|

市場調查報告書

商品編碼

1640503

合成橡膠:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

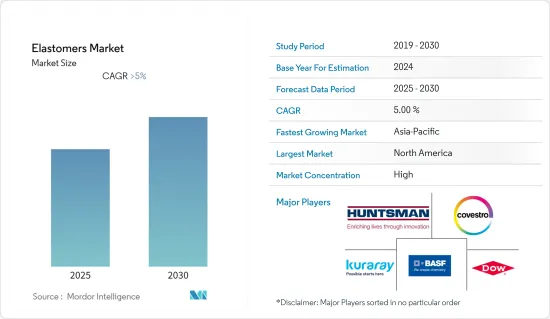

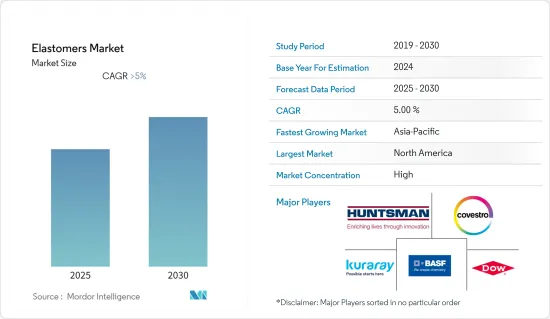

預測期內合成橡膠市場預期複合年成長率超過 5%

關鍵亮點

- 隨著汽車工業和合成橡膠工業對合成橡膠作為黏合劑、管材、被覆劑等原料的需求不斷增加,預計市場將會成長。

- 對合成橡膠在醫療應用中的生物相容性的擔憂可能會減緩市場的成長。

- 對生產生物基產品的重視程度提高以及在醫療器材製造中更多地使用合成橡膠可能會創造商機。

- 亞太地區是全球最大的市場,其中印度和中國等國家使用率最高。

合成橡膠市場趨勢

擴大汽車領域的應用

- 合成橡膠用於皮帶、軟管、波紋管、墊圈、內部隔音材料、地板和儀表板外皮。在非車輛方面,它可用於塗覆輪胎(基胎、胎側和胎面)、電線、電纜和幾乎所有汽車零件。

- 熱塑性烯烴 (TPO) 化合物可作為儀表板蓋和其他內裝應用中軟性 PVC 的替代品。

- 熱可塑性橡膠(TPE) 因其重量輕、易於加工、設計自由、多功能和可回收性而廣泛應用於汽車和運輸行業。熱固性橡膠是一種主要用於汽車輪胎的合成橡膠。

- 全球消耗的所有 TPE 產品中約有 40% 用於汽車製造。因此,汽車和運輸產業及其零件和OEM供應商的發展將成為未來 TPE 需求的關鍵指標。

- 2021年全球汽車產量將達8,000萬輛以上。與前一年相比,這項數據成長了約3%。因此,這對合成橡膠市場的成長產生了正面的影響。

- 隨著汽車行業尋求更輕的材料來提高汽車的效率,TPE 的市場正在不斷成長,為設計師提供了更多的汽車製造選擇。高性能熱可塑性橡膠使製造商能夠設計出像鋼一樣堅固的產品。這減輕了整體重量並有助於減少溫室氣體排放。

- 中國是全球電動車市場的領導者。根據中國汽車工業協會統計,2022年12月,全國新能源汽車產量年增96.9%。因此,電動車市場的擴大預計將增加對合成橡膠的需求。

- 因此,由於上述因素,預測期內合成橡膠市場預計將大幅成長。

亞太地區佔市場主導地位

- 由於中國、印度、台灣、泰國和印尼等國家的汽車製造和銷售成長,預計亞太地區將引領市場。

- 中國是建築、汽車、電氣電子和鞋類產業最大的合成橡膠市場。

- 汽車工業是合成橡膠的主要消費者之一。中國電動車市場規模不斷擴大,電動車新車銷量大幅增加。 2021年中國電動車總合將達330萬輛,較2020年的130萬輛成長154%。因此,對輪胎、皮帶、軟管等汽車零件的需求增加將對合成橡膠市場的需求產生正面影響。

- 此外,印度的汽車工業正在崛起。該國乘用車產量大幅增加。例如,2021-2022 會計年度的乘用車產量達到 3,650,698 輛,比 2020-21 會計年度增加 19%。

- 合成橡膠用於製造各種建築材料,包括黏合劑、密封劑和填縫劑。根據中國國家統計局數據,2021年全國建築業總產值25.92兆元,比2020年增加11%以上。

- 此外,根據韓國統計局的數據,2021年,國內外建築公司共訂單2,459億美元的建築訂單。這比去年有了很大的飛躍。

- 預計在日本舉辦的活動也將促進日本建築業的發展。東京將於2020年舉辦奧運(因疫情延後至2021年),大阪將於2025年舉辦世博會。

- 由於這些因素和其他因素,預計亞太地區將在未來幾年引領合成橡膠市場。

合成橡膠產業概況

合成橡膠市場部分整合。該市場的主要公司包括(不分先後順序)BASF公司、陶氏化學公司、科思創公司、可樂麗公司和亨斯邁國際有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車產業需求增加

- 建築業需求增加

- 限制因素

- 對某些醫用合成橡膠的生物相容性的擔憂

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 產品類型

- 熱固性合成橡膠

- 熱可塑性橡膠

- 應用

- 車

- 運動的

- 電子產品

- 工業的

- 膠水

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Ace Elastomer

- Avient Corporation

- Arkema

- BASF SE

- Exxon Mobil Corporation

- Covestro AG

- DingZing Advanced Materials Inc.

