|

市場調查報告書

商品編碼

1637917

北美過程自動化:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

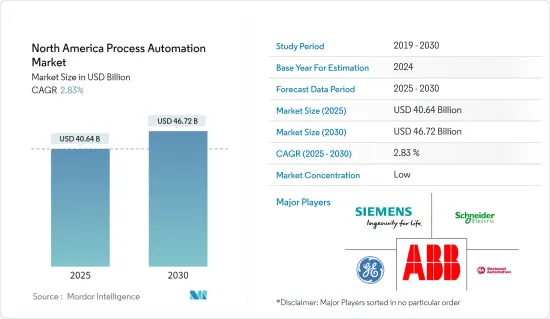

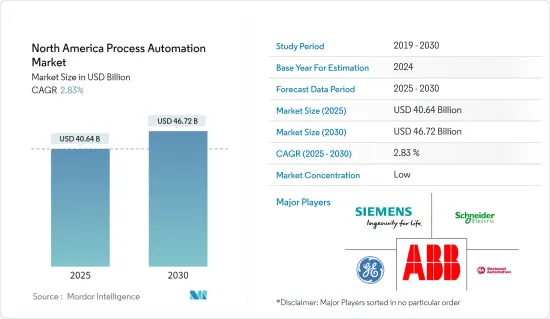

北美製程自動化市場規模預計在 2025 年為 406.4 億美元,預計到 2030 年將達到 467.2 億美元,預測期內(2025-2030 年)的複合年成長率為 2.83%。

流程自動化利用科技來簡化複雜的業務流程。它通常包含三個關鍵功能:自動化流程、集中資訊和最大限度地減少人工干預的需要。其主要目標是消除瓶頸,最大限度地減少錯誤和資料遺失,提高透明度、部門間溝通和處理速度。技術進步和對生產力的日益關注正在推動過程自動化市場的發展。

主要亮點

- 流程自動化是一種透過消除人工干預來提高系統效率的技術。結果是錯誤更少、交貨更快、品質更高、成本更低、整體業務流程更簡單。這涉及利用軟體工具、人員和程序來建立完全自動化的工作流程。透過採用流程挖掘來最佳化您的業務營運效率。這使您能夠對數位解決方案獲得寶貴的見解,並幫助您確定可以付出努力以獲得最大收益的領域。預計該地區各行業將擴大採用自動化技術將推動市場的發展。

- 過程自動化市場的成長源於對提高生產力和減少危險的手動任務的日益關注。北美是一個成熟的市場,為引進最尖端科技、建立關鍵合作夥伴關係和發展電力和公共產業、石油和天然氣、製藥和化學品等領域的產品協同效應提供了絕佳的機會。這些因素在推動製程自動化市場擴張方面發揮關鍵作用。

- 製造業中數位和實體元素的融合已經改變了北美自動化產業。這些進步的主要目標是實現最佳效率。自動化製造流程有許多好處,包括無縫監控、減少廢棄物和加快生產力。自動化提高了消費者的產品質量,並確保快速且經濟地交付標準化、可靠的產品。工業物聯網和工業 4.0 是重塑物流網路開發、生產和監控的尖端技術策略,並將推動市場成長。

- 市場成長的動力來自於尋求改善數位消費者體驗、生產力和效率的組織擴大採用機器人流程自動化。人工智慧和機器學習與機器人流程自動化的結合有助於實現複雜任務的自動化,進一步推動了這種成長。製藥、石油和天然氣以及食品和飲料等行業在該地區採用機器人技術以增強其市場潛力方面表現突出。

- 例如,美國製藥業蓬勃發展,是世界上最大的市場之一。自動化技術的進步現在使製藥公司能夠提高業務,包括填充、包裝和測試過程。這些自動化系統高度準確,消除了稱重、混合和包裝藥品等關鍵任務中人為錯誤的風險。因此,該地區製藥業的投資正在激增,預計將創造大量的市場機會。

