|

市場調查報告書

商品編碼

1641868

木塑複合材料 (WPC) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wood Plastic Composites (WPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

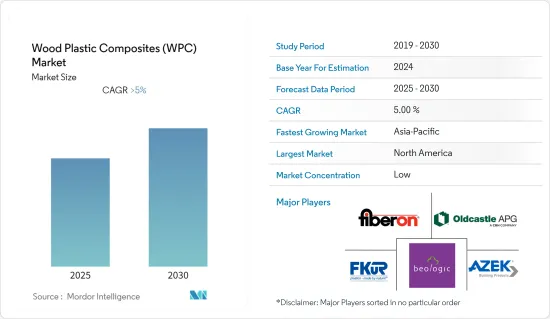

預測期內,木塑複合材料 (WPC) 市場預計將以超過 5% 的複合年成長率成長。

2020 年和 2021 年初,COVID-19 疫情零星爆發,導致各國政府採取禁令和限制措施,導致全球建築業(主要應用領域)大幅萎縮,並加劇了綠色建材市場的衰退. 成長受到限制。

由於各大城市採取嚴格的封鎖措施,導致住宅登記暫停,房屋抵押貸款付款陷入停滯,住宅房地產受到的打擊最為嚴重。同時,商業建設計劃也受到勞動力短缺和融資緊張的打擊。然而,自從限制解除以來,該行業已經恢復良好。過去兩年,住宅銷售量上升、新計畫的推出以及新辦公室和商業空間需求增加推動了市場的復甦。

關鍵亮點

- 從中期來看,建築業的強勁成長以及汽車業對可回收和輕量材料的需求不斷成長是推動研究市場成長的主要驅動力。

- 然而,預計溫度敏感性和磨損等技術問題將在預測期內抑制該行業的成長。

- 可回收塑膠在各個應用領域的使用越來越多,以設計出更具永續性的最終產品,這可能很快就會為全球市場創造有利可圖的成長機會。

- 預計北美將成為木塑複合材料的最大市場,而亞太地區預計在預測期內以最高的複合年成長率成長。北美佔據主導地位是由於建築業對木塑複合材料的不斷成長的需求,以及汽車行業對輕型車身部件的需求。

木塑複合材料 (WPC) 市場趨勢

建築和施工應用佔據市場主導地位

- 建築和施工是木塑複合材料 (WPC) 最大的應用領域。木塑複合材料具有高度防潮、防腐和持久耐用的特性,廣泛應用於裝飾地板、裝飾線條、裝飾物、圍欄、景觀美化和戶外應用。

- 裝飾板是 WPC 最重要的用途之一。在建築中,甲板是能夠支撐重量的平坦或異形(防滑)表面。甲板與地板類似,但一般建在室外,通常高於地面,通常與建築物相連。木塑複合地板可用於各種應用,包括作為景觀美化的一部分,擴大住宅的居住面積,取代石材特徵(如露台),或作為住宅甲板,烹飪,用餐或座位空間。

- 隨著人們對永續性建築方法的認知不斷增強,WPC 正迅速成為現代住宅和商業建築方法中必不可少的建築材料。全球建築業正在不斷擴張。根據世界銀行預測,未來12年,建築總支出預計將達到19.2兆美元,將進一步提振研究市場。

- 中國的人口趨勢引發了公共和私營部門對經濟適用住宅的投資。根據中國國家統計局的數據,中國住宅面積從2022年7月的7,600萬平方公尺飆升至2022年8月的8,500萬平方公尺。此外,預計到 2030 年中國將在建築方面投資近 13 兆美元,這對 WPC 來說是一個好兆頭。

- 根據《投資印度》報告,印度建築業的規模預計到 2025 年將達到 1.4 兆美元,其與智慧城市使命相關的計畫將得到支持,以改造 100 個城市並提供經濟適用住宅。

- 歐洲是WPC的主要消費國家之一。根據歐盟統計局的數據,2021年12月,光是住宅建築就為德國GDP貢獻了7.2%,為近十年來的最高佔有率。德國聯邦統計局報告稱,2021年該國住宅存量為4,310萬套,與前一年同期比較增加0.7%(即28萬套)。 2021年德國建築業獲得的建築許可總數連續第三次增加,達到248,688套。

- 2022年7月,德國政府宣布計畫每年津貼130至140億歐元(140.8至151.7億美元)用於維修建築,使其更加永續性。

- 考慮到上述因素,預測期內,建築應用中 WPC 的使用和需求預計會增加。

北美佔據市場主導地位

- 北美佔據木塑複合材料(WPC)市場的最大市場佔有率,主要由於該地區住宅和商業計劃的增加。

- 美國擁有龐大的建築業。根據美國人口普查局的統計,2021 年美國住宅建築成本為 8,029.33 億美元,而 2020 年為 6,442.57 億美元。此外,截至 2022 年 8 月的總建築價值超過了 2021 年的數字,達到 9,129.13 億美元。

- 美國正在進行大規模的住宅維修。隨著移民人口的不斷成長,翻修的需求變得越來越迫切。此外,人們對永續性和高效建築的認知不斷增強,也推動了修復趨勢。多種政府貸款也為全國各地的住宅翻修提供支援。

