|

市場調查報告書

商品編碼

1640468

苯 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Benzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

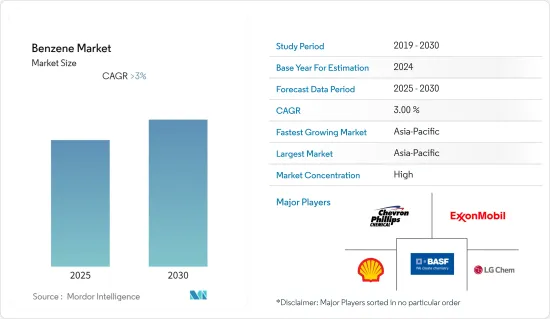

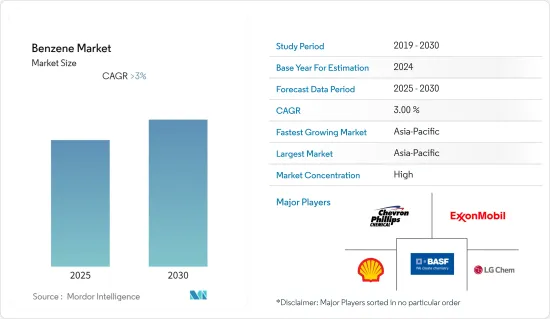

預計預測期內苯市場複合年成長率將超過 3%。

2020年的市場受到了COVID-19的影響。汽車製造設備的暫時關閉,導致尼龍輪胎、發泡板和由苯衍生中間體(如尼龍、苯乙烯和酚醛樹脂)製成的塗料等產品的需求降至最低,從而對市場需求產生了負面影響。造成影響。然而,自從限制解除以來,該行業已經恢復良好。對乙醯胺酚等消耗苯衍生中間體(如氯苯)的藥物的需求不斷增加,刺激了製藥業的市場需求。此外,在食品和電子商務應用中,由苯衍生的中間體聚苯乙烯製成的包裝的使用正在增加,這推動了對苯市場的需求。

關鍵亮點

- 紡織、包裝、建築等各終端用戶產業對苯乙烯聚合物的需求不斷增加,預計將推動市場成長。

- 苯暴露的不利影響可能會阻礙市場成長。

- 未來幾年,如果對生物基苯的需求持續增加,市場可能會看到更多收益的機會。

預計亞太地區將佔據最大的市場佔有率,並在預測期內以最高的複合年成長率成長。

苯市場趨勢

乙苯需求不斷增加

- 乙苯是一種高度易燃、無色、具有芳香氣味的液體。主要用於生產苯乙烯。

- 苯乙烯用於製造聚苯乙烯、丙烯腈-丁二烯-苯乙烯 (ABS)、苯乙烯-丙烯腈 (SAN) 樹脂、苯乙烯-丁二烯合成橡膠、乳膠和不飽和聚酯樹脂。

- 苯乙烯聚合物有多種用途,包括電視、IT 設備、一次性醫療產品(例如檢測套組)、家用電子電器產品、可攜式揚聲器和盒式磁帶外殼。

- 根據OEC統計,2022年9月,中國苯乙烯聚合物出口額為7,390萬美元。 2021年9月至2022年9月,中國苯乙烯聚合物出口增加了2,190萬美元(42.1%),從5,200萬美元增加至7,390萬美元。

- 根據世界銀行統計,美國出口了97,729,500公斤初級形狀的苯乙烯聚合物(可發性聚苯乙烯),價值198,686,760美元。

- 根據印度化學和石化工業委員會 (CPMAI) 的數據,2020-21 年印度苯乙烯進口量為 799 千噸,隨著國內需求的增加,消費量可能會上升。

- 由於兩國對橡膠輪胎的需求不斷增加,對苯乙烯的需求也持續成長。根據國家統計局數據,2020年全國輪胎產量達8,0747萬條。預計未來幾年這數字還會進一步增加。

- 根據世界銀行的數據,2021 年苯乙烯聚合物的最大出口國是荷蘭(620,109,100 美元)、亞洲其他地區(409,224,450 美元)、土耳其(291,832,220 美元)、比利時(2,171,620 美元)和中國(236,620 美元)。美元),以及希臘(248,471,970 美元)。

