|

市場調查報告書

商品編碼

1640477

中東和非洲智慧計量:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Middle East and Africa Smart Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

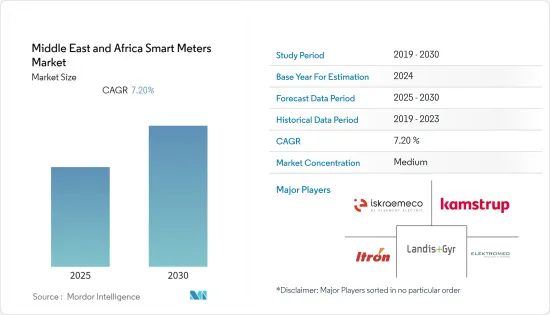

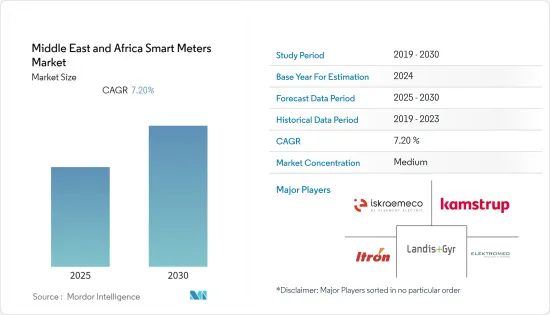

預計預測期內中東和非洲的智慧電錶市場複合年成長率將達到 7.2%。

經濟和人口的快速成長推動了能源需求的增加,中東和非洲對能源管理的需求很高,從而推動了市場成長。

關鍵亮點

- 由於迫切需要解決能源消費量的成長問題,智慧電錶變得越來越普及。這些儀表允許儀表和公用事業的中央系統之間進行雙向通訊。因此,正在進行的幾個計劃依靠智慧電錶來改善天然氣、水和電力資源的管理和利用。

- 由於經濟改善和技術採用的增加,中東和非洲、沙烏地阿拉伯和阿拉伯聯合大公國預計將引領區域市場。人均電力消耗量的增加推動了智慧電錶的需求。然而,缺乏明確的政府政策阻礙了這一領域的投資。此外,阿拉伯聯合大公國政府還計劃在2050年資金籌措6,000億迪拉姆(約1,630億美元),以滿足該國日益成長的能源需求並確保該國經濟的永續成長。

- 智慧電網部署正在擴大,與智慧電錶相關的政府措施和政策前景看好。該地區越來越多的商業、住宅和工業計劃,包括紅海計劃、奇迪亞娛樂城、智慧城市和讓·努維爾在阿爾烏爾的Sharaan 度假村,都需要節能、精準的計量解決方案。蘇。例如,2022年7月,NEOM智慧城市在阿拉伯沙漠中從零開始建成。 NEOM 是一個新的城市計劃,它將基於最新的城市創新來建立一個全新的城市。此外,2022 年 10 月,霍尼韋爾與阿卜杜拉國王金融區 (KAFD) 簽署了一份合作備忘錄,以幫助在沙烏地阿拉伯的主要商業和生活目的地創造永續的智慧城市體驗。預計這將在未來幾年進一步推動市場成長。

- 沙烏地阿拉伯政府的目標是到 2030 年在全國安裝約 1,200 萬台智慧電錶。此外,美國證券交易委員會宣布啟動智慧電錶計劃Wave 的公開競標,該專案涉及部署 200 多萬台智慧電錶、測試設備、通訊基礎設施和前端技術。

- 此外,2022 年 9 月,杜拜電力和水務局宣布競標在杜拜以南約 50 公里處建造一座 900 兆瓦的太陽能發電廠。該計劃預計於 2030 年竣工後,擁有 5GW 的太陽能光伏和聚光型太陽熱能發電(CSP) 容量。

中東和非洲智慧電錶市場趨勢

商業部門佔很大佔有率

- 智慧計量的商業基礎設施包括醫院、辦公室、學校、零售店、餐廳等。預計商業領域發展的大量投資將推動該領域對智慧電錶的需求。對於商務用用戶來說,真正的好處是能夠專注於使用並減少或簡化日常使用。此外,透過分析進行即時監控將使該地區的小型企業能夠解決任何浪費問題。

- 南非學校供水短缺導致智慧水錶廣泛採用。 2022年2月,政府開始在開普敦學校每天安裝智慧水錶。根據 Isikhokello 小學和 Intukumo 中學報告,他們每天共節水約 25,000 公升。此外,母親城 200 所學校引進智慧水錶,每天可節省約 200 萬公升水。

