|

市場調查報告書

商品編碼

1639531

中東電力產業的燃氣渦輪機MRO:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Middle East Gas Turbine MRO in the Power Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

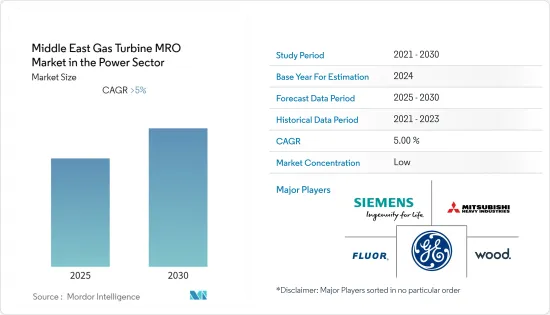

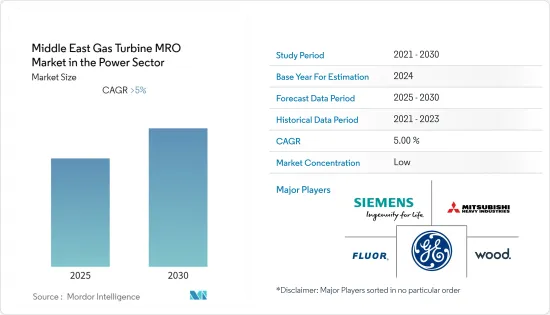

中東電力產業的燃氣渦輪機MRO 市場預計在預測期內複合年成長率將超過 5%。

由於計劃延誤和取消以及電力需求減少,市場受到了 COVID-19 大流行的負面影響。然而,市場在2022年開始復甦。

燃氣渦輪機老化、維持營運效率的需求以及發電廠嚴格的排放法規等因素預計將在預測期內推動市場成長。對燃煤發電廠能源產出環境影響的擔憂以及對燃氣渦輪機清潔能源不斷成長的需求預計將推動電力行業市場中燃氣渦輪機機MRO 市場的成長。然而,向太陽能和風能等可再生能源發電的日益轉變正在阻礙所研究市場的成長。該地區正在經歷從煤炭和原油發電到天然氣發電的轉變,預計這將為參與企業提供重大機會。

在該地區,沙烏地阿拉伯預計將主導市場成長。天然氣發電廠的投資和天然氣發電廠的老化預計將在預測期內推動市場成長。

中東電力產業燃氣渦輪機MRO 市場趨勢

維修業預計將主導市場

電力生產的增加已將重點轉向全球燃氣發電廠的發展。排放發電廠排放的溫室氣體比燃煤發電廠相對較少。全球電力尖峰時段需求不斷增加,燃氣發電可以最好地滿足這一需求。

燃氣發電廠的增加將導致燃氣渦輪機MRO市場的成長。燃氣渦輪機可能需要每四到五年維修或更換一次引擎,但維護在安裝後立即開始。

在最新一波擴張中,天然氣發電廠在 2002 年達到頂峰,大部分是在 1998 年至 2008 年間新增的。因此,預計全球幾乎所有燃氣發電廠安裝的設備在預測期內都需要大量的 MRO 服務。

在中東,天然氣發電量近年來顯著成長,從2012年的548.3太瓦時增加到2021年的929.7太瓦時。

因此,電力供應的增加、電動車數量的增加以及對燃煤電廠溫室氣體排放的日益擔憂等因素正在推動燃氣渦輪機。產業燃氣渦輪機維護市場的成長。

沙烏地阿拉伯可望主導市場

由於該地區能源需求和天然氣使用量的增加,預計沙烏地阿拉伯將在預測期內主導市場。

該國國家石油公司沙烏地阿美的目標是到 2030 年將其天然氣產量增加一倍,其中大部分將用於發電等國內用途。這為該國電力產業的燃氣渦輪機MRO市場創造了巨大的機會。

該國天然氣發電量從2008年的109.5太瓦時增加到2021年的216太瓦時,增加超過97%。由於政府尋求將發電來源從石油轉向天然氣,預計天然氣發電量將在預測期內大幅增加。

天然氣發電在電力市場中佔據主導地位,佔有率約60%。 2021年,天然氣發電量為216太瓦時,石油發電量為140太瓦時,可再生能源發電量為0.8太瓦時。

因此,上述因素預計將在預測期內推動市場成長。

中東電力產業燃氣渦輪機MRO 產業概況

中東電力產業燃氣渦輪機MRO 市場適度細分。主要企業包括通用電氣、西門子股份公司、三菱重工有限公司和約翰伍德Group Limited(排名不分先後)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按服務類型

- 維護

- 維修

- 檢修

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Bechtel Corporation

- Flour Corporation

- John Wood Group PLC

- Siemens AG

- Sulzer AG

- Babcock & Wilcox Enterprises Inc.

