|

市場調查報告書

商品編碼

1640461

異氰酸酯-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Isocyanates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

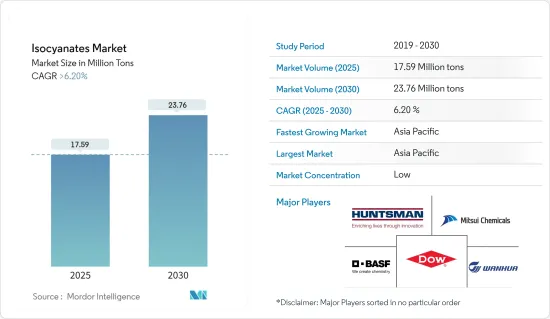

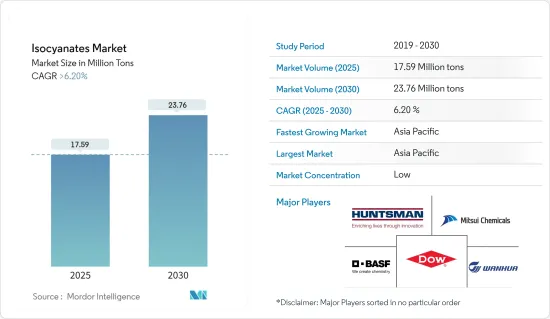

異氰酸酯市場規模預計在 2025 年將達到 1,759 萬噸,預計到 2030 年將達到 2,376 萬噸,預測期內(2025-2030 年)的複合年成長率將超過 6.2%。

關鍵亮點

- 從中期來看,聚氨酯泡棉的應用範圍不斷擴大、亞太地區工業化程度不斷提高以及建築業的需求不斷成長等因素正在推動所研究市場的需求。

- 然而,原料短缺和價格上漲可能會抑制市場成長。

- 製造商對研發活動的投資不斷增加以及生物基異氰酸酯的高效率預計將在未來幾年為市場成長創造機會。

- 由於工業化程度不斷提高,亞太地區在異氰酸酯市場佔據主導地位,並且很可能在預測期內實現高成長率。

異氰酸酯市場趨勢

疫情過後汽車產量增加將推動市場

- 異氰酸酯在汽車塗料中起著至關重要的作用。這些化學物質是硬化劑的關鍵成分,特別是對於面漆和透明塗層。此外,異氰酸酯對於汽車內部製造至關重要,可提供座椅、方向盤和地毯中軟性的一體式發泡系統。

- 根據國際汽車結構組織(OICA)預測,全球汽車產量將從2022年的8,483萬輛增加至2023年的9,354萬輛,年增率為17%。

- 根據OICA報告,2023年北美輕型車產量預計將達到近140萬輛,與前一年同期比較增加9.5%。僅在美國就生產了超過一百萬輛汽車,該地區是汽車領域異氰酸酯產品的重要市場。

- 此外,亞太地區是一些世界領先汽車製造商的所在地。中國、印度、日本和韓國等國家正在加強製造基礎、完善供應鏈以提高盈利。根據OICA報告,預計2023年亞太地區輕型汽車產量將達到約5,180萬輛,成長率為10%,顯示汽車領域對異氰酸酯基產品的需求不斷增加。

- 汽車產業正日益轉向電動車(EV),並獲得各大汽車製造商的大力投資。根據自然資源保護委員會 (NRDC) 的數據,到 2023 年,企業將在電動車領域金額高達2,100 億美元,而拜登總統任期開始時的2021 年這一數字僅為500 億美元。已經大幅增加。這一軌跡為異氰酸酯在電動車生產中的應用鋪平了道路,特別是在黏合劑和被覆劑領域。

- 因此,由於上述原因,預計預測期內汽車產業的需求將實現正成長。

亞太地區佔市場主導地位

- 在亞太地區,中國已成為全球聚氨酯產品的生產國和消費國。在中國市場,聚氨酯的主要成分MDI是生產硬質泡沫和軟質泡沫所必需的。

- 國際聚氨酯技術公司的資料凸顯了中國在該地區的主導地位。預計2023年聚氨酯產量將增加0.7%至970萬噸。

- 在印度,MDI 的主要用途是聚氨酯,在黏合劑、密封劑、發泡體、油漆和被覆劑等各種應用領域的成長迅速。推動這一繁榮的因素包括蓬勃發展的中產階級、不斷增加的可支配收入、都市化和大規模基礎設施投資。

