|

市場調查報告書

商品編碼

1641820

商業機器人-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Commercial Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

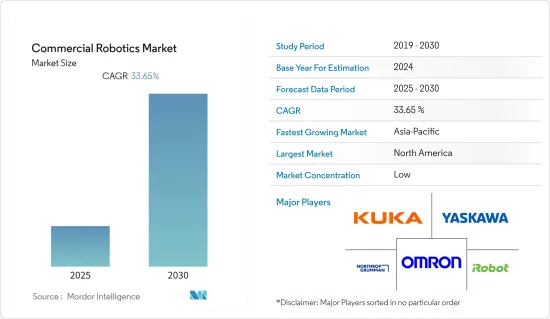

預測期內,商業機器人市場預計將以 33.65% 的複合年成長率成長

關鍵亮點

- 商業機器人廣泛應用於自主引導無人機和醫療應用領域。商業機器人比傳統方法提供更好的服務,因此投資和使用可能會受到刺激。

- 無人機正變得越來越普遍,並被納入各種應用,包括商業空間。此外,各種新興企業和科技巨頭都在大力投資這項技術,以在早期搶佔較高的市場佔有率。此外,市場上已經發現了公共和私人實體之間的各種夥伴關係和合作關係。例如,2022年8月,印度無人機聯合會與印度陸軍設計局簽署了一份合作備忘錄,以加速無人機技術開發和無人機生態系統的本土化。

- 此外,由於人們越來越認知到醫療機器人在醫療領域的益處,醫療機器人領域正在快速發展。醫療保健產業高度傾向技術創新,對物聯網產業和機器人技術的投資是市場成長的主要驅動力。

- 例如,2022 年 9 月,Care and Equity Healthcare Logistics UAS Scotland計劃從英國研究與創新未來飛行挑戰計畫獲得了 1,010 萬歐元(1,070 萬美元)的資助。 CAELUS 由 AGS Airports主導並與蘇格蘭 NHS 合作,涉及 16 個合作夥伴,包括思克萊德大學、NATS 和蘇格蘭 NHS。

- 市場上引入邊境保護機器人的數量正在增加。例如,一家以色列國防相關企業最近推出了一款遙控武裝機器人,旨在巡邏戰區、追蹤入侵者並向他們開火。它由電子平板電腦控制,配備兩機關槍、相機和感測器。

商業機器人市場趨勢

軍用和防禦無人機為商業機器人市場帶來巨大機會

- 軍事機器人防禦過程自動化是軍事發展的下一波。自動化系統和網路與網際網路相輔相成,促進了全球範圍內的通訊。在過去的十年中,國防領域對監控和安全的投資水準不斷增加。

- 政府對國防工業的支出增加為市場成長創造了進一步的機會。例如,2022年8月,東京防衛省要求為2023會計年度編列5.59兆日圓(404億美元)的預算。

- 此外,國家之間緊張局勢加劇,對國防工業自動化的需求也越來越大。例如,在與烏克蘭的戰爭中,俄羅斯的國防支出增加了43%,警察預算增加了40%。

- 無人機或無人駕駛飛機具有許多優勢,例如可以追蹤敵人、偵察衝突地區的未知區域和建築物、保護部隊、協助搜尋失蹤和受傷的士兵,以及為各種任務提供即時視圖。在世界各地的國防和軍事領域中得到越來越多的應用。

- 業界也看到開發中國家之間建立各種合作夥伴關係來開發無人機。例如,印度和美國最近簽署了一份關於合作製造空射無人機的合作備忘錄。該夥伴關係旨在促進聯合技術交流,為印度和美國軍隊共同生產和開發未來技術創造機會。

北美佔據市場主導地位

- 由於商業機器人系統實施所需的基礎設施已被廣泛接受,北美地區很可能引領商業機器人市場。

- 北美醫療保健領域穩步的技術進步是該地區商業機器人市場的主要推動力。美國是該市場一些最大參與者的所在地。中國是手術機器人應用的先驅,也是過去十年來市場成長的主要動力。

- 2022年1月,Wingcopter宣布與Spright建立商業合作夥伴關係,使用無人機運送醫療用品,以改善美國各地客戶的醫療服務。該交易將使 Spright 收購 Wingcopter 大量新旗艦送貨無人機,從而創建一個專注於運送藥品的無人機醫療運送網路。

