|

市場調查報告書

商品編碼

1640708

包裝薄膜:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

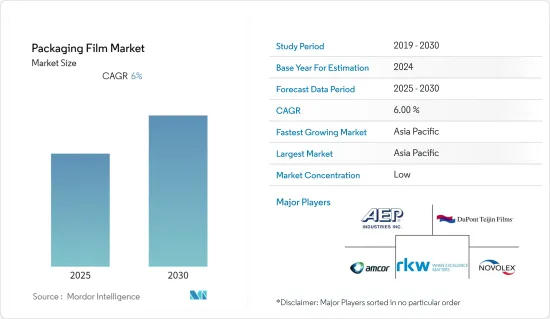

預測期內包裝薄膜市場預計複合年成長率為 6%

關鍵亮點

- 電子商務市場的擴大以及消費品和保健食品需求的激增,推動了包裝薄膜的需求。此外,由於保持衛生而導致的送餐宅配服務的增加以及疫情後對宅配領域的投資增加是支持市場成長的關鍵因素。

- 此外,零售業對延長包裝產品保存期限的需求不斷增加,以及消費者對便利產品的需求,正在推動零售業包裝薄膜的銷售。

- 食品包裝中薄膜用量的快速增加,對包裝薄膜市場的成長做出了巨大的貢獻。背後的原因是向下刨削的趨勢,推動了從硬包裝到軟包裝的轉變。人們對延長產品保存期限和減少包裝浪費的濃厚興趣,加上對水果、肉類、蔬菜和魚貝類等包裝生鮮食品的偏好日益成長,推動了對包裝薄膜的需求。

- 然而,原料價格波動、持續推動永續性(包括以生物分解性材料取代塑膠包裝產品,以及使用PCR(消費後回收)塑膠來應對日益成長的環境問題)等都是導致永續發展的一些因素。

- 新冠疫情導致薄膜包裝的需求大幅增加。網路購物、外帶的興起,帶動包裝薄膜使用量激增,市場需求大幅增加。同時,向電子商務的轉變也在加速,導致產量長期處於停滯狀態。此外,俄羅斯和烏克蘭之間的戰爭正在影響整個包裝生態系統。

包裝薄膜市場趨勢

電子商務激增推動包裝需求

- COVID-19 加劇了人們對安全問題的擔憂,並重新引起了人們對包裝衛生的關注。此外,這段時期電子商務的興起也增加了對永續、衛生、時尚和實用的包裝薄膜的需求。

- 隨著網路訂單的大幅增加,這種包裝膜比傳統的透明收縮膜更厚,且具有高撕裂強度等隱蔽性,可在隱藏貨件內容的同時確保耐用性和性能,在電子商務領域廣受歡迎。

- 收縮膜因其保存期限長、透氧性好等優點,廣泛用於電子商務領域的食品包裝。隨著食品業對收縮膜的需求快速成長,製造商正致力於擴大生產能力以滿足這一巨大需求。例如,2022年1月,IPG收購了位於北卡羅來納州埃弗雷茨的一家新薄膜工廠,擴大了在北美的收縮膜生產。

- 由於生活方式的改變和可支配收入的增加,零售業正在經歷強勁成長。隨著線上宅配服務的出現,泰國等國家的人們正在將購物習慣從傳統購物轉向電子商務。超級市場、大賣場、便利商店等現代零售店也顯著增加。近年來,泰國的零售額(包括網路購物和店內購物)大幅成長。

預測期內亞太地區和歐洲將貢獻健康的成長率

- 預計中國將佔據亞太地區包裝薄膜市場的最大市場佔有率,這主要得益於其龐大的中階人口、不斷成長的可支配收入以及對包裝食品和藥品的需求不斷成長。該地區藥品產量的不斷成長極大地推動了該地區包裝薄膜市場的成長。

- 泰國等東南亞國家的電子商務產業日益成長,為該地區的包裝薄膜發展鋪平了道路。此外,涉及工業粉末、顆粒化學品、潤滑劑、農產品和其他材料的工業應用需要自訂的包裝膜和包裝紙,從而促進市場成長。

- 公司正在進行各種擴張活動,以擴大其地理影響力和市場地位。例如,2021 年 12 月,PTL 在印尼推出了一條 BOPP 生產線,作為其東南亞擴張計畫的一部分。隨著新的10.6米BOPP薄膜生產線的推出,該公司旨在透過規模經濟進一步加強其在印尼業務的成本效益,並提高其在該地區的工業定位。

