|

市場調查報告書

商品編碼

1640505

拉丁美洲人機介面 (HMI):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Latin America HMI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

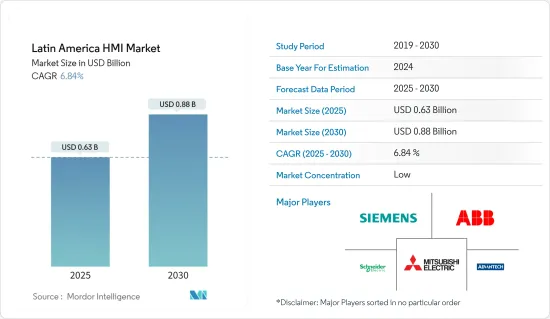

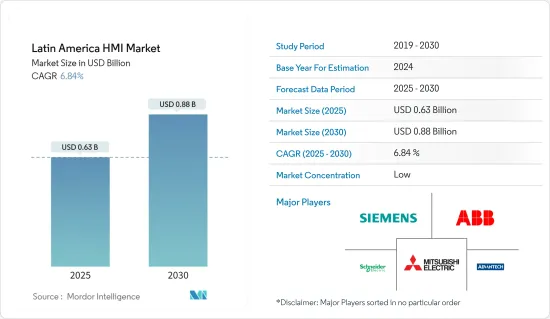

拉丁美洲的人機介面 (HMI) 市場規模預計在 2025 年為 6.3 億美元,預計到 2030 年將達到 8.8 億美元,2025-2030 年的複合年成長率為 6.84%。

主要亮點

- 由於製造業、能源和汽車等領域的工業自動化興起,拉丁美洲的人機介面 (HMI) 市場正在持續成長。 HMI 是人類操作員和機器之間的重要管道,簡化了工業製程的控制和監控。

- 人機介面 (HMI) 是一種使用者介面或儀表板,旨在將個人與機器、系統或設備連接起來。 HMI 與可程式邏輯控制器 (PLC) 和輸入/輸出感測器交互,以透過圖形、圖表和數位儀表板檢索和顯示關鍵資料。此外,管理警報和與 SCADA、ERP 和 MES 系統整合等任務都可以從統一主機執行。

- 在工業環境中,HMI 擅長以視覺化方式顯示資料、追蹤生產指標、監督KPI 以及監控機器輸入和輸出。這些應用程式提高了生產力,降低了硬體成本,簡化了管理業務,並減少了工作場所的傷害。

- HMI 在製造業尤其有用,因為可自訂的編程允許根據每個工廠的獨特需求自訂操作。 HMI 可以自主監控、控制和保護甚至複雜的任務,從而減少了對持續人工監督的需求。

- 然而,拉丁美洲HMI市場面臨障礙。該地區正面臨高額初始投資和熟練操作員短缺的雙重挑戰。實施 HMI 解決方案需要大量的前期投資,這對拉丁美洲的許多中小型企業 (SME) 來說尤其沉重。

拉丁美洲人機介面 (HMI) 市場趨勢

汽車有望成為最大的終端用戶產業

- 汽車 HMI 解決方案是汽車硬體和軟體組件和功能,促進駕駛員和乘客與車輛及其環境的互動。汽車 HMI 解決方案透過實現與多點觸控儀表板顯示器、語音資訊娛樂系統、控制面板和整合螢幕的互動來增強駕駛體驗。

- 由於產量增加和效率提高等多種因素,汽車產業正在擴大採用自動化。截至 2024 年 1 月,墨西哥的產值達 81.2 億美元。公司注重效率並採用精益製造和六標準差等理念。

- 預計在預測期內,聯網汽車和自動駕駛汽車的日益普及將極大地推動對汽車 HMI 產品的需求。預計對 HMI 技術、自動駕駛汽車和先進汽車功能研發的投資增加也將有利於市場成長。

- 便利性需求的不斷成長、車隊管理需求的不斷成長、 OEM擴大採用 HMI 技術、自動駕駛和聯網汽車的日益普及以及對改善駕駛安全性和用戶體驗的需求不斷成長,這些因素正在推動汽車市場的成長。

墨西哥預計成長最快

- 墨西哥是一個重點地區,各種北美公司由於其成本優勢和地理位置而將生產遷移到那裡。例如,豐田將其中型皮卡 Tacoma 從德克薩斯移至墨西哥。這些新興國家的發展正在增加對 HMI 的需求。

