|

市場調查報告書

商品編碼

1639419

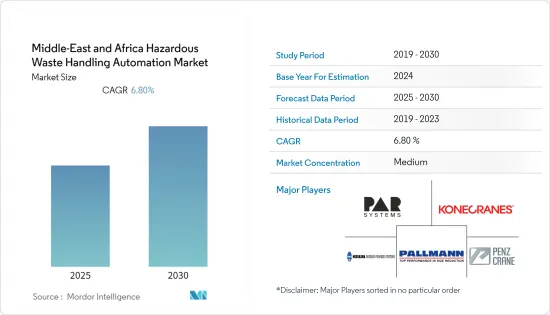

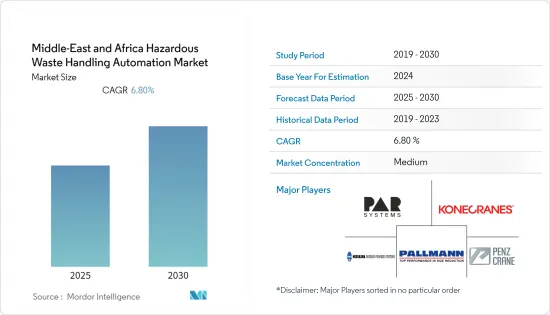

中東和非洲危險廢棄物自動化市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Middle-East and Africa Hazardous Waste Handling Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內中東和非洲危險廢棄物處理自動化市場複合年成長率將達到 6.8%。

危險廢棄物由於其毒性、易燃性、傳染性或放射性等特性,對人類健康、其他生物或環境構成實際或潛在的危險。

危險廢棄物管理是中東和非洲地區的新興議題。這是因為,已開發國家企業多年來一直在非洲傾倒危險廢棄物,而非洲地區的危險廢棄物管理監管措施仍不符合國際法。然而,該地區各國政府意識到日益嚴重的健康問題,現已舉措禁止這種做法。

中東地區的石油產品和頻繁的戰爭產生了大量危險廢棄物,如砲彈、彈藥筒和其他戰爭殘骸。

其中一些廢棄物可以手動處理,而其他一些則需要專業知識和自動化解決方案,以盡量減少人類與廢棄物的接觸。使用這種自動化解決方案進行廢棄物處理也使流程更加高效,並減少對人工的依賴。這消除了人們對正確處理危險物質的擔憂。

用於危險廢棄物自動化處理的各種產品包括起重機、機械手、尺寸縮小臂等。

隨著新冠肺炎疫情影響到中東和北非地區,廢棄物,包括被感染的口罩、手套和其他防護設備。這進一步增加了該地區對有效的危險廢棄物處理方法的需求。

此外,由美國國際開發署(USAID) 及其各合作夥伴主導的「Power Africa」等舉措旨在 2030 年在非洲新增 2,500 萬至 3,000 萬個太陽能發電設施。這些努力預計將產生大量廢棄物,包括過期的鉛酸電池和電源備用系統。預計這將推動對確保高效和安全處理的自動化危險廢棄物處理解決方案的需求。

中東和非洲危險廢棄物處理自動化市場趨勢

對自動化處理解決方案的需求可能會增加安全處理和一次性電子廢棄物

電子垃圾(E- 廢棄物)是指行動電話、電腦、螢光和白熾燈、汽車用電子設備,以及電視機、冰箱、洗衣機等大型家電產品廢棄後的殘餘物,定義為無法正常運作或接近使用壽命的東西。

根據聯合國的報告,每年產生約 5,000 萬噸電子廢棄物,預計到 2050 年,這一數字將增加一倍以上,達到 1.1 億噸,成為全球成長最快的廢棄物。然而,目前只有不到20%的舊電子產品被回收。非洲是世界上正規電子廢棄物最低的地區之一。

根據《環境健康展望》雜誌發表的一項研究,光是奈及利亞拉各斯港每月就接收10萬台二手電腦。加納也面臨管理進口電子廢棄物的挑戰。通常情況下,這些電子廢棄物最終都會被送到垃圾掩埋場。

電子設備中的重金屬和其他有害化學物質,如鉛、鎘、汞、溴化阻燃劑和聚氯乙烯(PVC),會污染地下水並對其他環境和公共衛生造成風險。

為了避免此類風險並確保人們的安全,該地區的政府已採取措施,單獨或與外部機構合作,安全處置危險廢棄物。例如,位於杜拜的中東首個全面運作的永續社區——永續城市(TSC)為其社區引入了新的電子廢棄物收集和管理解決方案。與EFATE合作設立的24小時電子廢棄物投放站將為居民和大眾提供免費、有效率的電子廢棄物管理解決方案。

