|

市場調查報告書

商品編碼

1687302

熱塑性聚酯彈性體(TPE-E)-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Thermoplastic Polyester Elastomer (TPE-E) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

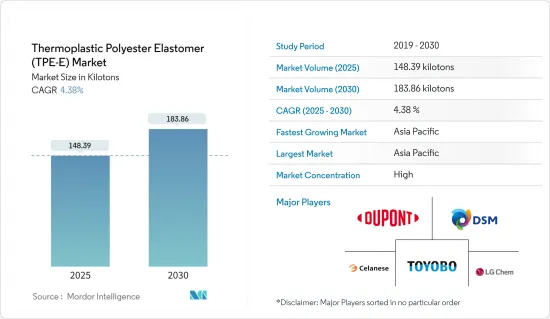

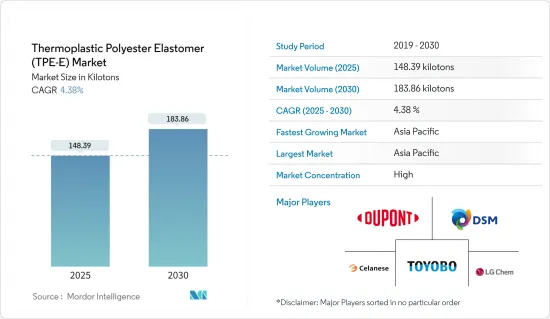

熱塑性聚酯彈性體的市場規模預計在 2025 年為 148.39 千噸,預計到 2030 年將達到 183.86 千噸,預測期(2025-2030 年)的複合年成長率為 4.38%。

2020年市場受到了新冠疫情的負面影響。疫情對汽車產業造成了嚴重衝擊,包括全球範圍內的生產中斷和供應鏈中斷,對市場產生了負面影響。然而,由於汽車行業的成長,市場在 2021 年復甦良好。

關鍵亮點

- 短期內,汽車產業需求的增加以及醫療保健和醫療設施支出的增加是推動市場成長的關鍵因素。

- 然而,熱塑性聚酯彈性體的高成本是預測期內限制該產業成長的主要因素。

- 生物基熱塑性聚酯彈性體市場的興起預計很快就會為全球市場提供豐厚的成長機會。

- 由於中國、日本和其他東南亞國家對熱塑性聚酯彈性體 (TPE-E) 的需求很高,加上汽車生產和醫療行業對 TPEE 的使用量持續增加,預計亞太地區在評估期內的研究市場將出現健康成長。

熱塑性聚酯彈性體(TPE-E)市場趨勢

在汽車產業的應用日益廣泛

- 熱塑性聚酯彈性體 (TPE-E) 是一種高性能材料,在汽車產業的應用正在迅速擴大。 TPE-E 在汽車領域的應用範圍從外部和內部零件到引擎零件。 TPE-E憑藉其高耐用性、輕盈性、成本績效,獲得了汽車材料廠商的大力支持。

- TPE-E 在汽車行業有多種應用,包括生產高品質汽車儀錶面板、CVJ 防塵罩、車輪罩、進氣管、安全氣囊展開門、儀表板組件、立柱飾板、門襯裡和把手、座椅靠背和安全帶組件。

- TPE-E 具有出色的耐磨性和抗震性,並且可以染成任何顏色,從而具有很高的設計自由度。 TPE-E 即使在惡劣的天氣條件下也非常耐用,因此成為汽車鎖等內部機構的熱門選擇。這些特性也支持了電動車製造對長期耐熱材料的需求。

- 汽車產業致力於將輕量材料應用於各種車輛。因此,全球汽車產業的成長預計將推動對 TPE-E 的需求。

- 根據 OICA 的數據,2021 年全球汽車總銷量為 80,154,988 輛,而 2020 年為 12,452,453 輛,成長了 3%。

- 印度和中國已經實施了汽車報廢政策,以淘汰過時的汽車並最大限度地減少污染。該計劃的目標是淘汰 51,000 輛車超過 20 年的輕型汽車和 34,000 輛車齡超過 15 年的輕型汽車。該計劃旨在透過逐步淘汰沒有有效適用證書的老舊和無法運行的車輛來減少污染。預計這種方法將增加市場對新車的需求。

