|

市場調查報告書

商品編碼

1639433

中東和非洲聚氨酯(PU)黏合劑市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Polyurethane (PU) Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

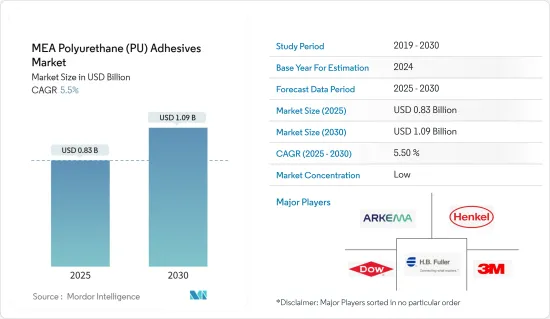

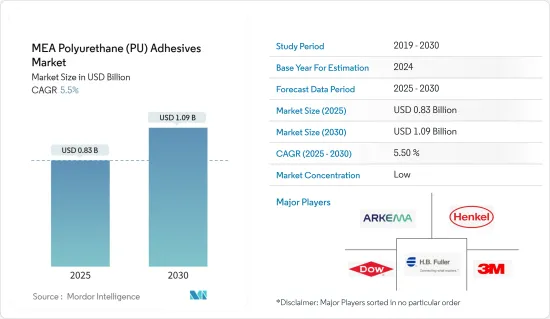

中東和非洲聚氨酯接著劑市場規模預計到2025年為8.3億美元,預計到2030年將達到10.9億美元,預測期內(2025-2030年)複合年成長率為5.5%。

COVID-19 的爆發對市場產生了負面影響。多個工業計劃的暫停或放緩、行動限制、生產停工和勞動力短缺都降低了聚氨酯(PU)黏合劑市場的成長。然而,由於建築、包裝、醫療保健和汽車等各種最終用途行業的消費增加,該數字在 2021 年大幅反彈。

主要亮點

- 短期內,建築業和醫療基礎設施的需求不斷成長是推動所研究市場成長的關鍵因素之一。

- 相反,有關揮發性有機化合物排放的嚴格環境法規預計將阻礙市場成長。

- 然而,向生物基黏合劑的轉變以及對製造輕質產品的日益關注可能會為聚氨酯黏合劑市場提供機會。

- 沙烏地阿拉伯在中東和非洲聚氨酯黏合劑市場佔據主導地位,並將在預測期內表現出最高的複合年成長率。

中東和非洲聚氨酯(PU)膠合劑市場趨勢

建築業主導市場

- 在最終用戶產業中,建築領域主導著該地區的聚氨酯黏合劑消費。

- PU 黏合劑具有快速固化和低強度特性,使其成為木工和其他建築應用的理想選擇。 PU 黏合劑列出了將建築材料連接在一起所需的高強度。

- 此外,這種材料在產品組裝黏合劑方面用途廣泛。適用於塑膠、玻璃、PVF、鋁、不銹鋼等金屬,無論黏合基材的韌性為何。

- 沙烏地阿拉伯、科威特、卡達、阿拉伯聯合大公國和埃及等國的建築投資和建設活動呈現強勁成長。例如,科威特2035年願景的永續生活環境軸有五個支柱,其中最突出的是透過有計劃的方式為公民提供住宅護理。這將確保透過價值約 32.2 億韓元(105 億美元)的五個計劃供應 65,500 套住宅,最後一個計劃將於 2029 年完工。

- 如果這些計劃得到實施,該州將滿足目前 91,000 套住宅需求的約 72%。住宅護理計劃的第一個計劃以賈比爾艾哈邁德市的科威特 2035(新科威特)計劃為中心,完成率為 95%,並將於 2022年終完成。第二個計劃是Al Mutraa,完工率為64%,預計於2023年終完工。

- 第三個計劃位於South Abdullah Al Mubarak郊區,完工率為72%,預計於2025年終完工。第四個計劃是South Sabah Al Ahmad,完工率約14%,目前仍處於初步階段,預計2029年完工。 South Saad Al Abdullah 計畫仍處於初步階段,完工率為 13%,預計將於 2029 年完工。因此,科威特的住宅建設不斷增加,科威特聚氨酯(PU)黏合劑市場的需求預計將增加。

- 因此,這些國家建築業的成長前景預計將帶動該地區PU膠黏劑的消費。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯在中東和非洲聚氨酯(PU)黏合劑市場中佔有最大佔有率。隨著該國對建築、醫療基礎設施和汽車輪轂開發的投資增加,預計在整個預測期內,對聚氨酯 (PU) 黏合劑的需求將增加。人口和可支配收入的成長增加了對更高品質住宅建設開發的需求。

