|

市場調查報告書

商品編碼

1640597

亞太合成氣:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia-Pacific Syngas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

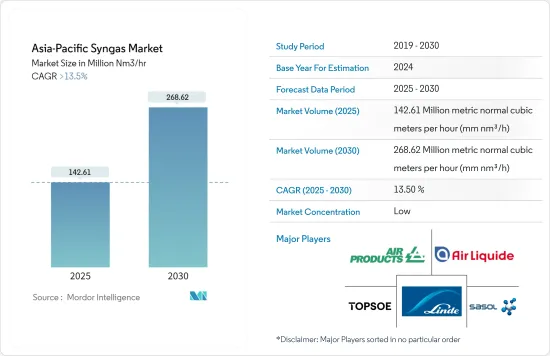

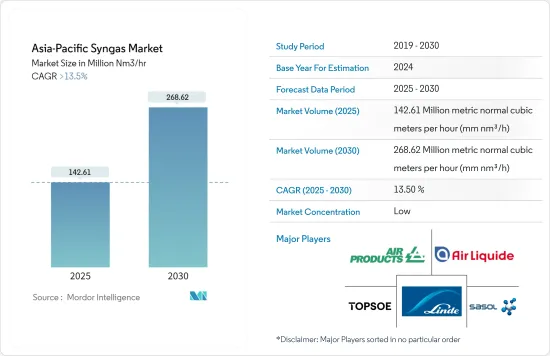

亞太地區合成氣市場規模預計在 2025 年達到 1.4261 億米每小時 (mmnm3/h),預計在 2030 年達到 2.6862 億米每小時 (mmnm3/h)。將超過13.5%。

關鍵亮點

- 亞太合成氣市場受到了 COVID-19 疫情的不利影響。中國是受新冠肺炎疫情影響最嚴重的國家。疫情導致印度、中國等地化工廠關閉,影響了合成氣市場。然而,限制解除後市場恢復良好。由於發電和化學工業合成氣消耗量的增加,市場出現強勁復甦。

- 電力和化學工業對合成氣的需求不斷增加、環保意識的增強和政府對可再生燃料使用的監管以及化肥對氫氣的需求不斷增加,預計將推動市場成長。

- 建立合成氣生產工廠需要大量的資本投入和資金,預計這會阻礙市場的成長。

- 煤炭氣化技術的發展被視為未來的一個機會。

- 由於發電和化學工業對合成氣的需求不斷成長,預計中國將佔據市場主導地位。預計在預測期內,其複合年成長率也將達到最高。

亞太合成氣市場趨勢

氨應用領域佔據市場主導地位

- 合成氣是氨和肥料工業合成的產物。在這個過程中,甲烷(來自天然氣)與水反應生成一氧化碳,氫氣(來自天然氣)與水反應生成一氧化碳和氫氣。氣化過程用於將任何含碳物質轉化為更長的碳氫化合物鏈。

- 哈伯-博施製程可以將合成氣轉化為氨。在此過程中,空氣中的氮與合成氣中的氫混合形成氨,可用於製造各種類型的肥料。

- 使用合成氣作為肥料原料有許多優點。例如,合成氣可以由多種原料製成,從而為企業提供更多選擇並減少對單一原料的依賴。此外,與利用化石燃料生產肥料相比,利用生質能石化燃料生產合成氣可減少溫室氣體排放量。

- 中國約佔全球整體面積的7%,養活了全球22%的人口。該國是多種作物的最大生產國,包括米、棉花和馬鈴薯。因此,由於該國大規模的農業活動,對用作肥料的氨的需求正在迅速增加。

- 中國是世界上最大的氨生產國和消費國。根據美國地質調查局 (USGS) 的數據,該國 2022 年的產量為 4,200 萬噸。由於氨在化肥、紡織、製藥和採礦等農業領域的應用日益廣泛,該國對氨的需求也日益成長。

