|

市場調查報告書

商品編碼

1690138

亞太氣體檢測:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Gas Detector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

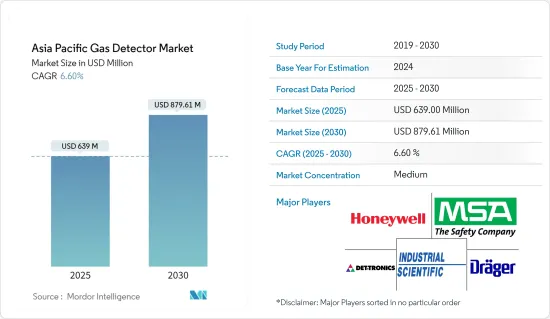

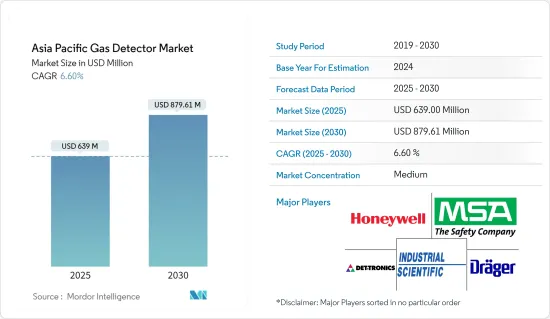

亞太地區氣體檢測市場規模預計在 2025 年為 6.39 億美元,預計到 2030 年將達到 8.7961 億美元,預測期內(2025-2030 年)的複合年成長率為 6.6%。

一個關鍵的成長指標是該地區的快速都市化,這導致溫室氣體排放急劇增加,並需要部署氣體檢測設備。

主要亮點

- 手持設備日益普及,推動了氣體檢測領域的發展,大大擴展了其在多個終端用戶領域的應用範圍。日益嚴格的政府排放和職業安全法規正在推動對氣體檢測設備的需求。

- 印尼國家石油公司(Pertamina)、泰國國家石油公司(PTTEP)等石油公司成功維持了國內供應,吸引了投資者擴大其能源公司投資組合。這些努力預計將增加對氣體探測器的需求。新加坡已成為石化工業的中心。這是由於BASF、朗盛、三井化學和殼牌等全球大型公司產業領導者的投資。此外,減少二氧化碳排放的努力也在進行中。

- 無線氣體檢測正在加速在以前難以到達或監測成本高昂的地方部署氣體檢測儀。因此,新興市場供應商越來越注重開發和提供無線解決方案。

- 然而,在存在爆炸風險的行業和場所,對有線氣體探測器的需求很高。現有的探測器在石油和天然氣、化學和石化行業中佔有重要地位,預計需求量很大。由於較高的成長率和對無線探測器的需求,有線氣體探測器預計將佔據突出的市場佔有率。

- 此外,檢測器能力和小型化的發展,加上改進的通訊能力,將使物聯網感測器能夠整合到各種設備和機器中,同時不會影響在安全距離內檢測有毒和可燃性氣體。

- 由於近年來技術變革導致了智慧組件的使用,氣體探測器的製造成本一直在穩步增加。預計這將導致採礦業和建築業等主要終端用戶行業的客戶支出略有下降,從而對市場產生負面影響。

- COVID-19 對市場成長產生了負面影響。這是由於世界各地的工廠和工業設施關閉,導致除食品和飲料行業外,氣體檢測儀的使用量下降。氣體檢測儀在這個行業的應用越來越廣泛。

亞太地區氣體檢測市場趨勢

石油和天然氣取得顯著成長

- 在政府鼓勵使用氣體檢測設備的推動下,石油和天然氣市場是該地區成長最快的市場。隨著能源需求的不斷增加,該地區在確保能源資源供應以滿足各經濟體國內需求方面面臨更大的挑戰。

- 由於工廠安全需求的大幅增加,預計未來亞太地區石油和天然氣領域的氣體檢測市場將會成長。用於檢測有害氣體存在的氣體監測設施的需求不斷成長,預計將推動恆定氣體檢測儀市場的成長,尤其是在工業領域。

