|

市場調查報告書

商品編碼

1640510

亞太工業控制系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Industrial Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

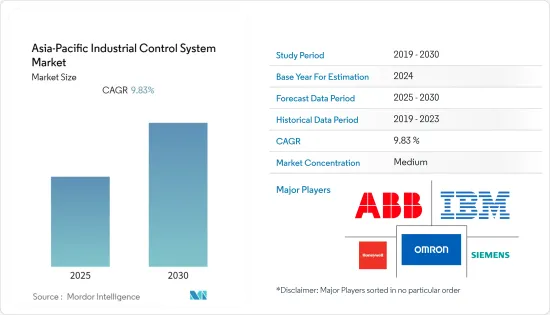

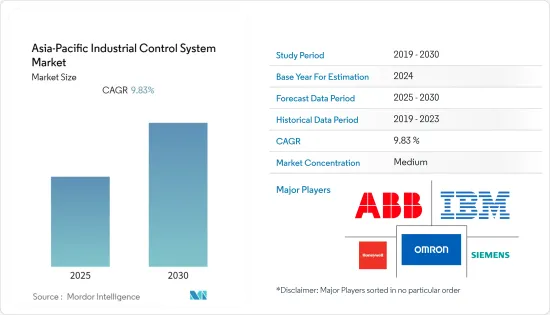

預計預測期內亞太工業控制系統市場複合年成長率將達到 9.83%。

主要亮點

- 隨著工業物聯網 (IIoT) 的出現,海量即時資料(巨量資料)有望改變控制系統的運作方式。根據通用電氣的一項新調查,58% 的製造商認為物聯網對於其工業業務的數位轉型是必不可少的。Accenture預測,到 2030 年,工業物聯網將為全球經濟增加 14.2 兆美元。

- 根據 IBM 去年的 X-Force 威脅情報指數,針對 ICS 資產的威脅目標與前一年同期比較增了 50% 以上。大多數此類目標都使用了 ICS 硬體組件、監控和資料收集 (SCADA) 中的已知漏洞以及密碼噴灑攻擊等暴力破解登入技術的組合。

- 此外,為了支持韓國不斷減少的勞動年齡人口,該國計劃在 2030 年建立 20 個智慧工業。為了跟上第四次工業革命時代全面數位化和自動化的快速發展,該公司計劃在2030年建立2,000家新的人工智慧智慧工廠。

- ICS 和 IT 需要更加一體化。將 ICS 與 IT 結合是組織面臨的最常見挑戰之一。隨著工業自動化技術的發展,兩者之間的融合需求顯著增加。然而,IT 團隊和處理器營運部門之間協作不力,導致大多數組織中的 ICS 關鍵基礎設施的安全容易受到工業間諜和破壞。此外,安全系統的部署變得越來越複雜,因為它們需要額外的人員來彌合營運和 IT 部門之間的差距。

亞太工業控制系統市場趨勢

汽車產業引領市場

- 企業廣泛採用工業控制系統是值得注意的趨勢。先進的系統促進了工廠生產。這也顯示企業對手工勞動的依賴正在逐步轉向基於先進技術的系統,從而實現設備自動化。

- 各公司正在採用新技術來提高年產量。例如,中國北方的裸金屬生產商北方銅業有限公司正在透過實施電氣和自動化系統(包括 ABB 的 Ability System 800xA 分散式控制系統 (DCS))來最佳化其生產能力。軋延銅裸金屬和箔。

- 該地區的汽車產業越來越關注數位化和工業 4.0,包括新加坡的「智慧國家」、印尼的「2020 年數位化願景」、「泰國 4.0」計畫和越南政府的工業 4.0 計畫。

- 所有主要汽車公司都將增加對智慧製造的投資,預計將進一步推動該地區的 ICS 市場的發展。例如,2022年6月,寶馬將在中國開設價值150億元人民幣(22億美元)的新工廠,專注於電動車,並試圖趕上領先者特斯拉和其他國內競爭對手。

- 多年來,汽車製造廠已經實現高度自動化,從焊接、噴漆到組裝等各個環節都大規模實施了自主操作和控制系統。控制系統、機器人、智慧感測器和其他設備正在互聯互通,以提高生產力和生產產量。在企業層面,製造執行系統(MES)和分散式控制系統(DCS)也正在走向互通性,以進一步最佳化生產。

