|

市場調查報告書

商品編碼

1639410

印尼塑膠市場:佔有率分析、產業趨勢、成長預測(2025-2030)Indonesia Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

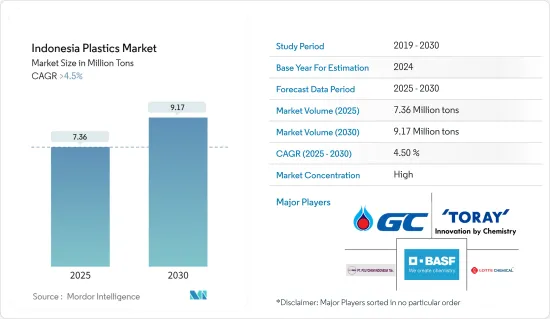

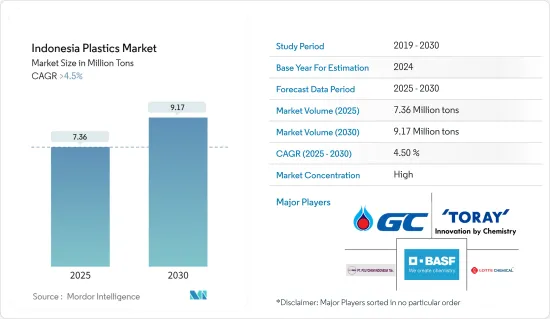

預計2025年印尼塑膠市場規模為736萬噸,2030年預估達917萬噸,預測期(2025-2030年)複合年成長率超過4.5%。

在該國隔離期間,COVID-19 大流行對該國的塑膠生產和供應產生了不利影響。然而,由於疫情期間線上食品和零售電子商務服務的使用增加,對包裝領域的需求激增。自2020年以來,由於國內活動的持續,市場穩步改善。

主要亮點

- 從中期來看,包裝、電氣/電子和建築業等終端用戶產業的需求不斷成長,以及下游加工能力的增加,預計將推動所研究市場的成長。

- 然而,政府對塑膠使用的監管以及對原料進口的過度依賴是阻礙所研究市場成長的主要因素。

- 對環保產品的需求不斷成長預計將為所研究市場的成長提供各種機會。

印尼塑膠市場趨勢

包裝產業需求不斷成長

- 塑膠因其耐磨性、耐化學性、易於成型、可回收性、耐穿刺性和高機械強度而主要應用於包裝領域。此外,聚對苯二甲酸乙二醇酯(PET)是印尼最常見的包裝塑膠。

- 塑膠由於其便攜性、設計靈活性、易於清洗、重量輕以及比其他材料更好的防潮性而經常用於食品、零售和製藥領域的產品包裝。此外,PET 的處理風險低、毒性低且不含雙酚 A (BPA) 和重金屬,這些因素使 PET 成為食品包裝的熱門選擇。

- 在製藥業,塑膠通常用於包裝血袋、注射器、霧化器和藥瓶。此外,印尼不斷成長的人口是藥物開發的關鍵原因,這增加了該國的塑膠消費量。

- 在印度尼西亞,電子商務行業擴大使用塑膠來包裝產品。例如,根據加拿大農業和農業食品部的數據,2022 年印尼零售電子商務銷售額達 480.7 億美元。預計2026年將達904.7億美元。

- 根據美國農業部的數據,印尼包裝食品零售從 2021 年的 334 億美元成長到 2022 年的 375 億美元。這一趨勢標誌著國內食品包裝塑膠消費量的增加,預計將持續下去。

- 塑膠材質在藥品包裝中發揮重要作用,具有耐用性、靈活性以及保持藥品完整性等品質。塑膠瓶、泡殼包裝和管瓶是常見的例子。

- 塑膠由於其有效的阻隔性能、靈活性、重量輕、成本效益、透明度、可靠性特徵和持續創新而通常被選擇用於無菌包裝。然而,為了解決與塑膠廢棄物相關的環境問題,人們越來越關注開發永續的替代品。

