|

市場調查報告書

商品編碼

1639496

工業控制系統 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Industrial Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

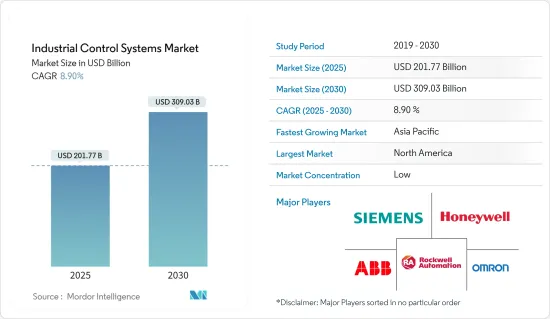

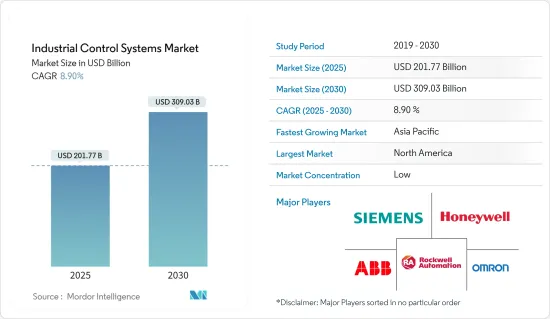

預計2025年工業控制系統市場規模為2,017.7億美元,預估至2030年將達3,090.3億美元,預測期間(2025-2030年)複合年成長率為8.9%。

不斷上升的人事費用和製造商在緊迫的期限內面臨的巨大壓力正在推動工廠擴大採用自動化。工廠自動化正在推動 ICS 市場的發展。

主要亮點

- 連接工業設備和機械並獲取即時資料在 SCADA、HMI、PLC 系統和提供可視化的軟體的實施中發揮關鍵作用。

- 此外,系統的效率、可靠性和速度最大限度地減少了與人為錯誤相關的品管問題。此外,製造業大規模生產的需求正在推動對工業控制設備的需求,以滿足不斷成長的人口的需求。

- 此外,德國工業 4.0 和法國工業計劃等政府措施可能會推動對 IIoT 解決方案的需求,並在未來增加對 ICS 安全解決方案和服務的需求。嚴重的網路災難可能導致重大的財務損失、品牌損害、消費者信心喪失、智慧財產權被盜、安全問題甚至死亡。因此,ICS 可能需要安全機制來審核並確保合規性,以保護生態系統免受財務、營運和人員損失。

- 由於連網型設備和感測器的高採用率以及 M2M通訊的啟用,製造業中產生的資料點正在迅速增加。根據 Zebra 最新的製造願景報告,預計到 2022 年,基於物聯網和 RFID 的智慧資產追蹤解決方案將取代基於電子表格的傳統方法。

- 這場大流行迫使組織遵守嚴格的要求,同時確保員工和客戶的安全。因此,對自動化解決方案的需求激增。在可預見的未來,這可能會被視為一個顯著趨勢。隨著世界繼續對抗新冠肺炎 (COVID-19) 大流行的蔓延,機器人技術支援的工廠自動化在保障人員安全和處理最終用戶所需的物資方面發揮關鍵作用。

工業控制系統市場趨勢

工業控制系統廣泛應用的食品飲料領域

- 由於經濟成長和可支配收入,食品飲料行業的需求逐年增加。人口成長也對該產業做出了貢獻。

- 此外,隨著購買力的增加和生活方式的改變,對加工產品的需求也增加。這迫使食品製造商實施自動化並提高加工率以滿足消費者的需求。此外,電腦科技的快速發展、消費者偏好的動態變化以及監管機構正在增加對食品品質和安全的需求。這就是食品業擴大採用自動化系統的原因。

- 2022年6月,百事印度公司宣布追加投資1,860萬印度盧比,擴建位於北方邦馬圖拉科希卡蘭的食品製造廠,生產多力多滋玉米片品牌。百事公司對百事公司最大的待開發區食品製造廠(生產樂事洋芋片)的總投資達102.2億盧比。

