|

市場調查報告書

商品編碼

1640653

熱可塑性橡膠(TPE) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Thermoplastic Elastomer (TPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

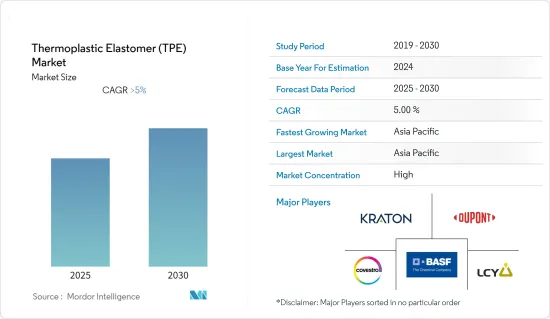

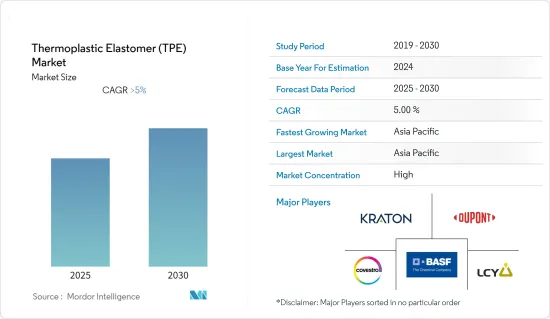

預測期內,熱可塑性橡膠市場預計將以超過 5% 的複合年成長率成長。

COVID-19 疫情導致全國封鎖、製造活動和供應鏈中斷以及全球生產停頓,對 2020 年的市場產生了負面影響。然而,情況在 2021 年開始好轉,預測期內市場的成長軌跡開始回升。

關鍵亮點

- 推動市場成長的主要因素是汽車產業的廣泛需求和 HVAC 產業不斷成長的應用。

- 預計原物料價格波動將阻礙未來的市場需求。

- 對生物基熱可塑性橡膠不斷成長的需求可能會在未來幾年為市場創造機會。

- 預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。

熱可塑性橡膠(TPE) 市場趨勢

擴大在汽車和運輸領域的應用

- 熱可塑性橡膠(TPE) 是一種高性能材料,在汽車工業中的應用正在迅速擴大。 TPE 在汽車行業有多種應用,包括生產高品質的汽車儀錶面板、車輪罩、儀表板組件、柱飾、車門襯裡和把手、座椅靠背和安全帶組件。

- 汽車工業對所用材料的要求特別高。在極端壓力下,材料必須保持尺寸穩定,並且在劇烈的溫度變化時不會彎曲,這導致了對 TPE 的需求。

- 根據國際汽車工業組織(OICA)預測,2021年全球汽車產量將達到8,010萬輛,較上年的7,760萬輛成長4%。由於消費需求增加而導致的汽車產量增加是推動市場成長的主要因素。

- TPE 是一種比金屬便宜的特殊塑膠,具有重量輕、耐用、耐腐蝕、堅韌、設計靈活、彈性好、性能高且成本低等特點,是提高汽車能源效率的理想選擇。 TPE 重量輕,可以讓車輛更加省油。據估計,車輛重量每減輕 10%,燃料消耗就會減少 5% 至 7%。

- 高性能熱可塑性橡膠為製造商提供與鋼相當的設計優勢和強度,有助於減輕重量和減少溫室氣體排放。

- 據天然橡膠生產國協會(ANRPC)稱,4 月全球橡膠產量從 3 月的 904,000 噸增至 914,000 噸。

- 根據美國聯邦航空管理局(FAA)預測,由於航空貨運需求的不斷成長,到2037年民航機的總數將達到8,270架。此外,由於現有機隊老化,美國主幹線航空公司預計每年將把機隊飛機數量增加到 54 架。

- 預計這些因素將在預測期內推動對熱可塑性橡膠的需求。

亞太地區佔市場主導地位

- 預計亞太地區將主導市場。在該地區,中國和印度是成長最快的經濟體,目前也是全球最大的製造業基地之一。

- 該地區是最大的汽車製造地,佔全球汽車產量的近60%。 2022年1月,本田的中國合資企業東風汽車公司宣佈在武漢建立電動車製造廠。東風本田新廠將於2024年投產,年產能12萬輛。