- 加拿大(尤其是多倫多)正在經歷高層建築建設熱潮,預計到 2025 年將有 30 多座高層建築竣工。 2022年4月,加拿大政府宣布了未來十年住宅建設量翻倍的目標,並在2022年預算下啟動的40億加元(29.9億美元)住宅加速基金的支持下實現了。

- 此外,北美國家汽車產銷量的成長為木塑複合材料市場提供了機會。美國是繼中國之後的世界第二大汽車生產國。根據 OICA 的數據,2021 年汽車產量為 9,167,214 輛,較 2020 年產量 8,822,399 輛成長 4%。

- 加拿大對電動車的需求不斷成長,正在鼓勵該國主要汽車製造商投資製造業務。福特宣布計劃在2021年建造兩到三家新的電池工廠,到2030年生產40萬輛電動車和卡車。安大略省和聯邦政府已提供 2.95 億加元(2.1926 億美元)支持福特汽車位於安大略省奧克維爾工廠的新電動車生產。

木塑複合材料 (WPC) 產業概況

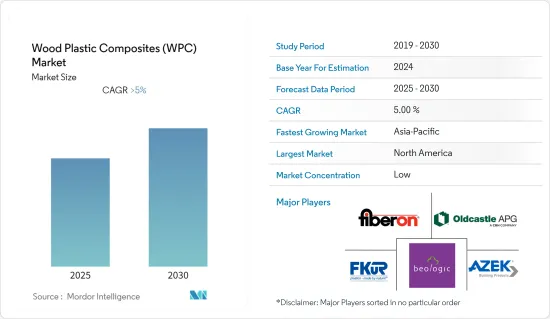

木塑複合材料 (WPC) 市場區隔程度適中,市場佔有率由眾多參與企業瓜分。市場的主要企業(不分先後順序)包括 FKuR、Biologic.、The Azek Company Inc.、Fiberon 和 CRH Company 旗下的 Oldcastle APG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築和施工領域的需求增加

- 汽車產業對可回收輕量材料的需求不斷增加

- 限制因素

- 溫度敏感性和磨損等技術問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 塑膠材質

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 聚苯乙烯(PS)

- 聚氯乙烯(PVC)

- 其他塑膠材質

- 應用

- 建築和建築材料

- 甲板材料

- 塑形和修剪

- 柵欄

- 景觀美化和戶外

- 汽車零件

- 工業產品

- 消費品

- 家具

- 其他

- 建築和建築材料

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AXION STRUCTURAL INNOVATIONS LLC

- The Azek Company Inc.

- Beologic

- CERTAINTEED

- Fiberon

- FKuR

- Geolam, Inc.

- JELU-WERK J. Ehrler GmbH & Co. KG

- Oldcastle APG a CRH Company

- PolyPlank AB

- Resysta International

- Trex Company Inc.

- UFP Industries, Inc.

第7章 市場機會與未來趨勢

- 擴大再生塑膠的使用

The Wood Plastic Composites Market is expected to register a CAGR of greater than 5% during the forecast period.

The sporadic outbreak of the COVID-19 pandemic in 2020 and the first half of 2021 drastically curtailed the major application sector, i.e., the global construction sector, due to imposed government bans and restrictions, thereby limiting the growth of the green building materials market.

Residential real estate was the worst hit as strict lockdown measures across major cities resulted in the suspension of home registrations and slow home loan disbursements. On the other hand, commercial construction projects were also hit due to a lack of labor and constrained financials. However, the sector has been recovering well since restrictions were lifted. An increase in house sales, new project launches, and increasing demand for new offices and commercial spaces have been leading the market recovery over the last two years.

Key Highlights

- Over the medium term, the robust growth in the building and construction sector and the growing demand for recyclable and lightweight materials in the automotive industry are the major driving factors augmenting the growth of the market studied.

- On the flip side, technical issues such as temperature sensitivity, wearability, etc. are anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the rising use of recyclable plastics in various application sectors to design more sustainable end-products is likely to create lucrative growth opportunities for the global market soon.

- North America emerged as the largest market for wood plastic composites, while Asia-Pacific is expected to witness the highest CAGR during the forecast period. The dominant position enjoyed by North America is attributed to the growing demand for wood-plastic composites in decking applications in the building and construction industry as well as for building lightweight components of vehicle bodies in the automotive industry.

Wood Plastic Composites (WPC) Market Trends

Building & Construction Application to Dominate the Market

- Building and construction is the largest application sector for wood-plastic composites (WPC). Being moisture and rot-resistant while retaining their aesthetic quality for longer, wood plastic composites are widely used in decking, moulding and trimming, fencing, landscaping, and outdoor applications.

- Decking is one of the most important applications of WPCs. In construction, a deck is a flat or profiled (anti-slip) surface that is capable of supporting weight. A deck is similar to a floor but is typically constructed outdoors, often elevated from the ground, and usually connected to a building. Wood plastic composite decking can be used in a number of ways, such as part of garden landscaping, the extension of the living areas of houses, an alternative to stone-based features (such as patios), and in residential decks, as well as spaces for cooking, dining, and seating.

