|

市場調查報告書

商品編碼

1637918

印度網路安全與網路風險管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Network Security And Cyber Risk Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

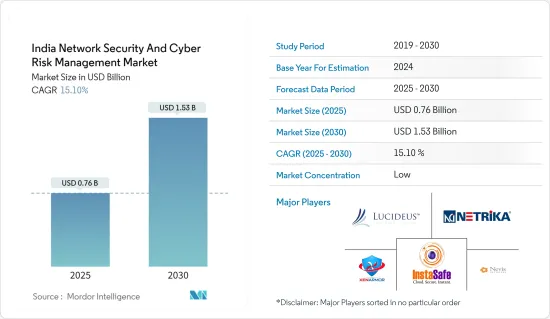

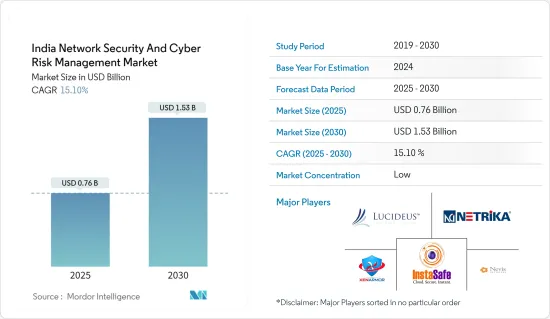

印度網路安全和網路風險管理市場規模預計在 2025 年達到 7.6 億美元,預計到 2030 年將達到 15.3 億美元,預測期內(2025-2030 年)的複合年成長率為 15.1%。 。

過去,印度成為網路攻擊的目標主要是出於政治原因,但趨勢表明,隨著更先進的技術出現,交易變得更加複雜,系統變得更加脆弱。 。

主要亮點

- 預計印度政府旨在實現工業數位化的措施將成為市場的主要推動要素。 「印度製造」、「創業印度」和「數位印度」等政府計畫正在促進印度網路安全市場的成長,並成為官民合作關係(PPP)模式的連接點。

- 在印度,關鍵基礎設施由公共和私營部門共同擁有,並按照規範和通訊協定運行,以保護基礎設施免受網路攻擊。然而,並沒有一個能夠整合公共和私人領域努力的國家安全架構。

- 隨著遠距工作趨勢走向無邊界網路部署,雲端運算採用已成為國際上的主要投資目標。這種快速的數位化導致了資料和隱私法規的加強、新技術堆疊與企業 IT 的整合以及雲端和遠端協作技術的整合。

- 這些變化和成長趨勢正在推動全球網路安全需求和支出。擁有全球知識和經驗的印度IT服務以及富有創意的印度網路安全產品生態系統是確保我們客戶全球數位轉型之旅的雙重成長引擎。

- 此外,新冠疫情也加速了印度的數位轉型進程。雖然最初的重點是業務永續營運,但我們現在看到數位化動態發生了顯著的轉變。隨著組織適應新現實,他們正在開發數位主導的組織策略,這增加了網路攻擊的風險。

印度網路安全與網路風險管理市場趨勢

入侵偵測和預防系統席捲市場

- 入侵偵測和預防軟體 (IDPS) 監控網路流量以查找攻擊徵兆。如果它偵測到潛在的危險活動,它將採取措施阻止攻擊。它們經常丟棄惡意資料包、阻止網路流量或重置連線。此外,IDPS 通常會向安全管理員發送有關潛在惡意活動的警報。

- 決定 IDS 或 IPS 成功部署和運作的兩個主要因素是部署的特徵和通過它的網路流量。

- 由於公共和商業組織增加對研發的投入,以提供新穎、實惠、安全、低功耗的入侵偵測和預防解決方案,市場正在不斷擴大。由於人們對家庭和商業場所安全意識的不斷增強,市場規模正在擴大。

- 此外,政府還推出了「印度製造」等舉措,旨在鼓勵製造業投資,促進印度製造產品的開發、製造和組裝;改善網際網路連接;政府發起「數位印度」等宣傳活動,以技術為公民提供數位化賦能影響了該國 IDP 制度的發展。

行動電話成長是市場成長的主要動力

- 印度的技術熟練人口顯著增加,行動電話已成為第一大數位媒體。印度擁有12億行動電話用戶,其中7.5億使用智慧型手機。預計未來五年印度將成為第二大智慧型手機製造國。