- Weg SA

第7章 市場機會及未來趨勢

The Middle East Gas Turbine MRO Market in the Power is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic due to delays and cancellations of projects and decreased demand for electricity. However, the market rebounded in 2022.

Factors such as the aging fleet of gas turbines, the need to maintain operational efficiency, and stringent emissions norms from power plants are expected to drive the market's growth during the forecast period. The increasing demand for cleaner energy from gas turbines over concerns about the environmental impact of energy generation from coal-fired plants is expected to boost the growth of the gas turbine MRO market in the power sector market. However, the increasing shift toward renewable energies, such as solar and wind, for power generation hampered the growth of the market studied. An increasing shift from coal and crude oil toward gas-based power generation in the region is expected to provide significant opportunities to the market players.

Saudi Arabia is expected to dominate the market's growth in the region. Investments in gas-based power generation plants and aging gas-based power plants are expected to drive the market's growth during the forecast period.

Middle East Power Sector Gas Turbine MRO Market Trends

Maintenance Sector is Expected to Dominate the Market

The increase in the production of electricity shifted the global focus on the development of gas-fired power plants. The greenhouse gases emitted from gas-fired power plants are comparatively lower than those from coal-fired power plants. The demand for peak power is increasing globally, which can be most effectively met by gas-based power generation.

The increase in the number of gas-based power generation plants leads to growth in the gas turbine MRO market. While a gas turbine might need an engine repair or replacement in four-five years, the maintenance starts soon after installation.

In the most recent wave of additions, gas-based power plants witnessed a peak in 2002, with the majority added between 1998 and 2008. Thus, the equipment installed in approximately all the gas-fired power plants across the world is expected to require significant MRO services during the forecast period.

In the Middle East, electricity generation from gas witnessed significant growth in recent years, from 548.3 TWh in 2012 to 929.7 TWh in 2021.

Therefore, factors such as increased access to electricity, a rise in the number of electric vehicles, and increased concerns over greenhouse gas emissions from coal-based power plants are expected to help drive the gas turbine market's growth in the power sector, which, in turn, is expected to drive the gas turbine maintenance market's growth in the power sector.

Saudi Arabia is Expected to Dominate the Market

Saudi Arabia is expected to dominate the market studied during the forecast period due to an increase in energy demand and natural gas usage in the region.

The country's national oil company Saudi Aramco has aimed to double its gas production by 2030, most of which will be used for domestic purposes like power generation. This has created a huge opportunity for the gas turbine MRO market in the power sector in the country.

The country witnessed a growth of over 97% in electricity generation from gas, from 109.5 TWh in 2008 to 216 TWh in 2021. Electricity generation from gas is expected to see significant growth in the country in the forecast period due to the government's efforts to shift from oil to gas as a source of electricity generation.

Electricity generation from natural gas dominates the power market at around 60% share. In 2021, electricity generation from natural gas was 216 TWH, from oil was 140 TWH, and from renewables was 0.8 TWh.

Therefore, the aforementioned factors are expected to drive the market's growth during the forecast period.

Middle East Power Sector Gas Turbine MRO Industry Overview

The Middle Eastern gas turbine MRO market in the power sector is moderately fragmented. Some of the major companies are (in no particular order) General Electric, Siemens AG, Mitsubishi Heavy Industries Ltd, and John Wood Group PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Maintenance

- 5.1.2 Repair

- 5.1.3 Overhaul

- 5.2 By Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Mitsubishi Heavy Industries Ltd

- 6.3.3 Bechtel Corporation

- 6.3.4 Flour Corporation

- 6.3.5 John Wood Group PLC

- 6.3.6 Siemens AG

- 6.3.7 Sulzer AG

- 6.3.8 Babcock & Wilcox Enterprises Inc.

- 6.3.9 Weg SA