|

市場調查報告書

商品編碼

1639540

3D 感測器 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)3D Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

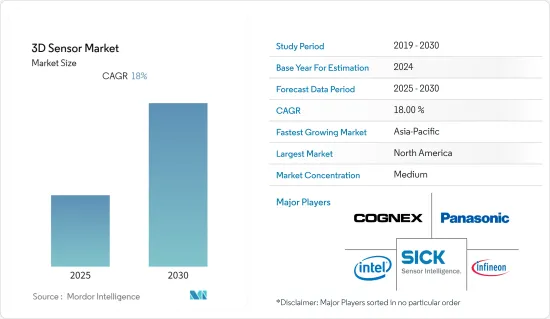

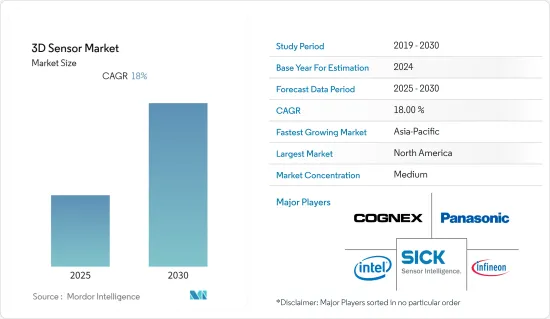

3D感測器市場預計在預測期內複合年成長率為18%

主要亮點

- 提高感測器與物聯網平台的兼容性正在成為促進遠端監控和控制的先決條件。連接物聯網的家用電子電器產品為醫療、家用電子電器、汽車、應用等多個產業的感測器帶來了巨大的機會。根據思科年度網際網路報告,到2023年,連網設備和連線數量將從2018年的184億增加到約300億。到 2023 年,物聯網設備將佔所有連網裝置的 50%(147 億),高於 2018 年的 33%(61 億)。物聯網設備的增加預計將推動所研究市場的成長。

- 此外,政府針對智慧家庭和智慧建築的舉措正在加速 3D 感測器的採用。最近,利茲、薩頓和里士滿議會推出了先進的住宅物聯網技術,以更好地支援居民並提高服務效率。此外,2022 年 7 月,Senet, Inc. 和資料分析軟體、低功耗廣域網路 (LPWAN) 無線電信業者,為加速智慧基礎設施 3D 感測器的採用,宣布雙方合作,透過915 MHz免授權頻譜和IotaComm 的800 MHz FCC 授權頻譜中的網路連線提供LoRaWAN。

- 消費性電子產品日益成長的需求預計將為增加企業收益提供機會。此外,可支配收入的增加、5G的出現以及通訊基礎設施的改善等多種因素正在導致全球對智慧型手機的需求激增。例如,根據愛立信的數據,全球智慧型手機用戶數量最近為 62.59 億,預計到 2027 年將達到 76.9 億。

- 最近,TDK 公司宣布將 HAR 3927 添加到其 Micronas 直角霍爾效應感測器系列中。本產品採用獨特的 3D HAL 像素單元技術,滿足符合 ISO 26262 的開發需求。此感測器具有比例類比輸出和符合 SAE J2716 rev 的數位 SENT 介面。預計此類發展將進一步促進市場發展。

- 此外,2022 年 5 月,英飛凌與 pmdtechnologies 合作開發適用於 Magic Leap 2 的 3D 深度感測技術,實現先進的尖端工業和醫療應用。 IRS2877C 飛行時間成像儀捕捉使用者周圍的實體環境,幫助設備了解環境並最終與該環境互動。

- 此外,工業 4.0 革命使機器變得更加智慧和直覺,這增加了工業應用對感測器的需求。 IFR 預測,到 2024 年,全球工廠中將有 518,000 台工業機器人運作,全球採用率顯著增加。工業機器人市場的積極成長軌跡預計將推動同期感測器的需求。

- 幾種專注於提高效率和準確性以及解決限制的生物感測器研究預計將引領生物感測器的採用。例如,2022 年 8 月,芝加哥大學普利茲克分子工程學院的新研究表明,直接佩戴在皮膚上的靈活、可拉伸的計算晶片使用人工智慧 (AI) 來即時收集和分析健康資料。做什麼。該設備被稱為神經形態計算晶片,使用半導體和電化學電晶體從接觸皮膚的生物感測器收集資料。與智慧型手錶等在用戶皮膚和設備之間留下小間隙的其他穿戴式設備不同,該晶片設計為直接佩戴,以提高感測器準確性和資料收集。同樣在 2022 年 7 月,IUPUI 理學院的研究人員報告稱,他們正在致力於創建一種新型生物感測器,可以滿足未來 COVID-19 測試的速度和效率要求。

