|

市場調查報告書

商品編碼

1685757

電力產業的燃氣渦輪機MRO:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Gas Turbine MRO In The Power Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

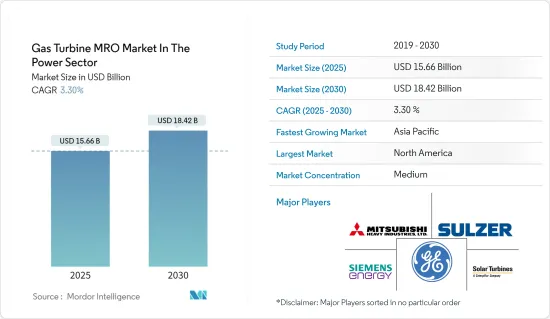

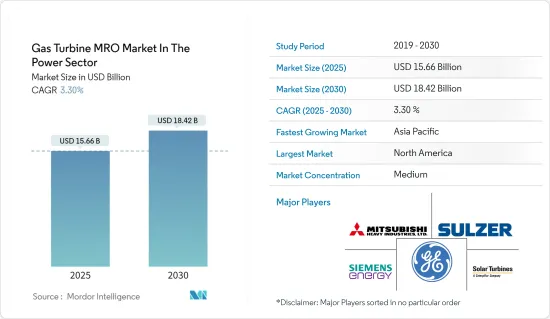

電力領域的燃氣渦輪機MRO 市場預計將從 2025 年的 156.6 億美元成長到 2030 年的 184.2 億美元,預測期內(2025-2030 年)的複合年成長率為 3.3%。

主要亮點

- 從長遠來看,長期運作的發電廠中老化的燃氣渦輪機裝置和渦輪機械的可靠性要求是推動市場發展的主要因素。

- 另一方面,可再生能源領域的成長可能會抑制燃氣渦輪機的應用並阻礙燃氣渦輪機MRO 服務的成長。

- 然而,電力行業天然氣消耗量的增加、從煤炭到天然氣發電的轉變以及燃氣發電廠基礎設施的增加,預計將在未來為燃氣渦輪機MRO 參與者創造重大機會。

- 由於天然氣發電產業集中度高,且老化發電廠數量眾多,預計預測期內亞太地區將以最快的速度成長。

燃氣渦輪機MRO 市場趨勢

維護領域:預計市場將大幅成長

- 為了保持發電設備良好運作,公司和發電廠營運商需要定期進行維護服務,例如定期檢查,零件更換,診斷和維修。從而提高了運作性能,確保了設備的長期穩定運作。

- 許多公用事業公司和獨立電力生產商簽訂長期服務協議 (LTSA),透過一系列服務來滿足其工廠需求,其中包括各方面的支持,包括燃氣渦輪機機組管理、庫存管理、維護、維修、大修和提供日常技術支援。

- 渦輪機製造商建議使用者每季檢查渦輪機三次,前兩年每年檢查一次。此類合約有助於降低整體成本,並透過更強大的部件提高燃氣渦輪機的性能。預計這將增加對維護服務的需求。

- 由於燃氣渦輪機的需求都在增加。然而,僅僅部署燃氣渦輪機並不能保證長期的運作靈活性,這正是 MRO 服務的角色所在。因此,在許多國家,維護服務是在工廠首次運作或運作一段時間後使用的。

- 根據《世界能源資料統計評論》預測,2023年全球天然氣發電總量將達到6,746.3兆瓦時,與前一年同期比較去年同期成長1.2%。隨著各國政府逐步淘汰燃煤發電,天然氣發電量預計將增加,從而推動燃氣渦輪機的使用並產生對燃氣渦輪機MRO 服務的需求。

- 此外,2023 年 3 月,EthosEnergy 與 Global Power Synergy Public Company Limited (GPSC) 簽署了長期服務協議 (LTSA),為燃氣燃氣渦輪機提供維護、檢查和維修服務。 LTSA 涵蓋羅勇兩座熱電汽電共生發電廠的八台 GE Frame 6B燃氣渦輪機:中央公用事業廠 1 號和 2 號(GPSC CUP-1 和 GPSC CUP-2)。

- 2023年7月,西門子能源全球公司與西門子能源越南的合資企業在國際競標中贏得了越南仁川2號電廠的長期維護合約。該合約涵蓋100,000 EOH(等效運轉小時),包括12年內對包括燃氣渦輪機在內的所有工廠設備進行全面的維護和維修服務。

- 由於這些發展,預計維護服務在未來幾年將經歷強勁成長。

亞太地區可望成為成長最快的市場

- 亞太地區是發電用天然氣的最大消費地區之一。過去十年來,天然氣消費量一直在增加,這主要是由於電力需求不斷成長以及發電行業加大排放力度所致。

- 中國有潛力佔據亞太地區燃氣渦輪機MRO服務市場的很大佔有率。蓬勃發展的經濟、快速成長的航空業以及新建和老舊的燃氣發電廠的快速增加都是推動 MRO 服務需求的強勁動力。短短10年間,中國天然氣發電量每年以驚人的9.6%成長,且趨勢沒有放緩的跡象。

