|

市場調查報告書

商品編碼

1640592

毫微微基地台:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Femtocells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

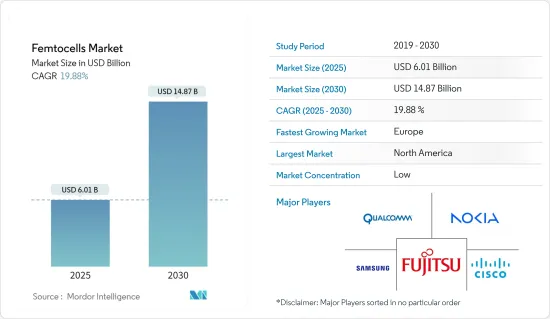

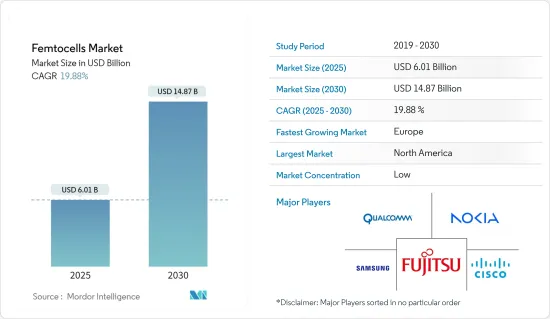

預計 2025 年毫微微基地台市場規模為 60.1 億美元,到 2030 年將達到 148.7 億美元,預測期內(2025-2030 年)的複合年成長率為 19.88%。

毫微微基地台是一種為行動裝置提供無線連接的蜂巢式基地台。在行動訊號較弱的地區可使用毫微微基地台。網路基地台可以更輕鬆地存取語音和資訊服務、可擴展部署、與大型基地台技術相容、降低傳輸功率、提高設備便攜性和擴大覆蓋範圍,從而延長行動裝置的電池壽命。

主要亮點

- 由於毫微微基地台技術的進步和毫微微基地台設備價格的下降,毫微微基地台市場正在不斷成長。住宅領域對毫微微基地台的採用日益增多以及企業領域的需求不斷成長正在推動市場的發展。

- 毫微微基地台市場的主要驅動力是功耗限制。與大型基地台網路相比,毫微微基地台的傳輸功率相對較小,因此毫微微基地台消耗的電量較少。毫微微基地台的功耗不到 7W,並且在每個範圍內支援多個連接。

- 用於提供附加價值服務的智慧型手機應用程式的成長正在推動毫微微基地台市場的成長。行動電話、筆記型電腦和其他設備成本的下降正在推動市場需求。

- 由於毫微微基地台可協助企業滿足大量網路流量需求,因此 COVID-19 疫情對毫微微基地台市場擴張產生了正面影響。過去一年,大多數網路和資料服務供應商都發現全球網路流量增加,這得益於新冠疫情以及製造業、電子商務、運輸和物流等各行各業採用工業自動化。增加對物聯網連接毫微微基地台的需求。

毫微微基地台市場趨勢

商業領域可望大幅成長

- 不斷成長的行動流量以及多租戶建築、酒店和辦公大樓的網路增強需求正在推動商業領域毫微微基地台的成長。毫微微基地台具有低成本、靈活性等優勢,進一步推動了市場成長。

- 物聯網的出現正在重塑經營模式、價值鏈和產業結構,從而改變各行各業。根據今年 6 月的愛立信行動報告,寬頻物聯網(4G/5G)是去年連接所有蜂巢式物聯網設備最大佔有率的技術。

- 工業 4.0 的日益普及以及企業擁抱 BYOD 等各種因素正在推動市場成長。市場促進因素包括創新城市計劃,鼓勵供應商開發專注於智慧城市等應用的產品。

- 例如,恩智浦半導體公司最近宣布推出一款針對高頻寬、低功耗基頻應用的毫微微基地台解決方案。該解決方案針對LTE和WCDMA(HSPA+)進行了最佳化,並為創新城市發展提供了成本和功率最佳化。