- COVID-19 的疫情對研究市場產生了重大影響。許多最終用戶公司受到影響,包括電子製造商。製造業的很大一部分涉及工廠車間的工作,人們在一起工作並密切溝通以提高生產力。此外,製造業服務業歷來適應變化的速度很慢。產品組裝、原型開發和風險評估是需要仔細規劃的微妙工作流程。因此,製造商不得不在 COVID-19 期間做出重大調整。

3D感測器市場趨勢

汽車佔很大佔有率

- 3D感測器廣泛應用於汽車產業,用於監測汽車的各個方面,例如汽車溫度、冷卻水系統、油壓和車速。對更安全、更清潔的車輛的需求不斷成長,推動了汽車產業對 3D 感測器的需求。例如,感測器提供有關引擎中清潔有效的燃料燃燒的資訊,有助於顯著降低排放值和燃料消耗。

- IBEF 表示,到 2030 年,印度有潛力成為共享出行領域的領導者,為電動車和自動駕駛汽車帶來機會。此外,2022年4月,塔塔汽車宣布計畫在未來五年內向其乘用車業務投資2,400億印度盧比(30.8億美元)。此外,根據中國汽車工業協會的數據,2022年4月,中國生產了約21萬輛商用車和99.6萬輛乘用車。對這些車輛的投資預計將進一步推動市場成長。

- 此外,根據汽車政策委員會的數據,汽車製造商及其供應商是美國最大的製造業,約占美國 GDP 的 3%。僅在過去五年中,FCA、福特和通用汽車就宣布對美國組裝廠、引擎廠、變速箱廠、研發實驗室、行政辦公室和其他基礎設施投資約 350 億美元。

- 市場競爭也在加劇,各種現有和新參與企業在自動化市場上開發和推出更多獨特的產品。例如,2022 年 7 月,優傲機器人宣布推出一款承重能力為 20 公斤的新型協作機器人,可協助機器運送重物。這些功能更強大、更快、能力更強的協作機器人的推出將加速公司在醫療和家用電子電器等高成長領域的擴張,以滿足許多行業日益成長的自動化需求。

- 此外,汽車和汽車領域是可能受到 3D 建模市場顯著影響的領域之一,這將推動 3D 感測器市場的發展。此外,市場上不同供應商也取得了許多技術進步。最近,Yokohama Rubber和 Zenrin 開始對安裝在輪胎內部表面上的感測器進行實際測試,作為試點研究的一部分,調查使用支援物聯網的道路感測系統進行道路和胎面磨損測量。

- 此外,2022年6月,Centronics宣布將與英國HORIBA合作,推出汽車產業的下一代超音波消費量測量感測器「HORIBA RealFlow:Powered by Sentronics」。 HORIBA RealFlow 採用最新的超音波燃油流量感測專利技術,可精確安裝在引擎蓋下,即時測量燃油消費量,以進行汽車檢驗和檢驗。與傳統產品相比,其性能最佳,流量測量精度在 1,000:1 的寬量程比範圍內提高了 +-0.5%。

北美佔據主要市場佔有率

- 在北美,美國預計將成為最大的成長市場。這是因為家用電子電器和汽車領域的需求強勁,每個領域的多種應用都採用了 3D 感測器。

- 智慧型手機在美國越來越流行,對感測器的需求預計也會同時增加。根據美國人口普查局和消費者技術協會的數據,2022 年美國智慧型手機銷售額達到 747 億美元,而 2021 年為 730 億美元。隨著市場上智慧型手機的激增,對 3D 感測器的需求預計也會以同樣的速度成長。

- 近日,高通發表了第二代3D聲波感測器螢幕下指紋辨識器。與三星 Galaxy S20 和 Note20 型號中的第一代掃描器相比,這款新型掃描器的指紋辨識器面積增加了 77%,速度提高了 50%。

