|

市場調查報告書

商品編碼

1687224

合成氣:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Syngas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

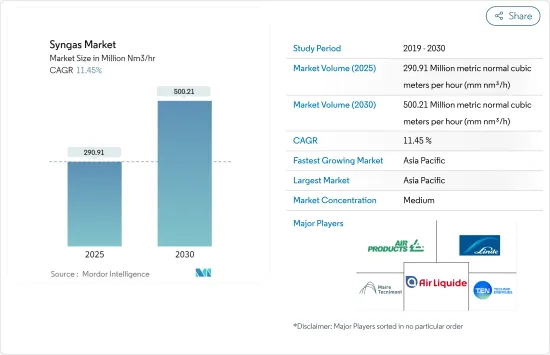

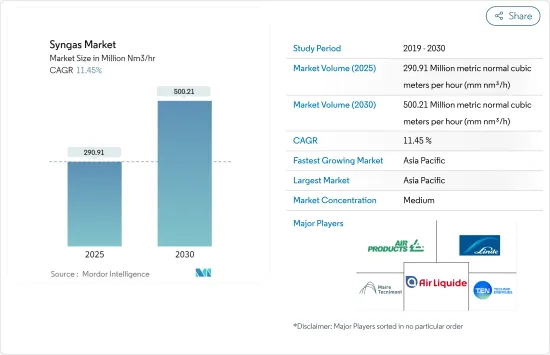

預計 2025 年合成氣市場規模為 2.9091 億公尺每小時,到 2030 年將達到 5.0021 億公尺每小時,預測期間(2025-2030 年)複合年成長率為 11.45%。

2020 年,新冠疫情對市場產生了負面影響。然而,隨著 2021 年主要應用的恢復,預計市場將在預測期內大幅復甦。

關鍵亮點

- 電力和化學工業對合成氣的需求不斷增加、環保意識的增強和政府對可再生燃料使用的監管以及化肥對氫氣的需求不斷增加預計將推動市場成長。

- 相反,建立合成氣生產工廠需要大量的資本投資和資金。預計這一因素將阻礙市場成長。

- 煤炭氣化技術的發展被視為未來的機會。

- 亞太地區在全球整體市場佔據主導地位,擁有最大的消費量並佔據主要的市場佔有率。

合成氣市場趨勢

氨領域佔據市場主導地位

- 氨是由合成氣生產的,而合成氣主要由甲烷製成。第一階段,蒸氣和甲烷透過催化劑生成二氧化碳和氫氣。第二階段,加入空氣,產生二氧化碳、氫氣、氮氣和蒸氣。

- 在下一階段,二氧化碳被去除,混合物被乾燥,並且先前壓縮和冷卻的氮氣和氫氣在催化劑存在下結合生成氨。最後過程中產生的剩餘合成氣被送回反應器。

- 氨是全球氮氣工業的基本組成部分。用於氮肥的氨消耗量佔全球氨市場的80%以上。

- 氨也用於製造硝酸銨,而硝酸銨又可用於製造炸藥。它也用於生產丙烯酸纖維和塑膠所使用的丙烯腈、尼龍66所使用的己二胺、尼龍6所使用的己內醯胺、聚氨酯和聯氨所用的異氰酸酯以及各種胺和腈。

- 根據美國地質調查局( 美國 Geological Survey 2022)的數據,預計2021年全球氨產量為1.5億噸。

- 中國是最大的氨生產國,其次是俄羅斯、美國和印度。 2021年中國合成氨產量為3,900萬噸。

- 美國氨產量估計為1400萬噸。 2021年,16家公司在全美16州的35家工廠投產。美國約60%的氨總產能位於路易斯安那州、奧克拉荷馬州和德克薩斯州,這些州的天然氣蘊藏量豐富。

- 根據美國地質調查局預測,未來四年全球氨產能將成長4%。預計非洲、東歐和南亞的產能將有所成長。

- 因此,隨著合成氨產業的快速成長,預測期內對合成氣的需求也預計將增加。

亞太地區推動市場需求

- 由於中國和印度等全球成長最快的經濟體的需求不斷成長,亞太地區佔據了全球市場佔有率的主導地位。此外,各國正在轉向可再生能源,這正在引發市場成長。

- 在中國,空氣產品公司已獲得一份長期現場契約,為位於中國呼和浩特的久泰新材料高價值單乙二醇計劃供應合成氣。計劃計劃於 2023 年開始。該設施/工廠設計生產能力為每小時 500,000 Nm3 以上的合成氣,包括五個氣化爐、兩個約 100,000 Nm3/h 的空氣分離裝置 (ASU)(用於合成氣精製和處理),以及相關的基礎設施和公共產業。