- 此外,這家寵物食品製造商還計劃投資 1.45 億美元用於其位於阿肯色州史密斯堡的加工工廠的擴建和設備升級。該計劃於近日核准。該計劃預計將於2022年完工,將進一步推動市場成長。

- 食品和飲料行業各個自動化階段的成功整合可以在供應鏈中創造價值,並確保長期競爭和高效生產。因此,食品公司正在尋找透過流程自動化來提高可靠性、提高生產力、消除浪費和降低總成本的方法。這種自動化要求也增加了公司生產控制的重要性。

- 此外,製程自動化的採用減少了每個工廠所需的工人數量,同時為工業營運商提供了產品定價的靈活性。在預測期內,控制此類關鍵費用的需求不斷成長可能會進一步促進工業製程自動化市場的成長。

北美市場佔據主導地位

- 北美正處於第四次工業革命的邊緣。產生的資料在生產中大規模利用,將資料與整個供應鏈中的各種製造系統整合。

- 該地區也是世界上最大的汽車市場之一,擁有超過 13 家主要汽車製造商。汽車製造是該地區製造業最大的收益來源之一。由於汽車行業大量採用工業控制系統和自動化技術,該地區提供了巨大的市場成長機會。

- 在該國營運的幾家主要供應商已經宣布了新的更新,以幫助智慧工廠隨著工業控制系統的發展而發展。這種技術進步顯示該地區所研究市場的成長。

- 此外,政府的支持措施和具有競爭力的天然氣價格使美國和加拿大的化學公司能夠建造、擴大、自動化和控制工廠。因此,北美地區工業控制設備的成長預計也將在預測期內進一步推動調查市場。

- 2022年8月,通用汽車簽署了三份電動車電池材料採購協議,這可以幫助該公司實現年產100萬輛電動車的目標。根據與 LG Chem、POSCO Chemical 和 Liventwill 簽訂的多年協議,通用汽車將供應包括鋰、鎳、鈷和活性陰極材料 (CAM) 在內的關鍵材料。該國汽車產業的擴張可能會進一步創造對 PLC 的巨大需求。

- 該國是最大的原油生產國之一,也是石油和天然氣行業的領先參與企業。例如,根據 EIA 的數據,到 2030 年,該地區的產量預計將達到 3 兆英熱單位。德克薩斯州佔全國原油產量的大部分,預計對生產設備有龐大的需求。

工業控制系統產業概況

工業控制系統市場分散。每個參與企業都專注於研究和開發活動,以獲得競爭優勢。這些主要企業在創新、定價和服務的基礎上競爭。向新興市場擴張正在幫助現有的主要企業擴大銷售網路。 GE Digital、西門子股份公司、施耐德電機股份公司、SAP、ABB 集團、發那科、霍尼韋爾國際公司

- 2022年9月-橫河電機公司宣布並報告了OpreX電磁流量計CA系列。 OpreXField Instruments 系列發布了新產品系列來取代 ADMAG CA 系列。此新產品系列包括電容式電磁式流量計,可透過測量管測量導電流體的流量,而無需流體接觸設備的電極。該產品的主要目標市場是化學品、紙漿和造紙、採礦、食品和飲料以及用水和污水處理。

- 2022 年 8 月 - 歐姆龍宣布推出 i-資料管理解決方案服務實施 (i-DMP)。這種以資料為中心的解決方案使客戶能夠透過簡化以前不用於工廠車間改進的不同類型資料的整合來及時解決問題。 i-DMP 透過根據需要在邊緣區域即時收集和儲存分散在製造現場的資料(例如現有系統和 PLC)來執行集中資料管理。連接到各種網路、關聯式資料庫(RDB) 和工廠自動化 (FA) 設備。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估主要宏觀經濟趨勢的影響

第5章市場動態

- 市場促進因素

- 工業安全技術的進步

- 製造業量產需求

- 市場問題

- 缺乏技術純熟勞工

第6章 市場細分

- 依操作技術

- 監控和資料採集(SCADA)

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 智慧電子設備 (IED)

- 人機介面 (HMI)

- 其他系統

- 透過軟體

- 資產績效管理(APM)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 企業資源規劃(ERP)

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 電力/公共產業

- 飲食

- 汽車/交通

- 生命科學

- 用水和污水

- 金屬/礦業

- 紙漿/紙

- 電子/半導體

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Siemens AG

- ABB Automation Company

- Omron Corporation

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Emerson Electric Co.