- 隨著智慧型手機在印度的普及,網路需求不斷成長。根據印度網際網路和移動協會 (IAMAI) 發布的一份報告,目前印度活躍網際網路用戶數量為 6.92 億,預計到 2025 年將達到 9 億,主要得益於農村地區的成長。

- 同時,隨著物聯網(IoT)、雲端處理、人工智慧(AI)和區塊鏈等技術的擴張,印度的IT支出也大幅成長。

- 愛立信預計,到 2022 年,LTE 將成為印度智慧型手機用戶的主導技術,用戶數量將達到 8.05 億部左右。預計到 2024 年,3G 用戶數量將達到高峰 8.386 億左右,屆時 3G 連線數預計將達到 2,200 萬。預計到 2027年終,在印度總計 11.3 億智慧型手機用戶中,5G 用戶將占到 6.465 億左右。

印度網路安全與網路風險管理產業概況

印度網路安全和網路風險管理市場較為分散,主要參與者有 Lucideus Tech、Instasafe、XenArmor、ArrayShield Technologies 和 Netrika Consulting India Pvt Ltd.。市場參與者正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 2 月—印度保險和風險管理服務提供者 Raghnall Insurance Broking 為各種規模的企業推出了 Business Cyber Shield。該技術旨在提供完整的網路安全解決方案。來自Business Cyber Shield的介紹:Ragnar致力於為客戶提供現代化的數位解決方案,以識別、最小化和管理與日益成長的網路攻擊威脅相關的風險。

- 2023 年 1 月 - InstaSafe 宣布計劃與印度和東南亞的技術服務和解決方案供應商Value InfoSolutions 合作,將其產品供應擴展到整個印度和南盟地區。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 政府推動工業數位化的措施推動市場成長

- 市場限制

- 缺乏國家安全基礎設施阻礙了市場成長

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按細分市場

- 安全資訊和事件管理 (SIEM)

- 安全閘道 (SWG)

- 身分管治與管理 (IGA)

- 企業內容感知資料遺失防護 (DLP)

- 按解決方案

- 加密

- 身分和存取管理 (IAM)

- 預防資料外泄(DLP)

- 入侵偵測系統/入侵防禦系統 (IDS/IPS)

- 其他解決方案

- 按服務

- 網路安全

- 端點安全

- 無線安全

- 雲端安全

- 其他服務

- 按行業

- 航太和國防

- 零售

- 政府

- 衛生保健

- 資訊科技和電信

- BFSI

第6章 競爭格局

- 公司簡介

- Lucideus Tech

- Instasafe

- XenArmor

- ArraySheild Technologies

- Netrika Consulting India Pvt Ltd.

- Aspirantz InfoSec

- Cyberoam

- Data Resolve Technologies

- Mirox Cyber Security & Technology

第7章投資分析

第8章 市場機會與未來趨勢

The India Network Security And Cyber Risk Management Market size is estimated at USD 0.76 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 15.1% during the forecast period (2025-2030).

In the past, India has been targeted through cyber-attacks primarily for political reasons, and trends show that this landscape seems to only gain prominence with the availability of more sophisticated technology and more complex transactions increasing the vulnerability of systems.

Key Highlights

- Government initiatives aimed at digitizing Indian industries are expected to be the major driving factor for the market. Government schemes such as 'Make in India,' 'Start-Up India,' and 'Digital India' supplement the growth of Cyber Security market in India and are a linking pin towards Public-Private Partnership (PPP) models.

- In India, Critical infrastructure is owned by both Public Sector and Private sector, operating with their norms and protocols for protecting their infrastructure from cyber-attacks. But there is no national security architecture that unifies the efforts taking place in the public sphere and the private sphere.

- As the trend of remote working is driving into a borderless network arrangement, cloud adoption has become a critical investment goal internationally. This fast digitization has resulted in a greater regulatory focus on data and privacy, integration of new technology stacks into company IT, and cloud and remote collaboration technologies.

- These changes and increased board are driving global cybersecurity demand and spending. Indian IT services, with their worldwide knowledge and experience, and the creative Indian cybersecurity product ecosystem have been the twin growth engines ensuring customers' global digital transformative journeys.

- Moreover, COVID-19 accelerated the country's digital transformation path. Initially, the emphasis was on business continuity, but there is now a noticeable shift in the dynamics of digitalization. As organizations adjust to the new reality, they are developing digitally led organizational strategies, which has increased the risk of cyber attacks.