- 同樣,在印度,農業、紡織和化學工業對氨的需求正在增加。因此,各公司都在國內增加合成氨生產能力。例如,2023 年 5 月,迪帕克化肥和石油化學公司 (DFPC) 宣布將試運行一座價值 5.225 億美元的新氨工廠,並於今年下半年開始生產。該公司將在馬哈拉斯特拉邦邦塔洛賈新增 5 億噸/年產能,使其氨總產能達到 628,700 噸/年。

- 因此,預計預測期內對氨的需求增加將推動該地區對合成氣的需求。

中國主導亞太市場

- 在亞太地區,中國是GDP最大的經濟體。中國是成長最快的經濟體之一,目前是世界上最大的生產國之一。該國的製造業對該國的經濟貢獻巨大。

- 中國對發電、化學品和化肥生產以及液體和氣體燃料應用的合成氣的需求日益成長。因此,各公司正在該國擴大其合成氣生產能力,推動市場發展。

- 在中國,空氣產品公司獲得了一份長期現場契約,為位於中國呼和浩特的久泰新材料高價值單乙二醇計劃供應合成氣。該設施設計生產能力為每小時 500,000 Nm3 以上的合成氣,包括五台氣化爐、兩台約 100,000 Nm3/h 的空氣分離裝置 (ASU)(用於合成氣精製和加工)以及一台100,000 Nm3 / 公共產業的氣化裝置。

- 中國是化肥尤其是氨基肥料的重要生產國和出口國。該國有幾家專門生產化肥的大型化工廠,國內外對氨基苯甲酸肥的需求都很高。

- 在化學工業中,合成氣用於生產化學品和燃料。為了製造合成氣,煤、石油焦和生質能轉化為氣體。在化學工業,合成氣用於生產甲醇、氨和氫氣。在「氣轉液」(GTL)過程中,一氧化碳和氫氣會發生反應,將合成氣轉化為甲醇。甲醇是生產甲醛和乙酸的原料。

- 合成氣既是燃料又是原料。合成氣可用於加熱化工廠的鍋爐和熱交換器以及其他高溫工業應用。根據BASF《化學品展望》報告,2022年預計中國化學品產能將成長7.7%,上年的成長率為6.6%。因此,預計化學工業的成長將推動該國對合成氣的需求。

- 國內發電量的增加推動了對合成氣的需求。根據中國電力委員會的數據,到 2022 年,全國發電量將達到 2,559.4 吉瓦,高於去年的 2,376.1 吉瓦。因此,預計增加發電能力將推動該國僧伽需求。

- 因此,化工、化肥和發電行業的成長預計將推動該國的合成氣市場的發展。

亞太合成氣產業概況

亞太合成氣市場本質上是分散的。市場的主要企業包括(不分先後順序)空氣產品及化學品公司、液化空氣集團、托普索公司、林德公司和薩索爾。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 合成氣生產的原料彈性

- 電力和化學產業的需求不斷成長

- 化肥對氫氣的需求不斷增加

- 限制因素

- 高資本投資和資金籌措

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 原料

- 煤炭

- 天然氣

- 油

- 寵物可樂

- 生質能

- 科技

- 蒸氣重組

- 部分氧化法

- 自熱重整

- 聯合或兩階段改造

- 生質能氣化

- 氣化爐類型

- 固定台

- 夾帶流

- 流體化床

- 應用

- 發電

- 化學

- 甲醇

- 氨

- Oxo基化學

- 正丁醇

- 氫

- 二甲醚

- 液體燃料

- 氣體燃料

- 地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Air Products and Chemicals, Inc.

- Air Liquide

- BASF SE

- BP plc

- DuPont

- General Electric

- Haldor Topsoe A/S

- KBR Inc

- Linde plc

- Royal Dutch Shell plc

- Sasol

- Siemens

- SynGas Technology LLC

- TechnipFMC plc

第7章 市場機會與未來趨勢

- 生質能和城市廢棄物的利用

- 煤炭氣化技術的發展

簡介目錄

Product Code: 55442

The Asia-Pacific Syngas Market size is estimated at 142.61 million metric normal cubic meters per hour (mm nm3/h) in 2025, and is expected to reach 268.62 million metric normal cubic meters per hour (mm nm3/h) by 2030, at a CAGR of greater than 13.5% during the forecast period (2025-2030).

