|

市場調查報告書

商品編碼

1640447

二甲苯:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Xylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

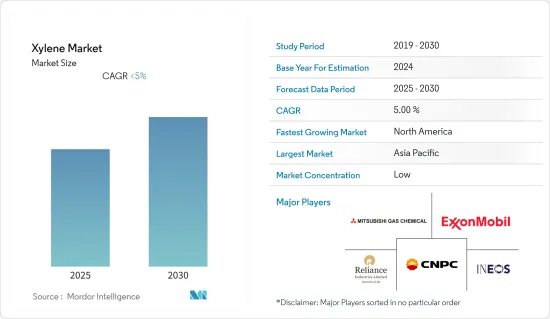

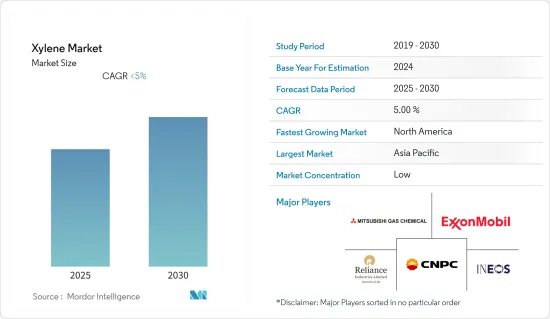

預測期內,二甲苯市場預計將以低於 5% 的複合年成長率成長。

新冠肺炎疫情對市場產生了中等影響。二甲苯用作油漆稀釋劑的溶劑。新冠疫情導致全球建設活動停頓。然而,面罩、透明口罩、食品和電子商務包裝的使用增加,刺激了對精對苯二甲酸、對苯二甲酸二甲酯和聚對苯二甲酸乙二醇酯等二甲苯衍生物的需求。這刺激了對二甲苯的需求。然而,由於終端用戶產業的成長趨勢,預計 2022 年市場將穩定成長。

關鍵亮點

- 短期內,市場受到快速成長的終端用戶產業需求的推動。

- 然而,二甲苯的毒性作用和消費者對無塑膠產品的日益增強的認知預計會阻礙市場的成長。

- 由於頁岩油的發現而產生的廉價原料和生物基二甲苯產量的上升趨勢可能會在預測期內帶來有利的機會。

- 預計在評估期內,亞太地區的二甲苯市場將出現健康成長,因為二甲苯因其優良性能將在塑膠、聚合物、油漆和塗料以及黏合劑等終端用途領域大量使用。

二甲苯市場趨勢

市場主導的溶劑應用

- 二甲苯大部分被用作橡膠、皮革、油漆和印刷工業的溶劑。二甲苯的其他用途包括作為化學中間體、節能燃料和航空燃料以及作為呼吸設備(吸入器)的混合劑。

- 由於其特性和化學結構,二甲苯非常適合溶解難溶於水的化合物。二甲苯具有揮發性,容易蒸發。因此,當化合物需要溶解但溶劑需要蒸發時,就會使用它們。

- 二甲苯是矽晶圓和鋼的良好清洗,也用於對多種材料進行消毒。二甲苯是生產汽油、石油和噴射機燃料的原料。

- 由於投資和擴建,油漆和塗料領域的二甲苯使用量正在增加。例如,根據美國油漆協會的數據,2022 年美國油漆和塗料行業的產量約為 13.6 億加侖。預計到 2023 年將超過 13.8 億加侖。

- 此外,根據美國塗料協會的數據,到 2022 年,建築塗料將占美國油漆和塗料市值的 51%。 OEM塗料佔29%,特殊用途塗料佔20%。同年,美國油漆和塗料市場價值約 310 億美元。

- 因此,由於這些因素,市場溶劑部分在預測期內可能會出現成長。

中國主宰亞太地區

- 在亞太地區,中國是全球最大的生產基地。它也是對二甲苯的最大生產國和消費國。

- 中國有20個二甲苯產能擴張計畫正在規劃或宣布,到2025年總產能將達到約2,436萬噸/年。該國的資本支出(CapEx)預計為 106.9 億美元。浙江石化岱山二甲苯工廠二期預計將成為新增產能的主要項目。