沙烏地阿拉伯有望佔據主要市場佔有率

沙烏地阿拉伯是中東和北非地區最大的國家之一,其多個行業產生大量危險廢棄物。這些產業大部分屬於石油天然氣和汽車產業。

據石油輸出國組織稱,沙烏地阿拉伯持有全球約17%的已探明石油蘊藏量。石油和天然氣產業約佔國內生產總值的50% 和出口收益的70% 。石油以外的天然資源包括天然氣、鐵礦石、黃金和銅。

由於可支配收入的增加,該國電子設備的消費量大幅增加,這也是該國產生電子廢棄物的主要因素。

根據聯合國訓練研究所的《阿拉伯國家 2021 年區域電子廢棄物監測報告》,沙烏地阿拉伯是阿拉伯國家中最大的電子廢棄物排放,2019 年排放了595 千噸電子廢棄物(或 13.2 公斤/小時)。

政府推出了多項措施來規範廢棄物的安全處理。例如,政府將於2021年9月公佈新的《廢棄物管理法》,旨在規範廢棄物、分類、儲存、進出口、安全處置和所有其他與廢棄物有關的活動。預計這些趨勢將在預測期內推動該地區的市場成長。

中東和非洲危險廢棄物自動化產業概況

由於對安全危險廢棄物處理解決方案的需求不斷成長,中東和非洲危險廢棄物處理自動化市場競爭日益激烈。市場的主要企業包括 PAR Systems、Konecranes 和 Pallmann Maschinenfabrik GmbH &Co.KG。

- 2022 年 1 月 - Ramky Enviro Engineers Middle East 與拉斯海馬酋長國廢棄物管理局(公共服務部)建立戰略夥伴關係關係,在阿拉伯聯合大公國拉斯海馬酋長國建立專門的工業危險廢棄物管理設施。

- 2022 年 1 月 - 科尼與 Pesmel 合作,提供自動化倉庫貨櫃處理技術,這將徹底改變物流中心和配送中心的物料輸送。自動化貨櫃追蹤是管理系統的一部分,可以輕鬆地與設施的整體物流管理系統整合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 政府和行業監管

- 人們對廢棄物管理的興趣日益濃厚

- 市場限制

- 成本高

第6章 市場細分

- 按自動化產品

- 機械手臂

- 伸縮桅杆

- 起重機

- 桁架

- 粉碎系統

- 其他自動化產品

- 依廢棄物類型

- 列出的廢棄物

- 特殊廢棄物

- 一般廢棄物

- 混合廢棄物

- 利用工業廢棄物

- 製造業

- 化學廢棄物

- 能源

- 消費者護理

- 政府

- 其他行業

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 南非

- 其他中東和非洲地區

第7章 競爭格局

- 公司簡介

- PAR Systems

- Konecranes

- DX Engineering

- Floatograph Technologies

- Pallmann Maschinenfabrik GmbH & Co. KG

- Hosokawa Micron Powder Systems

- PENZ Crane GmbH

- ACE Inc.

- Terex MHPS GmbH

- Hiab

- Ramky Enviro Engineers Ltd

第8章投資分析

第9章:市場的未來

The Middle-East and Africa Hazardous Waste Handling Automation Market is expected to register a CAGR of 6.8% during the forecast period.

Hazardous waste poses an actual or potential hazard to humans' health and other living organisms or the environment, owing to its toxic, flammable, infectious, and radioactive properties.

The management of hazardous waste is one of the emerging issues in the Middle-East and African region as companies from the developed regions have been dumping their toxic waste in Africa for many years, as regulating measures for hazardous waste management in the region are still not on a par with international legislation. However, the governments in the region are now taking initiatives and are banning this practice as a result of their awareness of growing health concerns.

In the Middle East, a large percentage of hazardous waste is produced from petroleum products and from frequent wars, including shellings, casings, and other types of war remain.

Some of these wastes can be handled manually, while some may require expertise and automation solutions to minimize human contact with the waste. The use of such automation solutions for handling waste also improves process efficiency and reduces the reliance on manual intervention. Thus, concerns about the proper handling of these harmful substances can be eliminated.

Different products used in hazardous waste handling automation include cranes, manipulator arms, and size reduction arms.

As the outbreak of COVID-19 impacted the Middle-East and African region, many types of additional medical and hazardous wastes were generated, including infected masks, gloves, and other protective equipment. This has further augmented the demand for effective hazardous waste handling practices in the region.

Moreover, initiatives such as Power Africa, taken by the United States Agency for International Development (U.S.A.I.D.) and various partners, aim to have 25 million to 30 million new solar connections across Africa by 2030. Such initiatives are expected to generate a significant amount of waste, including expired lead-acid batteries and power backup systems. This is expected to drive the demand for automated hazardous waste handling solutions for efficient and safe handling.

Middle-East and Africa Hazardous Waste Handling Automation Market Trends

Demand for Automated Handling Solutions May Increase Safer Handling and Disposable of E-waste

Electronic waste (e-waste) is defined as the remains of electronic gadgets such as mobile phones, computers, fluorescent and incandescent light bulbs, electronic gadgets used in automobiles, and large household appliances such as television sets, refrigerators, washing machines, etc., which are not working or are nearing their end of life.