- 此外,蘋果公司的產品iPhone在美國智慧型手機需求成長中發揮重要作用。例如,2022 年 9 月,蘋果在加州發表了 iPhone 14 和 iPhone 14 Plus。流行的 6.1 英寸設計,現在增加了獨特的 6.7 英寸更大尺寸,新的雙鏡頭系統,碰撞檢測,智慧手機行業首個通過衛星緊急求救的安全服務,以及 iPhone 的多重有用電池壽命都完成了。同樣,在加拿大,人們渴望嘗試創新技術的趨勢也不斷成長。

- 此外,如今的消費者更喜歡筆記型電腦、超高清和 4K 電視等高清產品。預計這將進一步推動 3D 感測器市場。此外,該地區正在見證自動駕駛汽車等新技術的快速採用,預計這將增加汽車領域對 3D 感測器的需求。

3D感測器產業概況

3D感測器市場競爭溫和。然而,隨著技術創新和永續產品的興起,許多公司正在透過探索新市場和獲得新合約來增加其市場佔有率,以保持其在全球市場的地位。

2022 年 9 月,高解析度數位雷射雷達感測器的領先製造商 Ouster, Inc. 發布了一套用於大批量物料輸送應用的 3D 工業 LiDAR 感測器。高解析度 OS0 和 OS1 感測器工業產品線旨在滿足堆高機、港口設備和自主移動機器人 (AMR) 製造商的需求,同時保持大批量生產車隊的經濟實惠。據該公司稱,其工業感測器套件的 3D 功能超越了傳統的 2D 雷射掃描儀,可提供卓越的解析度、範圍和視野,而不會增加系統成本或複雜性。

2022年6月,ST宣布推出首款配備元光學的3D感測器。這種直接飛行時間感測器是一種用於智慧型手機、虛擬實境耳機和機器人的深度感測器。元光學可以取代現有的複雜多元件鏡頭。元光學收集更多的光,在單層中執行多種功能,並在更小的空間內為智慧型手機和其他設備提供新的感測形式。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進和市場約束因素

- 市場促進因素

- 消費性電子產品對 3D 設備的需求增加

- 3D 感測技術在遊戲和應用程式中的使用增加

- 微型電子產品中光學和電子元件的整合

- 市場限制因素

- 維護這些設備需要高成本

- 與各種設備介面整合

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 依產品

- 位置感測器

- 影像感測器

- 溫度感測器

- 加速計感測器

- 其他

- 依技術

- 超音波

- 結構光

- 飛行時間

- 其他

- 按行業分類

- 家用電子電器

- 車

- 醫療保健

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- Intel Corporation

- Occipital Inc.

- SoftKinetic SA

- Sick AG

- LMI Technologies

- Infineon Technologies AG

- XYZ Interactive Technologies

- OmniVision Technologies

- Panasonic Corporation

- Cognex Corporation

第7章 市場機會及未來趨勢

第8章投資分析

The 3D Sensor Market is expected to register a CAGR of 18% during the forecast period.

Key Highlights

- Increasing sensor compatibility with the Internet of Things platform is gradually becoming a prerequisite for promoting remote monitoring and control. The IoT-connected appliances have opened massive opportunities for sensors in several industrial, medical, consumer electronics, automobile, applications etc. According to Cisco's Annual Internet Report, by 2023, there will be nearly 30 billion network-connected devices and connections, up from 18.4 billion in 2018. By 2023, IoT devices will make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Such an increase in IoT devices would drive the growth of the studied market.

- Moreover, governments' initiatives for smart homes and buildings are helping the adoption of 3D sensors faster. Recently, councils in Leeds, Suttons, and Richmond advanced IoT technology in homes to better support residents and make services more efficient. Further, in July 2022, Senet, Inc., and Iota Communications, Inc., a data analytics software, low power, vast area network (LPWAN) wireless communication company, announced a partnership to deliver LoRaWANthrough 915 MHz unlicensed spectrum and IotaComm's800 MHz FCC-licensed spectrum network connectivity, for facilitating the adoption of smart infrastructure 3D sensors.

- Increasing demand for consumer electronics is expected to provide opportunities to increase the company's revenue. Further, the global demand for smartphones has been witnessing an upsurge owing to several factors, such as increasing disposable income, the advent of 5G, and the development of telecom infrastructure. For instance, according to Ericsson, the number of smartphone subscriptions worldwide amounted to 6,259 million recently and is expected to reach 7,690 million in 2027.