- 2021年全年全球電動車銷量達6.75億輛,較2020年成長108%。這個數字包括乘用車、輕型卡車和輕型商用車。 2021 年,純電動車佔電動車銷量的 71%,而插電式混合動力車佔 29%。

- 國際能源總署預測,在新政策情境下,預計2030年全球電動車銷售將達到1.25億輛(不包括二輪車和三輪車)。根據EV30@30情景,預計到2030年中國約70%的汽車銷售將是電動車。銷售額數據,估計歐洲佔電動車銷售的50%,日本佔37%,加拿大和美國佔30%,印度佔29%。

- 因此,由於上述因素,預計預測期內對 TPE-E 的需求將受到正面影響。

亞太地區佔市場主導地位

- 預計亞太地區將主導市場。以國內生產毛額計算,中國是該地區最大的經濟體。中國是成長最快的經濟體之一,目前是世界上最大的製造業基地之一。該國的製造業是該國經濟的主要貢獻者之一。

- 中國是世界上最大的汽車製造國。由於人們日益關注環境問題,該國的汽車產業正在不斷發展,重點是製造確保燃油效率同時最大限度減少排放氣體的產品。據 OICA 稱,預計該國 2021 年汽車產量將達到 2,608 萬輛,比 2020 年的 2,523 萬輛成長 3%,到 2025 年將成長到 3,500 萬輛。汽車產量的成長預計將推動該國電動車和內燃機汽車製造領域對熱塑性聚酯彈性體的需求。

- 中國擁有完善的一般工業部門。中國國家統計局發布的資料顯示,2021年全國工業增加與前一年同期比較增9.6%。該國2021年12月工業生產年增4.3%(季增0.42%),增加了該國對熱塑性聚酯彈性體的需求。

- 中國擁有世界上最大的電子產品製造基地之一,對韓國、新加坡和台灣等現有的上游製造商構成了激烈的競爭。智慧型手機、OLED 電視和平板電腦等電子產品在市場消費性電子領域的需求成長最快。中國經濟發展和人民生活水準的提高,帶動了電子產品的需求。

- 收入的持續提高將導致人口人均可支配收入的增加,預計將有利於中國對電子產品的需求。中產階級和高所得群體的擴大預計將推動電子產品的需求。根據中國國家統計局的數據,2021年家用電子電器及電器產品領域的銷售額達到9.3464億元人民幣(約1.3127億美元)。預計銷售額將以每年2.04%的速度成長,到2025年市場規模預計將達到1,756.7億美元。

- 此外,根據 OICA 的數據,2021 年印度汽車產量約為 4,399,112 輛,比 2020 年的 3,381,819 輛成長 30%。

- 此外,預計到 2022 年,該國的醫療保健產業規模將達到 3,720 億美元,主要原因是健康意識增強、保險覆蓋率廣、收入增加以及疾病增加。印度的醫療保健產業受惠於每年1.6%的人口成長率。

- 近年來,印度工業部門快速成長。印度工業生產指數(IIP)從 2020-21 年的 111.7 上升至 2021-22 年的 128.7。這一成長也得到了政府各項舉措的支持,例如國家製造業計劃(旨在到 2025 年將製造業在 GDP 中的佔有率提高到 25%)和針對製造商的 PLI 計劃(於 2022 年啟動),從而增加了該國對熱塑性聚酯彈性體的需求。

- 據印度品牌資產基金會(IBEF)稱,到2025年,印度電子製造業的規模預計將達到5,200億美元。由於政府推出的「印度製造」、「國家電子產品計畫」、「電子設備零淨進口」和「零缺陷效應」等舉措,印度的電氣和電子設備製造業預計將快速成長。這些措施致力於發展國內製造業,減少進口依賴,促進出口和製造業,並使國家自力更生,正如「印度製造」計畫所體現的那樣。

- 由於所有這些因素,預計該地區的熱塑性聚酯彈性體市場在預測期內將穩定成長。

熱塑性聚酯彈性體(TPE-E)產業概況

全球熱塑性聚酯彈性體(TPE-E)市場呈現整合態勢,頂級上市公司佔據全球市場的大部分佔有率。全球公司正大力進行研發、收購和合作,以開發新技術並提高其市場佔有率和實力。研究的市場中的關鍵製造商包括杜邦、塞拉尼斯公司、荷蘭皇家帝斯曼集團、LG化學、東洋紡等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車產業需求增加