- 毫微微基地台技術使通訊業者能夠實現固定行動替代等優勢,並有助於推動ARPU成長。毫微微基地台技術將提高室內環境和郊區等偏遠地區的覆蓋範圍。

歐洲:預計成長顯著

- 在歐洲,英國在科技和服務領域處於領先地位,GDP成長率達到1.6%。由於消費支出疲軟以及英國脫歐談判結果帶來政治和經濟不確定性,預計經濟成長仍將保持溫和。

- 英國市場以強大的技術和基礎設施為基礎,擁有像 Verizon 這樣的市場領導。此外,該地區的行動和寬頻領域競爭激烈。這是該國行動電話普及率高於歐洲平均的原因之一,且消費價格相對較低。

- 由於智慧型手機普及率不斷提高(約 80%)、行動裝置功能的不斷進步以及 4G 技術在全部區域的推廣,資料使用量依然強勁。預計未來幾年英國近50%的家庭將實現智慧家庭。這一趨勢表明,毫微微基地台的普及潛力巨大。

- 英國市場的成長預計將受到住宅和商業領域對無線網路的強勁需求、行動裝置上強勁的資料使用以及智慧家居的日益普及的推動。

毫微微基地台行業概況

毫微微基地台市場十分分散。市場參與者引入了大量技術創新,並發生了各種併購事件。在這個市場中營運的市場參與者可以透過提供具有成本效益、一致性和擴充性的設備來獲得競爭優勢。

- 2023 年 6 月 - 一系列行業主要企業與台灣工業局 (IDB) 和台灣資訊產業策進會 (III) 合作,在 COMNEXT Tokyo 2023 上展示了創新的工業和企業 5G 連接解決方案。展會上,也就光寶科技等台灣、日本新一代通訊業動向進行了探討。 LITEON RAN Solutions 提供全面的符合 5G/O-RAN SA 的產品系列。 LITEON FlexFi AIO 和 Femtocell 支援 n78/n79 sub-6G 頻段,具有靈活、高效且經濟高效的架構。

- 2022 年 11 月-思科透露在西班牙開設新一代半導體設備設計中心的計畫。作為實現可靠、可擴展和永續的全球半導體供應鏈的全球策略的一部分,思科計劃建立一個工程設計中心來創建和製作下一代半導體設備的原型。該計畫將在西班牙微電子和半導體復甦和經濟轉型策略計劃框架內進行。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 毫微微基地台站在 4G 和 5G 延續中發揮越來越重要的作用

- 對異質網路的需求

- 市場限制

- 各行業專業工程師短缺

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 技術簡介

第6章 市場細分

- 按應用

- 商業的

- 住宅

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Nokia Corporation

- Samsung Electronics

- Cisco

- Qualcomm

- Airvana Inc.

- CommScope Inc.

- Fujitsu Ltd.

- ZTE Corporation

- Netgear Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Femtocells Market size is estimated at USD 6.01 billion in 2025, and is expected to reach USD 14.87 billion by 2030, at a CAGR of 19.88% during the forecast period (2025-2030).

Femtocells are cellular base stations providing wireless connectivity for mobile devices. Femtocells are used in areas with weak mobile signal. The access points facilitate feasible access to voice and data services, enabling a scalable deployment, compatibility with the macrocellular technology, reduced transmission power, device portability, and improved coverage that results in prolonged mobile battery life.

Key Highlights

- Femtocells market is growing due to advancements in femtocell technology and the low cost of femtocell devices. Increased adoption of femtocells in the residential segment and increasing demand from the enterprise segment augment the market.

- The primary driving factor for the femtocells market is limited power consumption. Femtocells consume less power as the transmission power of femtocells is comparatively less than macrocell networks. A femtocell consumes less than 7 W and support several connections in each range.

- Growth in the applications of smartphones for availing value-added services is propelling the growth of the femtocell market. Reductions in the cost of mobile phones, laptops, and other devices have increased the demand for the market.

- The COVID-19 pandemic has had a positive impact on the femtocell market's expansion as femtocell technologies assist businesses in meeting the high-capacity internet traffic demand. Most internet and data service providers noticed increased worldwide internet traffic over the past year related to the COVID-19 pandemic and the adoption of industrial automation across various industry verticals, including manufacturing, e-commerce, and transit and logistics, which is expected to increase demand for femtocells for Internet of Things connectivity.