- 國防和安全領域也佔該地區機器人需求的很大一部分,因為這些地區的已開發國家近年來一直致力於軍事現代化。然而,由於無人機常用於安全和監控,其使用範圍正在急劇成長。

商業機器人產業概況

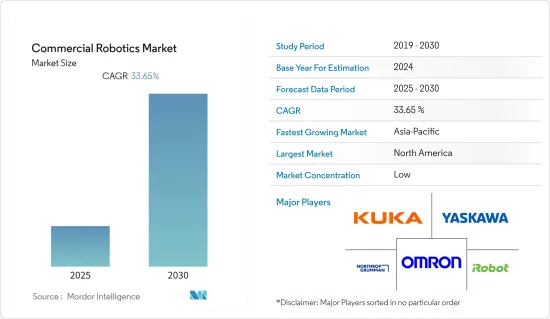

商業機器人市場高度分散,由於商業機器人具有卓越的優勢,其支出正在快速成長。特別是,醫療機器人領域的投資正在增加,再加上工業公司的技術創新和產品推出,預計將推動商業機器人市場的發展。市場的主要參與企業包括諾斯羅普·格魯曼公司、安川電機株式會社、庫卡股份公司、iRobot 公司、本田汽車公司、歐姆龍 Adept Technologies 公司和 3D Robotics 公司。

- 2022 年 11 月-Brain Corporation 推出其用於商業機器人的下一代自主平台。第三代平台是 BrainOS 的演進,BrainOS 是該公司的自主機器人作業系統,目前為公共場所運作的20,000 多個自主機器人提供支持,是該公司開發的一系列自主機器人中的最新產品。為商業領域使用的下一代智慧機器人解決方案提供動力。

- 2022 年 7 月——Leidos 宣布已與華盛頓的美國海上系統司令部簽署了一份價值1200 萬美元的契約,用於開發一種用於海洋環境感知和水雷對抗的中型無人水下航行器(UUV)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 機器人技術與人工智慧的進步與融合

- 政府增加國防開支

- 市場限制

- 機器人系統成本上升

- 技術簡介

第6章 市場細分

- 按機器人類型

- 無人機

- 現場機器人

- 醫療機器人

- 自主引導機器人

- 其他機器人

- 按應用

- 醫療

- 國防安全

- 農業和林業

- 海洋

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 新加坡

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Northrop Grumman Corp.

- Kuka AG

- iRobot Corporation

- Yaskawa Electric Corporation

- Omron Adept Technologies Inc.

- Honda Motor Company Limited

- 3D Robotics Inc.

- Alphabet Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Commercial Robotics Market is expected to register a CAGR of 33.65% during the forecast period.

Key Highlights

- Commercial robots are widely used in the field as autonomous guided drones and medical applications. Commercial robots' exceptional service over conventional methods will likely boost investment and utilization.

- Drones are becoming popular and are being integrated into diverse applications, including commercial space. Also, various startups and tech giants are rigorously investing in this technology to capture a higher market share at an early stage. Further, the market is witnessing various partnerships and collaborations by public and private organizations. For instance, in August 2022, The Drone Federation of India signed an MoU with the Indian Army Design Bureau to accelerate drone technology development and indigenization in the drone ecosystem.

- Moreover, the medical robotics sector has developed at a rapid rate due to the growing acknowledgment of its benefits in the healthcare sector. The healthcare industry strongly leans toward technological innovation the IoT industry and investments in robotics have been the major contributors to the growth of the market.

- For instance, in September 2022, The Care and Equity Healthcare Logistics UAS Scotland project secured EUR 10.1 million (USD 10.7 million) in funding from the future flight challenge at UK Research and Innovation. Led by AGS Airports in partnership with NHS Scotland, CAELUS brings together 16 partners, including the University of Strathclyde, NATS, and NHS Scotland.

- The market is witnessing the adoption of robots for protecting the border. For instance, recently, an Israeli defense contractor unveiled a remote-controlled armed robot to patrol battle zones, track infiltrations, and open fire. It is operated by an electronic tablet and can be equipped with two machine guns, cameras, and sensors.