- 由於「2030 年願景」、「NTP2020」以及正在進行的幾項石油多元化改革,沙烏地阿拉伯的建築市場預計將出現顯著成長並提供豐厚的潛力。 2030 年願景、NTP2020、私營部門投資促進和正在進行的改革預計將成為預測期內沙烏地阿拉伯建築業聚氨酯接著劑市場的成長動力。

- 此外,根據“2030 年願景”,到 2030 年,沙烏地阿拉伯將開設 80 家新酒店,擁有超過 11,000 間豪華客房。因此,飯店建築投資將增加,聚氨酯(PU)黏合劑市場需求預計。

- 沙烏地阿拉伯經濟正進入後石油時代,目前正在興建的特大城市將為未來提供成長動力。據業內人士透露,沙烏地阿拉伯正在施工的建設計劃超過5,200個,總成本達8,190億美元。這些計劃約佔波灣合作理事會(GCC) 正在進行的計劃總數的 35%。

- 沙烏地阿拉伯的主要城市建設計劃包括阿卜杜拉國王安全綜合體(五期)和大清真寺(聖地Haram擴建)。這些項目每項價值 213 億美元,由麥加市政和農村事務部開發。

- 沙烏地阿拉伯的頂級建築計劃包括 Neom、紅海計劃、Qiddiya 娛樂城、Amaala、讓·努維爾位於 Al-Ula 的 Sharaan 度假村、麥加大清真寺第三次擴建、吉達塔、住宅部的Sakani Homes、Jabal Omar、Al Widyan、利雅德地鐵等還包括利雅德快速公車系統、法赫德國王醫療城擴建工程、阿卜杜拉·本·阿卜杜勒阿齊茲國王醫療綜合體、薩勒曼國王能源公園(Spark)、沙烏地阿美公司的Beri和Marjan 以及Hanaji - 還包括太陽能公園、Dumat Al Jandal 風能。

- 沙烏地阿拉伯的 Amid Vision 2030 是一項由大型企劃支持的重大發展計劃,這些計畫將發展該國的基礎設施。 2030 年願景的重點是解決環境問題、提高公民的生活品質和創造強大的經濟,旨在帶來改變。 《2030 年願景》和相應的國家轉型計劃(NTP)的推出增加了醫療保健、教育和基礎設施等多個領域的投資。

- 沙烏地阿拉伯已經啟動了許多住宅和商業計劃,預計該國的建設活動將會增加。這些計劃包括耗資5000億美元的未來特大城市Neom計劃和紅海計劃一期(計劃於2022年竣工),其中包括橫跨五個島嶼的14家豪華和超豪華酒店,總合3000間客房)等。它還包括兩個內陸度假村:Qiddi 娛樂城、豪華健康目的地 Amaala、讓·努維爾 (Jean Nouvel) 位於歐拉 (Al-Ula) 的度假村 Sharaan,以及住宅部的Sakani 住宅和吉達塔( Jeddah Tower)。

- 據海灣理事會公司稱,沙烏地阿拉伯計劃投資664.9億美元用於衛生設施,預計到2030年私營部門的參與將增加65%。

- 沙烏地阿拉伯致力於將自己打造成中東新的汽車中心。沙烏地阿拉伯是汽車和汽車零件進口大國,目前正在尋求吸引目標商標產品製造商( OEM )在沙烏地阿拉伯設立生產工廠,以發展該國的汽車工業。例如,雷諾、標緻和大眾等多家原始設備製造商(OEM)已經在摩洛哥設立了工廠,各大汽車製造商也將摩洛哥視為一個具有成本效益的國家。

- 沙烏地阿拉伯的醫療保健產業佔海灣合作理事會地區最大的支出,推動了對更多醫院和長期照護中心的需求。沙烏地阿拉伯政府的目標是到2030年將私部門的貢獻從40%提高到65%,並計劃將290家醫院和2,300家初級衛生中心私有化。

- 因此,所有這些趨勢預計將在預測期內推動該國聚氨酯接著劑市場的消費。

中東和非洲聚氨酯(PU)膠黏劑產業概況

中東和非洲聚氨酯(PU)黏合劑市場高度細分。該市場的主要企業包括(排名不分先後)3M、Arkema、Dow、HB Fuller 和 Henkel AG &Co.KGaA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築業強勁成長