- 同樣,印度的電力需求在過去十年中也大幅成長。這主要歸功於持續的經濟成長和政府為改善不斷成長的人口的電力供應而採取的一系列措施。在印度,截至2023年,2.7%的發電量將來自天然氣,發電量約為52.6兆瓦時。燃氣發電廠定期進行維護和檢修,以最大限度地降低突然停電的風險。

- 截至 2023 年,日本是最大的天然氣進口國之一。日本30%的電力來自天然氣。日本營運大量燃氣發電廠,並定期維護這些發電廠,以最大程度地降低國內停電的風險。

- 例如,2023 年 8 月,在 GE Vernova、JERA 和 EPC 合作夥伴東芝能源系統與解決方案公司的合作下,日本一座 5.6 GW 發電廠的三台機組進行了法蘭對法蘭交換,升級為先進的 9HA.01燃氣渦輪機技術。該設施將由四個組別組成,預計將成為日本最大、最重要的發電廠之一,並將成為該國最大的LNG接收站,每年接收超過 1,100 萬噸液化天然氣。

- 2023 年 3 月,三菱重工旗下品牌三菱動力贏得了孟加拉國 Bibiyana-III 聯合循環發電廠為期七年的全套交鑰匙長期服務合約 (LTSA)。根據該協議,三菱電力將為M701F燃氣渦輪機和相關發電設備提供維護和檢查服務,以提高可靠性、性能和效率。

- 2023 年 3 月,Ethos Energy 獲得了 Global Power Synergy Public Company Limited (GPSC) 在亞太地區簽訂的一份為期 12 年的長期服務協議 (LTSA),為燃氣渦輪燃氣渦輪機提供維護、檢查和維修服務。 LTSA 涵蓋泰國羅勇府兩座汽電共生發電廠安裝的八台 GE Frame 6B燃氣渦輪機。

- 由於這些發展,預計亞太地區將成為預測期內成長最快的地區。

燃氣渦輪機MRO 產業概況

電力產業的燃氣渦輪機MRO 市場本質上是半地方性的。市場的主要企業(不分先後順序)包括通用電氣、西門子能源、三菱重工、蘇爾壽和索拉透平公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 調查前提條件

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 長壽命發電廠中燃氣渦輪機設備的老化

- 渦輪機械的可靠性要求

- 限制因素

- 可再生能源領域的成長

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 服務類型

- 維護

- 維修

- 大修

- 提供者類型(僅限定性)

- OEM

- 獨立服務提供者

- 內部

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- General Electric Company

- Mitsubishi Heavy Industries Ltd.

- RWG(Repair & Overhauls)Limited

- Metalock Engineering Group

- Goltens Worldwide Management Corporation

- Siemens Energy AG

- Sulzer Ltd

- Doosan Heavy Industries and Construction

- Solar Turbines Incorporated

- Ethos Energy LLC

第7章 市場機會與未來趨勢

- 從煤炭發電轉向天然氣發電

簡介目錄

Product Code: 47013

The Gas Turbine MRO Market In The Power is expected to grow from USD 15.66 billion in 2025 to USD 18.42 billion by 2030, at a CAGR of 3.3% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the major driving factors of the market are the aging gas turbine fleet in long-serving power plants and reliability requirements regarding turbomachinery.

- On the other hand, growth in the renewable energy sector is likely to restrain the applications of gas turbines, thus hindering the growth of gas turbine MRO services.

- Nevertheless, the increasing natural gas consumption in the power industry, the shift from coal to gas-based power generation, and the rise in the gas-fired power plant infrastructure are expected to create massive opportunities for gas turbine MRO players in the future.

- The Asia-Pacific region is expected to witness the fastest growth during the forecast period, as the natural gas-based power generation industry is highly concentrated there, with many aging power plants.

Gas Turbine MRO Market Trends

Maintenance Segment Expected to Witness Significant Market Growth

- To ensure that power equipment works in good condition, companies and power plant operators need to perform regular maintenance services, including periodic inspections, parts replacement, diagnosis, and renovations. This improves operational performance and ensures the long-term and stable operation of the facility.

- A large number of power utilities and independent power producers enter into long-term service agreements (LTSA) to meet their plant requirements across a range of services, which include all aspects of support, such as fleet management, inventory management, maintenance, repair, and overhaul, and the provision of day-to-day technical support of gas-turbines.

- Turbine manufacturers recommend users perform three quarterly inspections of the turbines, followed by an annual inspection for the first two years. Such agreements help reduce the overall costs, thereby enhancing the capacity of gas turbines through higher-performance parts. This is expected to increase the demand for maintenance services.

- Due to clean fuel properties, its demand is growing in almost every major country. However, only deploying gas turbines does not guarantee any flexibility in operations for the long term, and here, MRO services come into the picture. Thus, many countries have started using maintenance services, either at the beginning of the plant commencement or after crossing a certain period.