- 這項技術突破是在空氣產品公司與江蘇德邦化工集團(「德邦集團」)旗下子公司德邦興華科技各佔 80% 股份的合資企業——位於中國江蘇省徐圩國家石油化工園區的煤製合成氣加工廠內取得的。

- 印度已經開發出將高灰分印度煤轉化為甲醇的技術,並在海得拉巴建立了第一個試驗工廠。將煤轉化為甲醇的過程可能包括將煤轉化為合成氣(合成氣)並進一步加工。

- 印度企業集團信實工業有限公司也宣布計劃在其 Jamnagar 綜合設施中將合成氣轉化為藍氫,直到綠色氫氣的價格下降。這些因素可能會對所研究的市場產生正面影響。

- 氨主要用於肥料生產。印度政府已為2021-22會計年度肥料累計107.5億美元。預計這將在預測期內推動用於生產氨的合成氣市場的發展。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

合成氣產業概況

合成氣市場依其性質可分為部分細分市場。市場的主要企業(不分先後順序)包括液化空氣集團、林德集團、空氣產品和化學品公司、Maire Tecnimont SpA 和 Technip Energies NV。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電力和化學產業的需求不斷成長

- 提高環保意識和政府對可再生燃料使用的監管

- 肥料對氫氣的需求不斷增加

- 限制因素

- 高資本投資金籌措

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 原料

- 寵物可樂

- 煤炭

- 天然氣

- 其他原料類型

- 科技

- 蒸氣重組

- 氣化

- 氣化爐類型

- 固定台

- 夾帶流

- 流體化床

- 應用

- 甲醇

- 氨

- 氫

- 液體燃料

- 直接還原鐵

- 合成天然氣

- 電

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 千里達及托巴哥

- 歐洲

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 委內瑞拉

- 巴西

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 南非

- 伊朗

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AHT Syngas Technology NV

- Air Liquide

- Air Products and Chemicals Inc.

- Airpower Technologies Limited

- John Wood Group PLC

- KBR Inc.

- Linde PLC

- Maire Tecnimont Spa

- Sasol

- Shell PLC

- Technip Energies NV

- Topsoe AS

第7章 市場機會與未來趨勢

- 煤炭氣化技術的發展

The Syngas Market size is estimated at 290.91 million metric normal cubic meters per hour (mm nm3/h) in 2025, and is expected to reach 500.21 million metric normal cubic meters per hour (mm nm3/h) by 2030, at a CAGR of 11.45% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. However, with the resumption of operations in major applications in 2021, the market is expected to recover significantly during the forecast period.

Key Highlights

- The growing demand for syngas from the electricity and chemical industry, increasing environmental awareness and government regulations on renewable fuel use, and increasing hydrogen demand for fertilizers are expected to drive the growth of the market.

- Conversely, syngas production plant setup requires high capital investment and funding. This factor is expected to hinder the market's growth.

- The development of underground coal gasification technology is likely to act as an opportunity in the future.

- Asia-Pacific dominated the market across the world, with the largest consumption, holding a major share in the market.

Syngas Market Trends

Ammonia Segment to Dominate the Market

- Ammonia is produced from syngas with methane as the main feedstock. Steam and methane are passed through a catalyst to produce carbon dioxide and hydrogen in the first phase. In the second phase, air is added, forming carbon dioxide, hydrogen, nitrogen, and steam.

- In the next step, carbon dioxide is removed, the mixture is dried, and nitrogen and hydrogen, which were previously compressed and cooled, are combined in the presence of a catalyst to form ammonia. The remaining syngas formed in the penultimate step is sent back to the reactor.

- Ammonia is the basic building block of the global nitrogen industry. Consumption of ammonia for nitrogen fertilizers accounts for over 80% of the global ammonia market.

- Ammonia is used to produce ammonium nitrates to make explosives. It is also used in producing acrylonitrile for acrylic fibers and plastics, hexamethylenediamine for nylon 66, caprolactam for nylon 6, isocyanates for polyurethanes and hydrazine, and various amines and nitriles.

- According to the United States Geological 2022, global ammonia production is estimated to be 150 million metric tons in 2021.

