|

市場調查報告書

商品編碼

1640644

奈米材料-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Nanomaterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

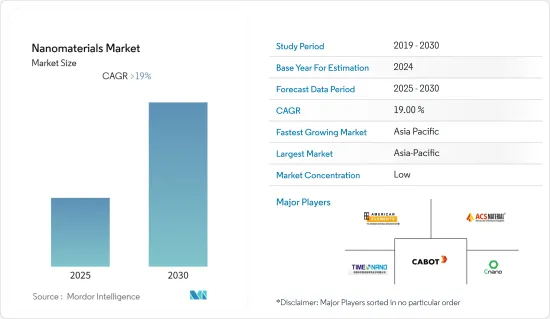

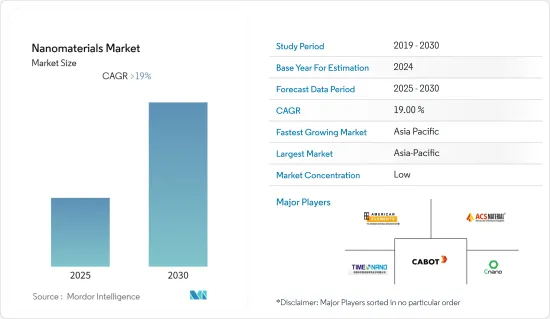

預計預測期內奈米材料市場複合年成長率將超過 19%。

2020 年前 9 個月,由於新冠肺炎疫情,全球多個國家實施了封鎖措施。結果,各種製造工廠和生產設施被迫關閉或停止生產。這種情況對建築、電子、橡膠和個人護理應用的需求產生了負面影響。然而,奈米材料在醫療和建築行業的不斷增加的使用幫助維持了 2021 年市場的成長率。

關鍵亮點

- 預計在預測期內,醫療產業中奈米材料使用量的增加以及水處理應用中奈米材料使用量的增加將推動奈米材料市場的需求。

- 然而,高昂的技術成本預計會阻礙市場成長。

- 預計預測期內,奈米材料研究活動的增加和應用的擴大將成為市場機會。

- 預計預測期內亞太地區將引領市場成長率。

奈米材料市場趨勢

電氣和電子領域佔市場主導地位

- 在電氣和電子領域,計算和電子技術的重大進步推動了奈米材料需求的大幅成長。

- 奈米材料在電子工業的主要應用包括半導體晶片中奈米碳管的使用、發光二極體(LED) 和有機發光二極體(OLED) 等照明技術中各種奈米材料的應用、雷射器中量子點的使用、目前正對其他用途進行研究。

- 由於亞太地區擁有大量目的地設備製造商(OEM),預計未來幾年亞太地區電子製造市場將快速成長。低成本、原料的可用性以及廉價的勞動力正在推動這一領域的成長。該地區的公司為德國、法國和美國的公司提供製造和組裝服務。

- 中國是全球最大的電子產品製造基地,為韓國、新加坡和台灣等現有的上游製造商帶來了激烈的競爭。智慧型手機、OLED 電視和平板電腦等電子產品在市場家用電子電器領域的需求成長最高。

- 根據JEITA發布的報告,全球電子與IT產業產值預計將從2021年的3.4159兆美元大幅增加,到2023年將達到3.5266兆美元。

- 在越南胡志明市,韓國巨頭三星以及許多其他跨國電子公司,例如日本的夏普和丹麥的 Sonion,正在大力投資生產設施。微軟、任天堂、理光和戴爾等多家公司計劃在越南建立生產線。

亞太地區主導奈米材料市場

- 亞太地區佔據全球市場佔有率的主導地位。中國、印度和日本等國家建設活動的增加以及對家具的需求不斷增加,推動了該地區對奈米材料的需求。

- 中國政府採取措施支持和鼓勵國內醫療設備創新,為市場研究提供了機會。作為僅次於美國的全球第二大醫療產業國,中國的醫療市場面臨更大的挑戰,尤其是在2020年新冠疫情的衝擊下。預計到2030年中國將佔全球醫療設備產業收益佔有率的25%。

- 印度的醫療保健產業規模預計到 2022 年將達到 3,720 億美元,主要推動力是健康意識的增強、保險覆蓋率的擴大、收入的增加以及疾病的增加。印度的醫療保健產業受惠於每年1.6%的人口成長率。超過1億的人口老化、文明病的增加、收入的增加以及醫療保險的普及率的提高,正在刺激行業中更先進、更精準的醫療設備的成長。

- 在日本,65歲以上人口約佔總人口的30%,預計到2050年將達到40%左右。日本人口老化迅速、患有慢性病和文明病疾病的患者數量不斷增加、全民健康保險覆蓋和監管措施正在推動日本醫療保健市場的發展。由於人口老化速度比其他國家都快,日本正在加強其醫療保健產業。