- 與製程自動化系統相關的大量費用與可靠、耐用的硬體和精簡的軟體有關。流程自動化的實施需要大量的資金投入來加強包括IT、機械等在內的整個基礎設施。此外,還需要持續的維護,與手動系統相比,這可能會阻礙市場擴張。

北美流程自動化市場趨勢

石油和天然氣產業強勁成長

- 自動化對於推動石油和天然氣產業的發展至關重要。自動化、數位化和先進技術的採用使操作員和技術人員能夠快速獲取關鍵性能、狀況和技術資料。流程自動化涉及利用軟體和技術來自動化業務流程和功能,並最終實現石油和天然氣行業的特定組織目標。在研究的產業中,企業越來越依賴流程自動化來增強決策、故障排除和整體效能。

- 自動化對於推動石油和天然氣產業的發展至關重要。數位化、自動化和先進技術的採用使操作員和技術人員能夠即時存取關鍵性能、狀況和技術資料。該地區的公司越來越依賴流程自動化來增強決策、故障排除和整體效能。

- 石油和天然氣市場正在經歷快速成長,自動化在該行業的擴張中發揮關鍵作用。特別是在美國,對增加石油和天然氣供應的需求很高,部分原因是這些地區的人口成長。監控和資料採集 (SCADA) 是石油和天然氣領域的一種常見自動化形式。 SCADA 系統從遠端石油和天然氣站點收集資訊和資料,從而無需監督和負責人親自訪問站點。由於該地區對石油和天然氣的需求不斷成長以及對石油和天然氣行業的投資不斷增加,預計市場將會成長。

- 例如,根據美國能源資訊署的數據,美國已連續六年維持全球第一大原油生產國地位。至2023年,原油和冷凝油油日均產量預計將達到1,290萬桶,超過2019年的1,230萬桶。美國豐富的石油和天然氣資源降低了能源成本,鼓勵了私部門的投資,從而推動了美國的經濟成長。

- 此外,加拿大修訂後的聯邦氣候變遷策略還包括一個值得注意的新目標,即減少溫室氣體排放。該計畫的目標是到2030年減少32-40%的排放,在2050年實現完全排放。這些目標將在減輕氣候變遷的最嚴重影響方面發揮關鍵作用。石油和天然氣產業佔加拿大溫室氣體排放的四分之一以上,是減排舉措的重點。預計這些重大舉措將刺激對自動化技術的需求,並促進該地區石油和天然氣產業的節能實踐。

- 透過提高自動化程度和營運分析能力來升級內部程序,該行業可以提高生產和分銷效率,從而產量比率。該行業越來越重視安全性和可靠性。該行業複雜的供應鏈導致人們更加關注自動化、行業專業知識和更緊密的合作。流程自動化不僅僅是提高效率;它是一種適應全球市場不斷變化的需求的策略決策。

美國經濟強勁成長

- 預計該地區將佔據大部分市場佔有率。在工業4.0的推動下,美國正在加強其在工廠自動化和工業控制系統的全球地位。該領域採用智慧技術不僅可以提高業務效率,還可以增強國家經濟。隨著全球製造業的互聯互通日益緊密,美國製造商面臨越來越大的採用自動化的壓力。他們努力實現成本效益和高品質標準。

- 針對美國智慧工廠的網路攻擊增多,引發了人們對工業控制系統的擔憂。各國政府正採取措施來應對這些風險。同時,採用國產工業控制系統作為減少智慧工廠網路安全漏洞的戰略方針也日益成為趨勢。Panasonic北美等公司透過提供包括 ERP 系統在內的廣泛創新製造解決方案,處於領先地位。

- 作為拜登政府疫情後經濟復甦戰略的一部分,美國正在對基礎設施和電子產業進行大量投資。這對中小企業來說是個好兆頭,因為基礎設施和電子產業是工業控制系統的主要消費者,並將直接受益。在機器人流程自動化(RPA)中,流程發現、最佳化、智慧和編配等術語越來越受歡迎。業務流程管理 (BPM) 與 RPA 之間深度整合的軌跡十分清晰。