- 除了苯乙烯之外,乙苯還可用作燃料的溶劑和其他化學用途的中間體。這些應用可能會使乙苯的需求保持在高位並促進其成長。

亞太地區佔市場主導地位

- 亞太地區目前佔據市場主導地位,佔全球苯消費量的近一半。

- 此外,由於電子和家用電子電器產品、包裝和建築的終端用戶市場不斷成長,預計中國、印度和東南亞國協將成為預測期內成長最快的市場。

- 根據世界銀行統計,2021年韓國出口了價值2254,944,800美元的苯,而印度出口了價值1,674,461,730美元的苯。泰國是第三大苯出口國,出口額為 591,338,610 美元。

- 苯廣泛用於製造黏合劑、油漆、地板材料和玻璃纖維等建築產品。根據中國國家統計局的數據,2021 年全國建築業總產值約為 29.31 兆元人民幣(4.54 兆美元),這可能會提振該地區的苯需求。

- 2021年,中國營企業恆逸石化宣布計畫建立一座石腦油裂解裝置,增加80,000噸/年的苯生產能力以及其他產品。

- 信實工業有限公司是該地區主要企業的苯生產商之一,年生產能力達1400噸,不僅滿足印度國內需求,也出口到世界各國。

- 由於這些原因,未來幾年亞太地區可能需要更多的苯。

苯行業概況

苯市場正在盤整。市場上的主要企業(不分先後順序)包括BASF SE、雪佛龍菲利普斯化學公司、埃克森美孚公司、LG 化學公司和殼牌公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 各終端用戶產業對苯乙烯聚合物的需求不斷增加

- 其他促進因素

- 限制因素

- 接觸苯的不良影響

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 技術簡介

- 貿易分析

- 價格趨勢

- 監理政策分析

第5章 市場區隔(市場規模(數量))

- 衍生性商品

- 乙苯

- 異丙苯

- 烷基苯

- 環己烷

- 硝基苯

- 其他衍生物(苯胺、順丁烯二酸酐等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Braskem

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- Eastman Chemical Company

- Exxon Mobil Corporation

- Flint Hills Resources

- Hengyi Industries Sdn Bhd

- INEOS

- LG Chem

- LyondellBasell Industries Holdings BV

- Marathon Petroleum Company

- Maruzen Petrochemical

- Mitsubishi Chemical Corporation

- Reliance Industries Limited

- Shell PLC

- SABIC

- SIBUR

第7章 市場機會與未來趨勢

- 生物基苯需求不斷成長

The Benzene Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. Temporary halts in the automotive manufacturing units minimized the demand for products like nylon tires, foam seating, and paints, which are made from benzene-derived intermediates like nylon, styrene, and phenol resins, thus negatively impacting market demand. However, the sector has been recovering well since restrictions were lifted. The demand for drugs like paracetamol, which consumes benzene-derived intermediates such as chlorobenzene, has increased, thus stimulating market demand in the pharmaceutical sector. Furthermore, the usage of packaging made up of polystyrene, an intermediate derived from benzene, has increased in food and e-commerce applications, which, in turn, has boosted the market demand for benzene.

Key Highlights

- The increasing demand for styrene polymers from various end-user industries, such as textile, packaging, and building and construction, is expected to drive the market's growth.

- Detrimental effects of benzene exposure may hinder the market's growth.

- In the coming years, the market may have more chances to make money if the demand for bio-based benzene keeps going up.

During the forecast period, the Asia-Pacific region is expected to have the largest market share and the highest CAGR.

Benzene Market Trends

Increasing Demand for Ethylbenzene

- Ethylbenzene is a highly flammable, colorless liquid with an aromatic odor. It is primarily used to manufacture styrene.