- Dow

- HEXPOL AB

- Huntsman International LLC

- KURARAY CO., LTD.

- Miracll Chemicals Co., Ltd.

- Sirmax SpA

- Suzhou Austin Novel Materials Technology Co. Ltd.

- Trinseo

- The Lubrizol Corporation

第7章 市場機會與未來趨勢

- 轉向生物基產品開發

- 擴大應用範圍至醫療器材製造

簡介目錄

Product Code: 53880

The Elastomers Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The market is expected to grow because the automotive industry needs more elastomers and the construction industry needs more elastomers to make things like adhesives, tubes, coatings, and other materials.

- Biocompatibility worries about how elastomers are used in medicine are likely to slow the market's growth.

- Opportunities are likely to come from putting more effort into making bio-based products and using them more in making medical instruments.

- Asia-Pacific was the biggest market in the world, with countries like India, China, and others using the most.

Elastomers Market Trends

Increasing Usage in the Automotive Segment

- Elastomers are used in belts and hoses, bellows, gaskets, sound management inside the car, floors, and instrument panel skins. Moreover, outside the car, it can be used in tires (base tires, sidewalls, and treads), wire, cables, and coatings in almost all car parts.

- The automotive industry has gotten better in part because more cars are being made and each car uses more polypropylene.Compounds of thermoplastic olefin (TPO) are used instead of flexible PVC to cover instrument panels and for other interior uses.

- The automotive and transportation industries use thermoplastic elastomers (TPEs) a lot because they are lightweight, easy to process, give designers more freedom, are versatile, and can be recycled.And thermoset rubber is a type of elastomer that is mainly used to make automotive tires.

- About 40% of all TPE products consumed worldwide are used in vehicle manufacturing. Therefore, the development of the automotive and transport industries and their parts, components, and OEM suppliers is an important indicator for future TPE demand.

- The global production of automobiles reached over 80 million units in 2021. In comparison to the previous year, this statistic represents a rise of about 3%. Hence, this is positively impacting the market growth of elastomers.

- The TPE market is growing because the automotive industry wants lighter materials to make cars more efficient and give designers more options for how to make them. High-performance thermoplastic elastomers give manufacturers the ability to design products and give them the same strength as steel. This helps reduce the weight of the whole thing and keep greenhouse gas emissions in check.

- China is a global leader in the electric car market. According to the China Association of Automobile Manufacturing, the production of new energy vehicles in the country witnessed a year-on-year increase of 96.9 percent in December 2022. Thus, the expanding electric vehicle market is expected to increase the demand for elastomers.

- Hence, owing to the abovementioned factors, the elastomers market is expected to grow significantly during the forecast period.

The Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be at the top of the market because countries like China, India, Taiwan, Thailand, and Indonesia are making and selling more cars.

- In the construction, automotive, electrical and electronics, and footwear industries, China is the biggest market for elastomers.

- The automotive industry is one of the major consumers of elastomers. China's electric car market is expanding considerably, with a significant increase in the sales of new electric vehicles. A total of 3.3 million units of electric vehicles (EVs) were sold in China in 2021, representing an increase of 154% compared to the 1.3 million units sold in 2020. Hence, an increase in demand for automotive parts like tires, belts, hoses, and others positively impacts the market demand for elastomers.

- Also, the automotive industry in India is rising. The country witnessed a significant increase in the production of passenger vehicles. For instance, the production of passenger vehicles reached 3,650,698 for the FY 2021-2022, representing an increase of 19% compared to the FY 2020-21.

- Elastomers are used in manufacturing various construction materials, such as adhesives, sealants, and caulking. According to the National Bureau of Statistics of China, the output value of the construction works in the country accounted for CNY 25.92 trillion in 2021, representing an increase of more than 11% compared to 2020, thereby enhancing the demand for the market studied.

- Statistics Korea also says that in 2021, local builders at home and abroad received construction orders worth a total of USD 245.9 billion. This is a big jump from the previous year.

- Also, events that will be held in Japan are expected to boost the construction industry there. Tokyo will host the Olympics in 2020 (postponed to 2021 due to the pandemic), and Osaka will host the World Expo in 2025.

- Due to these and other factors, the Asia-Pacific region is expected to lead the market for elastomers over the next few years.

Elastomers Industry Overview

The elastomers market is partially consolidated in nature. Some of the major players in the market include BASF SE, Dow, Covestro AG, Kuraray Co., Ltd., and Huntsman International LLC, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Automotive Industry

- 4.1.2 Rising Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Biocompatibility Concerns of Some Medical Elastomers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Thermoset Elastomers

- 5.1.2 Thermoplastic Elastomers

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Sports

- 5.2.3 Electronics

- 5.2.4 Industrial

- 5.2.5 Adhesives

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ace Elastomer

- 6.4.2 Avient Corporation

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Covestro AG

- 6.4.7 DingZing Advanced Materials Inc.

- 6.4.8 Dow

- 6.4.9 HEXPOL AB

- 6.4.10 Huntsman International LLC

- 6.4.11 KURARAY CO., LTD.

- 6.4.12 Miracll Chemicals Co., Ltd.

- 6.4.13 Sirmax S.p.A

- 6.4.14 Suzhou Austin Novel Materials Technology Co. Ltd.

- 6.4.15 Trinseo

- 6.4.16 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward the Development of Bio-based Products

- 7.2 Increasing Application in Fabrication of Medical Instruments

02-2729-4219

+886-2-2729-4219