- Yokogawa Electric Corporation

- GLC Controls Inc.

- Mitsubishi Electric Corporation

第8章投資分析

第9章市場的未來

The Industrial Control Systems Market size is estimated at USD 201.77 billion in 2025, and is expected to reach USD 309.03 billion by 2030, at a CAGR of 8.9% during the forecast period (2025-2030).

The rising cost of labor and the immense pressure on manufacturers to meet strict deadlines are resulting in the increased deployment of automation in factories. The automation of factories has fueled the market for ICS.

Key Highlights

- Connecting the industrial equipment and machinery and obtaining real-time data have played a key role in the adoption of SCADA, HMI, PLC systems, and software that offer visualization, thus, enabling reducing the faults in the product, reducing downtime, scheduling maintenance, and switching from being in the reactive state to predictive and prescriptive stages for decision-making.

- In addition, the quality control issue involved with human error is minimized, owing to the systems' efficiency, reliability, and faster work rate. Moreover, the demand for mass production in manufacturing industries fuels the need for industrial controls to cater to the demands of growing population.

- Moreover, government efforts such as Germany's Industry 4.0 and France's industrial plan are likely to drive demand for IIoT solutions, which may, in turn, enhance demand for ICS security solutions and services in the future. A serious cyber catastrophe may result in significant financial losses, brand damage, consumer trust loss, intellectual property theft, safety concerns, and even death. As a result, to protect its ecosystem from any financial, operational, or human losses, ICS may need security mechanisms to audit and assure compliance.

- Due to the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in the data points generated in the manufacturing industry. According to Zebra's latest manufacturing vision report, IoT and RFID-based smart asset tracking solutions are expected to overtake traditional, spreadsheet-based methods by 2022.

- The pandemic's impact has forced organizations to adhere to strict requirements while ensuring their employees' and customers' safety. As a result, the need for automated solutions witnessed a sudden spike. This could be observed as a notable trend in the foreseeable future. As the world continues to fight the spread of the COVID-19 pandemic, factory automation with robotics plays a crucial role in helping safeguard people and processing the supplies needed by the end user.

Industrial Control Systems Market Trends

Food and Beverage Sector to Widely Use Industrial Control Systems

- The demand for the food and beverage industry is growing yearly because of the economy's growth and disposable incomes. The increasing population is also contributing to this industry.

- Moreover, the demand for processed goods is increasing, with increased buying power and changing lifestyles. This has made it necessary for food manufacturers to implement automation to improve the processing rate to meet consumers' demands. Furthermore, the rapid development of computer technology, dynamic changes in consumers' preferences, and regulatory bodies have boosted the need for food quality and safety. This has resulted in the growing adoption of automated systems in the food industry.

- In June 2022, PepsiCo India announced an additional INR 1.86 crore investment in expanding its food manufacturing plant in Kosi Kalan, Mathura, Uttar Pradesh, to produce the Doritos cornflakes brand. PepsiCo's total investment in its largest Greenfield Foods manufacturing plant, which manufactures Lay's potato chips, will reach INR 1,022 crore.

- Moreover, the Pet food manufacturer plans to invest USD145 million in a 200,000 expansion and equipment upgrades at their FORT SMITH, AR processing facility. The project has recently received approval. The project is expected to be completed in 2022, further driving the market growth.

- Successful integration of different automation stages in the food and beverage industry leads to value-creation in the supply chain, which ensures a long-term competitive edge and efficient production. Hence, food companies are finding ways to improve reliability, increase productivity, reduce waste, and decrease total costs through process automation. This automation requirement also makes controls significant to a company's production.

- In addition, the adoption of process automation has also reduced the number of workers required per plant while providing flexibility in product pricing for industrial operators. Such a rising need for controlling significant expenses is likely to further proliferate the growth of the industrial process automation market during the forecast period.