- 中國石化企業正大幅擴張PTA產能。 2022年12月,英力士與中石化成立合資企業,在中國天津建造新的石化綜合體。這些合約的總合為每年 700 萬噸,總價值約為 100 億美元。

- INEOS 同意收購中國石油化學股份有限公司子公司上海賽科石油化學有限公司(「賽科」) 50% 的股份。賽科目前生產420萬噸石化產品,包括二甲苯、甲苯、乙烯、丙烯、聚乙烯、聚丙烯、苯乙烯、聚苯乙烯、丙烯腈、丁二烯和苯。該綜合體佔地 200 公頃,位於上海化學工業園區。

- 中國是PET樹脂的重要生產國,其中中油集團和江蘇三房巷是全球產量最大的生產商,產能都超過200萬噸。因此,終端用戶產業對 PET 的需求不斷增加,推動了對二甲苯的需求。

- 杜邦公司決定投資約 3,000 萬美元在中國東部江蘇省張家港市建造一個新的黏合劑生產工廠。該工程預計將於 2021 年底開工,並預計於 2023 年初投入運作。

- 因此,由於投資增加和終端用戶行業需求增加,二甲苯市場在預測期內可能會成長。

二甲苯產業概況

二甲苯市場較為分散。主要企業(不分先後順序)包括埃克森美孚、信實工業有限公司、英力士、中國石油天然氣集團公司、三菱瓦斯化學株式會社。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大二甲苯作為溶劑和單體的用途

- 快速成長的終端用戶產業的需求不斷增加

- 限制因素

- 二甲苯使用的有害健康影響及管制

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 類型

- 鄰二甲苯

- 間二甲苯

- 對二甲苯

- 混合二甲苯

- 應用

- 溶劑

- 單體

- 其他

- 最終用戶產業

- 塑膠和聚合物

- 油漆和塗料

- 膠水

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Braskem

- China Petroleum & Chemical Corporation

- CNPC(China National Petroleum Corporation)

- ENEOS Corporation

- Exxon Mobil Corporation

- Fujan Refining & Petrochemical Company Limited

- Indian Oil Corporation Ltd

- INEOS

- Mangalore Refinery & Petrochemicals Ltd

- Mitsubishi Gas Chemical Company, Inc.

- Reliance Industries Limited

- SK geo centric Co., Ltd.

- S-Oil Corporation

- TotalEnergies

第7章 市場機會與未來趨勢

- 生物基二甲苯產量呈成長趨勢

The Xylene Market is expected to register a CAGR of less than 5% during the forecast period.

The COVID-19 pandemic moderately impacted the market. Xylenes are used in paint thinners as solvents. Construction activities were halted globally due to the COVID-19 outbreak. However, the use of face shields, transparent masks, food, and e-commerce packaging increased, thus, enhancing the demand for xylene derivatives, including purified terephthalate acid, dimethyl terephthalate, and polyethylene terephthalate. This factor stimulated the xylene demand. However, the market is projected to grow steadily, owing to growth trends in the end-user industries in 2022.

Key Highlights

- Over the short term, the increasing demand from the rapidly growing end-user industries is driving the market.

- However, the toxic effects of xylenes and increased consumer awareness regarding plastic-free products are expected to hinder the market's growth.

- Nevertheless, cheaper feedstock through shale oil discoveries and a rising trend for the production of bio-based xylene are likely to act as an opportunity during the forecast period.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the xylene market due to the vast usage of xylene in end-use application segments, such as plastics, polymers, paints and coatings, adhesives, etc., due to their desirable properties.

Xylene Market Trends

Solvent Application to Dominate the Market

- The majority of xylene is used as a solvent for rubber, leather, paints, and printing industries. Other applications of xylene include chemical intermediates and blending agents for high-motor and aviation fuels and breathing devices (inhalers).

- It is very good at dissolving compounds that dissolve poorly in water, owing to its properties and chemical structure. Xylene is volatile, which means it evaporates readily. For this reason, it is used in applications where the manufacturer needs to dissolve a compound but evaporate the solvent.