- 物聯網在石油和天然氣行業的應用實現了更好的現場通訊、即時監控、數位化油田基礎設施、集中維護成本、降低電力消耗和提高生產力,從而提高了資產和勞動力的安全性。例如,天然氣浪費是一個需要解決的主要問題。液化石油氣極易燃燒,可能對生命財產造成危險。與物聯網結合的氣體檢測儀可以在氣體檢測中發揮重要作用並防止氣體浪費,從而刺激市場成長。

- 此外,該地區的公司正專注於採用先進技術,向市場提案差異化的氣體檢測產品。例如,華為eLTE氣體檢測解決方案為物聯網場景提供了高效的效能,減少了所需的設備數量,從而減少了管理和維護工作量。

- 此外,預計2013年至2030年間全球能源需求將成長約40%,尤其是印度和中國等開發中國家。根據國際能源總署(IEA)的報告,這些國家的石油和天然氣需求預計將分別增加50%和20%。此外,印度和中國等國家(分別在阿拉伯海和朱加爾盆地)發現石油蘊藏量以及計劃在探勘過程中進行投資,預計將增加對氣體探測器的需求。

- 此外,該地區正在實施多項舉措以確保安全。亞太經合組織石油和天然氣安全計劃(OGSI)成立的目的是協助各經濟體解決能源供應安全問題,並應對潛在的供不應求和緊急情況。 OGSI 有三大支柱:石油和天然氣安全演習(OGSE)、石油和天然氣安全研究(OGSS)和石油和天然氣安全網路(OGSN)。因此,氣體探測器在這些地區至關重要。

- 此外,當地正在進行的幾個計劃將增加對氣體探測器的需求。其中包括是拉差香甜辣椒醬煉油廠擴建和升級計畫(泰國,預計於 2024 年投入使用)和 Pulau Muara Besar 煉油廠和石化綜合體二期計畫(中國,預計於 2022 年投入使用)。

固定式氣體檢測儀佔據主要市場佔有率

- 當需要24小時監控時,安裝固定氣體探測器。它們旨在警告工人注意潛在危險,例如接觸有毒氣體、因缺氧而窒息以及因可燃性氣體而爆炸。這些氣體探測器用於可能積聚危險氣體的封閉或部分封閉的空間。

- 有毒氣體檢測儀廣泛應用於石油和天然氣、採礦、核能、醫療、食品和飲料、建築和工業等行業。基於金屬氧化物的氣體感測器是檢測有毒氣體最常用的探測器之一。這些感測器在接觸一氧化碳、氫氣、甲烷或丁烷等氣體時,電阻會增加。大多數家用煙霧偵測系統都是基於氧化物的感測器。

- 固定式可燃性氣體探測器佔據氣體探測器市場的很大佔有率。這些感測器可檢測並響應可燃性氣體和蒸氣,主要用於工業工廠中檢測氣體洩漏或積聚,以免達到爆炸水平。

- 這些探測器透過紅外線、電化學、超音波或半導體等感測器測量指定區域內特定氣體的濃度,並將其與參考點或尺度進行比較。如果感測器響應超過預設水平,則會透過警報、燈光或訊號組合提醒使用者。

- 此外,公司也持續投資於產品創新,將先進技術融入固定氣體檢測設備。目前正在開發這些探測器來監測多種氣體。例如,Teledyne 的 OLC 10 和 OLCT 10 氣體感測器專為檢測第三產業(鍋爐房、電池充電室、停車場、醫院)的可燃性氣體或有毒氣體而設計。兩個 OLC 10 可以連接到一個偵測通道以監控相同區域,而無需額外的接線盒或接線。

- 例如,2021 年 7 月,Ion Science 推出了 Cub 11.7 eV 個人裝置。此有毒氣體檢測解決方案在 0 度C至 55 度C的溫度下運行,不受濕度或水分的影響。該氣體檢測儀重量僅為 111 克,佩戴舒適,其小巧的尺寸使工人可以四處走動而不受笨重設備的阻礙,並且電池續航時間長達 12 小時。

- 此外,亞太地區是許多行業的所在地,也是對這些檢測器的需求不斷增加的重要市場。不斷成長的需求和穩定的盈利導致多家供應商進入市場。例如,2021 年 2 月,氣體偵測感測器技術供應商 NevadaNano Inc. 宣布 Elematec Corporation 將向其在日本各地的客戶群出售該公司的分子特徵光譜儀。