- Styrene is used to make things like polystyrene, acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers, latexes, and unsaturated polyester resins.

- Styrene polymers are used in many things, like TVs, IT equipment, one-time use medical products (like test kits), consumer electronics, portable speakers, and the housing for cassette tapes.

- According to OEC, in September 2022, China's styrene polymer exports accounted for USD 73.9 million. Between September 2021 and September 2022, the exports of China's styrene polymers increased by USD 21.9 million (42.1%), from USD 52 million to USD 73.9 million.

- According to the World Bank, the United States exported 97,729,500 kg of styrene polymers (expansible polystyrene) in primary forms worth USD 198,686.76 thousand.

- According to the Chemical and Petrochemicals Manufacturers Association of India (CPMAI), styrene imports in India stood at 799 kilotons in FY2020-21, and the consumption is likely to increase as per the rising demand in the country.

- The demand for styrene is continuously growing due to an increased demand for rubber tires in both countries. According to the National Bureau of Statistics of China, the country's tire production reached 807.47 million units in 2020. It is further expected to increase in the upcoming years.

- According to the World Bank, in 2021, the top exporters of styrene polymers were the Netherlands (USD 620,100.91K), Other Asia (USD 409,224.45K), Turkey (USD 291,832.22K), Belgium (USD 248,619.88K), and Greece (USD 248,471.97K).

- Besides styrene, ethylbenzene is also used as a solvent in fuels and as an intermediate for other chemical applications. These uses are likely to keep the demand for ethylbenzene high and help it grow, which will boost the benzene market in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific currently leads in benzene consumption, accounting for roughly half of global consumption.

- The region is also expected to be the fastest-growing market during the forecast period, with an increasing market for end-users like electronics and home appliances, packaging, and construction in China, India, and ASEAN countries.

- According to the World Bank, in 2021, South Korea exported USD 2,254,944.80 thousand of benzene, while India exported USD 1,674,461.73 thousand. Thailand ranked third among the largest exporters of benzene, with data revealing USD 591,338.61 thousand of benzene was exported by the country.

- Benzene is widely used to produce construction products like adhesives, paints, flooring, and fiberglass. According to the National Bureau of Statistics of China, in 2021, the country's construction output was valued at approximately CNY 29.31 trillion (USD 4.54 trillion), which is likely to boost the demand for benzene in the region.

- In 2021, China's private-sector Hengyi Petrochemical announced its plan to set up a naphtha cracker that will add 80,000 TPA of benzene capacity along with other products.

- Reliance Industries Limited is among the top players in the production of benzene in the region, with an annual production capacity of 1400 KT, which sustains the domestic demand in India and exports to various countries globally.

- Because of these things, the Asia-Pacific region is likely to need more benzene over the next few years.

Benzene Industry Overview

The benzene market is consolidated in nature. Some of the major players in the market (not in any particular order) include BASF SE, Chevron Phillips Chemical Company LLC, ExxonMobil Corporation, LG Chem, and Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Styrene Polymers from Various End-user Industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Detrimental Effects of Benzene Exposure

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Trade Analysis

- 4.7 Price Trends

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Ethylbenzene

- 5.1.2 Cumene

- 5.1.3 Alkylbenzene

- 5.1.4 Cyclohexane

- 5.1.5 Nitrobenzene

- 5.1.6 Other Derivatives (Aniline, Maleic Anhydride, Etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Braskem

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 Eastman Chemical Company

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Flint Hills Resources

- 6.4.8 Hengyi Industries Sdn Bhd

- 6.4.9 INEOS

- 6.4.10 LG Chem

- 6.4.11 LyondellBasell Industries Holdings BV

- 6.4.12 Marathon Petroleum Company

- 6.4.13 Maruzen Petrochemical

- 6.4.14 Mitsubishi Chemical Corporation

- 6.4.15 Reliance Industries Limited

- 6.4.16 Shell PLC

- 6.4.17 SABIC

- 6.4.18 SIBUR

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Bio-based Benzene