|

市場調查報告書

商品編碼

1640711

氣體檢測-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Gas Detectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

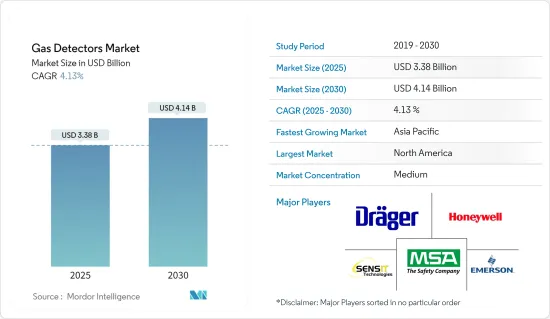

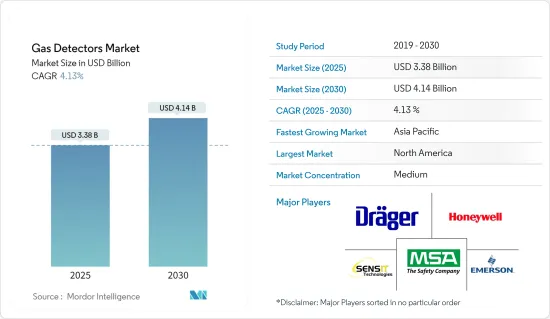

預計 2025 年氣體檢測市場規模為 33.8 億美元,到 2030 年預計將達到 41.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.13%。

關鍵亮點

- 職場安全意識的增強、技術進步導致準確性和可靠性的提高、氣體探測器的使用、快速工業化以及對環境監測的日益關注等多種因素正在推動研究市場的成長。

- 幾家主要的市場供應商正在開發先進的氣體檢測器,其應用範圍涵蓋臨床檢測、環境排放控制、爆炸物檢測、農產品儲存和運輸以及職場危害監測。例如,ATO Inc. 於 2023 年 7 月推出了適用於密閉空間和其他複雜環境的多氣體偵測器系列。透過同時監測多達四種不同的氣體,據說可以快速識別有毒化合物、可燃性氣體和氧氣水平,從而提高工人的安全性。

- 此外,嚴格的政府法規要求提高車輛的燃燒效率,以限制有害污染物的排放。這推動了氣體感測器和探測器的廣泛應用,為汽車排放氣體控制系統提供即時回饋。 2023 年 6 月,拜登-哈里斯政府啟動了全政府範圍的努力,以大幅減少溫室氣體排放。此外,拜登總統的國家目標是到2030年將全球甲烷排放2020年的水平降低30%,這對於汽車行業氣體檢測儀的普及也起到了重要作用。各個終端用戶產業中氣體洩漏案例的增加進一步產生了對氣體偵測器的需求。

- 無線/可攜式氣體檢測儀由於初始安裝成本較低、持續節省、維護成本降低、勞動力管理改善、資源工作流程加快和安全性提高而被廣泛採用。此外,感測器功能和小型化的發展,加上通訊能力的提高,將使物聯網感測器能夠整合到大量機器和設備中,同時又不影響在安全距離內檢測有毒和可燃性氣體。隨著物聯網感測器成本的下降,危險品/爆炸物產業開始將這些感測器納入日常業務中,以提高環境安全和業務效率。

- 政府機構已可燃性氣體積極措施,強制在潛在危險場所使用氣體檢測儀,氣體檢測儀主要用於化學、工業、醫療和汽車行業的空氣品質監測。是當氣體濃度異常上升時啟動多個行業緊急程序的關鍵因素。隨著研發工作不斷加強,以及一些知名公司的技術進步,可調諧二極體雷射(TDLA) 等技術正在被開發出來,用於檢測和測量空氣中低濃度的氣體。非常穩定的校準和減少由於其他氣體存在而引起的交叉干擾。

- 另一方面,技術純熟勞工的短缺是氣體檢測市場發展的根本限制。與氣體洩漏檢測器的具體應用相關的培訓至關重要,熟練人員的短缺會阻礙氣體檢測器的採用和有效使用。

- 此外,無線氣體偵測器的製造成本高以及無法限制火災風險可能會阻礙其廣泛應用。

氣體檢測儀市場趨勢

石油和天然氣產業可望佔據主要佔有率

- 由於對氣體監測設施識別危險氣體的需求不斷增加,尤其是在工業領域,氣體檢測市場預計將繼續成長。物聯網在石油和天然氣領域的應用將改善現場通訊、即時監控、油田數位基礎設施,降低維護成本,降低電力消耗,提高產量,提高工人和資產的安全性。例如,汽油浪費是一個需要解決的嚴重問題。液化石油氣極易燃燒,對人身及財產安全十分危險。與物聯網結合使用時,氣體檢測儀可以極大地幫助氣體檢測並防止氣體浪費。

