|

市場調查報告書

商品編碼

1640433

歐洲水力壓裂液 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Hydraulic Fracturing Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

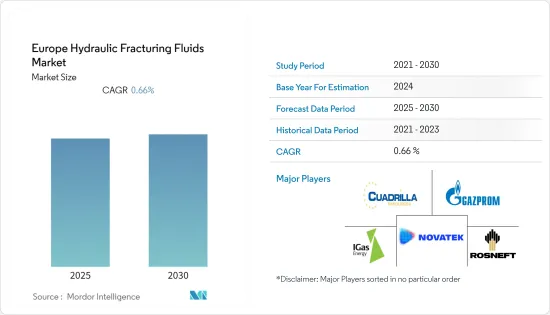

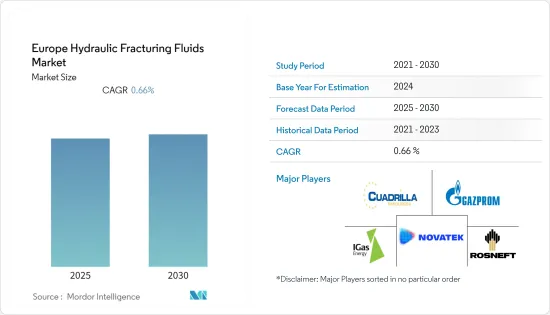

預計預測期內歐洲水力壓裂液市場複合年成長率為 0.66%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長遠來看,石油和天然氣需求的不斷成長以及各國減少進口依賴的努力正在推動這一領域的成長。

- 同時,水力壓裂法對環境的影響和技術限制也阻礙了該產業的發展。水力壓裂市場也存在擔憂,包括荷蘭和愛爾蘭在內的許多國家都禁止使用這種製程。

- 波羅的海管道的建設預計將增加對俄羅斯天然氣的需求。需求的增加可能帶來對非傳統資源的投資,為石油和天然氣公司創造機會。

- 由於俄羅斯擁有具有經濟價值的頁岩蘊藏量,預計預測期內該國將佔據市場主導地位。

歐洲水力壓裂液市場趨勢

天然氣強勁成長

- 天然氣是石油的清潔替代品,預計預測期內其需求將大幅增加。預計天然氣發電廠、液化天然氣燃料庫和區域供熱的新計畫將增加歐洲對天然氣的需求。

- 預計唯一會使用水力壓裂技術的歐洲國家是英國、俄羅斯以及某種程度上的波蘭。然而,波蘭的技術限制、俄羅斯的經濟可行性問題以及英國的環境問題阻礙了這一領域的成長。

- 2022年2月,北海六個新的油氣天然氣田獲得英國政府核准。財政部已敦促上級部門加快頒發六個能源項目的建設許可證。預計天然氣天然氣田的擴張將支持水力壓裂液市場未來的成長。

- 因此,水力壓裂頁岩氣產量預計會增加。不過,這很大程度上取決於頁岩氣的價格和生產的技術限制。

俄羅斯佔據市場主導地位

- 俄羅斯頁岩油資源豐富,頁岩氣蘊藏量潛力最大。巴熱諾夫頁岩被譽為世界最大頁岩蘊藏量。由於擁有大量廉價土地,巴熱諾夫的頁岩氣開發預計將於 2024 年開始。

- 截至2021年,俄羅斯是僅次於美國的世界第二大天然氣生產國。它還擁有世界上最大的天然氣蘊藏量,並且是世界上最大的天然氣出口國。 2021年,該國生產了7,620億立方米天然氣,並透過管道出口了約2,100億立方公尺天然氣。

- 穿越波羅的海的管道(北溪2號)的建設預計將進一步增加俄羅斯的天然氣需求。目前,管道必須經過多個國家,這增加了天然氣的整體成本並降低了俄羅斯公司的利潤率。

- 俄羅斯正在擴大其液化天然氣(LNG)生產能力,以與美國、澳洲和卡達不斷成長的液化天然氣出口競爭。 2021年,政府發布了長期液化天然氣發展計畫,目標到2025年液化天然氣出口量達到每年1,100-1,900億立方公尺。

- 2022 年 2 月,俄羅斯雅庫特共和國擬建的雅庫特液化天然氣 (LNG)計劃提案將於2027 年完工,該計畫年產1770 萬噸液化天然氣,將從俄羅斯遠東海岸向中國供應液化天然氣( LNG)。該計劃預計將於 2023 年達成最終投資決定 (FID)。

- 因此,由於水力壓裂領域的投資不斷增加以及私營部門努力探索石油和天然氣行業新的成長途徑,俄羅斯預計將主導市場。

歐洲水力壓裂液產業概況

歐洲水力壓裂液市場適度細分。市場的主要企業(不分先後順序)包括 Cuadrilla Resources Ltd、PJSC Rosneft Oil Company、PJSC Gazprom、PAO NOVATEK 和 IGas Energy PLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 資源類型

