|

市場調查報告書

商品編碼

1639442

歐洲移動雲:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Mobile Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

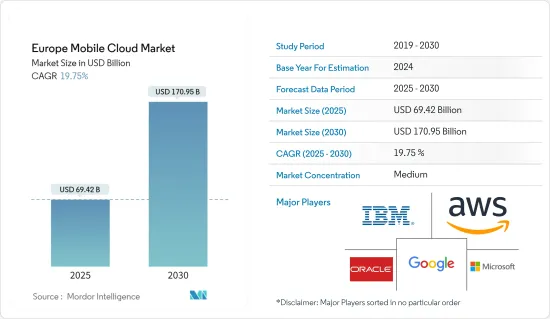

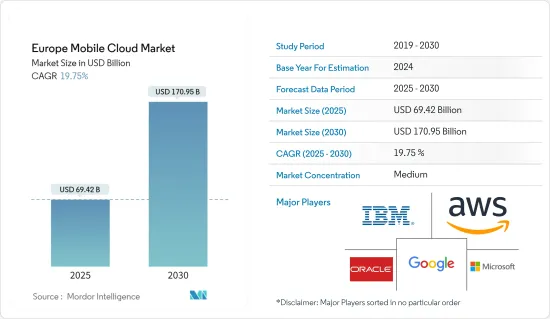

預計 2025 年歐洲行動雲市場規模為 694.2 億美元,到 2030 年將達到 1,709.5 億美元,預測期內(2025-2030 年)的複合年成長率為 19.75%。

新冠疫情大大增加了該地區消費者的資料消費模式。隨著很大一部分人口在家工作,企業和消費者層面對基於網際網路的內容消費需求呈指數級成長。

主要亮點

- 由於智慧型手機用戶的增加、BYOD(自帶設備)的普及、網路速度的加快以及對雲端基礎的服務的認知的不斷提高,歐洲行動雲市場預計將實現成長。

- 行動雲端也受惠於企業大規模向雲端的轉變以及快速成長的 BYOD 趨勢。可擴展性、易於整合、可靠性和資料同步等其他特性進一步增強了使用行動雲端的優勢。隨著時間的推移,行動雲只會變得越來越好,為其他智慧移動技術(如未來將受益於雲端技術的穿戴式設備)鋪平了道路。

- 在現代教室中,iPod、智慧型手機、平板電腦、Chromebook、Kindle 和其他類似裝置等行動裝置的使用越來越多。行動雲端處理對於學習提供者的另一個好處是靈活性和創造力。您可以更快、更頻繁地探索。這將使創新為學生提供更好的學習體驗。這是可能的,因為可以建置、測試和引入新工具和功能來改進現有程式。

- 對於客戶和公司而言,這些發展增加了行動性的價值並提高了可操作性。雲端基礎的應用程式正變得越來越流行,因為它們透過將運算工作轉移到雲端來提高記憶體較少的行動裝置的效能。隨著智慧型手機變得越來越智慧,網路變得越來越快,客戶越來越面臨使用雲端基礎的應用程式的壓力。

- 幾乎每個產業都受到了疫情的影響,許多產業被徹底摧毀。出乎意料的是,遊戲即即服務(也稱為雲端遊戲)的受歡迎程度飆升,預計將繼續成長。雲端趨勢繼續在許多其他行業中出現,遊戲也不例外。

歐洲移動雲市場趨勢

遊戲產業大幅成長

- 近年來,歐洲的電子遊戲產業經歷了顯著的成長。該行業的成長歸因於多種因素,包括手機遊戲日益普及、電子競技行業的發展以及高速網際網路和先進遊戲硬體的普及。

- 此外,新冠疫情也推動了歐洲電子遊戲產業的發展,許多人待在家中時將遊戲作為一種娛樂和社交方式。

- 該地區的高智慧型手機普及率也帶動了手機遊戲產業的興起。例如,該地區的智慧型手機和行動訂閱普及率很高,這影響了對遊戲解決方案的需求。愛立信預計,當2025年5G到來時,這數字將達到5億。

- 蘋果的 iOS 14 更新可能會有效削弱應用程式發布商透過廣告進行行銷和收益的能力。該公司報告稱,IDFA 的棄用將使定向廣告變得更加困難。 IDFA 的棄用可能會影響所有行動遊戲類型,包括休閒遊戲和核心遊戲。

- 根據 Esport1 報導,匈牙利最受歡迎的雲端遊戲服務是 GeForce,約有 20% 的受訪電競玩家使用該服務。只有 5% 的受訪者同時使用過 PlayStation 和 Google Stadia。

