|

市場調查報告書

商品編碼

1641879

石油和天然氣管道:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Oil and Gas Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

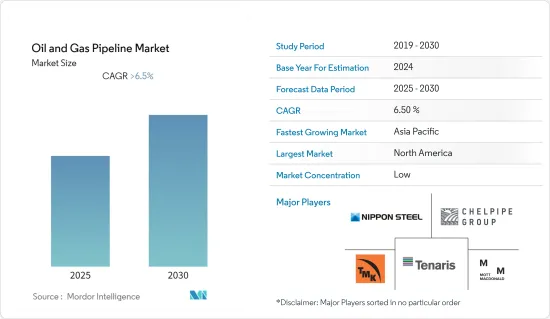

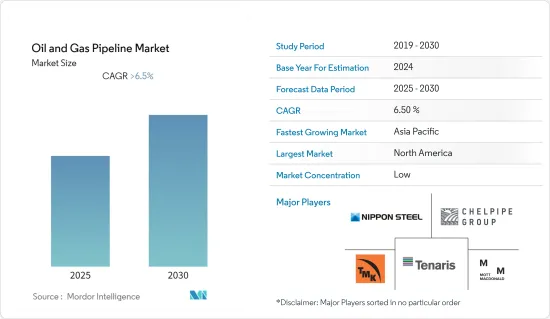

預計預測期內石油和天然氣管道市場複合年成長率將超過 6.5%。

市場受到了 COVID-19 疫情的負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 為了滿足日益成長的石油和天然氣消費量,管道容量正在擴大,新的管道計劃正在投入使用。此外,深水和超深水生產和開發等海上活動的增加正在推動石油和天然氣管道市場的發展。此外,豐富的天然氣蘊藏量和相對於其他石化燃料的低成本預計將補充包括發電在內的多個終端使用領域對天然氣的需求。預計這將在預測期內促進天然氣管道市場的發展。

- 然而,全球向再生能源來源發電的轉變對石油和天然氣需求構成了重大威脅,這可能會對未來幾年石油和天然氣管道設施的成長構成重大挑戰。

- 俄羅斯和巴基斯坦同意建造一條價值 20 億美元的新天然氣輸送管道。印度和俄羅斯也簽署了價值400億美元的向印度出口天然氣的協議。預計此類大型計劃將推動管道行業的進一步成長,並在不久的將來為市場相關人員創造機會。

- 由於亞太地區主要國家對石油和天然氣的需求不斷增加,預計該地區的管道市場將顯著成長。中國和印度是亞太地區最大的石油和天然氣消費國,其管道網路正在快速成長。

石油和天然氣管道市場趨勢

天然氣管道領域佔據市場主導地位

- 受發電、運輸等多個產業對天然氣需求增加的推動,天然氣消費量將大幅增加,到2021年將達到40,375億立方公尺。預計這一趨勢將持續下去,並可能成為天然氣管道基礎設施發展的主要驅動力。

- 到 2030 年,受環境效益以及中東、非洲和亞太等地區對能源安全的追求的推動,預計天然氣需求將在所有燃料類型中顯著成長。

- 俄羅斯2021年天然氣出口量達2,017億立方公尺/年,仍為全球最大液化天然氣出口國。預計全球液化天然氣貿易將大幅增加,從而導致對天然氣管道網路的需求增加。

- 截至2021年,全球共有408條新的天然氣管道在建或預建,共19.34萬公里。

- 根據全球能源監測數據顯示,歐洲正在興建的天然氣管道總合16條,總長度3,200公里,總建設成本為65億歐元。其中21億歐元將用於波羅的海管道計劃,預計該項目將使歐盟的天然氣進口能力每年增加100億立方公尺。

- 頁岩氣礦床等新天然氣資源的開發及相關的價格壓力,正在增加國際天然氣貿易。因此,預計這些發展將在預測期內增加對管道網路擴建的需求。

亞太地區佔市場主導地位

- 預計到 2050 年亞太地區的能源消耗將增加 48%。根據國際能源總署(IEA)預測,到2025年,中國預計將貢獻全球能源成長的30%。此外,中國天然氣進口量不斷增加,到2021年將達到1,627億立方米,以滿足不斷成長的需求。

- 包括中油和中國海洋石油總公司在內的中國國有企業計劃最大限度地提高當地天然氣田的產量,進一步推動該地區的管道需求。

- 此外,2022年1月,ONGC將管道更換計劃第七階段開發合約授予L&T Hydrocarbon Engineering Limited。 EPCIC的合約涉及印度石油天然氣公司西海岸海上油田約350公里海底管線和海洋工程的工程設計、採購、建造、安裝和試運行。

- 此外,2022年2月,中國海洋石油總公司和道達爾能源公司與烏干達和坦尚尼亞簽署了最終投資決定,開始投資超過100億美元在烏干達生產和出口原油。該項目涉及一條價值 50 億美元的石油管線,將原油從內陸國家烏干達通過坦尚尼亞印度洋沿岸的港口輸送到全球市場。

- 因此,亞太地區不斷成長的需求和新的管道基礎設施是推動石油和天然氣市場成長的關鍵因素。

石油天然氣管道產業概況

石油和天然氣管道市場適度細分。該市場的主要企業(不分先後順序)包括新日本製鐵公司、泰納瑞斯公司、TMK 集團、ChelPipe 集團和莫特麥克唐納Group Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 部署位置

- 陸上

- 海上

- 類型

- 原油管線

- 天然氣管道

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Nippon Steel Corporation

- Tenaris Inc.