- 《食品安全現代化法案》等嚴格的政府法規正在迫使美國食品和飲料公司實施自動化系統。這將加強美國自動化市場,簡化營運,降低成本並提高產品品質。此外,該地區餐飲業產能的提高預計將進一步推動市場發展。根據美國農業部的數據,2023年,農業、食品和相關產業對美國國內生產總值(GDP)的貢獻約為1.53兆美元,佔5.6%。

- 此外,自動化在簡化石油和天然氣輸送、開採和精製所涉及的各種流程方面發揮關鍵作用。目前,美國對石油和天然氣領域的投資顯著增加,這主要受到不斷升級的地緣政治局勢的推動。根據美國地質調查局預測,到2023年美國石油和天然氣開採產業生產指數將達到140人。這較 2017 年的 100 指數和 2022 年的 130 指數有顯著成長。預計這些重大進步將推動這一特定領域的成長。

北美製程自動化產業概況

由於生產這些系統所需設備高成本,退出障礙難以維持。儘管預測期內市場會出現整合,但預計市場競爭仍將加劇,因為許多市場參與者正在透過收購、策略性合併或新的智慧舉措來消除競爭對手。

2024 年 5 月-西門子宣佈在工廠管理方面取得重大進展,以解決處理多個硬體控制點的複雜性。答案是西門子 Simatic 自動化工作站。這種創新的解決方案使製造商能夠將硬體 PLC、傳統 HMI 和邊緣設備整合到基於軟體的工作站中。這種整合將資訊技術 (IT) 實踐無縫整合到操作技術(OT) 設置中。

2023 年 10 月-艾默生宣布支持其無邊界自動化願景的新技術,這是一個以軟體為中心的工業自動化平台,連接來自現場、邊緣和雲端的資料。新技術的發布超越了傳統的控制系統,提供了更先進的自動化平台,這些平台將資料情境化、民主化,為人們和塑造世界運作方式的人工智慧 (AI) 引擎提供服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 美國和加拿大主要工業自動化中心分析(根據過去三年的投資和擴張活動確定的中心)

- 主要宏觀經濟趨勢對北美過程自動化產業的影響

- 根據疫情V型復甦、中期復甦、低迷復甦的短期和中期影響所確定的關鍵主題分析

- 根據美國流程自動化市場最終用戶表現進行基礎變數分析

- 加拿大流程自動化市場:基於最終用戶績效的變數分析

- 供應挑戰的影響以及市場監管在振興市場中的作用

第5章 市場動態

- 市場促進因素

- 更加重視能源效率和降低成本

- 安全自動化系統的需求

- 工業物聯網的出現

- 市場挑戰

- 成本和實施挑戰

第6章 行業標準及規範

第7章 市場區隔

- 按通訊協定

- 有線

- 無線的

- 依系統類型

- 按系統硬體

- 監控和資料採集系統 (SCADA)

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 閥門和致動器

- 馬達

- 人機介面 (HMI)

- 製程安全系統

- 感應器和變送器

- 依軟體類型

- APC(獨立和客製化解決方案)

- 嚴格監管

- 多元模型

- 推理和順序

- 基於資料分析和彙報的軟體

- 製造執行系統(MES)

- 其他軟體和服務

- 按系統硬體

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 電力和公共產業

- 用水和污水

- 飲食

- 紙和紙漿

- 藥品

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

第8章 競爭格局

- 公司簡介

- ABB Limited

- Siemens AG

- Schneider Electric SE

- General Electric Co.

- Rockwell Automation Inc.

- Emerson Electric Co.

- Mitsubishi Electric

- Honeywell International Inc.

- Omron Corporation

- Fuji Electric

- Delta Electronics Limited

- Yokogawa Electric

第9章投資分析

第10章:未來市場展望

The North America Process Automation Market size is estimated at USD 40.64 billion in 2025, and is expected to reach USD 46.72 billion by 2030, at a CAGR of 2.83% during the forecast period (2025-2030).