IT 和 OT 網路的整合可能會推動市場發展

- 為了保持競爭力並做出更好的商業決策,越來越多的工業公司正在整合 IT 和 OT 網路。 IT和OT的融合使得更直接的控制和完整的監控成為可能。世界上任何地方都可以輕鬆地分析這些複雜系統的資料。

- 然而,整合這兩種技術需要考慮安全性問題。大多數 OT 系統在設計時並沒有考慮遠端訪問,也沒有考慮到連接的風險。因此,這些系統需要定期更新,這可能會導致漏洞。這可能會使關鍵基礎設施和組織遭受工業間諜和破壞。

- 隨著越來越多的工業控制系統、感測器和其他控制器充當工業物聯網 (IIoT) 端點,IT/OT 網路的整合使組織面臨越來越多的網路攻擊和安全風險。

- 對 OT 或 IT 網路的攻擊可能會因橫向移動的可能性而使資產面臨風險。例如,對控制系統的關鍵功能(如電力、清潔的自來水、製造流程或挽救生命的醫療治療)的成功攻擊可能導致公司資料外洩並可能造成災難性的後果。同樣,入侵公司 IT 網路也可能導致 ICS 攻擊。

亞太工業控制系統產業概況

亞太地區工業控制系統市場適度整合,許多市場參與者佔有極小的佔有率。區域市場發展和本土參與者在外國直接投資中的佔有率不斷增加是推動市場分化的主要因素。

- 2022 年 4 月:ABB 與三星電子合作開發整體能源管理解決方案,推動智慧建築技術的進步。這項發展將使 ABB 能夠為更多客戶提供家庭自動化技術和設備管理解決方案。在機器人領域,我們與蘇黎世聯邦理工學院合作進行RobotX機器人研究舉措。

- 2022年2月:ABB與吉寶在新加坡簽署數位合作合作備忘錄。此次合作將產生協同效應,加速水資源管理的數位轉型,加速實現脫碳和零排放的道路。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭強度

- 替代品的威脅

- 評估新冠肺炎疫情對產業的影響

第5章 市場動態

- 市場促進因素

- 網路攻擊增加

- IT 與 OT 網路的融合

- 市場限制

- 安全系統實施的複雜性

- ICS 安全產業出現了各種經營模式

第6章 市場細分

- 按最終用戶

- 車

- 化工和石化

- 電力和公共產業

- 藥品

- 飲食

- 石油和天然氣

- 電子和半導體

- 其他最終用戶

- 按地區

- 中國

- 印度

- 日本

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- IBM

- Siemens AG

- ABB

- Honeywell International Inc.

- Tofino Security

- Kasa Companies Inc.

- Schneider Electric

- Sourcefire Inc.

- Juniper Networks Inc.

第8章投資分析

第9章 市場展望

簡介目錄

Product Code: 53981

The Asia-Pacific Industrial Control System Market is expected to register a CAGR of 9.83% during the forecast period.

Key Highlights

- With the advent of the Industrial Internet of Things (IIoT), the sheer volume of real-time data (Big Data) is expected to change how control systems function. As per the latest survey by GE, 58% of manufacturers say IoT is required to transform industrial operations digitally. Accenture predicts IIoT could add USD 14.2 trillion to the global economy by 2030.

- According to IBM's X-Force Threat Intelligence Index of the last year, the threat targets on ICS assets have increased by over 50% year-over-year. Most of these targets used a combination of known vulnerabilities within ICS hardware components, supervisory control and data acquisition (SCADA), and brute-force login tactics such as password-spraying attacks.

- Furthermore, to support the decline of Korea's working-age population, the country intends to establish 20 smart industrial zones by 2030. The goal is to install 2,000 new AI-powered smart factories by 2030 to keep up with the rapid evolution of complete digitalization and automation in the Fourth Industrial Revolution era.

- ICS and IT need to be more unified. Integration of ICS with their IT departments is one of the most common challenges organizations face. The need to integrate these two increased significantly with evolving industrial automation technology. However, due to the lack of coordination between the IT teams and processor operations departments, the security of ICS critical infrastructure is at risk of industrial espionage and sabotage in most organizations. Further, the need for more personnel to bridge the gap between operations and IT complicates the implementation of security systems.

APAC Industrial Control Systems Market Trends

Automotive sector is likely to drive the market

- The widespread use of industrial control systems by businesses is a notable trend. The advanced systems facilitate factory production. This also indicates a gradual shift in companies' reliance on manual labor to advanced technology-based systems that allow facility automation.

