|

市場調查報告書

商品編碼

1640692

鎳合金:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Nickel Alloys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

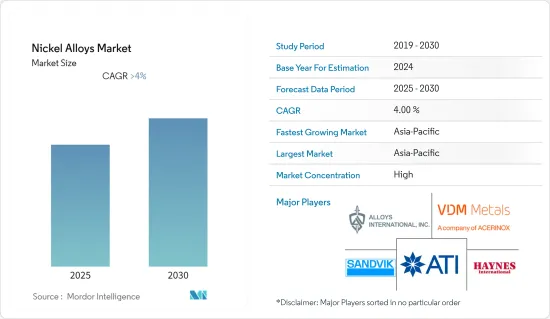

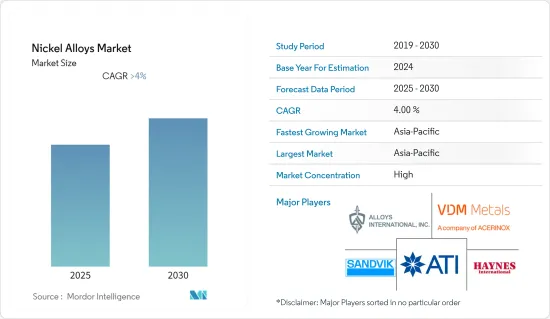

預測期內,鎳合金市場預計將以超過 4% 的複合年成長率成長。

主要亮點

- 2020 年,新冠疫情對市場產生了負面影響。不過,預計 2022 年市場將達到疫情前的水平,並持續穩定成長。

- 預計預測期內航太工業和石油天然氣行業不斷成長的需求將推動市場成長。另一方面,鎳和其他合金元素的價格波動預計會限制該行業的擴張。

- 此外,技術進步預計將創造巨大的市場成長機會。亞太地區佔據全球市場主導地位,其中中國、印度和日本等國家佔最大的消費量。

鎳合金市場趨勢

航太領域的需求不斷成長

- 預計預測期內航太領域將佔據鎳合金市場佔有率。鎳合金在航空航太工業的需求量很大。這些合金具有出色的耐高溫、耐壓和耐腐蝕性能,是航空航太機械生產中不可或缺的合金。

- 航太工業對鎳合金的需求不斷增加預計將推動市場成長率。新興國家航空旅客數量的增加刺激了對新飛機的需求,推動了市場成長。

- 根據美國運輸統計局(BTS)的數據,2021年美國航空業的客運票價收入為867億美元,較2020年成長約73.7%,支撐了對鎳合金的需求。根據美國聯邦航空管理局(FAA)的數據,到2021年,美國通用航空持有將激增至204,405架,這將刺激鎳合金的需求。

- 因此,由於上述所有因素,預計預測期內鎳合金市場將會成長。

亞太地區佔市場主導地位

- 亞太地區是鎳合金的最大消費地區,佔據全球市場的很大佔有率。電動車需求的不斷成長是推動該地區鎳合金需求的主要因素之一。

- 鎳合金的需求很大一部分來自航太和汽車製造業,推動了該地區的成長。中國引領全球電動車市場,新電動車的銷售和產量大幅成長。

- 根據中國汽車工業協會(CAAM)的數據,2022 年 12 月,全國新電動車(NEV)產量年增 96.9%。因此,電動車市場的擴大預計將增加對鎳合金的需求。

- 此外,印度的乘用車產量大幅成長。例如,根據印度汽車工業協會(SIAM)發布的最新資料,2021-2022年乘用車產量將達到3,650,698輛,比2020-21年成長19%,支撐市場成長。

- 因此,由於上述原因,預計亞太地區將在預測期內主導研究市場。

鎳合金產業概況

鎳合金市場本質上是整合的。市場的主要企業包括 Alloys International, Inc.、ATI、VDM Metals、Haynes International 和 Sandvik AB。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 航太領域的需求不斷成長

- 電動車越來越受歡迎

- 限制因素

- 鎳及其他合金元素的價格波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按類型

- 耐熱鎳合金

- 耐腐蝕鎳合金

- 耐電鎳合金

- 低膨脹鎳合金

- 其他類型

- 按最終用戶產業

- 航太

- 電氣和電子

- 石油和天然氣

- 化學處理

- 汽車

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Alloys International, Inc.