Key Highlights

- The Asia-Pacific Sngas market was negatively affected by the COVID-19 pandemic. China was worst hit by the COVID pandemic in the region. The pandemic resulted in the closure of chemical production plants in countries like India and China, thereby affecting the market for syngas. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of syngas in power generation and chemical industries.

- The growing demand for syngas from the electricity and chemical industry, increasing environmental awareness and government regulations on renewable fuel use, and increasing hydrogen demand for fertilizers are expected to drive the growth of the market.

- The syngas production plant setup requires high capital investment and funding, which is expected to hinder market growth.

- The development of underground coal gasification technology is likely to act as an opportunity in the future.

- China is expected to dominate the market due to the rising demand for syngas in the power generation and chemical industries. It is also expected to register the highest CAGR during the forecast period.

Asia Pacific Syngas Market Trends

Ammonia Application Segment to Dominate the Market

- Syngas is a byproduct of the industrial synthesis of ammonia and fertilizer. Throughout this process, methane (from natural gas) reacts with water to produce carbon monoxide, and hydrogen (from natural gas) reacts with water to produce carbon monoxide and hydrogen. The gasification process is used to transform any carbon-containing substance into longer hydrocarbon chains.

- Through the Haber-Bosch process, syngas can be turned into ammonia, which is a standard part of fertilizers. During this process, nitrogen from the air is mixed with hydrogen from the syngas to make ammonia, which can then be used to make different kinds of fertilizers.

- Using syngas as a source of raw materials to make fertilizer has a number of advantages. For example, syngas can be made from a number of different materials, which gives companies more options and makes them less reliant on a single raw material. Also, making syngas from biomass by gasifying it can help cut down on greenhouse gas emissions compared to making fertilizer from fossil fuels.

- China accounts for approximately 7% of the overall agricultural acreage globally, thus feeding 22% of the world's population. The country is the largest producer of various crops, including rice, cotton, potatoes, and others. Hence, the demand for ammonia, which is used as a fertilizer, is rapidly increasing owing to the large-scale agricultural activities in the country.

- China is the largest producer and consumer of ammonia in the world. According to the US Geological Survey (USGS), the country produced 42 million metric tons in 2022. The demand for ammonia in the country is rising due to increasing applications in the agriculture industry, such as fertilizers, textiles, pharmaceuticals, and mining.

- Similarly, in India, the demand for ammonia is increasing in the agriculture, textile, and chemical industries. Thus, various companies are increasing their ammonia production capacity in the country. For instance, in May 2023, Deepak Fertilisers and Petrochemicals Corporation (DFPC) announced that it would be commissioning a new USD 522.5 Million ammonia plant and start production by the start of the second half of this year. The company is adding a capacity of 5,00,000 million tonnes per annum (MTPA) at Taloja in Maharashtra, which would take the total ammonia capacity to 6,28,700 MTPA.

- Thus, the increasing demand for ammonia is expected to drive the demand for syngas in the region during the forecast period.

China to Dominate the Asia-Pacific Market

- In the Asia-Pacific region, China is the largest economy in terms of GDP. China is one of the fastest emerging economies and has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the significant contributors to the country's economy.

- In China, the demand for syngas is increasing from power generation, chemicals and fertilizers, liquid fuels, and gaseous fuel applications. Thus, various companies are increasing the production capacity of syngas in the country, thereby driving the market.

- In China, Air Products was awarded a long-term onsite contract to supply syngas to Jiutai New Material Co. Ltd for its high-value mono-ethylene glycol project in Hohhot, China. The facility is designed to produce over 500,000 Nm3/hr of syngas, comprised of five gasifiers, two approximately 100,000 Nm3/hr air separation units (ASU) with syngas purification and processing, and associated infrastructure and utilities.

