|

市場調查報告書

商品編碼

1637909

高強度鋼:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)High Strength Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

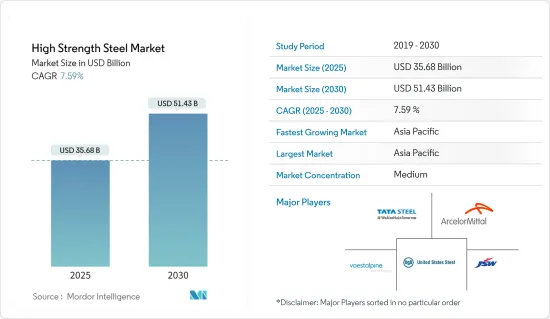

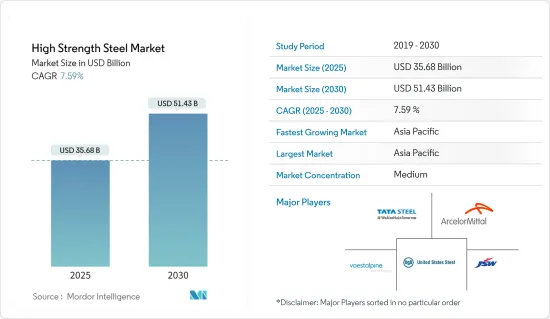

高強度鋼市場規模預計在 2025 年為 356.8 億美元,預計到 2030 年將達到 514.3 億美元,預測期內(2025-2030 年)的複合年成長率為 7.59%。

該地區的 COVID-19 疫情對市場產生了不利影響,導致需求下降、生產力下降、供應鏈中斷和地區關閉。然而,市場在 2021 年表現出顯著成長,並在 2022 年繼續成長。

主要亮點

- 短期內,建設產業和汽車產業的需求不斷成長是推動市場成長的一些因素。

- 另一方面,高生產成本和高技術限制可能會阻礙市場成長。

- 然而,預計亞太地區的工業和基礎設施發展將在預測期內提供大量機會。

- 預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。

高強度鋼市場趨勢

在汽車產業的應用日益廣泛

- 高強度鋼廣泛應用於汽車工業,以減輕車輛的整體重量,同時增加其在某些區域的剛度和能量吸收。

- 高強度鋼具有機械性能、厚度和寬度能力等多種特性,增加了其在汽車行業的需求。

- 通常,汽車工業中鋼材的強度由其化學成分、熱歷史和微觀結構控制,而這些成分、熱歷史和微觀結構會因製造過程中經歷的變形過程而改變。

- 高強度鋼比傳統鋼具有多種優勢,特別是在汽車行業,因為該行業的重量是燃油效率的考慮因素。其機械性能、焊接性、疲勞性、靜態強度、陰極保護和氫脆性能已被證明對汽車工業有益。

- 德國領先歐洲汽車市場,其41個組裝和引擎生產廠佔歐洲汽車總產量的三分之一。德國是汽車工業主要製造地之一,聚集了設備製造商、材料及零件供應商、引擎製造商、系統整合等多個領域的製造商。例如,根據OICA的預測,2022年德國汽車產量將達到36,778,820輛,較2021年成長11%。因此,預計該國汽車產量的增加將導致高抗張強度鋼板市場的需求增加。

- 印度汽車產業的投資不斷增加和進步預計將增加高強度鋼的消費量。例如,塔塔汽車在2022年4月宣布,計劃在未來五年內向其乘用車業務投資30.8億美元。預計這將對該國的高強度鋼市場產生積極影響。

- 此外,運輸車輛的需求不斷增加,推動了高強度鋼市場的發展。受強勁需求和消費者對私家車而非公共交通的偏好推動,印度汽車產業預計將在 2023 年成為亞太地區最強勁的汽車產業。例如,根據OICA的數據,該國2022年的汽車產量將達到54,566,857輛,比2020年增加24%。因此,隨著汽車製造業的整體成長,該地區的高強度鋼市場可能會擴大。

- 此外,美國是世界第二大汽車銷售和生產市場。例如,根據 OICA 的數據,2022 年美國汽車產量將達到 10,063,390 輛,比 2021 年增加 10%。因此,由於汽車產量的增加,預計燃料添加劑的需求將會增加。