- 泰國被視為亞洲主要醫療中心。作為亞洲的領導者,泰國在許多旨在促進該地區醫療設備進步的地區和國際組織中發揮關鍵作用。泰國生產並出口的大多數醫療設備屬於一次性設備類別,約84%的出口醫療用品屬於此類。

奈米材料產業概況

奈米材料市場高度分散。市場上的公司專注於特定類型的奈米材料或特定應用。市場的主要企業(不分先後順序)包括 American Elements、成都有機化學(Timesnano)、江蘇天奈科技、卡博特公司和 ACS Material。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大奈米藥物在醫療產業的應用

- 擴大奈米材料在水處理應用的使用

- 限制因素

- 技術成本上升

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 產品類型

- 奈米粒子

- 奈米金屬

- 金子

- 銀

- 鉑

- 鈦

- 鋁

- 非金屬氧化物

- 氧化鋁

- 氧化鐵

- 二氧化鈦

- 二氧化矽

- 氧化鋅

- 複合氧化物

- 磷酸鈣

- 稀土元素氧化物

- 鈦酸鋰

- 矽氫化物

- 奈米纖維

- 奈米管

- 奈米黏土

- 奈米線

- 奈米粒子

- 結構類型

- 非聚合物有機奈米材料

- 炭黑

- 奈米碳管

- 適體

- 小分子OLED

- 活性碳

- 奈米碳管複合材料

- 聚合物奈米材料

- 塗料和黏合劑

- 轉染試劑

- 診斷劑

- 藥物輸送載體

- 織物處理

- 光學塗層

- 奈米孔過濾膜

- 介電薄膜

- OLED 薄膜

- 非聚合物有機奈米材料

- 最終用戶產業

- 建造

- 電子產品

- 能源

- 醫療

- 個人護理

- 橡皮

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACS Material

- American Elements

- Arkema Group

- BASF SE

- Cabot Corporation

- CHASM Advanced Materials Inc.

- Chengdu Organic Chemicals Co. Ltd(Timesnano)

- Jiangsu Cnano Technology Co. Ltd

- LG Chem

- Nano-C

- Nanocyl SA

- Nanophase Technologies Corporation

- OCSiAl

- Raymor Industries Inc.

- SHOWA DENKO KK

- ZYVEX TECHNOLOGIES

第7章 市場機會與未來趨勢

- 研究活動活性化,應用不斷成長

The Nanomaterials Market is expected to register a CAGR of greater than 19% during the forecast period.

Due to the COVID-19 pandemic, various countries worldwide imposed lockdowns in the first nine months of 2020. Thus, various manufacturing plants and production facilities were shut down or halted production. This situation negatively affected the demand for construction, electronics, rubber, and personal care applications. However, increased usage of nanomaterials in healthcare and construction industries helped the market to retain its growth rate in 2021.

Key Highlights

- The growing usage of nanomaterials in the healthcare industry and the increasing usage of nanomaterials in water treatment applications are expected to drive the demand in the nanomaterials market during the forecast period.

- However, higher technology costs are expected to hinder the market's growth.

- Increasing research activities and growing applications of nanomaterials is expected to act as market opportunity in the forecast period.

- The Asia-Pacific is expected to drive the market growth rate during the forecast period.

Nanomaterials Market Trends

The Electrical and Electronics Segment to Dominate the Market

- In the electrical and electronics segment, the demand for nanomaterials has been greatly increasing owing to major advances in computing and electronics, leading to faster, smaller, and more portable systems that can manage and store progressively larger amounts of information.

- Some of the major applications of nanomaterials in the electronics industry include the use of carbon nanotubes in semiconductor chips, the use of a variety of nanomaterials in lighting technologies, including light-emitting diodes or LEDs and organic light-emitting diodes or OLEDs, use of quantum dots in lasers, along with ongoing research into the application of others.

- The electronics manufacturing market in Asia-Pacific is expected to grow rapidly during the upcoming years due to the presence of a large number of original equipment manufacturers (OEMs) in the region. Low cost, the availability of raw materials, and cheap labor are driving the growth of the sector. The companies in the region provide manufacturing and assembling services to companies in Germany, France, and the United States.

- China has the world's largest electronics production base and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, among others, registered the highest growth in the consumer electronics segment of the market in terms of demand.

- As per a report published by JEITA, the production of global electronics and IT industries is expected to increase significantly in 2023 and reach USD 3,526.6 million compared to USD 3,415.9 billion in 2021.

- In Ho Chi Minh City, Vietnam, the South Korean giant, Samsung has heavily invested in a production facility, along with many other multinational electronic firms, like Japan's Sharp and Denmark's Sonion. Microsoft, Nintendo, Ricoh, and Dell, are some other companies that plan to set up production lines in Vietnam.

Asia Pacific Region to Dominate the Nanomaterials Market

- The Asia-Pacific region dominates the global market share. With growing construction activities and the increasing demand for furniture in countries such as China, India, and Japan, the demand for nanomaterials is increasing in the region.