- 根據墨西哥國家汽車及皮卡製造業協會(INEGI)數據顯示,2018年墨西哥汽車和皮卡製造業的銷售額為6,051萬美元,預計2023年將達到7,997萬美元。儘管該行業大部分依賴出口,但預計未來幾年消費量將會增加。預計這些發展將進一步影響未來幾年的需求。

- 墨西哥政府表示,到2027年,墨西哥有望躋身經濟複雜性指數前十名的國家之列,鞏固其作為工業4.0創新者的地位。墨西哥的主要製造廠預計將繼續成長。墨西哥政府簡化了某些法規,允許公司在墨西哥順利開展業務。

- 墨西哥的電子和汽車產業是該國透過採用機器人技術實現和整合自動化的產業之一。此外,各行業對機器人的投資不斷增加以及銷售激增,推動了 HMI 的使用,有助於預測期內的市場成長。根據GSMA預測,2021年墨西哥的智慧型手機普及率將達到67%,預計2025年將成長到74%。

- 墨西哥政府致力於在國內實施工業4.0,這為當前市場提供了充足的機會。此外,該國熟練的勞動力和與美國的緊密經濟聯繫預計將創造新的投資管道並加速 HMI 的使用。

- 根據IFR的預測,2023年墨西哥製造業安裝的機器人數量將達到5,868台。汽車產業是該國成長最快的機器人採用領域,佔 2023 年引入的所有機器人的 69%,銷量達到 4,068 台。

拉丁美洲人機介面 (HMI) 產業概覽

拉丁美洲 HMI 市場高度分散,既有全球性企業,也有中小型企業。市場的主要參與者包括 ABB、西門子股份公司、施耐德電氣公司、研華公司和三菱電機公司。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024年4月,全球最大的專注於工業自動化和數位轉型的公司之一羅克韋爾自動化公司(Rockwell Automation Inc.)宣布,已成功與OEMHax Technologies合作,為Kinnareds Well升級和最佳化了HMI 。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 工業自動化領域的應用日益增多

- 向工業 4.0 和物聯網的轉變

- 更加重視製造製程開發

- 市場挑戰

- 初始成本上升和熟練操作員短缺

第6章 市場細分

- 依組件類型

- 硬體

- 軟體

- 服務

- 按最終用戶產業

- 車

- 飲食

- 包裝

- 藥品

- 石油和天然氣

- 金屬與礦業

- 其他最終用戶產業

- 按國家

- 巴西

- 墨西哥

- 阿根廷

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- Advantech Inc

- Mitsubishi Electric Corporation

- Panasonic Corporation

- GE Ltd

- Honeywell Inc.

- Bosch Inc.

- Rockwell Automation Ltd

- Omron Ltd

- Eaton Corporation

- Yokogawa Electric Corporation

- Beijer Electronics Inc.

第8章投資分析

第9章:市場的未來

The Latin America HMI Market size is estimated at USD 0.63 billion in 2025, and is expected to reach USD 0.88 billion by 2030, at a CAGR of 6.84% during the forecast period (2025-2030).

Key Highlights

- Latin America's Human-Machine Interface (HMI) market has witnessed consistent growth, propelled by the rising industrial automation in sectors spanning manufacturing, energy, and automotive. HMIs act as pivotal conduits, linking human operators with machines, thereby streamlining control and monitoring of industrial processes.

- A Human-Machine Interface (HMI) is a user interface or dashboard designed to connect individuals with machines, systems, or devices. HMI interacts with Programmable Logic Controllers (PLCs) and input/output sensors, retrieving and presenting crucial data through graphs, charts, or digital dashboards. They also facilitate tasks like managing alarms and interfacing with SCADA, ERP, and MES systems, all from a unified console.

- In industrial environments, HMIs excel at visually presenting data, tracking production metrics, overseeing KPIs, and monitoring machine inputs and outputs. These applications enhance production rates, cut hardware costs, streamline managerial duties, and mitigate workplace accidents.

- HMIs are especially valuable in manufacturing, where their customizable programming tailors operations to each plant's unique needs. They can autonomously monitor, control, and safeguard operations, even in intricate tasks, reducing the need for constant human oversight.

- However, Latin America's HMI market faces hurdles. The region grapples with the dual challenges of higher initial investment and a shortage of skilled operators. Implementing HMI solutions demands a significant upfront financial outlay, which is particularly burdensome for many small- and medium-sized enterprises (SMEs) in Latin America.