- 增加使用高強度鋼來提高燃油效率和減輕車輛重量可能會促進汽車行業的市場成長。

中國主宰亞太地區

- 中國佔據亞太地區高強度鋼市場的最大佔有率。預計在整個預測期內,該國活性化的投資和建設活動將推動對高強度鋼的需求。

- 以國內生產毛額計算,中國是亞太地區最大的經濟體。中國的成長率仍然很高,但隨著人口老化以及經濟從投資向消費、從製造業向服務業、從外部需求向內部需求再平衡,成長率正在逐漸下降。

- 近年來,中國一直是世界主要基礎設施投資國和貢獻國之一。例如,根據中國國家統計局的數據,2022年中國建築業產值將達到27.63兆元(41,085.81億美元),比2021年增加6.6%。

- 此外,汽車產業仍然是中國最大的產業,這對近期的發展來說是一個好兆頭。例如,根據OICA的預測,2022年汽車產量將達到27.2061億輛,較2021年成長3%。因此,預計該國汽車生產的這種積極情況將推動高強度鋼市場需求的上升趨勢。

- 此外,中國將在未來三年內超越美國成為全球最大的航空旅行市場。然而,中國對航空業的需求仍持續呈指數級成長。例如,2023年4月空中巴士在法國對中國進行國事訪問期間,與中國航空工業合作夥伴簽署了新的合作協議。未來20年,中國航空運輸量預計將以每年5.3%的速度成長,明顯高於全球3.6%的平均值。這將導致2023年至2041年期間對客機和貨機的需求為8,420架,佔未來20年全球約39,500架新飛機總需求的20%以上。因此,航空業的這些擴張預計將對高強度鋼市場產生向上的需求。

- 根據聯合國貿易和發展委員會預測,2022年中國商船數量將達到115154艘,較2021年的108481艘成長約6.1%。因此,預計商業航運的增加將導致高強度鋼市場的需求增加。

- 因此,隨著國內各終端用戶領域的成長,預計未來幾年對高強度鋼的需求將大幅增加。

高強度鋼業概況

高強度鋼市場呈現部分盤整態勢。該市場的主要企業(不分先後順序)包括安賽樂米塔爾、美國鋼鐵公司、塔塔鋼鐵、JSW、Vostalpine AG 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築業需求快速成長

- 汽車產業需求增加

- 其他促進因素

- 限制因素

- 生產成本上升

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 雙相不銹鋼

- 淬硬鋼

- 碳錳鋼

- 其他產品類型

- 按應用

- 車

- 施工機械

- 黃色商品和採礦設備

- 航空和航海

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ArcelorMittal

- ChinaSteel

- CITIC Heavy Industries Co., Ltd.

- JSW Steel

- NIPPON STEEL CORPORATION

- Nucor Corporation

- POSCO

- SAIL

- SSAB AB

- Tata Steel

- United States Steel Corporation

- Voestalpine AG

第7章 市場機會與未來趨勢

- 亞太地區工業和基礎設施發展

- 其他機會

The High Strength Steel Market size is estimated at USD 35.68 billion in 2025, and is expected to reach USD 51.43 billion by 2030, at a CAGR of 7.59% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic in the region, including decreased demand and productivity, supply chain disruptions, and regional lockdowns. However, the market showed significant growth in 2021 and continued to grow in 2022.

Key Highlights

- Over the short term, increasing demand from the construction and automotive industries are some factors driving the growth of the market studied.

- On the flip side, high production costs and high technological constraints will likely hinder the market's growth.

- Nevertheless, industrial and infrastructural development in Asia-Pacific is anticipated to provide numerous opportunities over the forecast period.

- The Asia-Pacific region is expected to dominate the market and will also witness the highest CAGR during the forecast period.

High Strength Steel Market Trends

Increasing Applications in the Automotive Industry

- High-strength steels are widely used in the automotive industry to reduce overall vehicle weight while increasing stiffness and energy absorption in some areas.

- High-strength steels have several properties that increase their demand in the automotive industry, including mechanical properties, thickness, and width capabilities.

- In general, the strength of steel in the automotive industry is controlled by its microstructure, which varies depending on its chemical composition, thermal history, and the deformation processes it goes through during the production process.