- The Chinese government has policies to support and encourage domestic medical device innovation, providing opportunities for the market studied. As the second-largest healthcare industry globally, behind the United States, the country's healthcare market has been more rigorous, especially in light of the COVID-19 pandemic in 2020. China is expected to have 25% of the global medical device industry revenue share by 2030.

- The healthcare sector in India was expected to reach USD 372 billion by 2022, mainly driven by increasing health awareness, access to insurance, rising income, and diseases. The medical sector in India is benefiting from the growing population at a rate of 1.6% per year. An aging population of over 100 million, rising incidences of lifestyle diseases, rising incomes, and increased penetration of health insurance are fueling the growth of more sophisticated and accurate medical devices in the industry.

- In Japan, the 65-and-above demographic represents around 30% of the country's total population and is expected to reach around 40% by 2050. The rapidly aging Japanese population, the increasing number of patients with chronic and lifestyle diseases, and universal health insurance coverage and regulatory measures are driving the Japanese healthcare market. Japan is boosting its medical sector as its citizens are getting older at a faster rate than the citizens of any other nation.

- Thailand is acclaimed as a major healthcare hub in Asia. Thailand, as a leader in Asia, is found to be playing a vital role in many regional and international organizations, dedicated to promoting the advancement of medical devices in the area. Most of the medical devices manufactured in Thailand for export fall into the category of single-use devices and approximately 84% of the revenue of all medical supplies exported are in this group.

Nanomaterials Industry Overview

The nanomaterials market is highly fragmented. The companies in the market focus on specific types of nanomaterials and also on specific applications. Some of the key players in the market (in no particular order) include American Elements, Chengdu Organic Chemicals Co. Ltd (Timesnano), Jiangsu Cnano Technology Co. Ltd, Cabot Corporation, and ACS Material, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Nanomedicines in the Healthcare Industry

- 4.1.2 Increasing Usage of Nanomaterials in Water Treatment Applications

- 4.2 Restraints

- 4.2.1 Higher Costs of Technology

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Nanoparticles

- 5.1.1.1 Nanometals

- 5.1.1.1.1 Gold

- 5.1.1.1.2 Silver

- 5.1.1.1.3 Platinum

- 5.1.1.1.4 Titanium

- 5.1.1.1.5 Aluminium

- 5.1.1.2 Nonmetal Oxides

- 5.1.1.2.1 Alumina

- 5.1.1.2.2 Iron Oxide

- 5.1.1.2.3 Titanium Oxide

- 5.1.1.2.4 Silica

- 5.1.1.2.5 Zinc Oxide

- 5.1.1.3 Complex Oxides

- 5.1.1.3.1 Calcium Phosphate

- 5.1.1.3.2 Rare Earth Metal Oxides

- 5.1.1.3.3 Lithium Titanate

- 5.1.1.3.4 Silica Hydride

- 5.1.2 Nanofibers

- 5.1.3 Nanotubes

- 5.1.4 Nanoclays

- 5.1.5 Nanowires

- 5.1.1 Nanoparticles

- 5.2 Structure Type

- 5.2.1 Non-polymer Organic Nanomaterials

- 5.2.1.1 Carbon Black

- 5.2.1.2 Carbon Nanotubes

- 5.2.1.3 Aptamers

- 5.2.1.4 Small Molecule OLED

- 5.2.1.5 Activated Carbon

- 5.2.1.6 Carbon Nanotubes Composites

- 5.2.2 Polymeric Nanomaterials

- 5.2.2.1 Coatings and Adhesives

- 5.2.2.2 Transfection Reagents

- 5.2.2.3 Diagnostics Reagents

- 5.2.2.4 Drug Delivery Vehicle

- 5.2.2.5 Fabric Treatments

- 5.2.2.6 Optical Coatings

- 5.2.2.7 Nano-porous Filtration Membrane

- 5.2.2.8 Di-electric Films

- 5.2.2.9 OLED Films

- 5.2.1 Non-polymer Organic Nanomaterials

- 5.3 End-user Industry

- 5.3.1 Construction

- 5.3.2 Electronics

- 5.3.3 Energy

- 5.3.4 Healthcare

- 5.3.5 Personal Care

- 5.3.6 Rubber

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACS Material

- 6.4.2 American Elements

- 6.4.3 Arkema Group

- 6.4.4 BASF SE

- 6.4.5 Cabot Corporation

- 6.4.6 CHASM Advanced Materials Inc.

- 6.4.7 Chengdu Organic Chemicals Co. Ltd (Timesnano)

- 6.4.8 Jiangsu Cnano Technology Co. Ltd

- 6.4.9 LG Chem

- 6.4.10 Nano-C

- 6.4.11 Nanocyl SA

- 6.4.12 Nanophase Technologies Corporation

- 6.4.13 OCSiAl

- 6.4.14 Raymor Industries Inc.

- 6.4.15 SHOWA DENKO K.K.

- 6.4.16 ZYVEX TECHNOLOGIES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research Activities and Growing Applications