Femtocell Market Trends

Commercial Segment Expected to Witness Significant Growth

- The increased mobile traffic and the need for more networks in multitenant buildings, hotels, or office towers are drivers of the growth of femtocell in the commercial segment. Benefits such as it can be cheaper and more flexible are further bolstering the market growth.

- The advent of IoT is transforming industries by reshaping business models, value chains, and industry configurations. Femtocells offers indoor coverage and satisfies the needs of smart devices, ensuring affordable connectivity throughout enterprises. according to Ericsson Mobility Report in June this year, broadband IoT (4G/5G) was the technology that connected the largest share of all cellular IoT devices last year.

- Rising Industry 4.0 adoption as well as business organizations promoting BYOD, various factors have been augmenting the market's growth. Significant market drivers include innovative city initiatives, encouraging vendors to develop products specific to applications such as smart cities.

- For instance, NXP Semiconductor recently introduced a femtocell solution that targets high-bandwidth, low-power baseband applications. The solution is optimized for LTE and WCDMA (HSPA+), offering optimized cost and power for innovative city development.

- Femtocell technology enables carriers to enjoy benefits, such as fixed mobile substitution, driving incremental ARPU. Femtocell technology raises the bar in indoor environments and remote areas, such as the suburbs.

Europe Expected to Witness Significant Growth

- In Europe, the United Kingdom is a front-runner in technology and services and recorded GDP growth of 1.6%. The economy is expected to be modest, owing to the subdued consumer expenditure and the political and economic uncertainty of the outcomes of Brexit negotiations.

- The UK segment is buoyed by the presence of robust technologies and infrastructure, owing to the presence of market leaders like Verizon. It is characterized by intense competition in the mobile and broadband sectors. This is one of the reasons why mobile penetration in the country is higher than the European average, supported by relatively low consumer prices.

- With the increasing smartphone penetration (which is around 80%), advancements in the capabilities of these mobile devices and the penetration of the 4G technology across the region have led to robust data usage. In the next few yaers, nearly 50% of UK households are expected to be smart homes. This trend indicates that there exists a significant potential for the adoption of femtocells.

- The growth of the UK segment is anticipated to be driven by the robust demand for wireless networks in the residential and commercial sectors, robust data usage on mobile devices, and the increasing adoption of smart homes.

Femtocell Industry Overview

The femtocells market is fragmented. The players in the market are bringing many innovations, and there are various mergers and acquisitions. The market players operating in this market can achieve a competitive advantage by providing cost-efficient, consistent, and scalable equipment.

- June 2023 - A series of industry-leading companies in partnership with the Industry Development Bureau (IDB) and the Institute for Information Industry (III), Taiwan, showcased their innovative industrial and enterprise 5G connectivity solutions at COMNEXT Tokyo 2023. The exhibition included LITE-ON Technology Corp., among others and a discussing regarding the next generation communication industry trends in Taiwan and Japan. LITEON RAN solution provides a comprehensive 5G/O-RAN SA compliant product portfolio. LITEON FlexFi AIO & Femtocell support sub-6G bands across n78/n79, using a flexible, high performance, and cost-effective architecture.

- November 2022 - Cisco revealed plans to open a next-generation semiconductor device design center in Spain. Cisco plans to establish an engineering design center to create and prototype next-generation semiconductor devices as part of its global strategy to enable a dependable, scalable, and sustainable global semiconductor supply chain. This will be done within the framework of the Spanish strategic project for the Recovery and Economic Transformation of Microelectronics and Semiconductors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Role of Femtocells in the Continuity of 4G and 5G

- 4.3.2 Demand for Heterogeneous Networks

- 4.4 Market Restraints

- 4.4.1 Lack of Skilled Professional Across Industries

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Commercial

- 6.1.2 Residential

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Samsung Electronics

- 7.1.3 Cisco

- 7.1.4 Qualcomm

- 7.1.5 Airvana Inc.

- 7.1.6 CommScope Inc.

- 7.1.7 Fujitsu Ltd.

- 7.1.8 ZTE Corporation

- 7.1.9 Netgear Inc.