|

市場調查報告書

商品編碼

1651026

北美危險廢棄物處理自動化:市場佔有率佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)NA Hazardous Waste Handling Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

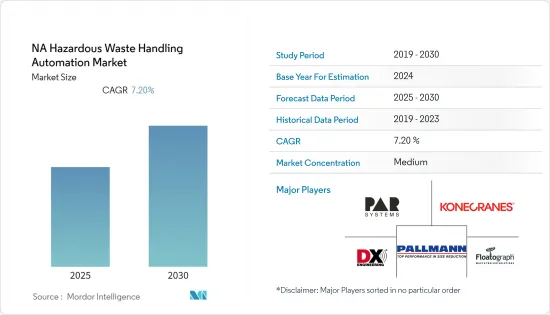

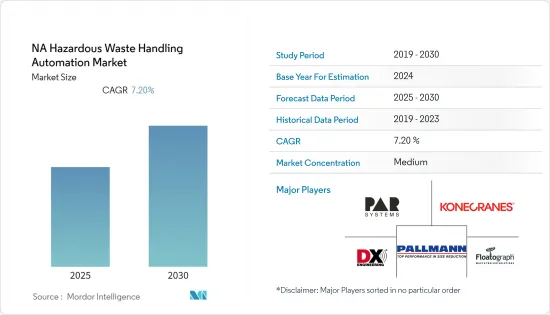

預計預測期內北美危險廢棄物處理自動化市場複合年成長率將達 7.2%。

主要亮點

- 危險廢棄物處理自動化是使用機器處理危險廢棄物。這些範圍從材料的分類和移動到實際銷毀。隨著公司尋求減少環境影響的解決方案,危險廢棄物處理自動化越來越受歡迎。

- 由於政府和工業法規的嚴格實施,旨在保護人們免受危險廢棄物的侵害,同時考慮到危險廢物對人類和環境造成的危害,北美危險廢棄物處理自動化市場在預測期內可能會大幅成長。

- 由於廢棄物管理過程中擴大採用自動化,預計美國將在預測期內主導北美危險廢棄物處理自動化市場。該地區最近的技術創新和採用趨勢有助於開發新的危險廢棄物處理自動化產品,這些產品可以改善多種應用的整體操作和準確性。

- 儘管美國民眾將危險廢棄物視為嚴重的環境問題,但其高開發和累積所造成的社會和環境問題卻很少受到重視。為此,美國環保署等組織一直致力於制定危險廢棄物法規,以平衡節約資源與保護人類健康和環境。雖然某些危險廢棄物可以透過垃圾掩埋場或焚化爐進行處理和處置,但其他廢棄物必須經過安全有效的處理和回收。

- 根據美國能源資訊署的數據,截至2022年12月,美國每100磅廢棄物中約有85磅廢棄物可以作為燃料燃燒以產生能量。該廢棄物轉化能源設施將減少垃圾量約 87%,將 2,000 磅垃圾轉化為重達 300 至 600 磅的灰燼。巨型起重機的爪子將垃圾收集起來,放入燃燒室,然後在大規模燃燒垃圾焚化發電廠中產生電力。

- 由於需要開發危險廢棄物管理的新技術,危險廢棄物的分解和中和也變得更加困難。危險廢棄物處理產業的開發商不斷開發創新技術來解決問題。

- 此外,一些非政府組織(NGO)和社區組織(CBO)也開始協助醫院和其他醫療機構收集、回收和處理醫療廢棄物。這些措施可望推動廢棄物管理領域進一步採用自動化解決方案。

- 環境解決方案供應商美國 Ecology 和機器學習技術公司 Smarter Sorting 已建立獨家合作夥伴關係,為零售商提供自動化解決方案,以更安全、更合規地對 RCRA、廢棄物和無害廢棄物進行分類和分離。 美國 Ecology 與 Smarter Sorting 之間的獨家合作標誌著首次將人工智慧納入被歸類為廢棄物的零售產品供應鏈的合作。