- 醫療基礎設施的成長

- 其他司機

- 抑制因素

- 關於VOC排放的嚴格環境法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 樹脂型

- 熱固性

- 熱塑性塑膠

- 科技

- 水性的

- 溶劑型

- 熱熔膠

- 其他

- 最終用戶產業

- 汽車和航太

- 建築/施工

- 電力/電子

- 鞋類和皮革

- 醫療保健

- 包裝

- 其他

- 地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 埃及

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema

- Avery Dennison Corporation

- Dow

- Dymax

- Franklin International

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers

- Jowat AG

- MAPEI SpA

- Sika AG

- Wacker Chemie AG

第7章 市場機會及未來趨勢

- 轉向生物基黏合劑

- 日益關注輕量化產品製造

The MEA Polyurethane Adhesives Market size is estimated at USD 0.83 billion in 2025, and is expected to reach USD 1.09 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

The COVID-19 outbreak negatively impacted the market. Stoppage or slowdown of several industrial projects, movement restrictions, production halts, and labour shortages led to a decline in the polyurethane (PU) adhesives market growth. However, it recovered significantly in 2021, owing to rising consumption from various end-use industries, including building and construction, packaging, healthcare, and automotive.

Key Highlights

- Over the short term, increasing demand from the construction industry and healthcare infrastructure are some of the major factors driving the studied market's growth.

- Conversely, stringent environmental regulations regarding VOC emissions are expected to hinder the studied market's growth.

- However, shifting focus towards bio-based adhesives and growing inclination towards manufacturing lightweight products will likely offer opportunities for the PU adhesives market.

- Saudi Arabia dominates the Middle East and Africa PU adhesives market and will also witness the highest CAGR during the forecast period.

MEA Polyurethane (PU) Adhesives Market Trends

Building and Construction Industry Dominates the Market

- Among end-user industries, the building and construction segment dominates the consumption of PU adhesives in the region.

- PU adhesives include rapid curing and low-strength properties, making them an excellent choice for woodworking and other construction applications. They provide the high strength required to hold construction materials together.

- Besides, this material is versatile when it comes to product assembly adhesives. It suits plastics, glass, PVFs, aluminum, stainless steel, and other metals, regardless of the toughness of bond substrates.

- Countries such as Saudi Arabia, Kuwait, Qatar, United Arab Emirates, and Egypt is witnessing strong growth in construction investments and activities. For instance, the sustainable living environment axis in Kuwait Vision 2035 includes five pillars, the most prominent of which is to provide housing care to citizens through what is planned. It is to ensure the provision of 65.5 thousand housing units through five projects costing about KWD 3.22 billion (USD 10.5 billion), the last of which ends by 2029.

- When these projects are implemented, the state will meet approximately 72% of the current housing requests, which are 91,000. The first project of the residential care plan revolves around the vision of Kuwait 2035 (New Kuwait) in the city of Jaber Al-Ahmad, which includes a completion rate of 95% and will complete at the end of 2022. The second project is in Al-Mutla'a, with a completion rate of 64%, to be completed by the end of 2023.

- The third project is in the suburb of South Abdullah Al-Mubarak, which contains a completion rate of 72% and will be completed by the end of 2025. The completion rate in the fourth project, the South Sabah Al-Ahmad, is about 14%, as it is still in the preparation stage and is expected to be completed in 2029. This south of Saad Al-Abdullah includes a completion rate of 13% as it is still in its preparatory phase and ends in 2029. Therefore, the growing residential housing construction in Kuwait is expected to create an upside demand for Kuwait's polyurethane(PU) adhesives market.

- Hence, the growth prospects for the construction industry in such countries are expected to propel the consumption of PU adhesives in the region.

Saudi Arabia to Dominate the Market

- Saudi Arabia holds the largest Middle East and African market share for polyurethane (PU) adhesives. The demand for polyurethane (PU) adhesives is expected to rise throughout the forecast period due to rising investments in construction, healthcare infrastructure, and the efforts to develop automotive hubs in the country. The rise in the population and disposable income increased the demand for better-quality residential building development.

- The Saudi Arabian construction market is expected to witness significant growth and offer lucrative potential due to its Vision 2030, NTP 2020, and several ongoing reforms to diversify away from oil. Vision 2030, NTP 2020, the private sector investment boost, and the ongoing reforms are expected to be the growth drivers for the Saudi polyurethane adhesives market from the country's construction industry during the forecasted period.

- Moreover, under Vision 2030, 80 new hotels with more than 11,000 luxurious rooms will be opened across Saudi Arabia by 2030. Therefore, increasing investments in the construction of hotels is expected to create demand for the polyurethane (PU) adhesives market.

- The country's economy is entering a post-oil era in which the kingdom's mega-cities, which are under construction, will provide future growth. According to industry sources, more than 5,200 construction projects are ongoing in Saudi Arabia at a value of USD 819 billion. These projects account for approximately 35% of the total value of active projects across the Gulf Cooperation Council (GCC).

