|

市場調查報告書

商品編碼

1640608

歐洲聚氯乙烯(PVC) -市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Europe Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

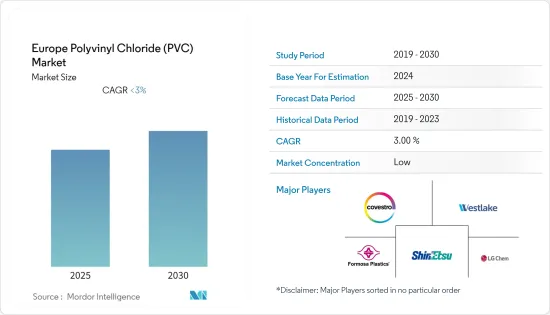

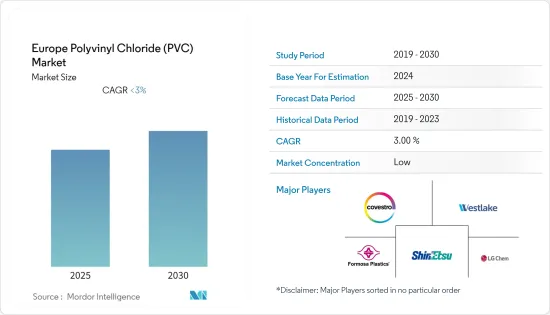

預計預測期內歐洲聚氯乙烯市場的複合年成長率將低於 3%。

2020 年,市場受到了 COVID-19 的負面影響。 2021年,儘管多個國家實施工廠關閉,導致產量減少,但市場仍穩定復甦。

關鍵亮點

- 市場研究的關鍵促進因素包括塑膠的使用日益增多,使汽車更輕、更省油、建築業的需求日益成長、以及醫療行業的應用日益增多。

- 然而,對人類健康和環境的有害影響預計會阻礙市場的成長。

- 加速使用電動車和PVC回收很可能是未來的機會。

歐洲 PVC 市場趨勢

建築業需求不斷成長

- PVC 管道在建築施工中已有 60 多年的使用歷史,因為它在製造過程中可以節省大量能源,運輸成本低,並且使用壽命安全、免維護。這些管道廣泛用於水、廢棄物和廢水管道系統,因為它們沒有積聚、結垢、腐蝕和點蝕,並且表面光滑,從而減少了泵送所需的能量。

- PVC地板材料具有多種優點,包括耐用性、美觀效果的靈活性、易於安裝、易於清潔和可回收性。因此,地板材料經受住了時間的考驗。建築業中 PVC 的另一個用途是作為屋頂材料,這主要是因為其維護要求低、使用壽命超過 30 年。

- 在獨棟住宅、道路和橋樑以及設施建設的推動下,歐洲建築業預計未來幾年將經歷溫和成長。

- 聚氯乙烯(PVC)是世界上產量第三大的塑膠。據ECVM稱,歐洲每年生產590萬噸PVC。 PVC 主要用作建築材料,歐洲生產的 PVC 有 70% 用於窗戶、管道、地板材料、屋頂膜和其他建築產品。

- 根據歐洲塑膠協會統計,歐洲塑膠總需求量為4,910萬噸,其中9.6%為PVC。

- 預計這些因素將在未來幾年推動歐洲 PVC 市場的發展。

德國佔據市場主導地位

- 德國是歐洲最大經濟體,世界第五大經濟體。汽車工業是德國最大的產業,佔工業總收益的20%。

- 公共消費率預計將上升0.5%,推動汽車、建築、電氣和電子領域的成長,同時加速PVC市場的成長。

- 近期,建築業的公共投資增加了1.5%以上。因此,由於住宅市場的繁榮和房地產需求,建築業預計將蓬勃發展。受此影響,預計預測期內該國對 PVC 的需求將會增加。

- 此外,由於德國近期經濟狀況,德國塑膠包裝產業協會預計,今年德國塑膠包裝產量銷售額將成長5.1%,產量將成長3.9%。這可能會增加該國對 PVC 的需求。

- 根據德國建築業中央協會 (ZDB) 和德國建築業主要協會 (HDB) 的數據,2021 年建築業總營業額預計將達到 1,435 億歐元(1,526.6 億美元),低於 2019 年的 1,430 億歐元。億美元(1,432 億美元)。

- 上述因素將導致預測期內該地區聚氯乙烯消耗需求增加。

歐洲聚氯乙烯產業概況

歐洲聚氯乙烯市場按前五大公司進行細分。頂尖公司專注於為各個終端用戶產業提供更好的材料。歐洲領先的聚氯乙烯製造商包括(不分先後順序)台塑股份有限公司、科思創股份公司、信越化學、西湖化學株式會社和 LG 化學。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 增加汽車塑膠使用量,使汽車更輕、更省油

- 建築業需求不斷成長

- 在醫療產業的應用日益廣泛

- 限制因素

- 對人類和環境的有害影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 產品類型

- 硬質 PVC

- 透明硬質 PVC

- 不透明硬質 PVC

- 軟質 PVC

- 透明軟質 PVC

- 不透明軟質 PVC

- 低煙聚氯乙烯

- 氯化聚氯乙烯

- 硬質 PVC

- 穩定器類型

- 鈣系穩定劑(Ca-Zn系穩定劑)

- 鉛基穩定劑(Pb穩定劑)

- 錫和有機錫穩定劑(Sn穩定劑)

- 鋇及其他(液態混合金屬)

- 應用

- 管道和配件

- 薄膜和片材

- 電線電纜

- 瓶子

- 型材、軟管、管材

- 其他

- 最終用戶產業

- 建築和施工

- 車

- 電氣和電子

- 包裝

- 鞋類

- 醫療

- 其他

- 地區

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 土耳其

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Benvic Group

- Covestro AG

- Ercros SA

- Formosa Plastics Corporation

- Industrie Generali SPA

- INEOS

- KEM ONE

- Lukoil

- Oltchim SA

- Orbia

- Shin-Etsu Chemical Co. Ltd

- Sibur

- Solvay

- Vynova

- Westlake Chemical Corporation

第7章 市場機會與未來趨勢

- PVC 回收

- 其他機會

The Europe Polyvinyl Chloride Market is expected to register a CAGR of less than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Several countries imposed factory shutdowns, leading to lower production, but the market steadily recovered in 2021.