- 包括食品藥物管理局(FDA)、環保署(EPA)和緝毒局(DEA)在內的多個政府機構也不斷努力進行適當的廢棄物管理,以確保免受危險的廢棄物、廢棄物和放射性廢棄物。

北美危險廢棄物處理自動化市場趨勢

上市:人們對廢棄物管理的日益關注預計將推動市場需求

- 所列出的廢棄物包括來自一般製造業、工業製程、特定產業的廢棄物以及可能來自廢棄的商業產品。這些廢棄物是由於工業化、都市化和經濟成長過程中伴隨的生活方式的改變而產生的。

- 自動化解決方案還可以幫助減少人們接觸這些危險廢棄物後遺症所造成的醫療治療費用。預計,人們意識的提高和環境條件的變化將推動全球危險廢棄物處理自動化市場的發展。

- PegEx Inc. 是一家危險廢棄物產業軟體開發商,最近向三大新客戶 Red Technology、EnviroSmart 和 EnviroCare 提供了雲端基礎的PegEx 平台,幫助他們提高生產力、消除風險並增加廢棄物管理業務的收益。

- 製造業是全球最大的廢棄物產生產業之一。這些廢棄物大部分都是危險的,因為其中含有化學物質。必須特別小心處理從製造業排放的物質,例如油漆、油、電池、強酸和強鹼、反應性物質和其他自燃廢棄物。不當處理這些廢棄物會對環境產生巨大影響,最終影響人類。因此,生產和製造部門產生的廢物量的增加正在推動市場成長。

- 為了避免人類與危險廢棄物的直接接觸,自動化的需求急劇增加。實施各種自動化解決方案可以幫助緩解正確處理的問題並提高流程效率。

預計美國將出現顯著成長

- 由於廢棄物管理過程中擴大採用自動化,預計預測期內美國將在全球危險廢棄物處理自動化市場中佔據主導地位。預計美國將繼續處於區域市場的前列,因為最新的技術突破和採用有助於新型危險廢棄物處理自動化產品的進步,這些產品可以使整個過程更加高效,並顯著提高各種應用的準確性。

- 由於各地的供應商都試圖利用這個機會,市場正在經歷一系列新產品的發布以及併購。市場投資的主要驅動力是新技術的不斷發展和應用,從而釋放了大量傳統上被認為是非商業性的東西。

- 威立雅透過其子公司威立雅北美公司最近簽署了一項協議,收購美國鋁業公司位於美國阿肯色州甘斯普林斯的危險廢棄物處理設施。威立雅計畫從北美開始,在全球擴大其危險廢棄物處理和回收業務,這筆交易為威立雅現有的投資組合增添了一個旗艦工廠。

- 此外,密西根州環境、五大湖和能源部 (EGLE) 向位於愛達荷州博伊西的美國生態公司底特律北部危險廢棄物管理設施重新頒發了許可證續約和延期。該許可證將允許美國生態公司繼續其現有業務,建造和營運兩棟新的儲存和加工建築,並重新使用其底特律工廠的現有建築。此項升級計畫將進一步加強該國的廢棄物管理系統。根據Owlcation報道,拉斯維加斯Apex地區垃圾掩埋場每天都會傾倒超過1萬噸廢棄物,是全球面積最大的掩埋。

北美危險廢棄物處理自動化產業概況

北美危險廢棄物處理自動化市場本質上具有中等競爭性。產品發布、高額研發支出、合作和收購是該地區公司為維持競爭優勢所採取的主要成長策略。

2023 年 2 月,特雷克斯公司收購了位於奧斯汀的 Apptronik Inc. 除了投資之外,兩家公司還同意合作開發特雷克斯設備的機器人應用程式。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 政府和行業監管

- 人們對廢棄物管理的擔憂日益增加

- 市場挑戰

- 新興市場停滯

第6章 市場細分

- 依廢棄物類型

- 列出的廢棄物

- 特殊廢棄物

- 普通廢棄物

- 混合廢棄物

- 按產品

- 機械手臂

- 伸縮桅杆

- 起重機

- 桁架

- 微型系統

- 其他產品

- 按最終用戶產業

- 製造業

- 化學

- 能源

- 消費者護理

- 政府

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- PaR Systems Inc.