- 印度建築業可望成為世界第三大建築業。智慧城市和全民住宅項目等政府計劃正在推動該產業的發展。此外,印度的能源效率法規涵蓋照明、暖通空調和隔熱等領域,促進商業建築的永續發展。

- 由於建築、汽車和家具行業的需求不斷成長,聚氨酯產量蓬勃發展,日本成為異氰酸酯市場成長的亮點。

- 日本的汽車產業在全球處於領先地位,日本汽車工業協會 (JAMA) 報告稱,2023 年汽車產量將達到 8,572,848 輛,年成長率為 16.1%。

- 因此,亞太地區很可能在預測期內主導市場。

異氰酸酯產業概況

異氰酸酯市場部分整合,全球市場佔有率由少數幾家公司瓜分。市場的主要企業包括(不分先後順序):陶氏化學、BASF歐洲公司、萬華化學集團、亨斯邁股份有限公司和三井化學公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 聚氨酯泡棉應用成長強勁

- 亞太地區工業化活動不斷增加

- 建築業需求增加

- 限制因素

- 原物料短缺和價格上漲

- 危險特性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格趨勢

- 監理政策分析

第5章 市場區隔(市場規模(數量))

- 按類型

- MDI

- TDI

- 脂肪族

- 其他

- 按應用

- 硬質泡沫

- 柔軟泡沫

- 畫

- 黏合劑和密封劑

- 合成橡膠

- 粘合劑

- 其他

- 按最終用戶產業

- 建築和施工

- 車

- 醫療

- 家具

- 其他最終用戶產業(航太、電子、船舶等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 西班牙

- 土耳其

- 北歐國家

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率**/排名分析

- 主要企業策略

- 公司簡介

- Anderson Development Company

- Asahi Kasei Chemicals

- BASF SE

- BorsodChem

- China National Bluestar(Group)Co. Ltd

- Chemtura Corp.

- Covestro

- DowDuPont Inc.

- Evonik Industries

- Huntsman Corporation LLC

- Kemipex

- Korea Fine Chemical Co. Ltd

- Kumho

- MITSUI CHEMICALS AMERICA INC.

- Perstorp

- Tosoh Corporation

- Vencorex

- Wanhua Chemical Group Co. Ltd

第7章 市場機會與未來趨勢

- 製造商加大研發投入

- 高效生物基異氰酸酯

簡介目錄

Product Code: 53269

The Isocyanates Market size is estimated at 17.59 million tons in 2025, and is expected to reach 23.76 million tons by 2030, at a CAGR of greater than 6.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors like growing applications of polyurethane foam, growing industrialization in Asia-Pacific, and growing demand from the construction industry are propelling the demand in the market studied.

- However, shortages and increased prices of raw materials are likely to restrain the market's growth.

- Growing investments by manufacturers in R&D activities and the high efficiency of bio-based isocyanates are expected to create opportunities for market growth in the future.

- Due to increased industrialization, Asia-Pacific dominated the isocyanates market, which is likely to witness a high growth rate during the forecast period.

Isocyanates Market Trends

Growing Automotive Production Post-Pandemic is Propelling the Market

- Isocyanates play a pivotal role in automotive coatings. These chemicals serve as key components in hardeners, particularly in topcoats and clearcoats. Furthermore, isocyanates are integral to producing automotive interiors and are utilized in flexible and integral foam systems found in seats, steering wheels, and carpets.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global automotive production surged from 84.83 million units in 2022 to 93.54 million units in 2023, marking a 17% annual increase.

- Light vehicle production in North America showcased a Y-o-Y rise of 9.5% in 2023, reaching nearly 1.4 million units, as reported by OICA. With over 1 million units rolling out from the United States alone, the region stands out as a pivotal market for isocyanate-based products in the automotive sector.