- 此外,這些檢測器也用於石油和天然氣工業。天然氣和原油位於地下深處、岩層中、難以到達的地方和極端氣候條件下。因此,感測器功能的進步和運算能力的提高正在推動對這些探測器的需求。

亞太地區氣體檢測產業概況

亞太地區氣體檢測市場的競爭適中,由幾家領先的公司組成。佔有較大市場佔有率的主要參與者正致力於擴大亞太地區各國的基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。

- 2022 年 4 月 - MSA Safety Incorporated 宣布推出其最新氣體檢測穿戴式裝置 ALTAIR io 4,這將改變整個產業。這是 MSA 的第一台直接針對雲層的氣體探測器。 ALTAIR io 4 設備旨在與該公司的新安全訂閱服務 MSA+ 配合使用,是 MSA 稱為「互聯工作平台」的一套雲端技術中的硬體部分。

- 2021年10月-Honeywell國際推出了兩款先進的藍牙連接氣體偵測儀:SearchLine Excel Plus 和 SearchLine Excel Edge。該公司先進的氣體檢測儀專為石油天然氣、化學、石化和其他工業設施而設計,即使在雨、霧、雪和其他惡劣天氣條件下也能持續監測危險和可燃性氣體洩漏。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 工人安全意識增強,法規更嚴格

- 亞太地區主要新興國家工業領域的穩定成長和擴張計劃

- 市場挑戰

- 近期特定產業的新冠肺炎疫情爆發以及主要垂直產業支出略有下降,可能會引起製造商的擔憂

- 分銷通路分析

- 主要行業標準和法規

- 使用的通訊類型:有線與無線

第6章 市場細分

- 按類型

- 固定的

- 有毒氣體偵測儀

- 可燃性氣體探測器

- 可攜式的

- 單一氣體

- 多種氣體

- 固定的

- 按行業

- 石油和天然氣

- 化工和石化

- 用水和污水

- 發電

- 金屬與礦業

- 飲食

- 其他行業(建築、製藥等)

- 按國家

- 中國

- 日本

- 印度和韓國

- 澳洲和紐西蘭

- 東南亞(新加坡、馬來西亞、泰國、印尼、菲律賓、越南)

第7章 競爭格局

- 供應商排名分析(根據關鍵差異參數對供應商進行排名)

- 公司簡介

- Honeywell Analytics Inc.

- MSA Safety Incorporated

- Draegerwerk AG & Co. KGaA

- Industrial Scientific Corporation

- Det-Tronics(a Carrier Company)

- Teledyne Technologies Incorporated

- Crowncon Detection Instruments Limited

- RKI Instruments Inc.

- GFG Gesellscharft

第8章投資分析

第9章 市場機會與未來趨勢

The Asia Pacific Gas Detector Market size is estimated at USD 639.00 million in 2025, and is expected to reach USD 879.61 million by 2030, at a CAGR of 6.6% during the forecast period (2025-2030).

An important growth indicator is rapid urbanization in the region, due to which greenhouse gas emissions have increased tremendously, necessitating the deployment of gas detecting devices.

Key Highlights

- The proliferation of handheld devices has led to developments in the field of gas detectors, which has considerably widened the scope of application across multiple end-user segments. Government regulations are increasingly becoming stringent in emission control and labor safety, driving the demand for gas detectors.

- Oil companies, such as Indonesia's Pertamina and PTTEP, are successfully maintaining domestic supply, attracting investors to expand the energy company's portfolio. These efforts are expected to increase the demand for gas detectors. Singapore is being highlighted as the hub for the petrochemical industry. This is because of the investments by the major global players in this industry, such as BASF, Lanxess, Mitsui Chemicals, and Shell. It has also been promoting initiatives for the reduction of carbon emissions.

- Wireless gas detection is helping accelerate the sheer number of deployments of gas detectors in previously inaccessible areas, which are too difficult to reach or costly for monitoring. Owing to this, the vendors in the market are increasingly focusing on developing and offering wireless solutions.

- However, wired gas detectors hold prominence in demand in industries and sites that run the risk of explosion. The existing detectors in places pretty evident in the oil and gas, chemicals, and petrochemical industries are expected to command significant demand. Wiring gas detectors are expected to cost a prominent market share, with higher growth and the need for wireless detectors.