不斷發展的網路連線可望推動市場發展

- 歐盟正在採取措施增強多個領域的連結性。歐盟已經取消了漫遊費,允許消費者在歐盟範圍內免費使用行動電話合約。 WiFi4EU計畫協助當地社區建立免費的Wi-Fi熱點。歐盟還提供資金、制定技術指南並召集專家,幫助政府和企業改善網路覆蓋並在歐洲範圍內推出 5G 網路。

- 為了改善連結性,歐盟在多個不同領域採取了行動。因此,現在在歐盟境內旅行時使用行動電話是免費的。由於 WiFi4EU舉措的資助,附近社區已經安裝了免費的 Wi-Fi 熱點。此外,歐盟還提供資金支持、制定技術指南並召集專家來支持企業和政府擴大網路覆蓋範圍並在歐洲推出 5G 網路。

- 阿姆斯特丹網際網路交換中心(AMS-IX)對荷蘭作為數位樞紐的地位做出了特別貢獻。 AMS-IX 是世界上最大的網路交換中心之一。 25 年來,我們一直幫助 ISP、電信業者和雲端供應商快速、安全、可靠地傳輸全球流量。

- 歐盟有一個2030計劃,到2025年讓每個歐洲家庭都連接到高速網際網路,到2030年實現Gigabit連接。該計劃還包括一項無線電頻譜政策計劃,以支援5G等無線網路。

- 根據歐盟統計局的一項民意調查,2022 年歐盟家庭擁有網路存取的比例與 2021 年大致相同,約為 92.52%。然而到2022年,歐盟92.52%的家庭將接取網際網路,創歷史新高。

歐洲行動雲端產業概況

歐洲行動雲市場集中度適中,眾多市場參與者佔比重都很小。由於區域市場的成長和本地參與者在外國直接投資中的佔有率不斷增加,市場變得越來越分散。

2022 年 10 月,思科千眼將推出新的歐盟雲端區域,擴大其全球影響力。該公司在歐盟 (EU) 和歐洲、中東和非洲 (EMEA) 地區不斷成長的基本客群將由位於德國法蘭克福的 AWS資料中心的新歐盟雲端區域提供服務。它利用了 ThousandEyes 的雲端和網路智慧技術。隨著企業在過去兩年中加快數位轉型步伐,雲端的採用以及向 SaaS、SD-WAN 和混合式工作方式的轉變仍然是關鍵促進因素。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業政策

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 區域IT基礎設施的發展

- 網路連線的演變

- 市場挑戰

- 資料安全問題

第6章 市場細分

- 按用戶

- 企業

- 消費者

- 按應用

- 遊戲

- 金融與商業

- 娛樂

- 教育

- 衛生保健

- 旅行

- 其他用途

- 按國家

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Amazon Web Services Inc.

- Google LLC

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Akamai Technologies Inc.

- Salesforce.com Inc.

- Cloudways Ltd.

- Kony Inc.

第8章投資分析

第9章:市場的未來

The Europe Mobile Cloud Market size is estimated at USD 69.42 billion in 2025, and is expected to reach USD 170.95 billion by 2030, at a CAGR of 19.75% during the forecast period (2025-2030).

The COVID-19 pandemic drastically increased the data consumption patterns of consumers in the region. Due to a large chunk of the population working from home, the demand for internet-based content consumption, both at the corporate and user levels, has increased by leaps and bounds.

Key Highlights

- The European mobile cloud market is expected to grow because more people are using smartphones, more people are using the "bring your own device" (BYOD) idea, networks are getting faster, and more people are aware of cloud-based services.

- The mobile cloud has also profited from the huge move to the cloud and the BYOD trend, which is rapidly rising among enterprises. Additional capabilities like scalability, ease of integration, dependability, and data synchronization increase the benefits of using a mobile cloud. Mobile cloud has been getting better and better over time, paving the way for other smart mobile technologies, like wearables, that will benefit from cloud technology in the future.

- There is an increasing use of mobile devices such as iPods, smartphones, tablets, Chromebooks, Kindles, and other similar devices in modern classrooms. Another advantage of mobile cloud computing for learning providers is agility and creativity. It allows them to explore more quickly and frequently. As a result, they will be able to innovate to provide better learning experiences for students. This is possible because new tools and features may be built, tested, and deployed in existing programs to improve them.

- For both customers and enterprises, these developments will boost the value of mobility and increase workability. Cloud-based apps are increasingly popular because they improve the performance of mobile devices with less memory by offloading computational work to the cloud. Customers are being pushed to use cloud-based apps more and more as smartphones get smarter and the internet gets faster.

- Nearly every industry was affected by the pandemic, and many were completely destroyed. Unexpectedly, the popularity of gaming-as-a-service, often known as cloud gaming, has skyrocketed and is expected to keep growing. Gaming is not an exception to the continued emergence of cloud trends in many other businesses.