Commercial Robotics Market Trends

Drones in Military and Defense to Present Significant Opportunities for the Commercial Robotics Market

- Military robot automation of the defense process is the next wave of military evolution. As automated systems and networking complement the Internet, communication is facilitated on a global basis. Over the past decade, there have been increasing levels of investment in surveillance and security in the defense sector.

- The increasing government spending on the defense industry is further creating an opportunity for market growth. For instance, in August 2022, the Ministry of Defense in Tokyo asked for a JPY 5.59 trillion (USD 40.4 billion) budget for the fiscal year 2023.

- Moreover, the increasing tensions among the countries are further creating a demand for automation in the defense industry. For instance, amid the war with Ukraine, Russia increased defense spending by 43% and the police budget by 40%.

- The UAVs and drones are increasingly being adopted in the defense and military sector worldwide due to their benefits, such as enemy tracking, use in war zones in reconnaissance of unknown areas or buildings, force protection, and to assist in the search for lost or injured soldiers, as well as a real-time view of various missions.

- The industry is also witnessing various partnerships among developing nations for the development of unmanned aerial vehicles. For instance, recently, India and United States signed an MoU for cooperation in the production of Air-launched unmanned aerial vehicles. The partnership is aimed to promote collaborative technology exchange and create opportunities for the co-production and co-development of future technologies for Indian and US military forces.

North America to Dominate the Market

- The North American region is set to lead the market for commercial robotics due to the widespread acceptance of the infrastructure required for the adoption of commercial robotic systems.

- The steady technological advancements in the healthcare sector in North America are a major driver for the commercial robotics market in the region. The United States is home to some of the largest players in the market. It is a pioneer in adopting surgical robots, which has been a primary factor influencing the market's growth during the past decade.

- In January 2022, Wingcopter announced its commercial partnership with Spright to use drones to deliver medical supplies to improve healthcare access for customers across the United States. This agreement will see Spright acquire a large fleet of Wingcopter's new flagship delivery drones to create a drone-based, healthcare-specific delivery network.

- The defense and security sector also accounts for a significant portion of the demand, for robotics, in the region, as developed countries in these regions have focused on military modernization in the recent past. However, airborne drones have seen a phenomenal increase in their application because of their heavy usage in security and surveillance.

Commercial Robotics Industry Overview

The commercial robotics market is highly fragmented, as expenditure on commercial robots is rapidly increasing due to their superior benefits. The increasing investments, especially in the medical robotics segment, coupled with technological innovations and product launches by the industry players, are expected to drive the commercial robotics market. Some key players in the market are Northrop Grumman Corp., Yaskawa Electric Corporation, Kuka AG, iRobot Corporation, Honda Motor Company Limited, Omron Adept Technologies Inc., and 3D Robotics Inc., among others.

- November 2022 - Brain Corporation launched a next-generation autonomy platform for commercial robotics. The third-generation platform represents the evolution of Brain Corp's BrainOS autonomous robotic operating system, which currently powers over 20,000 autonomous robots operating in public spaces and has been developed to underpin a future generation of intelligent robotic solutions to be used across multiple commercial sectors.

- July 2022 - Leidos announced the development of a medium-sized unmanned underwater vehicle (UUV) for marine environmental sensing and counter-mine warfare under terms of a USD 12 million contract with U.S. Naval Sea Systems Command in Washington.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements and Convergence of Robotics and Artificial Intelligence

- 5.1.2 Increasing Government Spending on Defense

- 5.2 Market Restraints

- 5.2.1 Higher Costs of the Robotic Systems

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Type of Robot

- 6.1.1 Drones

- 6.1.2 Field Robots

- 6.1.3 Medical Robots

- 6.1.4 Autonomous Guided Robotics

- 6.1.5 Other Types of Robots

- 6.2 By Application

- 6.2.1 Medical and Healthcare

- 6.2.2 Defense and Security

- 6.2.3 Agriculture and Forestry

- 6.2.4 Marine

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Singapore

- 6.3.3.5 Australia

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Northrop Grumman Corp.

- 7.1.2 Kuka AG

- 7.1.3 iRobot Corporation

- 7.1.4 Yaskawa Electric Corporation

- 7.1.5 Omron Adept Technologies Inc.

- 7.1.6 Honda Motor Company Limited

- 7.1.7 3D Robotics Inc.

- 7.1.8 Alphabet Inc.