- High-strength steel has several advantages over conventional steel, particularly when weight is a consideration for fuel efficiency in the automotive industry. Their mechanical properties, weldability, fatigue, static strength, cathodic protection, and hydrogen embrittlement performance have proven to be beneficial to the automotive industry.

- Germany leads the European automotive market, with 41 assembly and engine production plants contributing to one-third of Europe's total automobile production. Germany, one of the leading manufacturing bases of the automotive industry, is home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators. For instance, according to OICA, in 2022, automobile production in Germany amounted to 36,77,820 units, which showed an increase of 11% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to create an upside demand for high strength steel market.

- Increased investments and advancements in the automobile industry in India are expected to increase the consumption of high-strength steel. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to positively impact the high-strength steel market in the country.

- Moreover, the growing demand for transport vehicles drives the high-strength steel market. In 2023, India's automotive sector is predicted to be the strongest in the Asia-Pacific region, owing to strong demand and consumers' preference for personal vehicles over public transportation. For instance, according to OICA, in 2022, automobile production in the country amounted to 54,56,857 units, which showed an increase of 24% compared to 2020. Therefore, the region's high-strength steel market is likely to expand as a result of the rise in overall automobile manufacturing.

- Furthermore, the United States is the second-largest vehicle sales and production market globally. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create an upside demand for the fuel additives market.

- Increasing the usage of high-strength steel for better fuel efficiency and lightweight vehicles will boost the market growth in the automotive industry.

China to Dominate the Asia-Pacific Region

- China holds the largest Asia-Pacific market share for high strength steel market. The demand for the high-strength steel market is expected to rise throughout the forecast period due to rising investments and construction activity in the country.

- China is the largest economy in the Asia-Pacific region in terms of GDP. The growth in the country remains high but is gradually diminishing as the population is aging, and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, automotive continues to remain the country's largest sector and reflects positive signs for the near future. For instance, according to OICA, in 2022, automobile production in the country amounted to 2,70,20,615 units, which shows an increase of 3% compared with 2021. Therefore, such a positive scenario in the production of automobiles in the country is expected to create an upside demand for high strength steel market.

- Furthermore, China is on course to overtake the United States as the world's biggest air travel market within the next three years. Still, the country's appetite for aviation continues to grow exponentially. For instance, on April 2023, during a French state visit to China, Airbus signed new cooperation agreements with China's Aviation industry partners. Over the next 20 years, China's air traffic is forecast to grow at 5.3% annually, significantly faster than the world average of 3.6%. This will lead to a demand for 8,420 passenger and freighter aircraft between 2023 and 2041, representing more than 20% of the world's total demand for around 39,500 new aircraft in the next 20 years. Therefore, these expansions from the aviation industry are expected to create an upside demand for high strength steel market.

- According to UNCTD, China had 1,15,154 merchant ships in 2022, which showed an increase of around 6.1% compared to 2021, amounting to 1,08,481 merchant ships. Therefore, the increase in merchant ships is expected to create an upside demand for high strength steel market.

- Hence, with the growth in the various end-user sectors in the country, the demand for high-strength steel is expected to increase significantly in the upcoming years.

High Strength Steel Industry Overview

The High Strength Steel Market is partially consolidated in nature. The major players in this market (not in a particular order) include ArcelorMittal, United States Steel Corporation, Tata Steel, JSW, and voestalpine AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Increasing Demand from Construction Sector

- 4.1.2 Increasing Demand from Automobile Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Costs of Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Dual Phase Steel

- 5.1.2 Bake Hardenable Steel

- 5.1.3 Carbon Manganese Steel

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Construction

- 5.2.3 Yellow Goods and Mining Equipment

- 5.2.4 Aviation and Marine

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 ChinaSteel

- 6.4.3 CITIC Heavy Industries Co., Ltd.

- 6.4.4 JSW Steel

- 6.4.5 NIPPON STEEL CORPORATION

- 6.4.6 Nucor Corporation

- 6.4.7 POSCO

- 6.4.8 SAIL

- 6.4.9 SSAB AB

- 6.4.10 Tata Steel

- 6.4.11 United States Steel Corporation

- 6.4.12 Voestalpine AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Industrial and Infrastructural Development in Asia-Pacific

- 7.2 Other Opportunities