India Network Security And Cyber Risk Management Market Trends

Intrusion Detection and Prevention System to Dominate the Market

- An Intrusion Detection and Prevention Software (IDPS) monitors network traffic for signs of a possible attack. When it detects potentially dangerous activity, it takes action to stop the attack. Often this takes the form of dropping malicious packets, blocking network traffic or resetting connections. The IDPS also usually sends an alert to security administrators about the potential malicious activity.

- The two main contributors to the successful deployment and operation of an IDS or IPS are the deployed signatures and the network traffic that flows through it.

- The market is expanding as a result of rising R&D expenditures by both public and commercial organisations to provide novel and affordable secured low-power intrusion detection and prevention solutions. The market size is increased by rising awareness of home and commercial safety and security.

- Moreover, government initiatives like 'Make in India', which aims to promote the development, manufacture, and assembly of products made in India by incentivizing dedicated investments into manufacturing, and government campaigns like 'Digital India,' which was launched to ensure increased Internet connectivity and make the nation digitally empowered in terms of technology, have been influencing the growth of the IDP system in the country.

Growth in Mobile Phones to Significantly Drive the Market Growth

- India has seen a tremendous growth in tech savvy population, with mobile phones being the first digital medium. In India, there are 1.2 billion mobile customers, 750 million of whom use smartphones. The nation is anticipated to be the second-largest smartphone manufacturer in the coming five years.

- With the growing number of smartphones in India, the demand for the Internet is continuously growing in the country. According to the report published by IAMAI (The Internet and Mobile Association of India), there are currently 692 million active internet users in the country, and the number is estimated to hit 900 million by 2025, led by growth in rural areas.

- At the same time, there has been substantial growth in IT spending in India and a scaling up in the use of technologies such as the Internet of Things (IoT), Cloud Computing, Artificial Intelligence (AI), and BlockChain.

- According to Ericsson, In 2022, the dominant technology of smartphone subscriptions used in India was LTE, which had reached nearly 805 million. It was expected to peak in 2024 at around 838.6 million subscriptions, with 3G connections estimated at 22 million by that point. 5G was forecasted to be about 646.5 million of all 1.13 billion smartphone subscriptions in India at the end of 2027.

India Network Security And Cyber Risk Management Industry Overview

India Network Security And Cyber Risk Management Market is fragmented, with the presence of major players like Lucideus Tech, Instasafe, XenArmor, ArraySheild Technologies, and Netrika Consulting India Pvt Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2023 - Raghnall Insurance Broking, a supplier of insurance and risk management services in India, announced the launch of Business Cyber Shield for companies of all sizes. This technology is intended to offer complete cybersecurity solutions. With the introduction of Business Cyber Shield, Raghnall demonstrates its dedication to giving its clients access to the most up-to-date digital solutions for identifying, minimizing, and managing the risks connected with the rising danger of cyber-attacks.

- January 2023 - InstaSafe announced plans to expand its product offerings through India and the SAARC region by partnering with Value InfoSolutions, a technology services and solutions provider in India and Southeast Asia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Government Initiatives Towards Digitizing Industries is Driving the Market Growth

- 4.4 Market Restraints

- 4.4.1 Absence of National Security Infrastructure is Discouraging the Market Growth

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Segment

- 5.1.1 Security Information and Event Management (SIEM)

- 5.1.2 Security Web Gateway (SWG)

- 5.1.3 Identity Governance and Administration (IGA)

- 5.1.4 Enterprise Content-Aware Data Loss Prevention (DLP)

- 5.2 By Solution

- 5.2.1 Encryption

- 5.2.2 Identity and Access Management (IAM)

- 5.2.3 Data Loss Protection (DLP)

- 5.2.4 Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- 5.2.5 Other Solutions

- 5.3 By Service

- 5.3.1 Network Security

- 5.3.2 Endpoint Security

- 5.3.3 Wireless Security

- 5.3.4 Cloud Security

- 5.3.5 Other Services

- 5.4 By End-user Vertical

- 5.4.1 Aerospace and Defense

- 5.4.2 Retail

- 5.4.3 Government

- 5.4.4 Healthcare

- 5.4.5 IT & Telecom

- 5.4.6 BFSI

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lucideus Tech

- 6.1.2 Instasafe

- 6.1.3 XenArmor

- 6.1.4 ArraySheild Technologies

- 6.1.5 Netrika Consulting India Pvt Ltd.

- 6.1.6 Aspirantz InfoSec

- 6.1.7 Cyberoam

- 6.1.8 Data Resolve Technologies

- 6.1.9 Mirox Cyber Security & Technology