|

市場調查報告書

商品編碼

1640416

特種界面活性劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Specialty Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

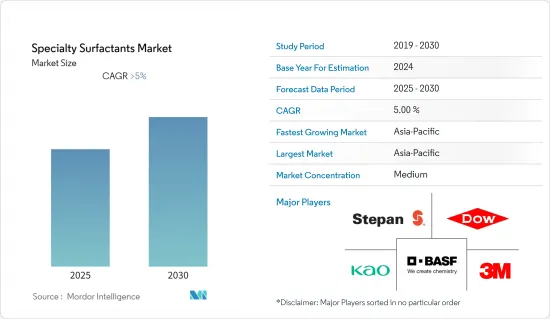

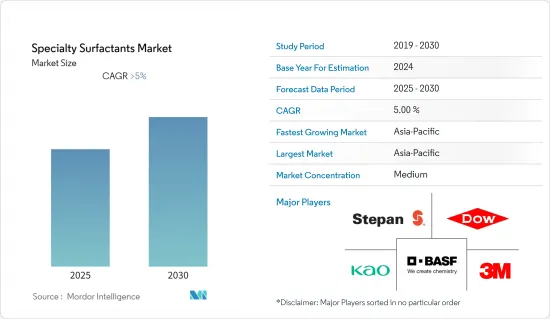

預測期內,特種界面活性劑市場預計將以超過 5% 的複合年成長率成長。

COVID-19 對特種界面活性劑市場產生了相當複雜的影響。由於家庭清洗和個人保健產品的需求增加,市場蓬勃發展。同時,關閉和旅行限制減少了對工業和商務用清潔劑、農產品、潤滑劑和燃料添加劑的需求。然而,隨著限制的放寬,市場從 2021 年開始加速發展,並且很可能在預測期內遵循類似的軌跡。

主要亮點

- 推動市場發展的關鍵因素是個人護理行業的成長和亞太地區油脂化學品市場的成長。

- 然而,對環境法規的日益關注阻礙了市場的成長。

- 食品加工產業對特種界面活性劑的需求不斷成長,這可能會在不久的將來增加所研究市場的成長潛力。

- 亞太地區佔據了最大的佔有率,預計未來幾年仍將保持這一勢頭。

特種表面活性劑市場趨勢

家用肥皂和清潔劑應用佔市場主導地位

- 清潔劑和肥皂中含有的專用界面活性劑與水混合後會附著在衣服和其他清洗表面的污垢上。這會降低表面張力並有助於去除污垢。

- 自動洗碗機清潔劑的界面活性劑含量低於手動清潔劑,以最大限度地減少洗碗機中的泡沫。主要界面活性劑有LAS和醇乙氧基硫酸鹽(AES)。

- 根據國際肥皂、清潔劑和保養產品協會預測,2021年歐洲家庭護理產品市場總值將超過400億美元。超過80%的市場是由家庭護理產品構成的。

近年來,美國對清潔劑的需求不斷增加。人們對健康和衛生的擔憂日益加劇,加上感染疾病的不斷增加,可能會進一步促進清潔劑的銷售。美國領先的清潔劑品牌包括 Tide、Gain、Arm &Hammer、All、Purex、Xtra、Persil、Dreft 和 Seventh Generation。 2022 年,汰漬在美國清潔劑產業佔據主導地位,銷售額約 24 億美元。

亞太地區佔市場主導地位

- 2022 年,亞太地區將主導特種界面活性劑市場,預計在預測期內仍將保持主導地位。印度、中國和日本的個人護理和工業清洗行業的成長將在未來幾年推動市場發展。

- 人口的不斷成長推動了該國對化妝品的需求。中國是美國等新興經濟體化妝品出口的主要市場之一。根據中國國家統計局數據,2021年中國化妝品零售額超過580億美元,佔全球化妝品市場的17%以上。

- 近年來,都市化進程加快和消費支出增加導致對更高品質產品的需求不斷成長。預計未來幾年領先的家居清潔公司提供的創新產品將提高市場集中度。例如,2022 年 7 月,Godrej Consumer Products 推出了印度首款即用型沐浴乳Godrej Magic Bodywash,售價僅 0.57 美元。此外,2021 年 9 月,RP-Sanjiv Goenka Group 推出護膚和護髮產品,進軍個人護理領域。

特種界面活性劑產業概況

全球特種界面活性劑市場中等分散,大部分市場佔有率由多家參與者瓜分。市場的主要企業包括BASF SE、陶氏、3M、Stepan Company 和 Koa Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區個人護理產業的成長

- 油脂化學品市場的成長

- 限制因素

- 對環境法規的興趣增加

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按產地

- 合成界面活性劑

- 生物基界面活性劑

- 按類型

- 陰離子界面活性劑

- 陽離子界面活性劑

- 非離子界面活性劑

- 兩性界面活性劑

- 矽膠表面活性劑

- 其他類型

- 按應用

- 家用肥皂和清潔劑

- 個人護理

- 潤滑油和燃料添加劑

- 工業和公共設施清洗劑

- 食品加工

- 油田化學品

- 農業化學品

- 紡織加工

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Arkema

- Ashland

- BASF SE

- Clariant

- Croda International Plc

- Dow

- ELEMENTIS PLC

- Emery Oleochemicals

- Evonik Industries AG

- GALAXY

- GEO

- Godrej Industries Limited

- Huntsman International LLC

- Innospec

- KAO CORPORATION

- KLK OLEO

- Lonza

- Mitsui & Co., Ltd.