- 此外,中國建築業也正在經歷強勁成長。根據中國國家統計局的數據,2021年中國建築業產值約4.29兆美元。

- 根據JEITA(電子情報技術產業協會)統計,2022年11月,電子產業總產值達70.9834億美元。 2022年12月,日本電子設備出口總額為83.9545億美元。

- 在印度,電子產品市場的需求不斷成長,市場規模正在快速成長。 2022 年 12 月,印度電子產品出口額為 166.7 億美元,而 2021 年同期為 109.9 億美元。印度和中國電子和家用電子電器市場的成長可能會進一步推動亞太地區的市場成長。

- 根據印度品牌資產基金會 (IBEF) 的數據,印度是全球前 20 大醫療設備市場之一。預計2021年印度醫療設備出口額將達25.3億美元,到2025年將增加至100億美元。例如,2021年9月,政府核准在奧拉加丹(泰米爾納德邦)建立一個醫療設備園區,預計將吸引4.7205億美元的投資。

- 2021年泰國天然橡膠產量為483萬噸,約佔全球天然橡膠產量的35%。泰國已成為世界主要天然橡膠生產國之一。 2021年泰國天然橡膠產量與前一年同期比較增1%。

- 由於上述因素,預計未來幾年該地區的熱可塑性橡膠市場將出現巨大的需求。

熱可塑性橡膠(TPE) 產業概況

熱可塑性橡膠市場正在經歷整合的本質。市場的主要企業(不分先後順序)包括杜邦、BASF、科思創、李長榮集團、科騰公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車和運輸業的廣泛需求

- 擴大暖通空調產業的應用

- 限制因素

- 採用軟質熱可塑性橡膠3D 列印的挑戰

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 產品類型

- 苯乙烯嵌段共聚物 (TPE-S)

- 熱塑性烯烴 (TPE-O)

- 合成橡膠合金(TPE-V 或 TPV)

- 熱塑性聚氨酯 (TPU)

- 熱塑性共聚酯

- 熱塑性聚醯胺

- 應用

- 汽車和運輸

- 建築和施工

- 鞋類

- 電氣和電子

- 醫療

- 其他用途(家用產品、黏合劑、密封劑)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)*/排名分析

- 主要企業策略

- 公司簡介

- Apar Industries Ltd

- Arkema Group

- Asahi Kasei Corporation

- Avient Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- DSM

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- Grupo Dynasol

- Huntsman International LLC

- KRATON CORPORATION

- LANXESS

- LCY GROUP

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- SABIC

- Sumitomo Chemicals Co. Ltd

- The Lubrizol Corporation

第7章 市場機會與未來趨勢

- 生物基熱可塑性橡膠的需求不斷增加

- 在醫療產業的應用日益廣泛

The Thermoplastic Elastomer Market is expected to register a CAGR of greater than 5% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- The major factors driving the market's growth are extensive demand from the automotive industry and growing applications in the HVAC industry.

- Volatility in raw material prices is expected to hinder future market demand.

- The growing demand for bio-based thermoplastic elastomers will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Thermoplastic Elastomers (TPE) Market Trends

Increasing Usage in the Automotive and Transportation Applications

- Thermoplastic elastomers (TPE) are high-performance materials whose application in the automotive industry is rapidly increasing. TPE serves the automotive industry in myriad applications, including manufacturing high-quality automotive instrument panels, wheel covers, dashboard components, pillar trims, door liners and handles, seat backs, and seat belt components.

- The automotive industry places particularly high requirements on the materials used. Under extreme stresses, the materials must be dimensionally stable and must not warp, even when faced with great temperature variations, which is, in turn, catering to the demand for TPE.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, global vehicle production reached 80.1 million units, with an increase of 4% from the previous year's production of 77.6 million units. The increasing production of vehicles owing to the growing need from consumers is the key factor for driving the market growth.

- TPEs are special types of plastic that are cheaper than metals and help make automobiles more energy-efficient by reducing weight, providing durability, corrosion resistance, toughness, design flexibility, resiliency, and high performance at low cost. The light weight of TPE enables more fuel-efficient vehicles. Every 10% reduction in vehicle weight is estimated to result in a 5-7% reduction in fuel usage.