- Recently, TDK Corporation announced the addition of the HAR 3927 to its Micronas direct-angle Hall-effect sensor family. This product employs proprietary 3D HAL pixel-cell technology and addresses the demand for ISO 26262-compliant development. The sensor includes a ratiometric analog output and a digital SENT interface by SAE J2716 rev. Such developments will further drive market growth.

- Further, in May 2022, Infineon and pmdtechnologies collaborated to create 3D depth-sensing technology for Magic Leap 2, allowing for advanced cutting-edge industrial and medical applications. The IRS2877C Time-of-Flight imager captures the physical environment around the user and assists the device in understanding and eventually interacting with it.

- Furthermore, the industry 4.0 revolution, in which machines are becoming more intelligent and intuitive, is increasing the need for the industrial applications of sensors. According to the IFR forecasts, global adoption is expected to increase significantly to 518,000 industrial robots operational across factories all around the globe by 2024. The positive growth trajectory of the industrial robots market is expected to drive the demand for sensors during the same period.

- Several types of research regarding biosensors focusing on increasing efficiency and accuracy and tackling limitations are expected to spearhead the adoption of biosensors. For instance, in August 2022, a new study from the University of Chicago's Pritzker School of Molecular Engineering showed that a flexible, stretchable computing chip worn directly on the skin could collect and analyze health data in real-time using artificial intelligence (AI). The device, a neuromorphic computing chip, utilizes semiconductors and electrochemical transistors to collect data from biosensors touching the skin. Unlike other wearables like smartwatches, which leave a small gap between the user's skin and the device, the chip is designed to be worn directly to improve sensor accuracy and data collection. Also, in July 2022, researchers from the School of Science at IUPUI reported that they were working to create a new biosensor that could meet future COVID-19 testing requirements for speed and efficiency.

- The COVID-19 outbreak had an enormous impact on the studied market. Many end-user enterprises were impacted, including those in electronics manufacturing. A large part of manufacturing includes work on the factory floor, where people are in close contact as they collaborate to boost productivity. Additionally, manufacturing services has been a historically slow industry when adapting to change. Tasks such as product assembly, prototype development, and risk assessment are sensitive workflows that need in-depth planning. For such reasons, manufacturers had to make significant adjustments during this COVID-19 period.

3D Sensors Market Trends

Automotive to Hold Significant Share

- 3D Sensors are widely used in the automotive industry to monitor various aspects of a car, including its temperature, coolant system, oil pressure, and vehicle speed. The rising demand for safer and cleaner vehicles drives the need for 3D sensors in the automotive industry. For instance, sensors provide information regarding clean and effective fuel combustion in the engine, which helps in significantly reducing exhaust emissions values and fuel consumption.

- According to IBEF, India could be a shared mobility leader by 2030, opening up electric and autonomous vehicle opportunities. Further, in April 2022, Tata Motors announced plans to invest INR 24,000 crores (USD 3.08 billion) in its passenger vehicle business over the next five years. In addition, according to CAAM, in April 2022, around 210,000 commercial motorcars and 996,000 passenger vehicles were produced in China. Such investment in automobiles will further drive market growth.

- Further, according to the American Automotive Policy Council, automakers and their suppliers are America's largest manufacturing sector, responsible for ~3% of America's GDP. Over the past five years alone, the FCA US, Ford, and General Motors have announced their investments of around USD 35 billion in their US assembly, engine, and transmission plants, R&D labs, administrative offices, and other infrastructure connecting and supporting them.

- The market is also getting increasingly competitive, with various established and new players developing and launching more unique products in the automation market. For instance, in July 2022, Universal Robots unveiled a new 20 kg payload cobot to help machines in heavy lifting. The launch of these more potent, faster, and more capable cobots aims at accelerating the company's expansion in high-growth segments, including healthcare, consumer electronics, etc., meeting the rising demand for automation across numerous industries.

- Furthermore, the car and automotive sector is one area that is likely to be affected significantly by the 3D modeling market, consequently boosting the 3D sensor market. Additionally, a lot of technological advancements are carried out by various vendors in the market. Recently, Yokohama Rubber and Zenrin started the practical testing of a sensor attached to the inner surface of a tire as part of a pilot study investigating road surface and tread wear measurement using an IoT-enabled road surface-sensing system.