- 在亞太地區,需要安全包裝的已調理食品越來越受歡迎,食品和飲料行業也隨之成長,推動了對聚氯乙烯(PVC) 保鮮膜等高品質、具成本效益包裝解決方案的需求。品質包裝產生了巨大的需求。

包裝薄膜產業概況

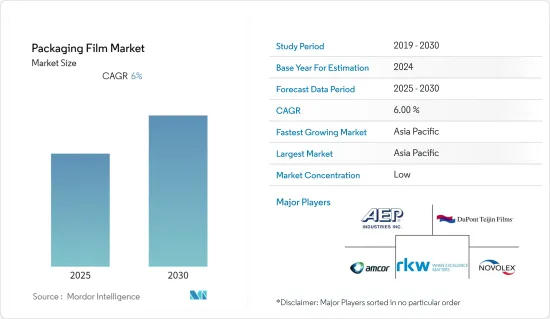

包裝薄膜市場由許多參與企業細分,例如 AEP Industries Inc.、Novolex、Bemis Company Inc.、RKW SE、Dupont Teijin Films、Jindal Poly Films Ltd、Innovia Films 和 ProAmpac。大多數新參與企業都採取了合併、收購、新產品發布和市場開發等多項策略發展措施來獲得競爭優勢。

2022 年 5 月,Jindal Poly Films Limited (JFPL) 與 Brookfield Asset Management 達成協議,出售其一小部分包裝膜業務。該公司及其機構投資者合作夥伴(統稱「Brookfield」)承諾向該業務投資 200 億印度盧比(2.6 億美元)。

2022 年 3 月,SAES 塗層薄膜公司與 RKW 集團合作開發用於永續食品包裝的高性能薄膜,旨在在產品的整個生命週期內提供高保護。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力模型

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 電子商務業務激增推動包裝需求

- 食品和飲料包裝的創新

- 市場限制

- 對包裝材料化學成分有嚴格規定

第6章 市場細分

- 依材料類型

- 聚乙烯

- 聚丙烯

- 聚酯纖維

- 氯乙烯

- 其他

- 按應用

- 食品和飲料包裝

- 醫藥包裝

- 消費品包裝

- 工業包裝

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- AEP Industries Inc.

- Novolex

- Amcor PLC(Bemis Company Inc.)

- RKW SE

- Dupont Teijin Films

- Jindal Poly Films Ltd

- Innovia Films

- ProAmpac

- Cosmo Films Ltd

- SRF Limited

- Graphic Packaging International LLC

- Sigma Plastics Group

- Sealed Air Corporation

第8章投資分析

第9章:未來市場展望

The Packaging Film Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- The growing e-commerce market and surge in demand for consumer goods and health products are driving demand for packaging films. Further, the rise in food delivery services due to maintaining hygiene and increasing investment in food delivery sectors post-pandemic are essential factors supporting the market's growth.

- Furthermore, the rising demand from the retail sector for the extended shelf life of packaged products and the consumers' demand for convenience products are augmenting the sales of packaging films in the retail industry.

- The rapidly growing usage of films in food packaging is significantly contributing to the growth of the packaging film market. This can be attributed to the increasing trend of down-gauging, which has supported the shift from rigid to flexible packaging. A strong focus on extending product shelf life and reducing packaging material waste, combined with a growing preference for packaged fresh foods such as fruits, meat, vegetables, and seafood, have increased demand for packaging films.

- However, the volatility of raw material prices, the ongoing drive for sustainability which includes replacing plastic-based packaging products with biodegradable materials, and mandates of using PCR (post-consumer recycled) plastics in response to growing environmental concerns are some of the major factors hampering the market growth.

- The COVID-19 pandemic has led to a significant increase in the demand for film packaging. The market experienced a marked increase in need through the rise in online shopping and food takeaway, which has led to an upsurge in the amount of packaging film usage. At the same time, the accelerated shift towards e-commerce resulted in a permanent plateau in production. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Packaging Film Market Trends

A Surge in E-commerce Business has Fueled Demand for Packaging

- Because of COVID-19, there has been a renewed interest in packaging hygiene due to increased safety concerns. Furthermore, the period saw an increase in e-commerce, which increased the demand for well-designed and functional packaging films that are both sustainable and hygienic.