Process automation leverages technology to streamline intricate business processes. It generally encompasses three essential functions: process automation, information centralization, and minimizing the need for human intervention. Its primary objective is to eliminate bottlenecks and and minimize errors and data loss while enhancing transparency, communication between departments, and processing speed. Growing technological advancements and a increasing focus on productivity fuel the market for process automation.

Key Highlights

- Process automation has become a a method that enhances a system's efficiency by eliminating human involvement. This results in reduced errors, an acceleration in delivery speed, an improvement in quality, a decrease in costs, and a simplification of the overall business process. It involves utilizing software tools, individuals, and procedures to establish a fully automated workflow. By employing process mining, it optimizes the effectiveness of business operations. This enables the acquisition of valuable insights into the user's digital solutions and facilitates the identification of areas where efforts can be applied for maximum advantage. The increasing adoption of automated technologies across the region's various sectors is expected to drive the market.

- The growth of the process automation market is driven by the rising emphasis on boosting productivity and reducing hazardous manual activities. North America, being a well-established market, presents an excellent opportunity for embracing cutting-edge technologies, establishing key alliances, and fostering product synergies in sectors like power and utilities, oil and gas, pharmaceuticals, and chemicals. These elements play a crucial role in propelling the expansion of the process automation market.

- Integrating digital and physical elements in manufacturing has transformed the North American automation industry. The primary goal of these advancements is to achieve optimal efficiency. Automating manufacturing processes has realized numerous advantages, including seamless monitoring, waste reduction, and accelerated production rates. Automation enhances product quality for consumers and ensures standardized, reliable goods are delivered quickly and affordably. The Industrial Internet of Things and Industry 4.0 represent cutting-edge technological strategies reshaping the development, production, and oversight of the logistics network, poised to propel market growth.

- The market's growth is growing due to the increasing adoption of robotic process automation by organizations aiming to improve digital consumer experience, productivity, and efficiency. This growth is further fueled by the integration of AI and machine learning in robotic process automation, facilitating the automation of intricate tasks. Industries such as pharmaceuticals, Oil and Gas, , and F&B are notably embracing robotic technology in the region to boost the market's potential.

- For instance, the pharmaceutical industry in the United States is thriving, making it one of the largest markets globally. Thanks to advancements in automation technology, pharmaceutical companies can now enhance the efficiency and precision of their operations, including filling, packaging, and inspection processes. These automated systems are highly accurate and eliminate the risk of human errors in crucial tasks like weighing, blending, and packaging pharmaceutical products. As a result, the region's pharmaceutical sector is witnessing a surge in investments, which is anticipated to create numerous market opportunities.

- The substantial expenses associated with process automation systems are linked to reliable and durable hardware and streamlined software. Implementing process automation necessitates significant financial investments to enhance the entire infrastructure, encompassing IT, machinery, and more. Additionally, it demands ongoing maintenance, which can impede market expansion compared to manual systems.

North America Process Automation Market Trends

Oil and Gas Industry to Witness Significant Growth

- Automation is essential for propelling the oil and gas sector forward. By adopting automation, digitization, and advanced technologies, operators and technicians can promptly access vital performance, condition, and technical data. Process automation involves utilizing software and technologies to automate business processes and functions, ultimately achieving specific organizational objectives within the oil and gas industry. In the examined area, companies increasingly rely on process automation to enhance decision-making, troubleshooting, and overall performance.

- Automation is crucial in propelling the oil and gas industry towards progress. By adopting digitization, automation, and advanced technologies, operators and technicians gain instant access to vital performance, condition, and technical data. Companies in the examined region increasingly rely on process automation to enhance decision-making, troubleshooting, and overall performance.

- The oil and gas market is experiencing rapid growth, and automation plays a significant role in this industry's expansion. The United States, in particular, is witnessing a high demand for increased oil and gas supply, partly due to population growth in these regions. Supervisory control and data acquisition (SCADA) is a prevalent form of automation in the oil and gas sector. SCADA systems gather information and data from remote oil and gas locations, eliminating supervisors and personnel needing to visit these sites physically. The market's growth is anticipated to rise owing to the growing need for oil and gas and rising investments in the region's oil and gas sector.