- 該地區不斷成長的基礎設施擴張預計將進一步推動對智慧電錶的需求,並吸引市場供應商來滿足廣泛的商業客戶的需求。 2022 年 9 月,西門子宣布打算為亞歷山大監控中心和西亞歷山大配電控制中心提供兩個先進的配電管理系統 (ADMS)。此計劃實施期間將建立先進的計量基礎設施,包括供應30萬台智慧電錶。

- 此外,2022 年3 月,Landis+Gyr Technology Inc. 與Otter Tail Power Company 簽署了一份合作備忘錄,以幫助該公司計劃建設一個更加周到、更加強大的能源網,為中東三個國家提供服務。宣布已簽署合約提供先進的計量基礎設施、軟體和服務。

- 2022 年 8 月,公共服務監理局與其他相關人員合作制定了《國家智慧電錶計畫》,該計畫要求在 2025 年安裝約 120 萬台智慧電錶,涵蓋所有電力消耗。 。預計此類發展將進一步加速市場發展。

政府獎勵和法規推動市場

- 該地區的國家正在實施多項政府舉措,支持在住宅領域推廣智慧電錶。例如,已經啟動了大規模智慧電錶推廣計劃,以支持沙烏地阿拉伯電力公司 (SEC) 提高能源效率的目標。沙烏地阿拉伯的目標是到 2025 年安裝約 1,200 萬台智慧電錶,並增加計量點,特別是在住宅領域。

- 政府措施和法規是在多個市場推出智慧電錶需要考慮的關鍵因素。日益成長的政府支持加上大量的投資預計將推動該全部區域的智慧電錶推廣。

- 例如,根據國際能源總署的數據,2022 年 5 月,石油和天然氣佔中東和北非地區發電量的近 95%。此外,火力發電廠每天還消耗超過2,900億立方公尺的天然氣和175萬桶石油。中東和北非地區經濟體中石化燃料占主導地位,導致其發電排放強度比全球平均高出近四分之一。

- 此外,2022年4月,埃及電力傳輸公司和沙烏地阿拉伯電力公司將電力互連線建設合約授予日立ABB電網主導的財團。沙烏地阿拉伯和埃及將能夠透過該互連管道交換高達 3,000 兆瓦的電力。這些發展對於加速市場發展具有巨大潛力。

- 此外,南非的「2030智慧電網願景」旨在改變該地區的電力格局。我們將透過安裝智慧電錶和整合電網、通訊系統和資訊基礎設施來升級我們老化的電力基礎設施。這將促進創新電網資料分析解決方案的普及。

- 即使在沒有推出智慧電錶或沒有支援立法的市場,公用事業公司也準備在電網損耗較高的地區安裝智慧電錶。此外,低電價使得大型電力公司安裝智慧電錶的吸引力不大,但是為了防止簡單的盜竊,電力公司正準備在功率損耗率最高的家庭安裝電錶。

- 此外,沙烏地阿拉伯 2030 願景以及政府在引進智慧燃氣表方面不斷增加的努力和投資也推動了市場的成長。住宅和商業部門天然氣消費量的增加以及採用智慧技術來平衡供需,推動了智慧燃氣表的普及,主要在中東地區。阿拉伯聯合大公國等國家正在引入智慧燃氣表以確保更準確的儀表讀數,預計將從經濟角度使消費者受益。

- 因此,憑藉上述計劃和雄心勃勃的可再生能源目標,中東地區預計將在研究市場中實現顯著成長。

中東和非洲智慧電錶產業概況

由於中東和非洲的國內企業數量較少,中東和非洲智慧電錶市場的競爭格局主要由在該地區擁有重要供應商/分銷管道和子公司的全球企業主導。市場的主要企業包括 Landis+Gyr Group AG、Kamstrup A/S、Itron Inc.、Iskraemeco dd 和 Elektromed(Termikel Group)。國內科技公司正在與全球智慧計量公司建立策略夥伴關係,以利用他們的技術專長並擴大其在國內的影響力。因此,我們更有可能贏得更多來自地方政府的合約。

- 2022 年 8 月:杜拜電力和水務局 (DEWA) 推出專有軟體,使網路設計工程師能夠擴大配電網。該機構正致力於利用基於人工智慧的程式來提高該國供水網路的效率,因此發布了這項聲明。這些解決方案可以根據感測器資料預測智慧電錶和泵浦的故障,並在客戶場所發生洩漏時自動向客戶發送通知。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 能源效率和智慧城市投資的必要性

- 政府支持和法規

- 市場限制

- 高成本、與智慧電錶整合困難

- 缺乏基礎建設資本投資

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場區隔

- 按最終用戶

- 住宅

- 商業的

- 工業的

- 按類型

- 各地區智慧電錶

- 中東

- 非洲

- 智慧燃氣表-按地區

- 中東

- 非洲

- 智慧水錶 - 按地區

- 中東

- 非洲

- 各地區智慧電錶

第6章 競爭格局

- 公司簡介

- LANDIS+GYR Group AG

- Kamstrup AS

- Itron Inc.