- WPCs are soon gaining pace as a vital building material in modern housing and commercial space construction methods, owing to the growing consciousness toward sustainability-driven construction practices. The global construction sector is continuously expanding. As per the World Bank, the total construction spending value is projected to reach USD 19.2 trillion over the next 12 years, which is expected to give an upward push to the studied market.

- China's demographics have triggered investments in affordable residential colonies by both the public and private sectors. As per the National Bureau of Statistics of China, housing starts in China jumped to 85 million sq m in August 2022 from 76 million sq m in July of 2022. Furthermore, China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for WPCs.

- As per the Invest India Report, India's construction industry is heading to reach USD 1.4 trillion market size by 2025 supported by schemes pertaining to the smart city mission targeting the transformation of 100 cities and affordable housing.

- Europe is one of the major consumers of WPCs. According to Eurostat, residential construction alone contributed 7.2% to Germany's GDP in December 2021, the highest share reached in the past decade. The German Federal Statistical Office reported the stock of dwellings at 43.1 million in 2021 in the country, showing an increase of 0.7% (i.e., 280,000 dwellings) from the previous year. The total number of building permits achieved by Germany's construction sector rose consecutively for the third time in 2021, reaching 248,688 units.

- In July 2022, the German government announced its plans to spend EUR 13-14 billion (USD 14.08-15.17 billion) annually in providing subsidies for the renovation of buildings to make them more sustainable.

- Considering all the above factors, the usage and demand of WPCs for building & construction applications are expected to drive up in the forecast period.

North America Region Dominates the Market

- North America accounts for the largest market share of the wood plastic composites (WPCs) market, driven primarily owing to the growing residential and commercial projects in the region.

- The United States flaunts a colossal construction industry. As per the statistics generated by the US Census Bureau, the value of residential construction put in place in the United States was valued at USD 802,933 million in 2021, compared to USD 644,257 million in 2020. Further, the value of total construction put in place till August 2022 surpassed the 2021 figures reaching USD 912,913 million.

- The United States is going massive on home renovations. With the growing population of migrants in the country, the need for renovation has become increasingly important. Also, the growing awareness toward sustainability and high-efficiency structures has created a spur in the restoration trend. The availability of several loans by the government also supports home remodeling in the country.

- There has been a boom in the construction of skyscrapers in Canada (more specifically in Toronto) with over 30 high-rise buildings expected to be completed by 2025. In April 2022, the Canadian government announced its target to double housing construction over the next decade with assistance from the Housing Accelerator Fund of CAD 4 billion (USD 2.99 billion) launched under Budget 2022, which aims to build 100,000 new housing units in the next five years.

- Furthermore, the growth in automotive production and sales in North American countries provides favorable opportunities to the wood plastic composites market. The United States is the second largest automotive manufacturing country in the globe falling only behind China. According to OICA, the automotive production in 2021 accounted for 9,167,214 units, an increase of 4% in comparison to the production in 2020, which was reported to be 8,822,399 units.

- The rising demand for electric vehicles in Canada has propelled the investment in production activities by key automotive manufacturers in the country. In 2021, Ford announced its aim to produce 400,000 electric cars and trucks by 2030 including two to three new battery plants. Ontario and federal governments offered CAD 295 million (USD 219.26 million) to support new EV production at Ford Motor's plant in Oakville, Ontario.

Wood Plastic Composites (WPC) Industry Overview

The wood plastic composites (WPC) market is moderately fragmented as the market share is divided among many players. Some of the major players in the market (in no particular order) include FKuR, Biologic., The Azek Company Inc., Fiberon, and Oldcastle APG, a CRH Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From the Building & Construction Sector

- 4.1.2 Rising Demand for Recyclable and Lightweight materials in the Automotive Industry

- 4.2 Restraints

- 4.2.1 Technical Issues Like Temperature Sensitivity, Wearability, etc

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Plastic Material

- 5.1.1 Polyethylene (PE)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Polystyrene (PS)

- 5.1.4 Polyvinyl chloride (PVC)

- 5.1.5 Other Plastic Materials

- 5.2 Application

- 5.2.1 Building & Construction Products

- 5.2.1.1 Decking

- 5.2.1.2 Molding & Trimming

- 5.2.1.3 Fencing

- 5.2.1.4 Landscaping & Outdoor

- 5.2.2 Automotive Parts

- 5.2.3 Industrial

- 5.2.4 Consumer Goods

- 5.2.5 Furniture

- 5.2.6 Other Applications

- 5.2.1 Building & Construction Products

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AXION STRUCTURAL INNOVATIONS LLC

- 6.4.2 The Azek Company Inc.

- 6.4.3 Beologic

- 6.4.4 CERTAINTEED

- 6.4.5 Fiberon

- 6.4.6 FKuR

- 6.4.7 Geolam, Inc.

- 6.4.8 JELU-WERK J. Ehrler GmbH & Co. KG

- 6.4.9 Oldcastle APG a CRH Company

- 6.4.10 PolyPlank AB

- 6.4.11 Resysta International

- 6.4.12 Trex Company Inc.

- 6.4.13 UFP Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of Recycled Plastics