Europe Mobile Cloud Market Trends

Gaming Segment is Observing a Significant Increase

- The video gaming industry has seen significant growth in Europe in recent years. The growth of the industry can be attributed to several factors, including the increasing popularity of mobile gaming, the growth of the esports industry, and the availability of high-speed internet and advanced gaming hardware.

- Moreover, the COVID-19 pandemic also played a role in the growth of the video gaming industry in Europe, as many people have turned to games as a form of entertainment and social connection while stuck at home.

- The mobile gaming industry is also increasing with the high penetration of smartphones in the region. For instance, the region commands a significant penetration rate of smartphones and mobile subscriptions, which is influencing the demand for gaming solutions. Ericsson says that when 5G comes out in 2025, that number should reach 500 million.

- Apple's iOS 14 updates can potentially disrupt app publishers' ability to market themselves and monetize through advertising effectively. The company reported that the abolition of the IDFA will make targeted advertising more difficult. The absence of IDFA will influence all mobile genres, both casual and core.

- GeForce, which was used by almost 20% of the eSports players questioned, was the most well-liked cloud gaming service in Hungary, according to Esport 1. Only 5% of respondents have also used PlayStation and Google Stadia at the same time.

Advancing Internet Connectivity is Expected to Drive the Market

- The EU has taken steps to boost connectivity in several areas. It eliminated roaming fees, allowing consumers to use mobile subscriptions throughout the EU at no additional cost. The WiFi4EU initiative helped local communities set up free Wi-Fi hotspots. The EU also offers finance, develops technical guidelines, and brings together specialists to assist governments and enterprises in improving network coverage and implementing 5G networks across Europe.

- To increase connectivity, the EU has taken action in several different sectors. As a result, customers were no longer charged for using their cell subscriptions while traveling within the EU. Free Wi-Fi hotspots were set up in neighborhood communities thanks to the WiFi4EU initiative's funding. Additionally, the EU offers financial aid, creates technical guidelines, and gathers specialists to assist enterprises and governmental agencies working on expanding network coverage and rolling out 5G networks across Europe.

- The Amsterdam Internet Exchange (AMS-IX), in particular, contributed to the Netherlands' status as a digital hub. AMS-IX is one of the largest internet exchanges in the world. For more than 25 years, it has helped ISPs, telecom companies, and cloud providers route their global traffic quickly, safely, and reliably.

- The EU has a 2030 plan to connect every European household with high-speed internet coverage by 2025 and gigabit connectivity by 2030. It also includes using the radio spectrum policy program to support wireless networks like 5G.

- According to a Eurostat poll, the proportion of homes in the European Union with internet access stayed almost the same in 2022 compared to 2021, at around 92.52%. But in 2022, 92.52% of homes in the European Union were connected to the internet, which was the most ever.

Europe Mobile Cloud Industry Overview

The European mobile cloud market is moderately concentrated, with many market players cornering a very small share of the market. The market is getting more and more fragmented because of the growth of regional markets and the growing share of local players in foreign direct investments.

In October 2022, with the opening of a new EU cloud region, Cisco ThousandEyes will have increased its worldwide reach. The company's expanding customer base in the European Union (EU) and Europe, the Middle East, and Africa (EMEA) area will be served by the new EU Cloud Region, situated on an AWS-based data center in Frankfurt, Germany. It will use ThousandEyes' cloud and Internet intelligence technology. Because businesses have accelerated their digital transformation initiatives over the last two years, the adoption of the cloud and the switch to SaaS, SD-WAN, and hybrid work remain key growth drivers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Policies

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development in IT Infrastructure in the Region

- 5.1.2 Advancing Internet Connectivity

- 5.2 Market Challenges

- 5.2.1 Concerns Associated with Data Security

6 MARKET SEGMENTATION

- 6.1 By User

- 6.1.1 Enterprise

- 6.1.2 Consumer

- 6.2 By Application

- 6.2.1 Gaming

- 6.2.2 Finance and Business

- 6.2.3 Entertainment

- 6.2.4 Education

- 6.2.5 Healthcare

- 6.2.6 Travel

- 6.2.7 Other Applications

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Russia

- 6.3.5 Spain

- 6.3.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Amazon Web Services Inc.

- 7.1.3 Google LLC

- 7.1.4 Oracle Corporation

- 7.1.5 Microsoft Corporation

- 7.1.6 SAP SE

- 7.1.7 Akamai Technologies Inc.

- 7.1.8 Salesforce.com Inc.

- 7.1.9 Cloudways Ltd.

- 7.1.10 Kony Inc.