- TMK Group

- Mott Macdonald Group Ltd

- Shengli Oil & Gas Pipe Holdings Limited

- United States Steel Corporation

- OMK Steel Ltd

- ChelPipe Group

- TechnipFMC PLC

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 61343

The Oil and Gas Pipeline Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19. Currently, the market has reached pre-pandemic levels.

Key Highlights

- In a bid to meet the rising oil and gas consumption, the pipeline capacities are being expanded, and new pipeline projects are being commissioned. Moreover, an increase in offshore activities, such as deepwater and ultra-deepwater production and development, is driving the oil and gas pipeline market. Also, The availability of abundant natural gas reserves and the lower cost in comparison to other fossil fuel types, among others, are expected to supplement the demand for natural gas from multiple end-use sectors, including power generation. This, in turn, is expected to boost the gas pipeline market during the forecast period.

- However, the global shift toward renewable sources for electricity generation poses a massive threat to oil and gas demand, which is likely to be a significant challenge for oil and gas pipeline installation growth in the coming years.

- Russia and Pakistan have agreed to build a new gas-carrying pipeline worth USD 2 billion. India and Russia also signed a deal worth USD 40 billion on natural gas exports to India. Such large-scale projects are expected to drive the pipeline industry to grow more, and this is expected to present an opportunity for the market players in the near future.

- Asia-Pacific is expected to witness significant growth in the pipeline market due to the increasing demand for oil and gas from the major countries in the region. China and India have been the largest consumers of oil and gas in the Asia-Pacific region, and the pipeline network is growing at a significant pace in both countries.

Oil and Gas Pipeline Market Trends

The Gas Pipeline Segment to Dominate the Market

- Natural gas consumption increased significantly, reaching 4037.5 billion cubic meters (bcm) in 2021, owing to the increasing demand for natural gas in multiple industries, including power generation and transportation. This trend is expected to continue in the coming years and is likely to drive the gas pipeline infrastructure significantly.

- By 2030, due to environmental benefits and the quest for energy security in regions such as the Middle East, Africa, and Asia-Pacific, the demand for natural gas is expected to witness significant growth among all fuel types.

- With exports of 201.7 billion cubic meters of gas annually in 2021, Russia continued to be the largest LNG exporter globally. The LNG trade is expected to witness a significant increase globally, resulting in increased demand for the natural gas pipeline network.

- As of 2021, Globally, 408 new gas pipelines are under construction or in pre-construction, totaling 193,400 km, while 510 capacity expansions and upgrades to existing infrastructure are in progress.

- According to the Global energy monitor, Europe has a total of 16 gas pipelines under construction, totaling 3,200 kilometers (km) and costing EUR 6.5 billion. Of this, EUR 2.1 billion is earmarked for the Baltic Pipe Project, which is expected to increase EU gas import capacity by 10 billion cubic meters annually.

- The development of new sources of natural gas, such as shale gas deposits, and the resulting price pressure are increasing the international trade of natural gas. Hence, these developments are expected to consequently result in increasing the demand for pipeline network expansion during the forecast period.

Asia-Pacific to Dominate the Market

- Energy consumption in Asia-Pacific is expected to increase by up to 48% by 2050. According to the International Energy Agency (IEA), China is expected to contribute 30% of the world's energy increase until 2025. Moreover, natural gas imports have continuously increased in China and reached 162.7 bcm in 2021, thus meeting the increasing demand.

- China's state-owned firms, including CNPC and China National Offshore Oil Corporation, have plans to maximize production at local gas fields, further driving the pipeline demand in the region.

- Moreover, In January 2022, ONGC awarded L&T Hydrocarbon Engineering Limited a contract for the seventh development phase of their Pipeline Replacement Projects. EPCIC's contract involves the engineering, procurement, construction, installation, and commissioning of around 350 km of subsea pipelines and offshore work spread across ONGC's west coast offshore fields.

- Moreover, In February 2022, A final investment decision was signed by China National Offshore Oil Company and TotalEnergies with Uganda and Tanzania to begin more than USD 10 billion in investments to produce and export crude oil from Uganda. The venture entails a USD 5 billion oil pipeline that aids in transporting crude from landlocked Uganda to global markets via a port on Tanzania's coast of the Indian Ocean.

- Therefore, the increasing demand and new pipeline infrastructure in Asia-Pacific are significant factors driving the market growth of oil and gas.

Oil and Gas Pipeline Industry Overview

The oil and gas pipeline market is moderately fragmented. Some major players operating in this market (in no particular order) include Nippon Steel Corporation, Tenaris Inc., TMK Group, ChelPipe Group, and Mott Macdonald Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Type

- 5.2.1 Crude Oil Pipeline

- 5.2.2 Gas Pipeline

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nippon Steel Corporation

- 6.3.2 Tenaris Inc.

- 6.3.3 TMK Group

- 6.3.4 Mott Macdonald Group Ltd

- 6.3.5 Shengli Oil & Gas Pipe Holdings Limited

- 6.3.6 United States Steel Corporation

- 6.3.7 OMK Steel Ltd

- 6.3.8 ChelPipe Group

- 6.3.9 TechnipFMC PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219