- 為了加強塑膠產業的發展,為無菌包裝提供優質產品和解決方案的知名領導者 Lamipak 透露,計劃於 2022 年 5 月在印尼建造第二家工廠,總產能為 1.6 億日圓。高達10,000,000 美元的重大投資。

- 上述因素預計將對預測期內印尼的塑膠需求產生相當大的影響。

射出成型技術主導市場

- 射出成型技術涉及將熱塑性聚合物加熱至熔點以上,形成低黏度熔融狀態。然後將這種熔融塑膠壓入所需形狀的模具中並注射以獲得所需的產品。

- 射出成型技術用於使用熱塑性聚合物製造簡單且複雜的塑膠製品,例如頭盔、瓶蓋和電風扇。它也用於電線絕緣、瓶子和化妝品包裝。

- 射出成型是使用高品質的加工樹脂完成的。它具有設計靈活、成本效益高、製造過程快速、人事費用低、色彩控制合理、產品品質好等優點。此外,這種方法主要消耗資本,但比其他技術類型能生產出更好、更準確的產品。

- 射出成型在製藥業的需求不斷增加,因為它用於製造各種醫療設備零件,包括燒杯、試管、蓋子、密封、封閉、閥門、注射器和吸入器。此外,根據聯合國商品貿易統計資料庫的數據,2022年印尼在進口藥品上的支出約為15.1億美元。這一趨勢顯示了射出成型技術在製藥領域的未來潛力。

- 射出成型更廣泛地應用於汽車零件的生產,如門板、保險桿、格柵、燈罩、擋泥板等。根據國際汽車建設組織(OICA)統計,2022年印尼汽車產量約121萬輛,與前一年同期比較去年同期成長37.5%。

- 此外,塑膠在電子工業中發揮重要作用,作為機殼、機殼、組件和連接器的輕質耐用材料,作為佈線和電路基板的絕緣材料,並且在印刷基板(PCB)的生產中它有利於包裝。

- 據工業部稱,2022年印尼電子製造業的投資將達到7.5兆印尼幣(4.8億美元)。

- 由於上述因素,預計所研究的市場在預測期內將穩定成長。

印尼塑膠產業概況

印尼塑膠市場得到鞏固。市場主要企業包括(排名不分先後) BASF SE、PT LOTTE CHEMICAL TITAN Tbk、PTT Global Chemical Public Company Limited、PT Polychem Indonesia Tbk 和 TORAY INDUSTRIES INC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 最終用戶產業的需求不斷成長

- 下游加工能力快速提升

- 其他司機

- 抑制因素

- 原料過度依賴進口

- 有關塑膠使用的政府法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 類型

- 傳統塑膠

- 聚乙烯

- 聚丙烯

- 聚氯乙烯

- 聚苯乙烯

- 工程塑膠

- 聚對苯二甲酸乙二酯 (PET)

- 聚丁烯對苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 苯乙烯聚合物(ABS & SAN)

- 氟樹脂

- 聚甲醛 (POM)

- 聚甲基丙烯酸甲酯(PMMA)

- 聚醯胺 (PA)

- 其他工程塑膠(液晶聚合物、聚醚醚酮)

- 生質塑膠

- 傳統塑膠

- 成型技術

- 射出成型

- 擠出成型

- 吹塑成型

- 其他

- 目的

- 包裝

- 電力/電子

- 建築/施工

- 汽車和交通

- 家具/寢具

- 其他用途(家居用品)

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Asahimas Chemical Company

- BASF SE

- LOTTE CHEMICAL TITAN HOLDING BERHAD.