- 根據石油輸出國組織預測,2022年全球原油需求(包括生質燃料)將達到每天9,957萬桶以上,2023年將上升至約1.0189億桶。此外,根據美國能源資訊署的數據,到 2023年終,全球液體燃料消費量預計將達到每天約 1.0214 億桶。原油和燃料需求的增加可能會推動所研究市場的成長。

- 由於擁有大量的石油鑽井設施,預計北美將出現強勁成長。據貝克休斯稱,北美持有世界上最多的石油和天然氣鑽井平台。截至 2023 年 11 月,該地區共有 797 個陸上鑽機,另有 22 個海上鑽機。 2023年終,全球運作的陸上石油鑽機數量將達到1,555座,而海上鑽機數量將達到272座。

- 美國內政部 (DoI)核准了2019-24 年國家大陸棚油氣租賃計劃,允許在近 90% 的大陸棚(OCS) 土地上進行海上探勘,從而為市場增加了新的供應商。機遇。

- 根據RegData的行業監管指數,石油和天然氣開採行業是美國監管最嚴格的十大行業之一。負責執行美國海上石油和天然氣產業安全和環境保護條例的安全與環境執法局(BSEE)等監管機構也延伸至歐洲等地區。這些機構制定的嚴格規定正在促進氣體檢測市場的發展。

- 根據《石油與天然氣雜誌》報告,與沒有使用先進技術的公司相比,使用先進技術管理安全和營運績效的公司可將計劃外資產停機時間減少約8%,合規相關成本減少約13%。監管執法行動減少%,截至2020年3月31日的會計年度,營業利潤率與公司企業計畫中設定的目標相比下降了8%。預計氣體檢測儀提供的眾多好處將在預測期內推動市場需求。

預計北美將佔很大佔有率

- 由於主要供應商的存在和政府關於氣體排放限制的法規,北美的氣體檢測呈現成長趨勢。在北美,美國環保署(EPA)和美國安全與健康管理局(OSHA)嚴格執行工業安全規定,並推動氣體檢測設備的採用。

- 幾乎美國的每一家企業都遵守 OSHA 標準,這使該標準成為各行各業雇主和員工關注的主要問題。美國環保署已經發布了新的排放性能標準,以測量和限制新建、重建和改造房屋的甲烷排放。

- 美國環保署也要求採礦業必須使用氣體探測器。總部位於美國的卡羅爾技術集團是礦業手持式氣體偵測儀的先驅。其中一種產品是礦山安全設備 (MSA) Altair 4X 探測器,它可以在探測到後 15 秒內向礦工發出警報。

- 此外,北美是世界上最活躍的採礦業之一。據加拿大礦業協會稱,加拿大是世界五大 13 種礦物和金屬生產國之一,包括鈾、鎳、鈷、鉀、鋁、鑽石、鈦和黃金。此外,根據美國地質調查局的數據,預計 2022 年美國採礦產運轉率將達到 87%,高於 2021 年的 81%。預計此類案例將為所研究市場的成長提供有利可圖的機會。

- 該地區是世界各地主要製造設施的主要樞紐。此外,美國、加拿大等國家,地方政府對安全要求較高,並鼓勵各產業引進氣體檢測設備。此外,2022 年 10 月,美國勞工部礦山安全與健康管理局 (MSHA)津貼985,284 美元,用於支援安全課程和其他計畫。

氣體檢測產業概況

氣體檢測市場半固體,由幾家主要公司組成。從市場佔有率來看,目前市場主要被少數幾家大公司佔據。這些佔據突出市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。預計競爭、快速的技術進步以及消費者偏好的頻繁變化將在預測期內威脅到公司的成長。

2023 年 10 月,Blackline Safety Corp. 宣布對其 G6 單一氣體偵測儀進行重大升級,為這款救生穿戴裝置增加了新功能和服務計畫。 G6 具有與該公司 G7 產品線相同的即時連接功能。新增的功能包括緊急 SOS,工人可以在危機情況下啟動該功能以獲得幫助,以及擴展的資料和報告分析套件。它還支援室內定位技術。

2022年10月,Drager Marine & Offshore宣布發表X-am 2800移動氣體偵測儀。新產品設計用於容納多達四種不同的氣體,用於密閉空間,以保護在可能存在爆炸性氣體、氧氣不足或有毒物質的危險場所工作的員工。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19影響評估

第5章 市場動態

- 市場促進因素

- 提高對重點產業危險的認知

- 政府對工人安全的嚴格規定

- 專注於智慧探測器的公司

- 市場限制

- 市場競爭加劇

第6章 市場細分

- 依通訊類型

- 有線

- 無線的

- 按下檢測器類型

- 固定的

- 可攜式的

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 用水和污水

- 金屬與礦業

- 公共產業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Dragerwerk AG & Co. KGaA

- MSA Safety Inc.