- Berkshire Hathaway Inc.

- HAYNES INTERNATIONAL

- Kennametal Inc.

- NeoNickel

- Sandvik AB

- SANYO SPECIAL STEEL Co., Ltd.

- thyssenkrupp Materials NA, Inc.

- voestalpine Specialty Metals

- ATI

- VDM Metals

- Proterial, Ltd.

第7章 市場機會與未來趨勢

- 技術進步預計將創造巨大的市場成長機會

簡介目錄

Product Code: 57062

The Nickel Alloys Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The increasing demand from the aerospace industry and expanding oil and gas sector are expected to fuel the market growth during the forecast period. On the other hand, the fluctuating prices of nickel and other alloying elements are expected to limit industry expansion.

- Further, technological advancements are expected to generate significant market growth opportunities. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Nickel Alloys Market Trends

Increasing Demand from Aerospace Sector

- Over the projection period, the aerospace segment is expected to hold considerable market shares for nickel alloys. Nickel alloys are in high demand in the aircraft industry. These alloys are essential in the production of aviation machinery due to their exceptional resistance to high temperatures, pressure, and corrosion.

- The increased demand for nickel alloys in the aerospace industry is anticipated to fuel the market's growth rate. The expanding number of passengers for air travel in emerging countries stimulates the demand for new aircraft, thus, driving market growth.

- According to the Bureau of Transportation Statistics (BTS), in 2021, passenger fare revenue for the US airline industry totaled 86.7 billion dollars, representing an increase of almost 73.7% compared to 2020, supporting the demand for nickel alloys. According to the Federal Aviation Administration (FAA), the general aviation fleet in the United States surged to 204,405 aircraft in 2021, fueling the demand for nickel alloys.

- Hence, owing to all the above-mentioned factors, the market for nickel alloys is expected to increase during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the largest consumer of nickel alloys and accounts for a healthy share of the global market. Increasing demand for electric vehicles is one of the major factors boosting the demand for nickel alloys in the region.

- The majority of the demand for nickel alloys is from the aerospace and automotive manufacturing segment, fueling the growth in the region. China is a leader in the global electric car market, with a significant increase in sales and production of new electric vehicles in the country.

- According to the China Association of Automobile Manufacturing (CAAM), the country's production of new electric vehicles (NEVs) witnessed a year-on-year increase of 96.9% in December 2022. Thus, the expanding electric vehicle market is expected to increase the demand for nickel alloys

- Also, India witnessed a significant increase in the production of passenger vehicles. For instance, according to the latest data published by the Society of Indian Automobile Manufacturers (SIAM), the production of passenger vehicles reached 3,650,698 for 2021-2022, representing an increase of 19% compared to 2020-21, supporting the market growth.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Nickel Alloys Industry Overview

The nickel alloy market is consolidated in nature. Some of the major players in the market include Alloys International, Inc., ATI, VDM Metals, Haynes International, and Sandvik AB, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Aerospace Sector

- 4.1.2 Rising Popularity of Electric Vehicles

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Nickel and Other Alloying Elements

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Heat-Resistant Nickel Alloys

- 5.1.2 Corrosion-Resistant Nickel Alloys

- 5.1.3 Electrical-Resistant Nickel Alloys

- 5.1.4 Low-Expansion Nickel Alloys

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Electrical and Electronics

- 5.2.3 Oil and Gas

- 5.2.4 Chemical Processing

- 5.2.5 Automotive

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alloys International, Inc.

- 6.4.2 Berkshire Hathaway Inc.

- 6.4.3 HAYNES INTERNATIONAL

- 6.4.4 Kennametal Inc.

- 6.4.5 NeoNickel

- 6.4.6 Sandvik AB

- 6.4.7 SANYO SPECIAL STEEL Co., Ltd.

- 6.4.8 thyssenkrupp Materials NA, Inc.

- 6.4.9 voestalpine Specialty Metals

- 6.4.10 ATI

- 6.4.11 VDM Metals

- 6.4.12 Proterial, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements Are Expected To Generate Significant Market Growth Opportunities

02-2729-4219

+886-2-2729-4219