- 增加醫療保健和醫療設施支出

- 限制因素

- 熱塑性聚酯彈性體高成本

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 射出成型級

- 擠壓等級

- 其他

- 最終用戶產業

- 車

- 醫療保健

- 工業的

- 電氣和電子

- 消費品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Celanese Corporation

- Chang Chun Group

- DSM

- Kolon Plastic Inc.

- LG Chem

- Mitsubishi Chemical Corporation

- Radici Partecipazioni SpA

- Sichuan Sunshine Plastics Co. Ltd

- SK Chemicals

- Toyobo Co. Ltd

第7章 市場機會與未來趨勢

- 生物基熱塑性聚酯彈性體的新興市場

The Thermoplastic Polyester Elastomer Market size is estimated at 148.39 kilotons in 2025, and is expected to reach 183.86 kilotons by 2030, at a CAGR of 4.38% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. The pandemic had a severe impact on the automotive industry, including manufacturing interruptions and disruption in the supply chain across the globe, thereby negatively affecting the market. However, the market recovered steadily, owing to the increased growth of the automotive industry in 2021.

Key Highlights

- Over the short term, growing demand from the automotive industry, coupled with growing expenditure on healthcare and medical facilities, are major factors driving the growth of the market studied.

- However, the high cost of thermoplastic polyester elastomer is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the emerging market for bio-based thermoplastic polyester elastomer is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the studied market due to the high demand for thermoplastic polyester elastomer (TPE-E) in China, Japan, and other Southeast Asian countries owing to continuous and rising usage of TPEE in automotive production, coupled with the growing medical industry.

Thermoplastic Polyester Elastomer (TPE-E) Market Trends

Increasing Usage in the Automotive Industry

- Thermoplastic polyester elastomers (TPE-E) are high-performance materials whose application in the automotive industry has rapidly increased. TPE-E utilization in the automotive sector extends from the exterior and interior parts to engine components. The high durability, light weight, and cost-effectiveness of TPE-Es make them extremely coveted by automotive materials manufacturers.

- TPE-Es serve the automotive industry in several applications, some of which include the manufacturing of high-quality automotive instrument panels, CVJ boots, wheel covers, air intake ducting, airbag deployment doors, dashboard components, pillar trim, door liners and handles, seat backs, and seat belt components, among others.

- TPE-Es offer high design flexibility by being resistant to abrasion and vibration and dyeable in any desired color. They are highly durable in harsh weather conditions; hence they are preferred for internal mechanisms such as car locks. These properties also support the demand for long-term heat-resistant materials in electric vehicle fabrication.

- The automotive industry is working on utilizing lightweight materials for various vehicle applications. Hence, the growing automotive industry globally is expected to boost the demand for TPE-Es.

- According to OICA, the global sales of all vehicles in 2021 acoounted for 80,154,988 units, registering a growth of 3% as compared to 12,452,453 units sold in 2020.

- Vehicle scrappage policies are being implemented in India and China to scrap outdated vehicles and minimize pollution. It plans to cover 51 lakh light motor vehicles older than 20 years and 34 lakh light motor vehicles older than 15 years. This program aims to reduce pollution by phasing out obsolete or inoperable vehicles that do not have a valid fitness certificate. This approach will raise market demand for new cars.

- The global EV sales reached 675 million units in the entire year of 2021, 108% more as compared to the EV sales in 2020. This volume includes passenger vehicles, light trucks, and light commercial vehicles. The BEVs stood for 71% of total EV sales, while the PHEVs stood at 29% in 2021.

- According to the IEA, in 2030, global electric vehicle sales are expected to reach 125 million, per the New Policies Scenario (excluding two/three-wheelers). In the EV30@30 Scenario, in 2030, around 70% of vehicle sales in China are expected to be EVs. Also, as per the approximate sales value till now, EV sales in Europe was estimated at 50%, while it was 37% in Japan, 30% in Canada and the United States, and 29% in India.