According to a report by the UN, about 50 million ton of e-waste is generated every year, which will more than double to 110 million ton by 2050, making it the fastest-growing waste stream in the world. However, less than 20% of used electronics are currently recycled. Africa holds the lowest rate of formal e-waste recycling in the world.

An article published by Environmental Health Perspectives shows that 100,000 used personal computers arrive at the Nigerian port of Lagos alone each month. Ghana also faces challenges in managing the e-waste imported. Usually, these e-wastes end up in landfills.

Heavy metals and other hazardous chemicals such as lead, cadmium, mercury, brominated flame-retardants, and polyvinyl chloride (PVC), found in electronics, contaminate groundwater and pose other environmental and public conditions health risks.

To avoid such risks and ensure the safety of people, the governments in the region are taking initiatives both standalone and in collaboration with external agencies for the safe disposal of hazardous waste. For instance, Sustainable City (TSC), the Middle East's first fully-operational sustainable community located in Dubai, has introduced new electronic waste (e-waste) collection and management solutions for the community. The 24-Hour e-Waste drop-off station, created in collaboration with EFATE, will provide a free and efficient e-waste management solution to residents and the general public.

Saudi Arabia is Expected to Hold a Significant Market Share

Saudi Arabia is among the largest countries in the Middle-East and African region and generates a significant amount of hazardous waste due to the presence of several industries. The majority of these industries are from the oil and gas and automotive sectors.

According to OPEC, Saudi Arabia possesses around 17% of the world's proven petroleum reserves. The oil and gas sector accounts for about 50% of gross domestic product and about 70% of export earnings. Apart from petroleum, the Kingdom's other natural resources include natural gas, iron ore, gold, and copper.

Owing to the rising disposable income, the consumption of electronic gadgets in the country is increasing significantly, which is also the primary contributor to the generation of e-waste in the country.

According to the regional e-waste monitor report for the Arab States 2021, by UNITAR, Saudi Arabia is the largest generator of e-waste among Arab countries, with 595 kilotons (kt) (or 13.2 kg/inh) of e-waste in 2019.

To regulate the safe disposal of waste, the government is taking several initiatives. For instance, the government published a new Waste Management Law in September 2021, which aims to regulate the transport, segregation, storage, import, export, safe disposal of waste, and all other activities related to it. Such trends are expected to drive the market growth in the region during the forecast period.

Middle-East and Africa Hazardous Waste Handling Automation Industry Overview

The Middle-East and Africa hazardous waste handling automation market has increased competition due to the rising demand for such solutions for safe hazardous waste disposal. Some of the major players operating in the market include PAR Systems, Konecranes, and Pallmann Maschinenfabrik GmbH & Co. KG, among others.

- January 2022 - Ramky Enviro Engineers Middle East and Waste Management Agency (Public Services Department) of the Emirate of Ras Al Khaimah entered a strategic partnership to set up an exclusive Industrial Hazardous Waste Management facility in RAK, UAE.

- January 2022 - Konecranes partnered with Pesmel to supply automated warehouse container handling technology that revolutionizes material handling in logistics hubs and distribution centers. Automated container tracking is part of a management system that can be integrated easily with the facility's overall logistics management system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government and Industry Regulations

- 5.1.2 Growing Concerns about Waste Management

- 5.2 Market Restraints

- 5.2.1 High Costs Involved

6 MARKET SEGMENTATION

- 6.1 Automation Product

- 6.1.1 Manipulator Arms

- 6.1.2 Telescoping Masts

- 6.1.3 Cranes

- 6.1.4 Trusses

- 6.1.5 Size Reduction Systems

- 6.1.6 Other Automation Products

- 6.2 Type of Waste

- 6.2.1 Listed Wastes

- 6.2.2 Charecteristic Wastes

- 6.2.3 Universal Waste

- 6.2.4 Mixed Waste

- 6.3 Industry

- 6.3.1 Manufacturing

- 6.3.2 Chemical

- 6.3.3 Energy

- 6.3.4 Consumer Care

- 6.3.5 Government

- 6.3.6 Other Industries

- 6.4 Geography

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Israel

- 6.4.4 South Africa

- 6.4.5 Rest of Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAR Systems

- 7.1.2 Konecranes

- 7.1.3 DX Engineering

- 7.1.4 Floatograph Technologies

- 7.1.5 Pallmann Maschinenfabrik GmbH & Co. KG

- 7.1.6 Hosokawa Micron Powder Systems

- 7.1.7 PENZ Crane GmbH

- 7.1.8 ACE Inc.

- 7.1.9 Terex MHPS GmbH

- 7.1.10 Hiab

- 7.1.11 Ramky Enviro Engineers Ltd