- Iskraemeco dd

- Electromed(Termikel Group)

- Holley Technology

- Hexing Electric Co. Ltd

- Sensus(Xylem Inc.)

- Diehl Metering FZE

- Sagemcom SAS

第7章投資分析

第 8 章:市場的未來

The Middle East and Africa Smart Meters Market is expected to register a CAGR of 7.2% during the forecast period.

With rapid economic and population growth resulting in higher energy demand, the need for energy management is substantial in the Middle East and African region, driving market growth.

Key Highlights

- Smart meters are becoming more popular due to the pressing need to address rising energy consumption. These meters allow two-way communication between the meter and the utility's central system. As a result, several ongoing projects rely on smart meters to improve the management and utilization of gas, water, and electricity resources.

- The Middle East and Africa, Saudi Arabia, and the UAE are anticipated to lead the regional market, owing to the improving economies and increasing incorporation of technology. The increasing per capita electricity consumption is pushing the need for smart meters. However, the absence of clear governmental policy is dissuading investments in this sector. Furthermore, the UAE government aims to finance AED 600 billion (~USD 163 billion) by 2050 to meet the increasing energy demand and ensure the country's sustainable economic growth.

- Growing smart grid deployment and promising government initiatives and policies connected with the smart meter. The rising number of regional commercial, residential, and industrial projects, such as the Red Sea Project, Qiddiya entertainment city, Smart city, and Jean Nouvel's Sharaan resort in Al-Ul, need energy-efficient and accurate meter solutions. For instance, in July 2022, NEOM, The Smart City, was Built From Scratch in The Arabian Desert. The NEOM is a new urban project to build an all-new city based on the most recent urban innovations. Furthermore, in October 2022, Honeywell and King Abdullah Financial District (KAFD) signed a Memorandum of Understanding to aid in constructing a sustainable smart city experience at the prime business and lifestyle destination in Saudi Arabia. It will further drive market growth over the coming years.

- With the metering points constantly rising, especially in the residential sector, the government of Saudi Arabia aims to install around 12 million smart meters across the Kingdom by 2030. Furthermore, the SEC announced the launch of the Smart Metering Project Wave public tender, which concerns the deployment of over 2 million smart meters, testing equipment, telecommunications infrastructure, and head-end technique.

- Furthermore, in September 2022, The Dubai Electricity and Water Authority announced a tender to build a 900 MW solar installation about 50km south of Dubai. The project is intended to have 5 GW of solar and concentrating solar power (CSP) capacity upon completion in 2030.

Middle East and Africa Smart Meters Market Trends

Commercial Sector to Hold Significant Share

- The commercial infrastructure in smart metering contains hospitals, offices, schools, retailers, and restaurants, among others. The high investment in the commercial sector's development is expected to propel the demand for smart meters in this segment. The real benefit for commercial users is that they can focus on the volume used, lowering or streamlining the amount spent daily. Furthermore, real-time monitoring with analysis can enable small businesses in the region to address any waste.

- The water deficiency in schools in South Africa has led to the increased adoption of smart water meters. In February 2022, the government installed Smart water meters at Cape Town schools daily. Isikhokelo Primary School and Intshukumo Secondary School have reported combined savings of about 25,000 liters of water per day. Further, implementing smart water meters at 200 schools in the Mother City saved approximately 2 million liters of water daily.

- The growing infrastructure expansion in the region is further anticipated to drive the demand for smart meters and attract market vendors to target a vast range of commercial customers. In September 2022, Siemens announced that it intends to provide two Advanced Distribution Management Systems (ADMS) for the Alexandria Supervisory Control Center and the West Alexandria Distribution Control Center. During the project's implementation, advanced metering infrastructure will be established, including the supply of 300,000 smart meters.

- Moreover, in March 2022, Landis+Gyr Technology Inc. announced an agreement with Otter Tail Power Company to provide advanced metering infrastructure, software, and services to support the utility's plans to build a more thoughtful, robust energy grid across its three-state service territory in theMiddle East.

- In August 2022, a National Smart Meter Programme established by the Authority for Public Services Regulation, in coordination with other sector stakeholders, envisages the building of an estimated 1.2 million smart meters covering all electricity consumers by 2025. Such developments will further drive market growth.