- According to the Statistical Review of World Energy Data, in 2023, total world electricity generation from natural gas accounted for 6746.3 Terawatt-hours, an annual growth rate of 1.2% compared to the previous year. With the government's aim to close coal-based power generation, electricity from natural gas is expected to increase, thereby driving the use of gas turbines and creating demand for MRO services for gas turbines.

- Moreover, in March 2023, EthosEnergy made a Long-Term Service Agreement (LTSA) for gas turbine maintenance, inspection, and repair services by Global Power Synergy Public Company Limited (GPSC). The LTSA covers eight GE Frame 6B gas turbine units at two cogeneration power plants in Rayong: Central Utility Plants 1 and 2 (GPSC CUP-1 and GPSC CUP-2).

- In July 2023, A joint venture contractor of Siemens Energy Global and Siemens Energy Vietnam Co., Ltd. secured the long-term maintenance contract for the Nhon Trach 2 Power Plant in Vietnam through open international bidding. The contract spans the next 100,000 equivalent operating hours (EOH) and encompasses comprehensive maintenance and repair services for all plant equipment, including gas turbines, over a 12-year period.

- Owing to such developments, the maintenance services are expected to have robust growth in the forthcoming years.

Asia Pacific Expected to be the Fastest Growing Market

- The Asia-Pacific region is among the largest natural gas consumers for power generation. Natural gas consumption has been rising since the last decade, primarily due to the growing demand for electricity and the growing efforts to reduce emissions from the power generation sector.

- China is primed to hold a significant share of the vast Asia Pacific gas turbine MRO service market. Its booming economy, burgeoning aviation industry, and rapid surge in gas-based power generation plants, both new and aging, are potent driving demand for MRO services. Electricity generation from gas in China witnessed a staggering 9.6% annual increase over just a decade, and this trend shows no signs of slowing.

- Similarly, India's requirement for electricity has been growing tremendously over the past decade, primarily due to continuous economic growth and numerous government initiatives targeted at increasing access to electricity for the country's larger population. In India, as of 2023, 2.7% of the electricity generated is from natural gas, with a generating capacity of approximately 52.6 terawatt-hours. The gas-fired power stations are regularly maintained and overhauled to minimize the risks of sudden outages.

- Japan is among the largest importer of natural gas as of 2023. The country generated 30% of its electricity from natural gas. Japan operates numerous gas-fired power stations, regularly maintained to minimize the risks of outages in the country.

- For instance, in August 2023, in a collaborative effort involving GE Vernova, JERA, and EPC partner Toshiba Energy Systems & Solutions Corporation, a flange-to-flange replacement was executed to upgrade three units to the advanced 9HA.01 gas turbine technology at a 5.6 GW facility in Japan. This facility, consisting of four groups, is expected to be one of Japan's largest and most crucial power generation sites and serves as the country's largest LNG terminal, receiving over 11 million tons of LNG annually.

- In March 2023, Mitsubishi Power, a brand of Mitsubishi Heavy Industries, secured a seven-year full-turnkey Long Term Service Agreement (LTSA) for the Bibiyana-III Combined Cycle Power Plant in Bangladesh. Under this agreement, Mitsubishi Power is expected to provide maintenance and inspection services for the M701F gas turbine and associated power generation equipment to enhance reliability, performance, and efficiency.

- In March 2023, EthosEnergy secured a 12-year Long-Term Service Agreement (LTSA) for gas turbine maintenance, inspection, and repair services from Global Power Synergy Public Company Limited (GPSC) in the Asia-Pacific region. This LTSA covers eight GE Frame 6B gas turbine units at two cogeneration power plants in Rayong, Thailand.

- Due to such developments, the Asia-Pacific is expected to be the fastest-growing region during the forecast period.

Gas Turbine MRO Industry Overview

The gas turbine MRO market in power sector is semi-consolidated in nature. Some of the major players in the market (in no particular order) include General Electric Company, Siemens Energy AG, Mitsubishi Heavy Industries Ltd, Sulzer Ltd, Solar Turbines Incorporated, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Aging Gas Turbine Fleet in the Long-Serving Power Plants

- 4.5.1.2 Reliability Requirements with Regard to Turbomachinery

- 4.5.2 Restraints

- 4.5.2.1 Growth in the Renewable Energy Sector

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Maintenane

- 5.1.2 Repair

- 5.1.3 Overhaul

- 5.2 Provider Type (Qualitative Analysis Only)

- 5.2.1 OEMs

- 5.2.2 Independent Service Providers

- 5.2.3 In-house

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canda

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Mitsubishi Heavy Industries Ltd.

- 6.3.3 RWG (Repair & Overhauls) Limited

- 6.3.4 Metalock Engineering Group

- 6.3.5 Goltens Worldwide Management Corporation

- 6.3.6 Siemens Energy AG

- 6.3.7 Sulzer Ltd

- 6.3.8 Doosan Heavy Industries and Construction

- 6.3.9 Solar Turbines Incorporated

- 6.3.10 Ethos Energy LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Shift From Coal to Gas-Based Power Generation

02-2729-4219

+886-2-2729-4219