- Also, the development of detector capabilities and miniaturization, coupled with improved communication capabilities, enables the integration of IoT sensors into various devices and machines without compromising the detection of toxic or flammable gases at safe distances.

- The cost of production for gas detectors has been steadily rising due to recent technological changes resulting in the use of intelligent components. Thus, this is expected to negatively impact the market due to the Marginal decrease in spending of customers in Key End-User Verticals such as Mining, Construction, and many more.

- COVID-19 has negatively impacted the market growth. This is because of the global lockdown of factories and industrial facilities, which has caused a declining usage of gas detector devices, except in the food and beverage sector. In this industry, gas detectors are being used more since the sector comes under essential services and works round the clock.

APAC Gas Detector Market Trends

Oil & Gas to Register Significant Growth

- The oil and gas market is the fastest in the region due to government initiatives encouraging the use of gas detectors. With the growing energy demand, the region is facing more significant challenges in securing the supply of energy resources to meet the domestic requirements of each economy.

- The Asia Pacific gas detectors market in the oil and gas sector is expected to grow in the future, owing to the enormous rise in demand for plant safety. The growing demand for gas monitoring amenities to detect the presence of harmful gases is expected to drive constant gas detector market growth, particularly in the industrial segment.

- The deployment of IoT in the oil and gas industry has realized superior field communication, real-time monitoring, digital oil field infrastructure, condensed cost of maintenance, reduced power consumption, higher productivity, and, thus, heightened safety and security of assets and workforce. For instance, gas wastage is a crucial issue that needs to be countered. LPG gas is highly flammable and can inflict harm to life and property. Gas detectors, coupled with IoT, can play a substantial role in gas detection and block the wastage of gases, thus fueling the market's growth.

- Furthermore, the businesses in the region are focusing on incorporating advanced technologies for proposing gas detecting product differentiation in the market. For instance, Huawei eLTE Gas Detection Solution provides efficient performance for IoT scenarios, requiring fewer devices, with correspondingly fewer management and maintenance efforts.

- Moreover, global energy needs are anticipated to increase by around 40% between 2013 and 2030, particularly in developing nations like India and China. The IEA (International Energy Agency) reported that the demand for oil and gas is projected to increase by 50% and 20% in those countries, respectively. Moreover, the discovery of oil reserves in countries like India and China (the Arabian Sea and Juggar Basin, respectively) and upcoming investments in exploration processes are expected to drive the need for gas detectors.

- Further, several initiatives are being implemented in the region to ensure safety. The APEC Oil and Gas Security Initiative (OGSI) was established to assist economies in tackling the issue of energy supply security and how to deal with potential supply shortages and emergencies. It has three critical pillars - Oil and Gas Security Exercise (OGSE), Oil and Gas Security Studies (OGSS), and Oil and Gas Security Network (OGSN). Thus, gas detectors are of paramount importance in these areas.

- Additionally, several regional projects are underway, which would increase the demand for gas detectors. Some of these include Sriracha Refinery Expansion & Upgrade (To be started in 2024 in Thailand), Pulau Muara Besar Refinery & Petrochemical Complex Phase 2 (To be started in 2022 in China), etc.

Fixed Gas Detectors to Hold Significant Market Share

- Fixed gas detectors are installed when there is a need for round-the-clock monitoring. They are designed to alert workers of the potential danger of toxic gas exposure, asphyxiation due to lack of oxygen, or explosion caused by combustible gases. These gas detectors are used in an enclosed or partially enclosed space where hazardous gases accumulate.

- Toxic gas detectors are widely used by industries including gas and oil, mining, nuclear, medical, food and beverage, construction, and industrial. A metal oxide-based gas sensor is one of the most commonly used detectors for detecting toxic gases. These sensors increase their electrical resistance by contacting gasses such as carbon monoxide, hydrogen, methane, and butane. Most home-based smoke detection systems are oxide-based sensors.

- Combustible gas detectors by Fixed type hold a significant share in the gas detectors market. These sensors detect and respond to combustible gases or vapors and are primarily used in industrial plants to detect gas leakage or buildup before it can reach an explosive level.

- These detectors measure the concentration of certain gases in a specified area through sensors such as infrared, electrochemical, ultrasonic, or semiconductor and compare that to a reference point or scale. If a sensor's response surpasses the pre-set level, an alarm, light, or combination of signals warns the user.