- Emerson Electric Company

- SENSIT Technologies, LLC

- Industrial Scientific Corporatioh

- New Cosmos Electric Co. Ltd

- Trolex Ltd

- Crowncon Detection Instruments Limited

- Hanwei Electronics Group Corporation

- International Gas Detectors Ltd

- Sensidyne LP

第8章投資分析

第9章:市場的未來

The Gas Detectors Market size is estimated at USD 3.38 billion in 2025, and is expected to reach USD 4.14 billion by 2030, at a CAGR of 4.13% during the forecast period (2025-2030).

Key Highlights

- Several factors, like the increasing awareness of workplace safety, advancements in technology leading to enhancements in accuracy, reliability, use of gas detectors, rapid industrialization, and growing focus on environmental monitoring, are anticipated to drive the growth of the studied market significantly.

- Several major market vendors are developing advanced gas detectors with applications across clinical assays, environmental emission control, explosive detection, agricultural storage, shipping, and workplace hazard monitoring. For instance, in July 2023, ATO Inc. introduced its new line of multi-gas detectors for confined spaces and other complex environments. It is claimed to improve worker safety by quickly identifying poisonous compounds, flammable gases, and oxygen levels by monitoring up to four different gases simultaneously.

- Stringent government regulations have also resulted in the efficiency enhancement of combustion within the vehicle to limit the emission of harmful pollutants. This has further increased the adoption of gas sensors and detectors, therefore gaining applications in providing real-time feedback to emission management systems of automobiles. In June 2023, the Biden-Harris Administration launched a whole-of-government initiative to significantly reduce greenhouse gas emissions. In addition, President Biden's national goal is to cut global methane emissions by 30 percent below 2020 levels by 2030, which also plays an important role in the penetration of gas detectors in the automotive industry. The increasing cases of gas leaks in various end-user industries are further creating a demand for gas detectors.

- Wireless/portable gas detectors are also witnessing widespread adoption owing to their reduced initial implementation costs and recurrent savings, lower maintenance costs, better workforce management, faster resource workflow, and improved safety. Moreover, the development of sensor capabilities and miniaturization, coupled with improved communication capabilities, enables the integration of IoT sensors into numerous machines and devices without compromising the detection of toxic or flammable gases at safe distances. As IoT sensors' cost is declining, industries dealing with hazardous/explosive materials have started integrating these sensors into their day-to-day operations to improve environmental safety and operational efficiency.

- Governmental agencies have been taking proactive measures to enforce the use of gas detectors in potentially hazardous locations, where they are seen as a vital cog for triggering emergency procedures across several industries in case of an abnormal increase in the concentration of gases that are actively employed for monitoring the air quality and detection of combustible gases primarily in the chemical, industrial, medical, and automotive industries. With increased R&D efforts, along with the technological advancements by some prominent players, technologies such as tunable diode lasers (TDLA) are being developed, which detect and measure gases at a low density of air, thereby offering several measurement advantages, such as highly stable calibration and less cross-interference from the presence of other gases.

- On the flip side, the lack of skilled labor is an essential restraining factor for the gas detector market. Training associated with specific applications of gas leak detectors is essential, and the shortage of skilled personnel could hinder the adoption and effective use of gas detectors.

- Further, the high cost of production of wireless gas detectors and the inability of the detectors to restrict probable fire hazards could hinder the widespread adoption of gas detectors.

Gas Detector Market Trends

Oil and Gas Sector is Expected to Hold Major Share

- The market for gas detectors is expected to continue to rise, especially in the industrial sector, as there is an increasing need for gas monitoring amenities to identify the presence of hazardous gases. The use of IoT in the oil and gas sector has resulted in improved field communication, real-time monitoring, digital infrastructure for oil fields, decreased maintenance costs, lower power consumption, more production, and increased safety and security for workers and assets. For instance, petrol waste is a serious problem that must be resolved. Liquefied petroleum gas is highly combustible and dangerous to both people and property. When used in conjunction with IoT, gas detectors can significantly aid in gas detection and prevent gas wastage.

- According to the Organization of the Petroleum Exporting Countries, the global demand for crude oil (including biofuels) in 2022 amounted to over 99.57 million barrels per day, and it is estimated to increase to approximately 101.89 million barrels per day in 2023. Also, according to EIA, the worldwide consumption of liquid fuels is forecasted to reach approximately 102.14 million barrels per day by the end of 2023. The increasing demand for crude oil and fuel is likely to boost the growth of the studied market.

- North America is estimated to witness robust growth owing to the presence of numerous oil rigs. According to Baker Hughes, North America hosts the most oil and gas rigs worldwide. As of November 2023, there were 797 land rigs in that region, with a further 22 rigs located offshore. By the end of 2023, there were 1,555 operational onshore oil rigs globally, compared with 272 offshore rigs.