- Konecranes PLC

- DX Engineering

- Floatograph Technologies

- Pallmann

- Hosokawa Micron Powder Systems

- ACE Inc.

- Terex MHPS GmbH

- Hiab

- PENZ Crane

第8章投資分析

第9章:市場的未來

The NA Hazardous Waste Handling Automation Market is expected to register a CAGR of 7.2% during the forecast period.

Key Highlights

- Automating hazardous waste handling is the method of handling hazardous waste with machines. This can range from classifying and moving the material to actually destroying it. Automation of hazardous waste handling is growing in popularity as businesses explore for solutions to lessen their environmental effect.

- The North American hazardous waste handling automation market is likely to grow significantly over the forecast period as a result of severe governmental and industrial laws designed to keep people safe from hazardous waste in light of the harm caused to people and the environment.

- Because of the rising adoption of automation in the waste management process, the United States is predicted to dominate the North American hazardous waste handling automation market during the forecast period. The region's most recent technology innovations and adoptions have aided in developing dangerous new waste-handling automation products that can improve overall operations and accuracy in several applications.

- Although the American public views hazardous waste as a severe environmental problem, the social and environmental issues brought on by its high development and buildup rates have not received considerable consideration. Because of this, organizations like the EPA have worked to create hazardous waste rules that strike a balance between resource conservation and maintaining the protection of human health and the environment. While particular dangerous wastes can be processed and disposed of in landfills or incinerators, other wastes must be treated and recycled safely and effectively.

- According to the US Energy Information Administration, around 85 pounds of MSW can be burned as fuel to produce energy for every 100 pounds of MSW in the US as of December 2022. Trash-to-energy facilities reduce waste volume by roughly 87% and turn 2,000 pounds of garbage into ash that weighs between 300 and 600 pounds. A massive crane claw gathers rubbish and deposits it in a combustion chamber while generating power in a mass-burn waste-to-energy plant.

- Decomposing or neutralizing hazardous waste has also become difficult due to the need to create new technologies for hazardous waste management. Businesses in the hazardous waste management industry are constantly trying to develop innovations and solutions to problems.

- Furthermore, several non-government organizations (NGOs) and community-based organizations (CBOs) are stepping in to help hospitals and other healthcare facilities collect, recycle, and dispose of medical waste. Such initiatives are expected to boost further the adoption of automation solutions for waste management.

- An exclusive partnership was formed between environmental solutions provider US Ecology and machine learning technology company Smarter Sorting to provide retailers with an automated solution to more safely and compliantly classify and segregate RCRA, hazardous and non-hazardous waste. The exclusive partnership between US Ecology and Smarter Sorting was the first collaboration to incorporate artificial intelligence into the supply chain of retail products classified as waste.

- Several government organizations, such as the Food and Drug Administration (FDA), Environment Protection Agency (EPA), and Drug Enforcement Administration (DEA), are also consistently working toward the proper management of waste to ensure safety from hazardous medical, chemical, and radioactive wastes.

North America Hazardous Waste Handling Automation Market Trends

Growing Concerns Over Listed Waste Management Expected to Drive Market Demand

- Listed wastes are wastes from common manufacturing, industrial processes, and specific industries and can be generated from discarded commercial products. The increasing industrialization, urbanization, and changes in the pattern of life, which accompany the process of economic growth, give rise to the generation of these wastes.

- The automation solutions also help control the expenditure on healthcare treatment caused by the after-effects of these hazardous wastes in contact with the population. The growth in awareness and the changing environmental conditions are expected to drive the dangerous global waste-handling automation market.

- PegEx Inc., a software developer for the hazardous waste industry, recently supplied its cloud-based PegEx platform to three major new customers, Red Technologies, EnviroSmart, and EnviroCare, to improve productivity, help eliminate risks, and increase the revenues of their waste management businesses.