- PT. INNAN

- PT Pertamina(Persero)

- PT Polychem Indonesia Tbk

- PT Chandra Asri Petrochemical

- LyondellBasell Industries Holdings BV

- PT. Standard Toyo Polymer(Tosoh Corporation)

- Sulfindo Adiusaha

- PTT Global Chemical Public Company Limited

- PT Solvay Chemicals Indonesia

- PT Toray International Indonesia

第7章 市場機會及未來趨勢

- 對環保產品的需求不斷成長

- 其他機會

The Indonesia Plastics Market size is estimated at 7.36 million tons in 2025, and is expected to reach 9.17 million tons by 2030, at a CAGR of greater than 4.5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the country's production and supply of plastics during the lockdown. However, the demand from the packaging segment surged due to the increasing use of online food and retail e-commerce services during the pandemic. After 2020, the market improved steadily due to continuous activities within the country.

Key Highlights

- Over the medium term, growing demand from the end-user industries, such as packaging, electrical, and electronics, as well as the construction industry, along with the rapid increase in the downstream processing capacity additions, is expected to drive the growth of the market studied.

- However, government regulations on the use of plastics and over-reliance on the imports of raw materials are the primary factors hindering the growth of the market studied.

- Nevertheless, the rising demand for eco-friendly products is expected to offer various opportunities for the growth of the market studied.

Indonesia Plastics Market Trends

Growing Demand from the Packaging Industry

- The primary utilization of plastics is in the packaging segment due to better wear and chemical resistance, ease of molding, recyclability, puncture resistance, and high mechanical strength. Furthermore, polyethylene terephthalate (PET) is Indonesia's most common plastic used for packaging purposes.

- Plastics are more commonly used in the food, retail, and pharmaceutical sectors for packaging goods due to their properties, such as portability, design flexibility, ease of cleaning, lightweight, and protection against moisture over other materials. In addition, low handling hazards, low toxicity, and the absence of bisphenol A (BPA) and heavy metals are other factors that allow PET to be used for food packaging.

- In the pharmaceutical industry, plastics are commonly used for packaging blood bags, syringes, nebulizers, and medicine bottles. Furthermore, the growing population in Indonesia is the main reason for pharmaceutical development, which has increased the consumption of plastics within the country.

- In Indonesia, the use of plastics for packaging goods is increasing in the e-commerce industry. For instance, according to Agriculture and Agri-Food Canada, the sales value of retail e-commerce in Indonesia was valued at USD 48.07 billion in 2022. It is forecasted to reach USD 90.47 billion in 2026.

- According to the United States Department of Agriculture, the retail sales value of packaged foods in Indonesia reached USD 37. 5 billion in 2022 and registered growth when compared to USD 33.4 billion in 2021. This trend, which shows the growing consumption of plastics in food packaging within the country, is expected to continue.

- Plastic materials play a crucial role in pharmaceutical packaging, offering qualities such as durability, flexibility, and the ability to maintain the integrity of medicines. Plastic bottles, blister packs, and vials are common examples.

- Plastic is commonly chosen for aseptic packaging due to its effective barrier properties, flexibility, lightweight nature, cost-effectiveness, transparency, reliability features, and ongoing innovations. However, there is an increased focus on developing sustainable alternatives to address environmental concerns associated with plastic waste.

- In a move to bolster the plastic industry, Lamipak, a prominent leader in delivering top-quality products and solutions for aseptic packaging, revealed its plans to build a second factory in Indonesia in May 2022, demonstrating a substantial investment of USD 160 million.

- The factors mentioned above are expected to have a considerable impact on Inodnesia's demand for plastic during the forecast period.

Injection Molding Technology to Dominate the Market

- In injection molding technology, the thermoplastic polymer is heated above its melting point and converted into a molten form of low viscosity. This molten plastic is then forced and injected into a mold of the desired shape to get the desired product.

- Injection molding technology is used to make the shape of simple or complex plastics such as helmets, bottle caps, and fans using thermoplastic polymers. It is also used for wire insulation, bottles, and cosmetics packaging.