- Further, in June 2022, Sentronics announced a partnership with HORIBA UK to launch the next-generation Ultrasonic Fuel Consumption Measurement Sensor, the HORIBA RealFlow: Powered by Sentronics, for the automotive industry. Featuring the latest patented technology in ultrasonic fuel flow sensing, the HORIBA RealFlow offers accurate under-bonnet installation and real-time measurement of fuel consumption for automotive validation and verification of test applications. With an improved flow measurement accuracy of +-0.5% over an expanded turndown range of 1000:1, it offers optimum performance compared to its predecessor.

North America to Hold Significant Market Share

- In North America, the United States is expected to be the largest growing market, owing to the great demand from consumer electronics and automotive sectors, employing 3D sensors for multiple applications in their domains.

- With the increasing adoption of smartphone devices in the US, the demand for sensors is expected to increase simultaneously in the market. According to the US Census Bureau and Consumer Technology Association, the sales of smartphones in the US reached USD 74.7 billion in 2022 compared to USD 73 billion in 2021. With the increasing adoption of smartphones in the market, the demand for 3D sensors is also expected to increase at the same speed.

- Recently, Qualcomm launched its second-generation 3D Sonic Sensor under-display fingerprint reader. The new scanner would offer a 77% larger fingerprint reader area and 50% faster than its first-gen scanner, featured in Samsung's Galaxy S20 and Note20 models.

- Moreover, Apple's product, iPhone, plays a significant role in increasing the demand for smartphones in the United States. For instance, in September 2022, Apple unveiled the iPhone 14 and iPhone 14 Plus in California. A unique, larger 6.7-inch size joins the popular 6.1-inch design, with a new dual-camera system, Crash Detection, a smartphone industry-first safeness service with Emergency SOS via satellite, and multiple helpful battery life on iPhone. Similarly, a trend of people keen on trying innovative technology is rising in Canada.

- Also, consumers today prefer enhanced image quality, such as laptops and Ultra HD or 4K television sets. This is, further expected to drive the 3D sensor market. In addition, the fast adoption of new technology in this region, such as self-driving cars, is expected to drive the demand for 3D sensors in the automotive sector.

3D Sensors Industry Overview

The 3D sensor market is moderately competitive. However, with increased innovations and sustainable products, to maintain their position in the global market, many companies are increasing their market presence by securing new contracts by tapping new markets.

In September 2022, Ouster, Inc., a leading manufacturer of high-resolution digital lidar sensors, released a 3D industrial lidar sensor suite for high-volume material handling applications. The industrial line of high-resolution OS0 and OS1 sensors is designed to meet the needs of forklifts, port equipment, and autonomous mobile robot (AMR) manufacturers while remaining affordable for high-volume production fleets. According to the company, its industrial sensor suite's 3D capabilities outperform legacy 2D laser scanners by providing superior resolution, range, and field of view without increasing system cost or complexity.

In June 2022, ST introduced the first 3D sensor with meta-optics. The direct time-of-flight sensor is a depth sensor used in smartphones, virtual reality headsets, and robotics. Meta-optics can replace existing complex and multi-element lenses; they collect more light, perform multiple functions in a single layer, and enable new forms of sensing in smartphones and other devices while taking up less space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Demand for 3D-enabled Devices in Consumer Electronics

- 4.3.2 Increasing Use of 3D Sensing Technology in Gaming Applications

- 4.3.3 Integration of Optical and Electronic Components in Miniaturized Electronics Devices

- 4.4 Market Restraints

- 4.4.1 High Cost Required for the Maintenance of these Devices

- 4.4.2 Integration With Interfaces in Different Devices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Position Sensor

- 5.1.2 Image Sensor

- 5.1.3 Temperature Sensor

- 5.1.4 Accelerometer Sensor

- 5.1.5 Other Products

- 5.2 By Technology

- 5.2.1 Ultrasound

- 5.2.2 Structured Light

- 5.2.3 Time of Flight

- 5.2.4 Other Technologies

- 5.3 By End User Vertical

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.4 Other End User Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of the Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.5 Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intel Corporation

- 6.1.2 Occipital Inc.

- 6.1.3 SoftKinetic SA

- 6.1.4 Sick AG

- 6.1.5 LMI Technologies

- 6.1.6 Infineon Technologies AG

- 6.1.7 XYZ Interactive Technologies

- 6.1.8 OmniVision Technologies

- 6.1.9 Panasonic Corporation

- 6.1.10 Cognex Corporation