Latin America HMI Market Trends

Automotive is Expected to be the Largest End-user Industry

- HMI solutions for automobiles are components and features of automotive hardware and software that facilitate the interaction between the driver and passengers with the vehicle and its environment. HMI automobile solutions enhance driving experiences by enabling users to interact with multi-touch dashboard displays, vehicle voice-enabled infotainment systems, control panels, and integrated screens.

- The automotive industry has been increasingly adopting automation owing to various factors, such as the demand for more production and better efficiency. As of January 2024, in Mexico, the production value was USD 8.12 billion. Companies are adopting philosophies such as Lean manufacturing and Six Sigma, emphasizing efficiency.

- The growing popularity of connected cars and autonomous vehicles is anticipated to significantly drive the automotive HMI product demand over the forecast period. Rising investments in research and development of HMI technologies, autonomous vehicles, and advanced automotive features are also expected to favor the market's growth.

- The increasing demand for convenience, rising demand for fleet management, growing adoption of HMI technologies by OEMs, increasing popularity of autonomous and connected vehicles, and rising demand for enhanced driver safety and user experience are anticipated to be other factors that positively impact sales of automotive HMI systems.

Mexico is Expected to Witness the Fastest Growth

- Mexico is the major region; various enterprises across North America are shifting their production facilities to Mexico due to cost benefits and geographical position. For instance, Toyota shifted its Tacoma midsize pickup from Texas to Mexico. Such developments in the country augment the demand for HMIs.

- The Mexican automobile and pickup truck manufacturing industry's revenue in 2018 stood at USD 60.51 million, and it is expected to reach USD 79.97 million by 2023, according to INEGI. A major industry share depends on exports, but consumption is expected to rise over the coming years. Such developments are anticipated to influence demand further over the coming years.

- According to the Mexican government, Mexico is expected to be among the top 10 countries in the Economic Complexity Index by 2027, cementing its place as an innovator in Industry 4.0. The major manufacturing factories in Mexico are expected to see continual growth. The involved governments have streamlined certain regulations, which have allowed businesses to establish operations in Mexico with little difficulty.

- The electronics and automotive industries in Mexico are some of the industries utilizing and integrating automation through the introduction of robotics in the country. Additionally, increasing investments and rapidly rising sales of robots to be incorporated in diverse industries are driving the usage of HMI, thereby propelling market growth over the forecast period. According to GSMA, In 2021, Mexico had a smartphone adoption rate of 67%, which is expected to increase to 74% by 2025.

- The Mexican government is focused on implementing Industry 4.0 in the country, as it poses ample opportunity in the current market. Furthermore, the country has a skilled workforce and strong economic relations with the United States, which creates new avenues for investment, which is expected to increase the utilization of HMIs.

- According to IFR, robotic installations in Mexico's manufacturing industry amounted to 5,868 units in 2023. The country's leading adopter was the automotive industry, which accounted for 69% of the robotic installations in 2023, with sales reaching 4,068 units.

Latin America HMI Industry Overview

The Latin American HMI market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are ABB Ltd, Siemens AG, Schneider Electric SE, Advantech Inc., and Mitsubishi Electric Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2024: Rockwell Automation Inc., one of the largest global companies dedicated to industrial automation and digital transformation, announced a successful collaboration with OEM Hax Technologies to upgrade and optimize the HMI for Kinnareds Well.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage in Industrial Automation

- 5.1.2 Shift toward Industry 4.0 and Adoption of IoT

- 5.1.3 Increasing Focus on Developing Manufacturing Processes

- 5.2 Market Challenges

- 5.2.1 Higher Initial Cost and Lack of Skilled Operators

6 MARKET SEGMENTATION

- 6.1 By Component Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage

- 6.2.3 Packaging

- 6.2.4 Pharmaceutical

- 6.2.5 Oil and Gas

- 6.2.6 Metal and Mining

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric SE

- 7.1.4 Advantech Inc

- 7.1.5 Mitsubishi Electric Corporation

- 7.1.6 Panasonic Corporation

- 7.1.7 GE Ltd

- 7.1.8 Honeywell Inc.

- 7.1.9 Bosch Inc.

- 7.1.10 Rockwell Automation Ltd

- 7.1.11 Omron Ltd

- 7.1.12 Eaton Corporation

- 7.1.13 Yokogawa Electric Corporation

- 7.1.14 Beijer Electronics Inc.