- Injection molding is done using high-quality processing resins. It has several advantages: design flexibility, cost-effectiveness, fast manufacturing process, low labor costs, reasonable color control, and good product quality. In addition, this process is mostly capital-consuming, but it offers better and more accurate products than other technology types.

- The pharmaceutical industry's demand for injection molding is increasing since it is utilized to manufacture various medical equipment parts such as beakers, test tubes, caps, seals, closures, valves, syringes, and inhalers. Furthermore, according to the UN Comtrade, Indonesia spent approximately USD 1.51 billion on imported pharmaceutical products in 2022. This trend demonstrates future opportunities for injection molding technology in the pharmaceutical sector.

- Injection molding is more extensively used in the manufacturing of automotive parts such as door panels, bumpers, grilles, light housings, fenders, and other parts. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), Indonesia produced around 1.21 million units of vehicles in 2022, witnessing a growth rate of 37.5% as compared to the previous year.

- Furthermore, plastics play a crucial role in the electronics industry, serving as lightweight and durable materials for casings, enclosures, components, and connectors, providing insulation for wiring and circuit boards, contributing to the production of printed circuit boards (PCBs), facilitating packaging, creating displays and screens, enabling 3D printing of prototypes, and offering antistatic properties to prevent damage to electronic components.

- According to the Ministry of Industry, the investment value of the electronics manufacturing industry in Indonesia reached IDR 7.5 trillion (USD 0.48 billion) in 2022.

- Due to the factors mentioned above, the market studied is expected to have steady growth during the forecast period.

Indonesia Plastics Industry Overview

The Indonesian plastics market is consolidated. Some major players in the market (not in any particular order) include BASF SE, PT LOTTE CHEMICAL TITAN Tbk, PTT Global Chemical Public Company Limited, PT Polychem Indonesia Tbk, and TORAY INDUSTRIES INC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the End-user Industries

- 4.1.2 Rapid Increase in the Downstream Processing Capacity Additions

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Over-reliance on the Imports of Raw Materials

- 4.2.2 Government Regulations on the Use of Plastics

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 Polyvinyl Chloride

- 5.1.1.4 Polystyrene

- 5.1.2 Engineering Plastics

- 5.1.2.1 Polyethylene Terephthalate (PET)

- 5.1.2.2 Polybutylene Terephthalate (PBT)

- 5.1.2.3 Polycarbonates(PC)

- 5.1.2.4 Styrene Polymers (ABS & SAN)

- 5.1.2.5 Fluoropolymers

- 5.1.2.6 Polyoxymethylene (POM)

- 5.1.2.7 Polymethyl Methacrylate (PMMA)

- 5.1.2.8 Polyamide (PA)

- 5.1.2.9 Other Engineering Plastics (Liquid Crystal Polymer, Polyether Ether Ketone)

- 5.1.3 Bioplastics

- 5.1.1 Traditional Plastics

- 5.2 Technology

- 5.2.1 Injection Molding

- 5.2.2 Extrusion Molding

- 5.2.3 Blow Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Furniture and Bedding

- 5.3.6 Other Applications (Houseware)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahimas Chemical Company

- 6.4.2 BASF SE

- 6.4.3 LOTTE CHEMICAL TITAN HOLDING BERHAD.

- 6.4.4 PT. INNAN

- 6.4.5 PT Pertamina(Persero)

- 6.4.6 PT Polychem Indonesia Tbk

- 6.4.7 PT Chandra Asri Petrochemical

- 6.4.8 LyondellBasell Industries Holdings BV

- 6.4.9 PT. Standard Toyo Polymer (Tosoh Corporation)

- 6.4.10 Sulfindo Adiusaha

- 6.4.11 PTT Global Chemical Public Company Limited

- 6.4.12 P.T. Solvay Chemicals Indonesia

- 6.4.13 P.T. Toray International Indonesia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising demand for Eco-friendly Products

- 7.2 Other Opportunities