- With the massive growth in online ordering, packaging film has gained popularity in the e-commerce market due to its discreet characteristics, which include being thicker than traditional clear shrink films to ensure durability and performance while keeping the contents of shipment private and having higher tear strength.

- Shrink films are widely used for wrapping food packaging products in the e-commerce sector owing to their benefits, such as optimal shelf life and better oxygen transmission rates. With the demand for shrink film from the rapidly growing food industry, manufacturers are focusing on expanding their capacity to cater to this significant demand. For instance, In January 2022, IPG expanded its North American shrink film production by acquiring a new film plant in Everetts, NC, which allowed the company to expand its production capacity and product types.

- The retail sector has witnessed strong growth due to changing lifestyles and rising disposable income. The emergence of online delivery services has shifted people's shopping habits from traditional to e-commerce in the countries like Thailand. Modern retail stores such as supermarkets, hypermarkets, and convenience stores have also risen significantly. Thailand's retail sales, including online and in-store purchases, have increased dramatically in the past few years.

Asia-Pacific and Europe Contribute to Healthy Growth Rate over the Forecast Period

- China is expected to account for the largest market share in the packaging films market of the Asia Pacific region, majorly due to its large middle-class population, increasing disposable incomes, and high demand for packaged food and pharmaceutical products. The increasing pharmaceutical production in the region is significantly driving the growth of the packaging film market in the region.

- The e-commerce sector's growing presence in Southeast Asian nations such as Thailand is paving the way for packaging film in the region. Moreover, custom-made packaging films and wraps are required for industrial applications involving industrial powders, granular chemicals, lubricants, agricultural products, and other materials, which cater to market growth.

- There have been various expansion activities by companies in the market to enhance their geographical presence and position. For instance, in December 2021, PTL launched a BOPP line in Indonesia as a part of its Southeast Asia expansion plans. With the start-up of the new BOPP film line, a 10.6-meter line, the company aims to further strengthen the cost-effectiveness of the operations in Indonesia due to economies of scale and improve its industry positioning in the geography.

- The growing popularity of ready-to-eat meals that require safe packaging in the Asia Pacific and the growth of the food and beverage industries create a significant demand for high-quality and cost-effective packaging such as Cling films made of polyvinyl chloride (PVC) is a sustainable option for fresh food packing.

Packaging Film Industry Overview

The packaging film market is fragmented with many players, such as AEP Industries Inc., Novolex, Bemis Company Inc., RKW SE, Dupont Teijin Films, Jindal Poly Films Ltd, Innovia Films, ProAmpac, and many others. Most of these players are undergoing several strategic developments to gain a competitive edge, including mergers, acquisitions, new product launches, and market expansion.

In May 2022, Jindal Poly Films Limited (JFPL) signed a contract with Brookfield Asset Management to sell a small portion of its packaging film business. The company decided to spend INR 2,000 crores (USD 260 million) in the business with institutional partners (collectively referred to as "Brookfield").

In March 2022, SAES Coated Films and RKW Group partnered to develop premium performance films for sustainable food packaging that aimed to offer high protection throughout the product lifecycle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in E-commerce Business has Fueled Demand for Packaging

- 5.1.2 Innovations in Food and Beverage Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations for Chemical Composition of Packaging Materials

6 MARKET SEGMENTATION

- 6.1 By Type of Material

- 6.1.1 Polyethylene

- 6.1.2 Polypropylene

- 6.1.3 Polyester

- 6.1.4 PVC

- 6.1.5 Other Type of Materials

- 6.2 By Application

- 6.2.1 Food and Beverage Packaging

- 6.2.2 Medical and Pharmaceutical Packaging

- 6.2.3 Consumer Products Packaging

- 6.2.4 Industrial Packaging

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEP Industries Inc.

- 7.1.2 Novolex

- 7.1.3 Amcor PLC (Bemis Company Inc.)

- 7.1.4 RKW SE

- 7.1.5 Dupont Teijin Films

- 7.1.6 Jindal Poly Films Ltd

- 7.1.7 Innovia Films

- 7.1.8 ProAmpac

- 7.1.9 Cosmo Films Ltd

- 7.1.10 SRF Limited

- 7.1.11 Graphic Packaging International LLC

- 7.1.12 Sigma Plastics Group

- 7.1.13 Sealed Air Corporation