- For instance, according to the US EIA, the United States has maintained its position as the top producer of crude oil globally for the last six years. By 2023, the average daily production of crude oil and condensate will hit 12.9 million barrels, exceeding the previous record of 12.3 million barrels set in 2019, both domestically and worldwide. The ample oil and gas supply in the country has reduced energy expenses, fostering investments in the private sector and bolstering economic expansion in the United States.

- Moreover, the revised climate strategy of the Canadian federal government sets forth a notable new goal to diminish greenhouse gas emissions. The plan's objective is to reduce emissions by 32-40% by 2030, aiming to achieve complete emissions neutrality by 2050. These targets play a vital role in mitigating the most severe consequences of climate change. The oil & gas industry, which accounts for over a quarter of Canada's total GHG emissions, has become a focal point for reduction initiatives. Such substantial initiatives are anticipated to increase the demand for automation technology in the oil and gas sector of the region, thereby promoting energy-efficient practices.

- The sector can improve production and distribution effectiveness by upgrading its internal procedures with automation and enhanced operational analytics, leading to increased yields. The industry's focus on safety and dependability is growing stronger. With the industry's intricate supply chain, there is an increasing interest in automation, specialized industry expertise, and intense collaborations. Process automation goes beyond efficiency; it represents a strategic decision to adapt to the constantly changing global market demands.

United States to Witness Major Growth

- The region is expected to contribute a significant portion of the market share. Fueled by Industry 4.0, the United States is strengthening its position on a global scale in factory automation and industrial control systems. The incorporation of intelligent technologies in this field not only improves operational effectiveness but also reinforces the country's economy. With the increasing interconnectedness of global manufacturing, American manufacturers are facing growing pressure to adopt automation. They are aiming and working towards achieving a balance between cost-effectiveness and elevated quality benchmarks.

- With the increase in cyber-attacks targeting U.S. smart factories, worries about Industrial Control Systems are growing. The government is implementing measures to address these dangers. At the same time, there is a noticeable trend towards using domestically produced industrial control systems as a strategic approach to reduce cybersecurity vulnerabilities in intelligent factories. Companies such as Panasonic North America are leading the way by providing extensive innovative manufacturing solutions including ERP systems and beyond.

- Significant investment is being made in infrastructure and the electronics industry as part of the Biden administration's economic recovery strategy post-pandemic. This bodes well for small and medium-sized enterprises, as the infrastructure and electronics sectors are major consumers of industrial control systems and are poised to benefit directly. Terms like process discovery, optimization, intelligence, and orchestration are gaining prominence in Robotic Process Automation (RPA). A clear trajectory towards deeper integration between business process management (BPM) and RPA exists.

- Stringent government regulations, exemplified by the Food Safety Modernization Act, are compelling food and beverage firms in the U.S. to adopt automation systems. This enhances the nation's automation market and streamlines operations, reducing costs and elevating product quality. Moreover, the increasing region's F&B industry capabilities is further expected to drive the market. The USDA stated that in 2023, the agriculture, food, and related industries made a contribution of around USD 1.530 trillion to the U.S. gross domestic product (GDP), accounting for a 5.6% share.

- Moreover, automation plays an important role in streamlining the various processes involved in the transmission, extraction, and refining of oil and gas within the industry. The United States is currently experiencing a notable surge in investments within the oil and gas sector, largely due to the escalating geopolitical circumstances. As per the U.S. Geological Survey, the production index for the oil and gas extraction industry in the United States is projected to reach an estimated 140 by 2023. This represents a substantial increase compared to the index of 100 in 2017 and 130 in 2022. These significant advancements are anticipated to drive the growth of this particular segment.

North America Process Automation Industry Overview

The barriers to exit are non-supportive, considering the high-cost equipment needed for producing these systems. Many companies operating in the market eliminate the competition through acquisitions and strategic mergers or new smart initiatives, and hence, the market is expected to become more competitive despite consolidation during the forecast period.