- The National Outer Continental Shelf Oil and Gas Leasing Program for 2019-24, approved by the U.S. Department of the Interior (DoI), allows for offshore exploratory drilling on nearly 90% of the Outer Continental Shelf (OCS) acreage, and this is expected to create new opportunities for the market vendors under consideration.

- According to the RegData's Industry Regulation Index, the oil and gas extraction industry is among the top 10 most regulated industries in the United States. Regulatories like the Bureau of Safety and Environmental Enforcement (BSEE) - which enforces safety and environmental protection regulations for the offshore oil & natural gas industry in the United States - are also prevalent across regions like Europe. The strict rules imposed by such institutions facilitate the development of the gas detector market.

- According to the Oil & Gas Journal, companies that are utilizing advanced technologies to manage safety & operations performance are reported to have approximately 8 percent less unscheduled asset downtime (over those who do not), experience about 13 percent reduction in compliance-related costs, 8 percent fewer regulation citations, and realize operating margins 2 percent or greater than targeted in the corporate plan. Then, numerous benefits offered by gas detectors would augment the market demand during the forecast period.

North America is Expected to Hold Significant Share

- North America is witnessing the growth of gas detectors due to the presence of major vendors and government regulations regarding limiting gas emissions. In the North American region, the Environmental Protection Agency (EPA) and the U.S. Occupational Safety and Health Administration (OSHA) strictly implement industrial safety, driving the adoption of gas detectors.

- Almost all businesses in the United States are subject to OSHA standards, so they are a significant concern for employers and employees in various industries. The Environmental Protection Agency has released the New Source Performance Standards to measure and limit methane emissions from new, reconstructed, or modified assets.

- The EPA has also mandated the use of gas detectors in the mining industry. USA-based Carroll Technologies Group is a pioneer in offering handheld gas detectors for the mining industry. One of the products is the Mine Safety Appliances (MSA) Altair 4X Detector, which alerts the miner within 15 seconds of detection.

- Additionally, North America has one of the most active mining industries in the world. According to the Mining Association of Canada, Canada ranks among the top 5 members for the global production of 13 minerals and metals such as uranium, nickel, cobalt, potash, aluminum, diamonds, titanium, and gold. Further, according to the U.S. Geological Survey, in 2022, the capacity utilization of the United States' mining industry stood at an estimated 87 percent, which increased from 81 percent in 2021. Such instances are anticipated to offer lucrative opportunities for the growth of the studied market.

- The region is the primary hub for all the major manufacturing establishments worldwide. The regional authority further demands high safety concerns in countries such as the United States and Canada, which also encourages gas detectors to be deployed across the respective industries. Moreover, in October 2022, the United States Department of Labor's Mine Safety and Health Administration (MSHA) awarded USD 985,284 in grant funding to support safety courses and other programs.

Gas Detector Industry Overview

The gas detectors market is semi-consolidated and consists of several major players. In terms of market share, few major players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the growth of companies during the forecast period.

In October 2023 - Blackline Safety Corp. announced a significant upgrade to its G6 single-gas detector, adding new features and service plans to the life-saving wearable device. G6 features the same real-time connectivity as the company's G7 product line. Additional new features include an emergency SOS that workers can trigger in critical situations to get assistance and an expanded suite of data and reporting analytics. The device also supports indoor location technology.

In October 2022, Drager Marine & Offshore announced the release of the mobile gas detector, the X-am 2800. The new product simultaneously measured up to four different gases for application in confined spaces to safeguard employees working in areas at risk of explosive atmospheres, oxygen depletion, or those where toxic substances may be present.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness about Hazards across Major Industries

- 5.1.2 Stringent Government Regulations for Safety of Workers

- 5.1.3 Companies Focusing on Smart Detectors

- 5.2 Market Restraints

- 5.2.1 Intense Competition in the Market

6 MARKET SEGMENTATION

- 6.1 By Communication Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Type of Detector

- 6.2.1 Fixed

- 6.2.2 Portable and Transportable

- 6.3 By End-User Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemicals and Petrochemicals

- 6.3.3 Water and Wastewater

- 6.3.4 Metal and Mining

- 6.3.5 Utilities

- 6.3.6 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Dragerwerk AG & Co. KGaA

- 7.1.3 MSA Safety Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 SENSIT Technologies, LLC

- 7.1.6 Industrial Scientific Corporatioh

- 7.1.7 New Cosmos Electric Co. Ltd

- 7.1.8 Trolex Ltd

- 7.1.9 Crowncon Detection Instruments Limited

- 7.1.10 Hanwei Electronics Group Corporation

- 7.1.11 International Gas Detectors Ltd

- 7.1.12 Sensidyne LP