North America to Dominate the Market

- North America is on the verge of the fourth industrial revolution. The data generated is being used on a large scale for production while integrating the data with various manufacturing systems throughout the supply chain.

- The region is also one of the largest automotive markets in the world and is home to over 13 major auto manufacturers. Automotive manufacturing has been one of the largest revenue generators, in the region, in the manufacturing sector. As the automotive industry accounts for the significant adoption of industrial control systems and automation technologies, the region offers a huge opportunity for market growth.

- Multiple major key vendors operating in the country are launching new updates to help in the growth of smart factories with developments in industrial control systems. Such technological advancement is indicative of the growth of the region in the studied market.

- Moreover, supporting government policies and competitively priced natural gases are enabling the US and Canadian chemical companies to build plants, expand, automate, and control their facilities. Hence, the growth of industrial controls in the North American region is also expected to further drive the market studied over the forecast period.

- General Motors signed three sourcing agreements for EV battery materials in August 2022, potentially aiding the automaker in achieving its objective of manufacturing one million EVs annually. The multi-year contracts with LG Chem, POSCO Chemical, and Liventwill supply GM with critical materials such as lithium, nickel, cobalt, and active cathode material (CAM). Such expansion in the automotive sector in the country may further create significant demand for PLCs.

- The country is one of the largest crude oil producers and a prominent oil and gas industry player. For instance, according to EIA, by 2030, the production is expected to reach 30.01 quadrillions Btu in the region. Texas produces the major share of crude oil in the country and is expected to generate significant demand for production equipment.

Industrial Control Systems Industry Overview

The industrial control system market is fragmented. The players are focusing on R&D activities to attain a competitive advantage. These key players compete based on innovation, pricing, and service. Expansion in the emerging market helps the established key players to extend their sales networks. GE Digital, Siemens AG, Schneider Electric AG, SAP, ABB Group, Fanuc, Honeywell International Inc., Bosch, and Cisco Systems are some companies that provide the industrial internet platform.

- Sep 2022 - The OpreXMagnetic Flowmeter CA Series has been released and reported by Yokogawa Electric Corporation. The OpreXField Instruments family is releasing this new product series to replace the ADMAG CA Series. This new line of products includes capacitance-type magnetic flowmeters, which can measure the flow of conductive fluids via a measurement tube without the fluids touching the device's electrodes. The product's main target markets will be chemicals, paper and pulp, mining, food and beverage, water, and sewerage.

- Aug 2022 - OMRON has unveiled i-Data-Managed Solution Service Implementation (i-DMP). This data-centric solution will enable the clients to solve their issues in a timely manner by simplifying the integration of various types of data, which was never intended for the purpose of improving factory floors. The i-DMP will gather and store data, as needed, dispersed throughout the manufacturing floor, such as those from existing systems and PLCs, in the edge region in real time for uniform data management. It is connected to various networks, relational databases (RDB), and factory automation (FA) devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in Industrial Safety Technology

- 5.1.2 Demand for Mass Production in Manufacturing Sector

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Operational Technology

- 6.1.1 Supervisory Control and Data Acquisition (SCADA)

- 6.1.2 Distributed Control System (DCS)

- 6.1.3 Programmable Logic Controller (PLC)

- 6.1.4 Intelligent Electronic Devices (IED)

- 6.1.5 Human Machine Interface (HMI)

- 6.1.6 Other Systems

- 6.2 By Software

- 6.2.1 Asset Performance Management (APM)

- 6.2.2 Product Lifecycle Management (PLM)

- 6.2.3 Manufacturing Execution System (MES)

- 6.2.4 Enterprise Resource Planning (ERP)

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power & Utilities

- 6.3.4 Food & Beverages

- 6.3.5 Automotive & Transportation

- 6.3.6 Life Sciences

- 6.3.7 Water & Wastewater

- 6.3.8 Metal & Mining

- 6.3.9 Pulp & Paper

- 6.3.10 Electronics/Semiconductor

- 6.3.11 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 ABB Automation Company

- 7.1.3 Omron Corporation

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Schneider Electric SE

- 7.1.7 Emerson Electric Co.

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 GLC Controls Inc.

- 7.1.10 Mitsubishi Electric Corporation