- The manufacturing sector is one of the most significant sectors for waste production globally. A large portion of these wastes is hazardous due to the presence of chemical substances. Materials from the manufacturing sectors should be disposed of with special care, such as paints, oils, batteries, strong acids and bases, reactive substances, and other ignitable wastes. The improper disposal of these wastes impacts the environment greatly and, ultimately, human beings, which is a significant factor driving the market. Therefore, the increasing amount of waste from the production and manufacturing sector is driving the market's growth.

- The need for automation increased drastically to avoid direct contact with humans with hazardous waste. By deploying various automation solutions, the concerns of proper handling can be reduced, and process efficacy can be improved.

The United States is Expected to Witness Significant Growth

- The US is expected to dominate the global hazardous waste handling automation market during the forecast period due to its increasing adoption of automation in the waste management process. The US is expected to remain at the forefront of the regional market as the latest technological breakthroughs and adoptions have assisted the advancement of new hazardous waste handling automation products that can make overall processes more efficient and significantly improve accuracy in various applications.

- The country is witnessing a series of new product launches, mergers, and acquisitions in the market, as every vendor wants to utilize the opportunity. The major drivers behind the investments in the market are the continuous evolution and application of new technologies to unlock enormous volumes previously considered non-commercial.

- Veolia, through its subsidiary Veolia North America, recently signed an agreement to take over Alcoa USA Corp.'s Hazardous Waste Treatment Site located in Gum Springs, Arkansas (the US). With this agreement, Veolia plans to expand its hazardous waste treatment and recycling activity globally, starting from North America, by adding a flagship site to its existing portfolio.

- Also, the Michigan Department of Environment, Great Lakes and Energy (EGLE) reissued a license renewal and expansion to Boise, Idaho-based US Ecology's Detroit North hazardous waste management facility. The license is expected to allow US Ecology to continue existing operations, construct and operate two new buildings for storage and treatment, and repurpose an existing building at its Detroit facility. The renewal plans will further strengthen the country's waste management systems. According to Owlcation, More than 10,000 tons of waste are dumped daily at the Apex Regional landfill site in Las Vegas, the largest landfill facility in the world by area.

North America Hazardous Waste Handling Automation Industry Overview

The North American hazardous waste handling automation market is moderately competitive in nature. Product launches, high expenses on R&D, partnerships, and acquisitions are the prime growth strategies that companies in the region adopt to sustain the intense competition.

In February 2023, Terex Corporation announced an equity investment with the Austin-based business Apptronik Inc. ("Apptronik"), which specializes in creating adaptable, mobile robotic systems to usher in the next generation of robots. In addition to the equity investment, the two companies have also agreed to collaborate on developing possible robotic uses for Terex equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government and Industry Regulations

- 5.1.2 Growing Concerns overWaste Management

- 5.2 Market Challenges

- 5.2.1 Market Becoming Stagnant in Several Developed Countries

6 MARKET SEGMENTATION

- 6.1 By Type of Waste

- 6.1.1 Listed Wastes

- 6.1.2 Characteristic Wastes

- 6.1.3 Universal Wastes

- 6.1.4 Mixed Wastes

- 6.2 By Product

- 6.2.1 Manipulator Arms

- 6.2.2 Telescoping Masts

- 6.2.3 Cranes

- 6.2.4 Trusses

- 6.2.5 Size Reduction Systems

- 6.2.6 Other Products

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Chemical

- 6.3.3 Energy

- 6.3.4 Consumer Care

- 6.3.5 Government

- 6.3.6 Other End-user Industries

- 6.4 By Country

- 6.4.1 US

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PaR Systems Inc.

- 7.1.2 Konecranes PLC

- 7.1.3 DX Engineering

- 7.1.4 Floatograph Technologies

- 7.1.5 Pallmann

- 7.1.6 Hosokawa Micron Powder Systems

- 7.1.7 ACE Inc.

- 7.1.8 Terex MHPS GmbH

- 7.1.9 Hiab

- 7.1.10 PENZ Crane