- High-performance thermoplastic elastomers offer manufacturers advantages of design and the comparable strength of steel, which help reduce the weight and control greenhouse gas emissions.

- According to the Association of Natural Rubber Producing Countries (ANRPC), the global rubber production volumes increased in April to 914 thousand tons from 904 thousand tons in March.

- According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 in 2037, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow to 54 aircraft per year due to the existing fleet getting older.

- All the factors above, in turn, are expected to drive the demand for thermoplastic elastomers during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market. In the region, China and India are the fastest emerging economies and have become one of the biggest production houses in the world today.

- The region is the largest automotive manufacturing hub, with almost 60% share of global automotive manufacturing. In January 2022, Honda's Chinese joint venture with Dongfeng Motor Corporation Ltd. announced the development of an electric-vehicle manufacturing factory in Wuhan. The new Dongfeng-Honda Automobile facility will be opened in 2024 with a production capacity of 120,000 units per year.

- Furthermore, China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China will be valued at approximately USD 4.29 trillion.

- According to JEITA (Japan Electronics and Information Technology Industries Association), in November 2022, the total production of the electronics industry reached USD 7,098.34 million. In December 2022, Japan exported a total of electronics worth USD 8,395.45 million.

- In India, the electronics market witnessed a growth in demand, with market size increasing at a rapid growth rate. India's electronic goods exports fetched USD 16.67 billion in December 2022, compared to USD 10.99 billion in the same month of 2021. The growing electronics and appliances market in India and China may push the market growth further in Asia-Pacific.

- According to India Brand Equity Foundation (IBEF), India is among the top 20 markets for medical devices worldwide. The export of medical devices from India stood at USD 2.53 billion in 2021 and is expected to rise to USD 10 billion by 2025. For instance, in September 2021, the government approved a medical devices park in Oragadam (Tamil Nadu) that is expected to attract an estimated investment of USD 472.05 million.

- In 2021, Thailand produced 4.83 million metric tons of natural rubber, accounting for approximately 35% of the global natural rubber production. It made Thailand the world's leading natural rubber-producing country. Natural rubber output in Thailand increased by 1% in 2021 compared to the previous year.

- Owing to the factors above, the market for thermoplastic elastomers in the region is expected to witness huge demand in the coming years.

Thermoplastic Elastomers (TPE) Industry Overview

The thermoplastic elastomer market is consolidated in nature. The market's key players (not in any particular order) include DuPont, BASF SE, Covestro AG, LCY GROUP, and KRATON CORPORATION, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Extensive Demand from the Automotive and Transportation Industry

- 4.1.2 Growing Application in the HVAC Industry

- 4.2 Restraints

- 4.2.1 Challenges of 3D Printing with Soft Thermoplastic Elastomers

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Styrenic Block Copolymer (TPE-S)

- 5.1.2 Thermoplastic Olefin (TPE-O)

- 5.1.3 Elastomeric Alloy (TPE-V or TPV)

- 5.1.4 Thermoplastic Polyurethane (TPU)

- 5.1.5 Thermoplastic Copolyester

- 5.1.6 Thermoplastic Polyamide

- 5.2 Application

- 5.2.1 Automotive & Transportation

- 5.2.2 Building & Construction

- 5.2.3 Footwear

- 5.2.4 Electricals & Electronics

- 5.2.5 Medical

- 5.2.6 Other Applications(Household Goods, ahdesives & sealants)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)*/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Apar Industries Ltd

- 6.4.2 Arkema Group

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 Avient Corporation

- 6.4.5 BASF SE

- 6.4.6 Celanese Corporation

- 6.4.7 Covestro AG

- 6.4.8 DSM

- 6.4.9 DuPont

- 6.4.10 Evonik Industries AG

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 Grupo Dynasol

- 6.4.13 Huntsman International LLC

- 6.4.14 KRATON CORPORATION

- 6.4.15 LANXESS

- 6.4.16 LCY GROUP

- 6.4.17 LG Chem

- 6.4.18 LyondellBasell Industries Holdings B.V.

- 6.4.19 Mitsubishi Chemical Corporation

- 6.4.20 SABIC

- 6.4.21 Sumitomo Chemicals Co. Ltd

- 6.4.22 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-based Thermoplastic Elastomers

- 7.2 Increasing Applications in the Medical Industry