- Various businesses are implementing new technologies to increase annual outputs. For example, Northern Copper Industry Co. Ltd, a company in North China that produces aw material copper stock, chose ABB to install an electrical and automation system that included an ABB Ability System 800xA distributed control system (DCS) to optimize its production capacity and achieve an annual output of 50,00 tonne of rolled copper strip and foil production.

- Significant initiatives have resulted in increased attention being given to digitalization and Industry 4.0 in the automotive sector of the region, such as Singapore's Smart Nation, similar to Indonesia's "2020 Go Digital Vision," the "Thailand 4.0" initiative, and the Vietnamese government's Industry 4.0 initiatives, amongst others.

- The increasing investments by all large automotive companies in smart manufacturing are further expected to drive the ICS market in the region. For instance, in June 2022, BMW opened a new CNY 15 billion (USD 2.2 billion) factory in China, emphasizing electric vehicles, to catch up with leaders Tesla and domestic competitors.

- Over the years, automotive manufacturing plants have become highly automated with massive deployments of autonomous operations and control systems from welding and painting to assembly. Control systems, robots, intelligent sensors, and other equipment are becoming interconnected to drive higher productivity and outputs. At the enterprise level, the manufacturing execution system (MES) and distributed control system (DCS) are also moving toward interoperability to optimize production further.

Convergence of IT and OT Networks May Drive the Market

- More industrial companies are integrating their IT and OT networks to remain competitive and make better business decisions. The convergence of IT and OT enables more direct control and complete monitoring. Data analysis from these complex systems can be executed with little effort from anywhere in the world.

- However, the integration of these two technologies requires consideration of security. Most OT systems were never designed for remote accessibility, and the connectivity risks were not considered. As a result, these systems may need to be regularly updated, leading to vulnerabilities. This could leave critical infrastructure and organizations at risk of industrial espionage and sabotage.

- With a more significant number of industrial control systems, sensors, and other controllers acting as Industrial Internet of Things (IIoT) endpoints due to the converged IT/OT network, organizations are more vulnerable to cyberattacks and increased security risk.

- An attack on an OT or IT network can compromise assets due to the possibility of lateral movement. For instance, a successful attack on critical functions of a control system, such as electric power, clean running water, manufacturing processes, and life-saving healthcare treatments, could result in a corporate data breach, leading to a catastrophe. Similarly, an enterprise IT network infiltration could lead to an ICS attack.

APAC Industrial Control Systems Industry Overview

The Asian-Pacific industrial control system market is moderately consolidated, with many market players cornering a minimal share. The development of regional markets and increasing shares of local players in foreign direct investments are the major factors promoting the fragmented nature of the market.

- April 2022: ABB collaborated with Samsung Electronics to develop holistic energy management solutions to propel the advancement of smart building technology. The development will allow ABB to provide more customers access to home automation technologies and device management solutions. In the robotics domain, the company collaborated with ETH Zurich on the latter's RobotX robotics research initiative.

- Feb 2022: ABB and Keppel signed a memorandum of understanding for digital collaboration in Singapore. This collaboration helps in stepping up digital transition in water management and synergy to facilitate pathways to decarbonization and zero-emission.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of the COVID-19 Pandemic on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Incidence of Cyberattacks

- 5.1.2 Convergence of IT and OT Networks

- 5.2 Market Restraints

- 5.2.1 Complexity in Implementing the Security Systems

- 5.3 Emergence of Various Business Models in the ICS Security Industry

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Automotive

- 6.1.2 Chemical and Petrochemical

- 6.1.3 Power and Utilities

- 6.1.4 Pharmaceuticals

- 6.1.5 Food and Beverage

- 6.1.6 Oil and Gas

- 6.1.7 Electronics and Semiconductor

- 6.1.8 Other End Users

- 6.2 Geography

- 6.2.1 China

- 6.2.2 India

- 6.2.3 Japan

- 6.2.4 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM

- 7.1.2 Siemens AG

- 7.1.3 ABB

- 7.1.4 Honeywell International Inc.

- 7.1.5 Tofino Security

- 7.1.6 Kasa Companies Inc.

- 7.1.7 Schneider Electric

- 7.1.8 Sourcefire Inc.

- 7.1.9 Juniper Networks Inc.

8 INVESTMENT ANALYSIS

9 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219