- China is the major producer of ammonia, followed by Russia, the United States, and India. In 2021, China's ammonia production was 39 million metric tons.

- Ammonia production in the United States was estimated to be 14 million metric tons. Sixteen companies produced it at 35 plants in 16 States in the United States in 2021. About 60% of the total US ammonia production capacity was in Louisiana, Oklahoma, and Texas because of their large natural gas reserves.

- According to the US Geological Survey, it is estimated that global ammonia capacity is expected to increase by 4% during the next four years. Capacity additions are expected in Africa, Eastern Europe, and South Asia.

- Therefore, with the rapid growth of the ammonia industry, the demand for syngas is expected to increase during the forecast period.

Asia-Pacific Region to Drive the Market Demand

- Asia-Pacific dominated the global market share, with rising demand from the countries such as China and India, which are among the fastest-growing economies across the world. Moreover, countries are moving toward renewable energy sources, which triggers market growth.

- In China, Air Products was awarded a long-term onsite contract to supply syngas to Jiutai New Material Co. Ltd for its high-value mono-ethylene glycol project in Hohhot, China. The project is expected to start in 2023. The facility/plant is designed to produce over 500,000 Nm3/hr of syngas, comprised of five gasifiers, two approximately 100,000 Nm3/hr air separation units (ASU) with syngas purification and processing, and associated infrastructure and utilities.

- A breakthrough in the coal-to-syngas processing facility in Xuwei National Petrochemical Park, Lianyungang City, Jiangsu Province, China, is evident in the 80% Air Products/20% joint venture with Debang Xinghua Technology Co. Ltd (a subsidiary of Jiangsu Debang Chemical Industrial Group Co. Ltd ('Debang Group')).

- India developed a technology to convert high ash Indian coal to methanol and established its first pilot plant in Hyderabad. The process of converting coal into methanol may consist of converting coal to synthesis (syngas) gas, and further process, thus adding to the syn gas market in the country.

- Indian conglomerate Reliance Industries Limited also announced its plans to turn syngas into blue hydrogen in its Jamnagar complex until the pricing of green hydrogen comes down. Such factors may positively affect the market studied.

- Ammonia is majorly used in fertilizer production. The Indian government has also provided a budget allocation for fertilizers in FY 2021-22 of USD 10.75 billion. This is expected to drive the syn gas market for ammonia production during the forecast period.

- Therefore, the abovementioned factors are expected to impact the market in the future significantly.

Syngas Industry Overview

The syngas market is partly fragmented in nature. Some of the key players in the market (not in particular order) include Air Liquide SA, Linde PLC, Air Products and Chemicals Inc., Maire Tecnimont SpA, and Technip Energies NV, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in the Electricity and Chemical Industry

- 4.1.2 Increasing Environmental Awareness and Government Regulations on the Use of Renewable Fuel

- 4.1.3 Increasing Hydrogen Demand for Fertilizers

- 4.2 Restraints

- 4.2.1 High Capital Investment and Funding

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Feedstock

- 5.1.1 Pet Coke

- 5.1.2 Coal

- 5.1.3 Natural Gas

- 5.1.4 Other Feedstock Types

- 5.2 Technology

- 5.2.1 Steam Reforming

- 5.2.2 Gasification

- 5.3 Gasifier Type

- 5.3.1 Fixed Bed

- 5.3.2 Entrained Flow

- 5.3.3 Fluidized Bed

- 5.4 Application

- 5.4.1 Methanol

- 5.4.2 Ammonia

- 5.4.3 Hydrogen

- 5.4.4 Liquid Fuels

- 5.4.5 Direct Reduced Iron

- 5.4.6 Synthetic Natural Gas

- 5.4.7 Electricity

- 5.4.8 Other Applications

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Trinidad and Tobago

- 5.5.3 Europe

- 5.5.3.1 Russia

- 5.5.3.2 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Venezuela

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 South Africa

- 5.5.5.4 Iran

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A.H.T Syngas Technology NV

- 6.4.2 Air Liquide

- 6.4.3 Air Products and Chemicals Inc.

- 6.4.4 Airpower Technologies Limited

- 6.4.5 John Wood Group PLC

- 6.4.6 KBR Inc.

- 6.4.7 Linde PLC

- 6.4.8 Maire Tecnimont Spa

- 6.4.9 Sasol

- 6.4.10 Shell PLC

- 6.4.11 Technip Energies NV

- 6.4.12 Topsoe AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Underground Coal Gasification Technology