- Therefore, owing to the above factors, the demand for TPE-E is expected to be impacted positively during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market. In the region, China is the largest economy in terms of GDP. China is one of the fastest emerging economies and has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the primary contributors to the country's economy.

- China is the largest manufacturer of automobiles in the world. The country's automotive sector has been shaping up for product evolution, focusing on manufacturing products to ensure fuel economy while minimizing emissions, owing to the growing environmental concerns. In 2021, according to the OICA, the automotive production in the country reached 26.08 million, which increased by 3%, compared to 25.23 million vehicles produced in 2020, and is expected to grow up to 35 million vehicles by 2025. The increase in automotive production is estimated to drive the demand for thermoplastic polyester elastomers in the country from both EVs and IC engine vehicle manufacturing sectors.

- China has a well-established general industrial sector. According to the data published by China's National Bureau of Statistics, the country's value-added industrial output went up 9.6% Year-on-Year in 2021. The country's industrial output grew 4.3% Y-o-Y in December 2021 (a 0.42 % increase from November), thereby increasing the demand for thermoplastic polyester elastomers in the country.

- China has one of the world's largest electronics production bases and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand. Economic development in China and improving living standards among the population drive the demand for electronic goods.

- The continuous growth of income resulted in the rise in the population's per capita disposable income, which is expected to benefit the demand for electronic goods in China. The expansion of the middle class and high-income population group is expected to propel the demand for electronics. According to the National Bureau of Statistics of China, the revenue in the consumer electronics and household appliances segment reached CNY 934.64 million (approx. USD 131.27 million) in 2021. The revenue is expected to show an annual growth rate of 2.04%, resulting in a projected market volume of USD 175,670 million by 2025.

- Further, in India, as per OICA, around 4,399,112 vehicles were produced in 2021, which increased by 30%, comparison to 3,381,819 units manufactured in 2020.

- Also, the healthcare sector in the country is expected to reach USD 372 billion by 2022, mainly driven by increasing health awareness, access to insurance, rising income, and diseases. The medical sector in India is benefiting from the growing population at a rate of 1.6 % per year.

- India has witnessed rapid growth in the industrial sector in recent years. The index of industrial production (IIP) in India increased from 111.7 in 2020-21 to 128.7 in the 2021-22 period. This growth is also supported by various government initiatives like the National Manufacturing Policy (which aims to increase the share of manufacturing in GDP to 25% by 2025) and the PLI scheme for manufacturing (which was launched in 2022), thereby increasing the demand for thermoplastic polyester elastomers in the country.

- According to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, the National Policy of Electronics, Net Zero Imports in Electronics, and the Zero Defect Zero Effect. Such policies offer a commitment to growth in domestic manufacturing, lowering import dependence and energizing exports and manufacturing, like the 'Make in India' program, to make the country self-reliant.

- Due to all such factors, the market for thermoplastic polyester elastomer in the region is expected to have a steady growth during the forecast period.

Thermoplastic Polyester Elastomer (TPE-E) Industry Overview

The global thermoplastic polyester elastomer (TPE-E) market is consolidated in nature, as the top listing companies hold a significant share of the global market. Global companies are significantly focusing on R&D, acquisitions, and collaborations to develop new technologies and to increase their market presence and foothold. The major manufacturers in the market studied include Dupont, Celanese Corporation, Koninklijke DSM N.V., LG Chem, and Toyobo Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From the Automotive Industry

- 4.1.2 Growing Expenditure on Healthcare And Medical Facilities

- 4.2 Restraints

- 4.2.1 High Cost of Thermoplastic Polyester Elastomer

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Injection Molding Grade

- 5.1.2 Extrusion Grade

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Healthcare

- 5.2.3 Industrial

- 5.2.4 Electrical and Electronics

- 5.2.5 Consumer Goods

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Chang Chun Group

- 6.4.3 DSM

- 6.4.4 Kolon Plastic Inc.

- 6.4.5 LG Chem

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 Radici Partecipazioni SpA

- 6.4.8 Sichuan Sunshine Plastics Co. Ltd

- 6.4.9 SK Chemicals

- 6.4.10 Toyobo Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Market for Bio-based Thermoplastic Polyester Elastomer