Supportive Government Initiatives and Regulations Driving the Market

- The countries in the region carry out multiple government activities to support the building of smart meters in the residential sector. For instance, the plan for large-scale intelligent metering implementation, helping Saudi Electric Company's (SEC) goal for boosting energy efficiency, has been set in motion. With the growing number of metering points, particularly in the residential sector, Saudi Arabia strives to install around 12 million smart meters in the Kingdom by 2025.

- Government initiatives and regulations are vital factors to be considered in the rollout of smart meters in multiple markets. Rising government support by the government in different nations, coupled with considerable investments, is expected to boost the rollout of smart meters across the region.

- For instance, in May 2022, according to IEA, oil and gas accounted for almost 95% of electricity generation in the MENA region. Also, thermal plants consume over 290 billion cubic meters of gas and 1.75 million barrels of oil daily in the region. This dominance of fossil fuels in MENA producer economies makes the emissions intensity of their power generation almost one-quarter higher than the global average.

- Furthermore, in April 2022, the Egyptian Electricity Transmission Company and the Saudi Electricity Company awarded a contract to a consortium led by Hitachi ABB Power Grids to construct an electricity interconnection. Saudi Arabia and Egypt can exchange up to 3,000 MW of power through the interconnection. Such developments hold significant potential to drive market growth.

- Moreover, South Africa's Smart Grid Vision 2030 aims to transform the electricity landscape in the region. It will upgrade the aging electricity infrastructure by installing smart meters and integrating the power grid, telecom systems, and information infrastructure. This would lead to the popularity of innovative grid data analytics solutions.

- In markets with no smart meter rollout or supportive legislation, utilities are still prepared to install smart meters in areas of their distribution networks where losses are high. Further, low electricity prices make it unattractive for significant utilities to deploy smart meters, yet to prevent simple theft, the players are preparing to install meters in households with the highest electricity loss rates.

- Furthermore, the Saudi Arabia Vision 2030 and growing government initiatives and investment to deploy smart gas meters in the country also propel the market's growth. The increasing gas consumption in the residential and commercial sectors and the adoption of smart technologies to balance the demand and supply are mainly fueling the adoption of smart gas meters in the Middle East. Smart gas meters are being implemented in countries such as the United Arab Emirates to ensure more accurate readings, which is expected to benefit consumers from a financial point of view.

- Therefore, with the projects mentioned above and ambitious renewable goals, the Middle East region is expected to witness considerable growth in the market studied.

Middle East and Africa Smart Meters Industry Overview

With only a few domestic companies in the Middle East and African region, the global companies with significant supplier/distribution channels and subsidiaries in the area constitute the competitive landscape of the Middle East and African smart meters market. Some major players in the market are Landis+Gyr Group AG, Kamstrup A/S, Itron Inc., Iskraemeco d.d., and Elektromed (Termikel Group). Domestic technology companies are involved in strategic partnerships with global intelligent meter companies to benefit from the technical expertise and increase their domestic presence. This, in turn, increases the chances for more contracts from the regional government.

- August 2022: Dubai Electricity and Water Authority (DEWA) has announced a unique software to enable network design engineers to augment electricity distribution networks. The announcement comes as the authority has been working to leverage AI-based programs to enhance the efficiencies of the country's water network. These solutions predict malfunctions of smart meters and pumps based on sensor data, in addition to automating the notifications sent to clients in the event of a water leak on their premises.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need For Improvement in Energy Efficiency and Smart City Investments

- 4.2.2 Supportive Government Initiatives and Regulations

- 4.3 Market Restraints

- 4.3.1 High Costs and Integration Difficulties with Smart Meters

- 4.3.2 Lack of Capital Investment for Infrastructure Installation

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial

- 5.2 By Type

- 5.2.1 Smart Electricity Meters - By Region

- 5.2.1.1 Middle East

- 5.2.1.2 Africa

- 5.2.2 Smart Gas Meters - By Region

- 5.2.2.1 Middle East

- 5.2.2.2 Africa

- 5.2.3 Smart Water Meters - By Region

- 5.2.3.1 Middle East

- 5.2.3.2 Africa

- 5.2.1 Smart Electricity Meters - By Region

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 LANDIS+GYR Group AG

- 6.1.2 Kamstrup AS

- 6.1.3 Itron Inc.

- 6.1.4 Iskraemeco d.d.

- 6.1.5 Electromed (Termikel Group)

- 6.1.6 Holley Technology

- 6.1.7 Hexing Electric Co. Ltd

- 6.1.8 Sensus (Xylem Inc.)

- 6.1.9 Diehl Metering FZE

- 6.1.10 Sagemcom SAS