- Some major urban construction projects in Saudi Arabia include the King Abdullah Security Compounds (Phase 5) and the Grand Mosque (Holy Haram Mosque expansion). Each of these is valued at USD 21.3 billion and developed by the Ministry of Municipalities and Rural Affairs in Makkah.

- The top construction projects in Saudi Arabia include Neom, the Red Sea Project, Qiddiya entertainment city, Amaala, Jean Nouvel's Sharaan resort in Al-Ula, Makkah Grand Mosque - Third Expansion, Jeddah Tower, Ministry of Housing's Sakani Homes, Jabal Omar, Al Widyan, and Riyadh Metro. It also includes Riyadh Rapid Bus Transit System, King Fahd Medical City Expansion, King Abdullah Bin Abdulaziz Medical Complexes, King Salman Energy Park (Spark), Saudi Aramco's Berri and Marjan, Hanergy Solar Park, Dumat Al Jandal Wind Power Plant, Saudi Aramco-Total's PIB factory, and Pan-Asia bottling facility.

- Saudi Arabia's Amid Vision 2030 is a significant development plan supported by megaprojects to grow the nation's infrastructure. With an emphasis on environmental commitments, enhancing citizen quality of life, and creating a strong economy, Vision 2030 aspires to bring about change. Investments in several fields, including healthcare, education, and infrastructure, expanded due to the introduction of Vision 2030 and the corresponding National Transformation Plan (NTP).

- Many residential and commercial projects are being launched in Saudi Arabia, which is anticipated to increase the country's construction activity. Some of these projects are the USD 500 billion futuristic mega-city "Neom" project and the Red Sea Project Phase 1 (due for completion in 2022), which includes 14 luxurious and hyper-luxury hotels that may total 3,000 rooms spread across five islands. It also includes two inland resorts, Qiddi Entertainment City, Amaala - the luxurious wellness tourism destination, Jean Nouvel's Sharaan resort in Al-Ula, the Ministry of Housing's Sakani homes, and Jeddah Tower.

- According to the Gulf Council Corporation, Saudi Arabia planned to invest USD 66.49 billion in healthcare facilities, with help from the private sector, whose participation is expected to rise by 65% by 2030.

- Saudi Arabia is focusing on establishing itself as the new automotive hub in the Middle East. Though the country is a large importer of vehicles and auto parts, it is now trying to attract original equipment manufacturers (OEMs) to open their production plants in the kingdom to develop the domestic auto industry. For instance, several OEM manufacturers such as Renault, Peugeot, and Volkswagen already set up units in Morocco, and major automotive manufacturers see Morocco as a cost-effective country.

- The healthcare industry in Saudi Arabia accounts for the largest expenditure in the GCC region, and there is a rising demand for increasing hospital and long-term care centers. Saudi Arabian Government aims to increase private sector contribution from 40% to 65% by 2030, targeting the privatization of 290 hospitals and 2,300 primary health centers.

- Hence, all such trends are expected to drive the consumption of the polyurethane adhesives market in the country during the forecast period.

MEA Polyurethane (PU) Adhesives Industry Overview

The Middle East and African polyurethane (PU) adhesives market is highly fragmented. Some of the major players in the market include 3M, Arkema, Dow, H.B. Fuller, and Henkel AG & Co. KGaA, amongst others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Growth of Construction Industry

- 4.1.2 Growing Healthcare Infrastructure

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin Type

- 5.1.1 Thermoset

- 5.1.2 Thermoplastic

- 5.2 Technology

- 5.2.1 Water Borne

- 5.2.2 Solvent-borne

- 5.2.3 Hot Melt

- 5.2.4 Other Technologies

- 5.3 End-user Industry

- 5.3.1 Automotive and Aerospace

- 5.3.2 Building and Construction

- 5.3.3 Electrical and Electronics

- 5.3.4 Footwear and Leather

- 5.3.5 Healthcare

- 5.3.6 Packaging

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 South Africa

- 5.4.5 Egypt

- 5.4.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Dow

- 6.4.5 Dymax

- 6.4.6 Franklin International

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 ITW Performance Polymers

- 6.4.11 Jowat AG

- 6.4.12 MAPEI S.p.A.

- 6.4.13 Sika AG

- 6.4.14 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards Bio-Based Adhesives

- 7.2 Growing Inclination Towards Manufacturing of Lightweight Products

![全球特種粘合劑市場聚氨酯 (PU) 粘合劑:趨勢、機遇和競爭分析 [2023-2028]](/sample/img/cover/42/1289708.png)