- It is a good cleaning agent for silicon wafers and steel and is also used to sterilize several substances. Xylene is used as a feedstock in the production of petrol, gasoline, and jet fuel.

- The use of xylene in the paints and coatings sector is increasing due to investments and expansions. For instance, according to the American Coatings Association, the paint and coatings industry in the United States produced around 1.36 billion gallons in 2022. In 2023, the industry's output is expected to exceed 1.38 billion gallons.

- Moreover, according to the American Coatings Association, architectural coatings accounted for 51% of the paint and coatings market value in the United States in 2022. OEM and special purpose coatings held 29 and 20% of the market, respectively. The worth of the US paints and coatings market was approximately USD 31 billion in the same year.

- Thus, due to these factors, the solvents segment of the market may register growth during the forecast period.

China to Dominate the Asia-Pacific Region

- In Asia-Pacific, China includes the biggest production houses in the world. It is also the largest manufacturer and consumer of paraxylene.

- China includes 20 planned and announced xylene capacity additions, with a total capacity of about 24.36 Mtpa by 2025. The country is expected to spend a capital expenditure (CapEx) of USD 10.69 billion. Major capacity additions are expected from Zhejiang Petrochemical Daishan Xylene Plant 2.

- Petrochemical companies in China are massively increasing their PTA capacities. In December 2022, INEOS and SINOPEC formed a joint venture to construct a new petrochemicals complex in Tianjin, China. The agreements will have a combined capacity of 7 million tonnes per year, with a total value of roughly USD 10 billion.

- INEOS agreed to acquire a 50% stake in Shanghai SECCO Petrochemical Company Limited ("SECCO"), a China Petroleum & Chemical Corporation subsidiary. SECCO presently includes a 4.2 million-tonne capacity for petrochemicals such as xylene, toluene, ethylene, propylene, polyethylene, polypropylene, styrene, polystyrene, acrylonitrile, butadiene, and benzene. It is a 200-hectare complex in the Shanghai Chemical Industry Park.

- China is a significant producer of PET resins, with the PetroChina Group and Jiangsu Sangfangxiang among the most prominent global manufacturers in terms of volume, with more than 2 million ton capacity. Thus, the rising demand for PET from end-user industries is driving the demand for paraxylene.

- DuPont decided to invest approximately USD 30 million in building a new manufacturing facility in the adhesive sector in Zhangjiagang, Jiangsu Province, in East China. Construction began in late 2021, and the facility is expected to be operational by early 2023.

- Therefore, the xylene market will likely grow with the increasing investments and demand from end-user industries during the forecast period.

Xylene Industry Overview

The xylene market is fragmented in nature. The major companies (not in any particular order) include Exxon Mobil Corporation, Reliance Industries Limited, INEOS, CNPC (China National Petroleum Corporation), and Mitsubishi Gas Chemical Company, Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Xylene as Solvents and Monomers

- 4.1.2 Increasing Demand from the Rapidly Growing End-user Industries

- 4.2 Restraints

- 4.2.1 Toxic Health Effects and Regylations on Usage of Xylenes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Ortho-xylene

- 5.1.2 Meta-xylene

- 5.1.3 Para-xylene

- 5.1.4 Mixed Xylene

- 5.2 Application

- 5.2.1 Solvent

- 5.2.2 Monomer

- 5.2.3 Other Applications

- 5.3 End-user Industry

- 5.3.1 Plastics and Polymers

- 5.3.2 Paints and Coatings

- 5.3.3 Adhesives

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Braskem

- 6.4.2 China Petroleum & Chemical Corporation

- 6.4.3 CNPC (China National Petroleum Corporation)

- 6.4.4 ENEOS Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Fujan Refining & Petrochemical Company Limited

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 INEOS

- 6.4.9 Mangalore Refinery & Petrochemicals Ltd

- 6.4.10 Mitsubishi Gas Chemical Company, Inc.

- 6.4.11 Reliance Industries Limited

- 6.4.12 SK geo centric Co., Ltd.

- 6.4.13 S-Oil Corporation

- 6.4.14 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Trend for the Production of Bio-based Xylene