監控軟體。數量的快速成長是由於雲端服務使用的增加。提供諮詢服務的企業預計在預測期內將呈現類似的模式並穩定成長。

- 2024 年 6 月 - Workiva 是一家強大的綜合彙報解決方案全球供應商,透過推出 Workiva Carbon 擴展了其技術組合。加強我們的環境、社會和管治(ESG) 以及永續發展平台,以有效遵守嚴格的全球氣候變遷法規。

- 2024 年 3 月 - SLB 宣布達成協議,將其碳捕集業務與 Aker Carbon Capture (ACC) 合併,以協助加速大規模工業脫碳。該協議有可能匯集互補的技術組合、尖端的工藝設計專業知識和已建立的專案提供平台。此次整合將利用 ACC 和 SLB 的新技術開發和工業化能力提供的商業碳捕集產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 人們對環境議題的興趣日益濃厚,並專注於減少碳足跡

- 市場問題

- 管理波動的能源和資源需求

第6章 市場細分

- 按服務

- 軟體

- 按服務

- 按用途

- 能源

- 溫室氣體管理

- 空氣品質管理

- 永續性

- 其他

- 按最終用戶產業

- 石油和天然氣

- 製造業

- 醫療保健

- 資訊科技和電訊

- 由其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Simble Solutions Ltd

- IBM Corporation

- ENGIE Impact

- GreenStep Solutions Inc.

- SAP SE

- Enablon SA

- IsoMetrix

- Schneider Electric SE

- Salesforce.com Inc.

- Greenstone+Ltd

- Microsoft Corporation

- Sphera

第8章投資分析

第9章 市場未來展望

The Carbon Management System Market size is estimated at USD 16.11 billion in 2025, and is expected to reach USD 28.50 billion by 2030, at a CAGR of 12.09% during the forecast period (2025-2030).

The demand for carbon management systems is continuously increasing due to the increasing stringency of climate change regulations, the growing cost of carbon emissions, and evolving technologies related to carbon management.

The introduction of carbon emission policies is a key driver of the increasing demand for carbon management systems globally. These policies create a favorable environment for adopting carbon management systems with emission reduction targets, carbon pricing and taxation, compliance, and regulatory requirements.

The integration of advanced technologies with carbon management platforms enables real-time tracking of carbon emissions to take effective necessary prevention, driving the sales of carbon management systems in the market.

In addition, with growing awareness among businesses about the importance of sustainability and corporate social responsibility, many organizations are setting targets for carbon reduction, aiming for carbon neutrality that aligns with international climate commitments. In this way, the adoption of carbon management systems by companies is increasing considerably to track progress and identify areas for development.

The continuously evolving regulatory environment makes it difficult for businesses to compare different systems for implementation. Technological changes present challenges for carbon management system providers to keep up with the latest technology trends, which are some factors challenging market growth.

In order to preserve sustainability, market players are expanding their capacities and reach through partnerships and alliances in the area of carbon management. For instance, according to the International Energy Agency, to reach net zero emissions by 2050, annual clean energy investment worldwide will demand more than triple by 2030 to approximately USD 4 trillion. This initiative is expected to generate a multitude of new employment opportunities, substantially boost the worldwide economy, and ensure everyone has access to electricity and clean cooking methods by the decade's end.

Global environmental challenges, including climate changes, have become more visible because of the COVID-19 pandemic. The demand for carbon management solutions has grown as organizations and governments focus on sustainability and reducing their environmental footprint. In addition, businesses have been adopting digital solutions for the management of their environmental data and effective collaboration on sustainability initiatives, as remote work was the compulsion during the pandemic.

Carbon Management System Market Trends

The Oil and Gas Industry to Witness Growth

- The oil and gas industry is expected to contribute significantly to market growth. As one of the largest and most carbon-intensive industries worldwide, it is facing increased pressure to reduce its carbon footprint and transition toward a more sustainable future.

- Digital technologies could benefit scope 1 and 2 emissions as oil firms set more challenging targets for emissions reduction. Tracking harmful methane emissions from oil wells and pipelines is crucial, and machine learning helps refine energy use more efficiently. Drones, sensors, satellite, and camera data are also vital.