- Nouryon

- Reliance Industries Limited

- Sanyo Chemical Industries, Ltd.

- Sasol

- Solvay

- Stepan Company

- Sumitomo Corporation

第7章 市場機會與未來趨勢

- 食品加工產業對特種界面活性劑的需求不斷增加

The Specialty Surfactants Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 had a rather mixed impact on the market for specialty surfactants. The market experienced a boom as a result of the rise in demand for household cleaning and personal care products. On the other hand, the market also saw a decrease in demand for industrial and institutional cleaners, agricultural products, lubricants, and fuel additives as a result of lockdowns and travel restrictions. However, with the ease in regulations, the market has started to gather pace since 2021, and the market is likely to follow a similar trajectory during the forecast period as well.

Key Highlights

- The major factors driving the market are the growing personal care industry in Asia-Pacific and the growth of the oleochemicals market.

- However, increasing focus on environmental regulations is hindering the growth of the market studied.

- In the near future, the growing need for specialty surfactants in the food processing industry is likely to give the market under study a number of chances to grow.

- Asia-Pacific had the biggest share of the market, and it's likely that it will continue to do so for the next few years.

Specialty Surfactants Market Trends

Household Soap and Detergent Application to Dominate the Market

- Applications in laundry detergents and soaps for use in the home accounted for the majority of the specialty surfactant market.The specialty surfactants incorporated in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce the surface tension and remove the dirt from the concerned surface.

- The surfactant level in automatic dishwasher detergents is lower than in hand dishwashing detergents to minimize foaming in the dishwasher. The major surfactants used are LAS and alcohol ethoxy sulfates (AES).

- The International Association for Soaps, Detergents, and Maintenance Products says that the total market value of household care products in Europe will be more than USD 40 billion in 2021. More than 80% of the market will be made up of household care products.

Demand for detergent has increased in the United States in recent years. The rising prevalence of infectious diseases, coupled with growing concerns related to health and hygiene, will further increase the sales of detergent. Leading detergent brands in the United States include Tide, Gain, Arm & Hammer, All, Purex, Xtra, Persil, Dreft, and Seventh Generation. Tide dominated the U.S. detergent industry in 2022 and generated sales of nearly $2.40 billion.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the specialty surfactants market in 2022 and is expected to continue its dominance over the forecast period. Growing personal care and industrial cleaning industries in India, China, and Japan will propel the market in the future.

- Continuous population growth is a factor fueling the demand for cosmetics in the country. China is one of the leading markets for cosmetics exports from developed economies, such as the United States. According to the National Bureau of Statistics of China, in 2021, the retail sales of cosmetics in China surpassed USD 58 billion and accounted for more than 17% of the global cosmetics market.

- Increasing urbanization followed by rising expenditure has increased the demand for better-quality products over the past few years. Innovative product offerings by leading household cleaning companies are expected to increase market concentration over the coming years. For instance, in July 2022, Godrej Consumer Products unveiled Godrej Magic Bodywash, India's first ready-to-mix body wash, at just USD 0.57. Furthermore, in September 2021, the RP-Sanjiv Goenka Group entered the personal-care segment by launching skin and hair care products.

Specialty Surfactants Industry Overview

The global specialty surfactants market is moderately fragmented, as the majority of the market share is divided among many players. Some of the key players in the market include BASF SE, Dow, 3M, Stepan Company, and Koa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry In Asia-pacific

- 4.1.2 Growth Of The Oleo Chemicals Market

- 4.2 Restraints

- 4.2.1 Increasing Focus On Environmental Regulations

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market size in Value)

- 5.1 Origin

- 5.1.1 Synthetic Surfactants

- 5.1.2 Bio-based Surfactants

- 5.2 Type

- 5.2.1 Anionic Surfactants

- 5.2.2 Cationic Surfactants

- 5.2.3 Non-ionic Surfactants

- 5.2.4 Amphoteric Surfactants

- 5.2.5 Silicone Surfactants

- 5.2.6 Other Types

- 5.3 Application

- 5.3.1 Household Soap and Detergent

- 5.3.2 Personal Care

- 5.3.3 Lubricants and Fuel Additives

- 5.3.4 Industry and Institutional Cleaning

- 5.3.5 Food Processing

- 5.3.6 Oilfield Chemicals

- 5.3.7 Agricultural Chemicals

- 5.3.8 Textile Processing

- 5.3.9 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Clariant

- 6.4.7 Croda International Plc

- 6.4.8 Dow

- 6.4.9 ELEMENTIS PLC

- 6.4.10 Emery Oleochemicals

- 6.4.11 Evonik Industries AG

- 6.4.12 GALAXY

- 6.4.13 GEO

- 6.4.14 Godrej Industries Limited

- 6.4.15 Huntsman International LLC

- 6.4.16 Innospec

- 6.4.17 KAO CORPORATION

- 6.4.18 KLK OLEO

- 6.4.19 Lonza

- 6.4.20 Mitsui & Co., Ltd.

- 6.4.21 Nouryon

- 6.4.22 Reliance Industries Limited

- 6.4.23 Sanyo Chemical Industries, Ltd.

- 6.4.24 Sasol

- 6.4.25 Solvay

- 6.4.26 Stepan Company

- 6.4.27 Sumitomo Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Demand for Specialty Surfactants in Food Processing Industry