- 油

- 天然氣

- 流體類型

- 光滑的水基流體

- 泡沫液體

- 啫咖哩狀油性液體

- 其他流體類型

- 井型

- 水平的

- 軸

- 地區

- 英國

- 俄羅斯

- 挪威

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Cuadrilla Resources Ltd

- PJSC Rosneft Oil Company

- PJSC Gazprom

- IGas Energy PLC

- PAO NOVATEK

- Equinor ASA

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 52925

The Europe Hydraulic Fracturing Fluids Market is expected to register a CAGR of 0.66% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the increasing demand for oil and gas and the countries trying to reduce their dependence on imports have been boosting the growth in the sector.

- On the other hand, the impact of hydraulic fracturing on the environment and technological constraints have impeded the growth in the industry. Many countries, including the Netherlands and Ireland, have banned the process of hydraulic fracturing, which also caused concerns in the hydraulic fracturing market.

- The pipeline being built through the Baltic Sea is expected to add to the demand for Russian gas. An increase in demand may lead companies to invest in unconventional resources, which can become an opportunity for companies in the oil and gas industry.

- Russia is expected to dominate the market over the forecast period due to the presence of economically feasible shale reserves in the country.

Europe Hydraulic Fracturing Fluids Market Trends

Natural Gas to Witness Significant Growth

- Natural gas is a cleaner alternative to oil, and its demand is likely to increase considerably during the forecast period. New projects of natural gas-powered plants, LNG bunkering, and district heating are expected to increase the demand for natural gas in Europe.

- The only countries that are expected to use hydraulic fracturing in Europe are the United Kingdom, Russia, and, to some extent, Poland. However, technological constraints in Poland, economic feasibility issues in Russia, and environmental concerns in the United Kingdom have impeded growth in the sector.

- In February 2022, six new oil and gas fields in the North Sea received approval from the UK government. The finance department pushed the senior authorities to fast-track the licenses for constructing the six energy areas. The growing natural gas fields will support the growth of the hydraulic fracturing fluids market in the future.

- Hence, shale gas production is expected to increase through hydraulic fracturing. Still, a lot is dependent upon the price of shale gas and technological constraints in the production of shale gas.

Russia to Dominate the Market

- Russia has significant shale oil and the biggest potential in shale gas reserves. Bazhenov Shale is known to be the biggest shale reserve in the world. As cheaper sites are abundant, shale gas development in Bazhenov is expected to start in 2024.

- As of 2021, Russia is the world's second-largest producer of natural gas, behind the United States. It also has the world's largest gas reserves and is the world's largest gas exporter. In 2021, the country produced 762 bcm of natural gas and exported approximately 210 bcm via pipeline.

- The pipeline being built through the Baltic Sea (Nord Stream 2) is expected to add to the demand for Russian gas. As of now, the pipeline must go through several countries, which increases the cost of the overall gas, thereby reducing the profit margin for Russian corporations.

- Russia has been expanding its liquefied natural gas (LNG) capacity to compete with growing LNG exports from the United States, Australia, and Qatar. In 2021, the government released a long-term LNG development plan, targeting 110-190 bcm/year LNG exports by 2025.

- In February 2022, Yakutia LNG, a 17.7 million metric ton/year (mmty) liquefaction project proposed for the Russian Republic of Yakutia, is planned to start in 2027 to deliver liquefied natural gas (LNG) from Russia's Far Eastern coast to China. This project is expected to reach a final investment decision (FID) in 2023.

- Hence, Russia is expected to dominate the market due to an increase in investments in the hydraulic fracturing sector and the private sector's push to discover new avenues of growth in the oil and gas industry.

Europe Hydraulic Fracturing Fluids Industry Overview

The European hydraulic fracturing fluids market is moderately fragmented. Some of the key players in the market (in no particular order) include Cuadrilla Resources Ltd, PJSC Rosneft Oil Company, PJSC Gazprom, PAO NOVATEK, and IGas Energy PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, Until 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Resource Type

- 5.1.1 Oil

- 5.1.2 Natural Gas

- 5.2 Fluid Type

- 5.2.1 Slick Water-based Fluid

- 5.2.2 Foam-based Fluid

- 5.2.3 Gelled Oil-based Fluid

- 5.2.4 Other Fluid Types

- 5.3 Well Type

- 5.3.1 Horizontal

- 5.3.2 Vertical

- 5.4 Geography

- 5.4.1 United Kingdom

- 5.4.2 Russia

- 5.4.3 Norway

- 5.4.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cuadrilla Resources Ltd

- 6.3.2 PJSC Rosneft Oil Company

- 6.3.3 PJSC Gazprom

- 6.3.4 IGas Energy PLC

- 6.3.5 PAO NOVATEK

- 6.3.6 Equinor ASA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219