Key Highlights

- Major factors driving the market study are the increasing use of plastics to reduce vehicle weight and enhance fuel economy, growing demand from the construction industry, and increasing applications in the healthcare industry.

- However, hazardous impacts on humans and the environment are expected to hinder the growth of the market studied.

- The accelerating usage of electric vehicles and PVC recycling are likely to act as opportunities in the future.

Europe PVC Market Trends

Growing Demand from the Construction Industry

- PVC pipes have been used in building and construction for over 60 years, as they offer valuable energy savings during production, low-cost distribution, and a safe, maintenance-free lifetime of service. These pipes are widely used for pipeline systems for water, waste, and drainage as they suffer no build-up, scaling, corrosion, or pitting, and they provide smooth surfaces, reducing energy requirements for pumping.

- PVC flooring has several benefits, such as durability, freedom of aesthetic effects, ease of installation, ease of cleaning, recyclability, etc. As a result, its flooring has been used for many years.Another area in the building and construction industry where PVC is used is in roofing; it is used mainly due to its low maintenance requirements and the fact that it lasts more than 30 years.

- In the Europe region, the construction industry is expected to witness moderate growth, supported by single-family, roads and bridges, and institutional construction expected in the coming years.

- Polyvinyl chloride (PVC) is the third-most-produced plastic in the world. According to the ECVM, 5.9 million metric tons of PVC are manufactured in Europe each year.PVC is primarily used as a building material, where 70% of all PVC produced in Europe goes into windows, pipes, flooring, roofing membranes, and other building products.

- According to PlasticsEurope, the total demand for plastic in Europe was 49.1 million metric tons, of which 9.6% of demand was for PVC.

- All the above factors are expected to drive the market for Europe's polyvinyl chloride in the coming years.

Germany to Dominate the Market

- Germany is the largest economy in Europe and the fifth largest globally. The automotive industry is the largest sector in Germany, accounting for 20% of the total industry revenue.

- The public consumption rate has increased by 0.5%, which is expected to drive the growth of the automotive, construction, and electrical and electronics sectors, along with the accelerating growth of the PVC market.

- Public investment increased by over 1.5% in the construction sector in the recent past. Hence, due to the booming housing market and real estate demand, the construction and building industry is expected to grow rapidly. This is expected to increase the demand for PVC in the country during the forecast period.

- Besides this, the German Plastics Packaging Industry Association expects a 5.1% increase in sales for German plastic packaging production and a 3.9% increase in volume in the recent past, which is expected to be driven by the healthy economic conditions in the country. This is likely to increase the country's demand for PVC.

- According to the Central Association of the German Building Industry (ZDB) and the Main Association of the German Building Industry (HDB), the construction industry achieved total sales of EUR 143.5 billion (USD 152.66 billion) in 2021, which was a 0.5% growth on the previous year's sale of EUR 143 billion (USD 152.13 billion).

- The aforementioned factors are contributing to the increasing demand for polyvinyl chloride consumption in the region during the forecast period.

Europe PVC Industry Overview

The European polyvinyl chloride market is fragmented among the top five players. The top companies have been focusing on providing better materials for various end-user industries. Major manufacturers of Europe's PVCs are, not in any particular order, Formosa Plastics Corporation, Covestro AG, Shin-Etsu Chemical Co., Ltd., Westlake Chemical Corporation, LG Chem, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Plastics to Reduce Vehicle Weight and Enhance Fuel Economy

- 4.1.2 Growing Demand from the Construction Industry

- 4.1.3 Increasing Applications in the Healthcare Industry

- 4.2 Restraints

- 4.2.1 Hazardous Impact on Humans and the Environment

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-Clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 Stabilizer Type

- 5.2.1 Calcium-based Stabilizers (Ca-Zn Stabilizers)

- 5.2.2 Lead-based Stabilizers (Pb Stabilizers)

- 5.2.3 Tin- and Organotin-based Stabilizers (Sn Stabilizers)

- 5.2.4 Barium-based and Others (Liquid Mixed Metals)

- 5.3 Application

- 5.3.1 Pipes and Fittings

- 5.3.2 Films and Sheets

- 5.3.3 Wires and Cables

- 5.3.4 Bottles

- 5.3.5 Profiles, Hoses and Tubings

- 5.3.6 Other Applications

- 5.4 End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Packaging

- 5.4.5 Footwear

- 5.4.6 Healthcare

- 5.4.7 Other End-user Industries

- 5.5 Geography

- 5.5.1 United Kingdom

- 5.5.2 France

- 5.5.3 Germany

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Turkey

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Benvic Group

- 6.4.3 Covestro AG

- 6.4.4 Ercros S.A.

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 Industrie Generali S.P.A.

- 6.4.7 INEOS

- 6.4.8 KEM ONE

- 6.4.9 Lukoil

- 6.4.10 Oltchim SA

- 6.4.11 Orbia

- 6.4.12 Shin-Etsu Chemical Co. Ltd

- 6.4.13 Sibur

- 6.4.14 Solvay

- 6.4.15 Vynova

- 6.4.16 Westlake Chemical Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 PVC Recycling

- 7.2 Other Opportunities