- China is a significant producer and exporter of fertilizers, particularly ammonia-based fertilizers. The country is home to several significant chemical businesses that specialize in fertilizer manufacture, and its ammonia-based fertilizers are in high demand both domestically and internationally.

- In the chemical industry, syngas is used to make chemicals and fuels. To make syngas, coal, petroleum coke, and biomass are turned into gas. In the chemical business, syngas is used to make methanol, ammonia, and hydrogen. Through the "gas-to-liquids" (GTL) process, carbon monoxide and hydrogen react to turn syngas into methanol. Methanol can be used to make formaldehyde, acetic acid, and other things.

- Syngas is both a fuel and a raw material. It can be used to heat boilers and heat exchangers in chemical plants and for other high-temperature industrial uses. According to the BASF chemical outlook report, the chemical production capacity in China will increase by 7.7% in 2022 as compared to the growth rate of 6.6% during the previous year. Thus the growth in the chemical industry is expected to drive the demand for syngas in the country.

- Increasing power generation in the country is boosting the demand for syngas. According to the China Electricity Council (CEC), in 2022, the power generation capacity in the country is registered at 2559.4 gigawatts, as compared to 2376.1 gigawatts of power generation capacity in the previous year. Thus, the increasing power generation capacity is expected to drive the demand for sungas in the country.

- Thus, the growth in chemical, fertilizer, and power generation industries is expected to drive the market for syngas in the country.

Asia Pacific Syngas Industry Overview

The Asia-Pacific Syngas Market is fragmented in nature. Some of the major players in the market include (not in any particular order) include Air Products and Chemicals, Inc., Air Liquide, Haldor Topsoe A/S, Linde plc, and Sasol, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Feedstock Flexibility for Syngas Production

- 4.1.2 Growing Demand in the Electricity and Chemical Industries

- 4.1.3 Increasing Hydrogen Demand for Fertilizers

- 4.2 Restraints

- 4.2.1 High Capital Investment and Funding

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Feedstock

- 5.1.1 Coal

- 5.1.2 Natural Gas

- 5.1.3 Petroleum

- 5.1.4 Pet Coke

- 5.1.5 Biomass

- 5.2 Technology

- 5.2.1 Steam Reforming

- 5.2.2 Partial Oxidation

- 5.2.3 Auto-thermal Reforming

- 5.2.4 Combined or Two-step Reforming

- 5.2.5 Biomass Gasification

- 5.3 Gasifier Type

- 5.3.1 Fixed Bed

- 5.3.2 Entrained Flow

- 5.3.3 Fluidized Bed

- 5.4 Application

- 5.4.1 Power Generation

- 5.4.2 Chemicals

- 5.4.2.1 Methanol

- 5.4.2.2 Ammonia

- 5.4.2.3 Oxo Chemicals

- 5.4.2.4 n-Butanol

- 5.4.2.5 Hydrogen

- 5.4.2.6 Dimethyl Ether

- 5.4.3 Liquid Fuels

- 5.4.4 Gaseous Fuels

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Australia & New Zealand

- 5.5.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals, Inc.

- 6.4.2 Air Liquide

- 6.4.3 BASF SE

- 6.4.4 BP p.l.c.

- 6.4.5 DuPont

- 6.4.6 General Electric

- 6.4.7 Haldor Topsoe A/S

- 6.4.8 KBR Inc

- 6.4.9 Linde plc

- 6.4.10 Royal Dutch Shell plc

- 6.4.11 Sasol

- 6.4.12 Siemens

- 6.4.13 SynGas Technology LLC

- 6.4.14 TechnipFMC plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Utilization of Biomass and Municipal Waste

- 7.2 Development of Underground Coal Gasification Technology

02-2729-4219

+886-2-2729-4219