May 2024 - Siemens unveiled a significant advancement in factory management, addressing the complexity of handling multiple hardware control points. The answer comes in the form of the Siemens Simatic Automation Workstation. This innovative solution enables manufacturers to consolidate a hardware PLC, a traditional HMI, and an edge device into a unified, software-based workstation. This integration seamlessly merges Information Technology (IT) practices into Operational Technology (OT) settings.

October 2023 - Emerson announced new technologies that support its Boundless Automation vision, a software-centric industrial automation platform that connects data from the field, the edge, and the cloud. The new technology releases will transcend a traditional control system, creating a more advanced automation platform that contextualizes and democratizes data for both people and the artificial intelligence (AI) engines that shape the way the world operates.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Analysis of the Major Industrial Automation Hubs in the United States and Canada (Hubs Identified Based on the Investor Activity and Expansion Activities Undertaken over the Last Three Years)

- 4.5 Impact of Key Macroeconomic Trends on the Process Automation Industry in North America

- 4.6 Analysis of the Key Themes Identified Based on the Short- and Medium-term Effects of the Pandemic V-shaped Recovery, Mid-range Recovery, and Slump Recovery

- 4.7 US Process Automation Market Base Variable Analysis Based on End-user Performance

- 4.8 Canada Process Automation Market Base Variable Analysis Based on End-user Performance

- 4.9 Impact of Supply-related Challenges and the Role of Market Regulations in Spurring Activity

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Energy Efficiency and Cost Reduction

- 5.1.2 Demand for Safety Automation Systems

- 5.1.3 Emergence of IIoT

- 5.2 Market Challenges

- 5.2.1 Cost and Implementation Challenges

6 INDUSTRY STANDARDS AND REGULATIONS

7 MARKET SEGMENTATION

- 7.1 By Communication Protocol

- 7.1.1 Wired

- 7.1.2 Wireless

- 7.2 By System Type

- 7.2.1 By System Hardware

- 7.2.1.1 Supervisory Control and Data Acquisition System (SCADA)

- 7.2.1.2 Distributed Control System (DCS)

- 7.2.1.3 Programmable Logic Controller (PLC)

- 7.2.1.4 Valves and Actuators

- 7.2.1.5 Electric Motors

- 7.2.1.6 Human Machine Interface (HMI)

- 7.2.1.7 Process Safety Systems

- 7.2.1.8 Sensors and Transmitters

- 7.2.2 By Software Type

- 7.2.2.1 APC (Standalone and Customized Solutions)

- 7.2.2.1.1 Advanced Regulatory Control

- 7.2.2.1.2 Multivariable Model

- 7.2.2.1.3 Inferential and Sequential

- 7.2.2.2 Data Analytics and Reporting-based Software

- 7.2.2.3 Manufacturing Execution Systems (MES)

- 7.2.2.4 Other Software and Services

- 7.2.1 By System Hardware

- 7.3 By End-user Industry

- 7.3.1 Oil and Gas

- 7.3.2 Chemical and Petrochemical

- 7.3.3 Power and Utilities

- 7.3.4 Water and Wastewater

- 7.3.5 Food and Beverage

- 7.3.6 Paper and Pulp

- 7.3.7 Pharmaceutical

- 7.3.8 Other End-user Industries

- 7.4 By Country

- 7.4.1 United States

- 7.4.2 Canada

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Limited

- 8.1.2 Siemens AG

- 8.1.3 Schneider Electric SE

- 8.1.4 General Electric Co.

- 8.1.5 Rockwell Automation Inc.

- 8.1.6 Emerson Electric Co.

- 8.1.7 Mitsubishi Electric

- 8.1.8 Honeywell International Inc.

- 8.1.9 Omron Corporation

- 8.1.10 Fuji Electric

- 8.1.11 Delta Electronics Limited

- 8.1.12 Yokogawa Electric