- Several companies are working on mitigating the carbon dioxide emissions of industrial operations and accelerating the transition to net zero. For instance, AVEVA is working closely with Aker Carbon Capture, which designs and builds facilities for companies in carbon-intensive industries, such as cement, steel, and oil and gas.

- Due to growing investor demand to reduce greenhouse gas emissions, more digital companies are releasing software that oil and gas producers may use to assess their carbon emissions. In July 2024, California Resources Corporation introduced the completion of the all-stock combination with Aera Energy LLC (Aera). This transformational deal creates significant scale and asset durability to meet California's growing energy needs and expands its leading carbon management platform to help the state meet its ambitious climate goals.

North America Accounts for Largest Market Share

- The launch of several Carbon Management Programmes in North America represents a significant step toward making Airport Carbon Accreditation the global standard for airport carbon management. At the initiative's launch ceremony, Seattle-Tacoma International Airport received certification for the first time in North America.

- Several government initiatives regarding net-zero emissions are anticipated to fuel demand in the market. In response to the government's goal of net-zero emissions by 2050, the Department of Energy (DOE) in the United States launched the Carbon Negative Shot, an all-hands-on-deck call for innovation in CO2 removal pathways that will capture carbon dioxide from the atmosphere and store it at gigaton scales for less than USD 100/net tonne of carbon dioxide-equivalent.

- Market demand is also increasing due to government measures to reduce energy emissions from several outdated public buildings. For instance, thanks to a contract signed by the US General Services Administration with IBM Corporation, the 50 most energy-intensive buildings owned by the state and federal governments will have efficient and smart building technology installed.

- According to the Energy Information Administration (EIA), US energy-related CO2 emissions decreased slightly in 2023 compared to 2022. Although emissions decreased across many economic industries, more than 80% of US energy-related CO2 emissions reductions in 2023 occurred in the electric power industry. These reductions were caused largely by reduced coal-fired electricity generation, as natural gas and solar power made up a larger portion of the generation mix. Therefore, the government's focus on reducing carbon emissions generated by the energy industry is likely to support the market demand positively in the coming years.

Carbon Management System Industry Overview

The carbon management system market is fragmented, as many players are offering software for management and monitoring. This surge in numbers is being caused by greater uptake of cloud services. Businesses that offer consultation services are expected to grow steadily and exhibit a similar pattern during the forecast period.

- June 2024 - Workiva, a global provider of assured integrated reporting solutions, expanded its tech portfolio with the launch of Workiva Carbon. This new addition enhances its Environmental, Social, and Governance (ESG) and Sustainability platforms, enabling businesses to adhere to stringent global climate regulations effectively.

- March 2024 - SLB announced an agreement to combine its carbon capture business with Aker Carbon Capture (ACC) to support accelerated industrial decarbonization at scale. The agreement may bring together complementary technology portfolios, leading process design expertise, and an established project delivery platform. The combination will utilize ACC's commercial carbon capture product offering and SLB's new technology developments and industrialization capability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Environmental Concerns and Focus on Reducing Carbon Footprints

- 5.2 Market Challenges

- 5.2.1 Managing Variable Energy and Resource Demand

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Energy

- 6.2.2 Greenhouse Gas Management

- 6.2.3 Air Quality Management

- 6.2.4 Sustainability

- 6.2.5 Other Applications

- 6.3 By End-user Verticals

- 6.3.1 Oil and Gas

- 6.3.2 Manufacturing

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Simble Solutions Ltd

- 7.1.2 IBM Corporation

- 7.1.3 ENGIE Impact

- 7.1.4 GreenStep Solutions Inc.

- 7.1.5 SAP SE

- 7.1.6 Enablon SA

- 7.1.7 IsoMetrix

- 7.1.8 Schneider Electric SE

- 7.1.9 Salesforce.com Inc.

- 7.1.10 Greenstone+ Ltd

- 7.1.11 Microsoft Corporation

- 7.1.12 Sphera