- Additionally, companies continuously invest in product innovation by incorporating advanced technologies in fixed gas detectors. These detectors are now being developed to monitor multiple gases. For instance, Teledyne's OLC 10 and OLCT 10 gas sensors are designed to detect combustible or toxic gases for tertiary applications (boiler plants, battery charging rooms, car parks, and hospitals). Two OLC 10's can be connected to one detection channel to monitor the same area without an additional junction box or wiring.

- For instance, in July 2021, ION Science launched Cub 11.7 eV personal device. This toxic gas detection solution operates in temperatures between 0 °C to 55 °C and is resistant to the effects of humidity or moisture. This gas detector weighs in at a mere 111 grams, so it is comfortable to wear; its compact size enables workers to move around unfettered by cumbersome equipment and has a battery life of up to 12 hours.

- Moreover, The presence of many industries in the APAC region is a crucial market wherein the demand for these detectors is increasing. The rising demand and stable profitability are attracting several vendors to enter the market. For instance, in February 2021, NevadaNano Inc., a gas detection sensor technology vendor, announced that Elematec Corporation would distribute its Molecular Property Spectrometer to its customer base throughout Japan.

- Furthermore, these detectors are also used in the oil & gas industry. Natural gas and crude oil are located deep underground, concealed in rock layers, are difficult to access, and are found in places with extreme climates. Thus, advancements in sensor capability coupled with increasing computing power are driving the demand for these detectors.

APAC Gas Detector Industry Overview

The Asia Pacific Gas Detectors Market is moderately competitive and consists of several major players. Major players with a prominent share in the market are focusing on expanding their customer base across the countries in the APAC region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- April 2022 - MSA Safety Incorporated announced the availability of its latest industry game-changer - the ALTAIR io 4 Gas Detection Wearable device. This is MSA's first direct-to-cloud gas detector to feature. Designed to work in concert with the company's new MSA+ safety subscription service, the ALTAIR io 4 device represents the hardware portion of a cloud-ready suite of technology that MSA calls the Connected Work Platform.

- October 2021 - Honeywell International Inc. introduced two advanced Bluetooth-connected gas detectors - Searchline Excel Plus and Searchline Excel Edge. Designed for oil and gas, chemical, petrochemical, and other industrial facilities, the company's latest gas detectors facilitate constant monitoring of hazardous and flammable gas leaks in the rain, fog, snow, and other severe weather conditions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Awareness on Worker Safety and Stringent Regulations

- 5.1.2 Steady Increase in the Industrial Sector in Key Emerging Countries in Asia-Pacific, Coupled with Expansion Projects

- 5.2 Market Challenges

- 5.2.1 Recent Outbreak of COVID-19 and Marginal Decline in Spending in Key Verticals Expected to Pose a Concern to Manufacturers

- 5.3 Distribution Channel Analysis

- 5.4 Key Industry Standards and Regulations

- 5.5 Type of Communications Used Wired Vs. Wireless

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed

- 6.1.1.1 Toxic Gas Detectors

- 6.1.1.2 Combustible Gas Detectors

- 6.1.2 Portable

- 6.1.2.1 Single-gas

- 6.1.2.2 Multi-gas

- 6.1.1 Fixed

- 6.2 By End-user Verticals

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Water and Wastewater

- 6.2.4 Power Generation

- 6.2.5 Metals and Mining

- 6.2.6 Food and Beverage

- 6.2.7 Other End-user Verticals (Construction, Pharmaceuticals, etc.)

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India & South Korea

- 6.3.4 Australia & New Zealand

- 6.3.5 Southeast Asia (Singapore, Malaysia, Thailand, Indonesia, Philippines, and Vietnam)

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Ranking Analysis (Ranking of Vendors based on Key Differentiating Parameters)

- 7.2 Company Profiles

- 7.2.1 Honeywell Analytics Inc.

- 7.2.2 MSA Safety Incorporated

- 7.2.3 Draegerwerk AG & Co. KGaA

- 7.2.4 Industrial Scientific Corporation

- 7.2.5 Det-Tronics (a Carrier Company)

- 7.2.6 Teledyne Technologies Incorporated

- 7.2.7 Crowncon Detection Instruments Limited

- 7.2.8 RKI Instruments Inc.

- 7.2.9 GFG Gesellscharft