- Furthermore, Asia-Pacific boasts some of the world's most esteemed vehicle manufacturers. Nations like China, India, Japan, and South Korea are bolstering their manufacturing foundations and refining supply chains for enhanced profitability. OICA reported that in 2023, Asia-Pacific produced approximately 51.8 million light vehicles, marking a 10% growth rate and signaling heightened demand for isocyanate-based products in the automotive realm.

- The automotive sector is increasingly pivoting toward electric vehicles (EVs), underscored by substantial investments from leading automakers. According to the Natural Resources Defense Council (NRDC), in 2023, companies committed a staggering USD 210 billion to the EV sector, a leap from just over USD 50 billion at the onset of President Biden's term in 2021. This trajectory opened avenues for isocyanate applications in EV production, notably in adhesives and coatings.

- Hence, for the reasons above, the demand from the automotive sector is expected to witness positive growth during the forecast period.

Asia-Pacific to Dominate the Market

- China emerges as the dominant global producer and consumer of polyurethane products in Asia-Pacific. In the Chinese market, MDI, a key ingredient for polyurethanes, is crucial for producing rigid and flexible foams.

- Data from Urethanes Technology International highlights China's dominance in the region. Polyurethane production increased 0.7% to 9.7 million tons in 2023.

- In India, MDI's primary application, polyurethane, is experiencing a surge in a wide array of applications, including adhesives and sealants, foams, paints, and coatings. This boom is fueled by a burgeoning middle class, rising disposable incomes, urbanization, and significant infrastructure investments.

- India's construction sector is poised to become the world's third-largest. Government initiatives, including the Smart Cities and Housing for All projects, are set to bolster the industry. Furthermore, energy efficiency regulations in India target areas like lighting, HVAC systems, and insulation, promoting sustainable practices in commercial buildings.

- Japan is witnessing a surge in polyurethane production, driven by growing demand from the construction, automotive, and furniture sectors, signaling a positive outlook for isocyanate market growth.

- Japan's automotive sector, a global frontrunner, saw a notable 16.1% annual growth in motor vehicle production in 2023, with figures reaching 8,572,848 units, as reported by the Japan Automotive Manufacturers Association (JAMA).

- Hence, Asia-Pacific is likely to dominate the market during the forecast period.

Isocyanates Industry Overview

The isocyanate market is partly consolidated as the global market share is divided among a few companies. Some of the key players in the market include Dow, BASF SE, Wanhua Chemical Group Co. Ltd, Huntsman Corporation LLC, and Mitsui Chemicals Inc. (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Huge Growth in the Polyurethane Foam Application

- 4.1.2 Increase in Industrialization Activities in Asia-Pacific

- 4.1.3 Increasing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Shortage and Increased Price of Raw Material

- 4.2.2 Hazardous in Nature

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend

- 4.6 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 MDI

- 5.1.2 TDI

- 5.1.3 Aliphatic

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Rigid Foam

- 5.2.2 Flexible Foam

- 5.2.3 Paints & Coatings

- 5.2.4 Adhesives & Sealants

- 5.2.5 Elastomers

- 5.2.6 Binders

- 5.2.7 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.4 Furniture

- 5.3.5 Other End-user Industries (Aerospace, Electronics, Water Vessels, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Turkey

- 5.4.3.8 Nordic Countries

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 Nigeria

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anderson Development Company

- 6.4.2 Asahi Kasei Chemicals

- 6.4.3 BASF SE

- 6.4.4 BorsodChem

- 6.4.5 China National Bluestar (Group) Co. Ltd

- 6.4.6 Chemtura Corp.

- 6.4.7 Covestro

- 6.4.8 DowDuPont Inc.

- 6.4.9 Evonik Industries

- 6.4.10 Huntsman Corporation LLC

- 6.4.11 Kemipex

- 6.4.12 Korea Fine Chemical Co. Ltd

- 6.4.13 Kumho

- 6.4.14 MITSUI CHEMICALS AMERICA INC.

- 6.4.15 Perstorp

- 6.4.16 Tosoh Corporation

- 6.4.17 Vencorex

- 6.4.18 Wanhua Chemical Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments by the Manufactures in R&D Activities

- 7.2 High-Efficiency Bio-based Isocyanates

02-2729-4219

+886-2-2729-4219