|

市場調查報告書

商品編碼

1645074

東南亞石油和天然氣管道-市場佔有率分析、產業趨勢和成長預測(2025-2030 年)South-East Asia Oil And Gas Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

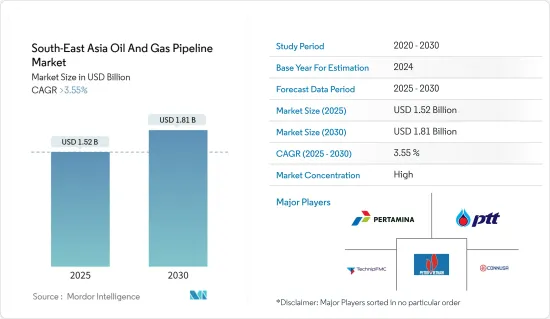

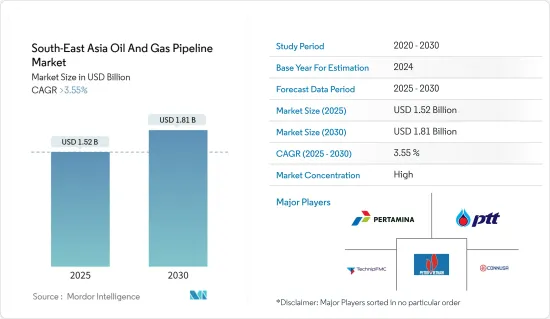

東南亞石油和天然氣管道市場規模預計在2025年為15.2億美元,預計到2030年將達到18.1億美元,預測期內(2025-2030年)的複合年成長率將超過3.55%。

關鍵亮點

- 從中期來看,該地區不斷成長的能源需求和新的出口機會預計將推動東南亞石油和天然氣管道市場的發展。

- 然而,能源價格的波動預計會阻礙東南亞市場的成長。

- 預計在預測期內,監控系統等智慧管道系統的日益普及將帶來成長機會。

- 印尼是最大的能源消耗國,預計它將主導東南亞石油和天然氣管道市場,並且預測期內該地區對石油和天然氣的需求預計會增加。

東南亞石油天然氣管道市場趨勢

天然氣管道領域佔據市場主導地位

- 人口的快速成長和經濟的擴張推動著對更清潔、更有效率的能源來源需求。作為一種相對清潔的石化燃料,天然氣符合環境關注和經濟成長意願。能源偏好向天然氣的轉變正在推動天然氣管道基礎設施的發展和擴張。

- 根據能源研究所的《世界能源統計評論》,由於該地區的工業成長放緩,預計 2022 年天然氣消費量將跌至近十年來的最低水準。然而,由於該地區大多數國家都致力於減少石化燃料消耗並增加天然氣消耗,預計未來幾年消費量將會增加。

- 此外,東南亞的地理特徵也有利於天然氣管道的優勢。該地區有許多群島和島嶼,使得海上運輸石油在物流上非常困難且成本高昂。相較之下,天然氣管道是在這些充滿挑戰的地形上運輸天然氣的一種經濟高效的解決方案。這一地理優勢使得天然氣管道成為能源運輸的首選方式。

- 東南亞對天然氣基礎設施的投資不斷增加,包括液化天然氣(LNG)終端和相關管道的開發。這些投資將促進更清潔的替代能源的進口和分配。隨著天然氣成為初級能源,管道在將液化天然氣從終端運輸到消費點的過程中發揮著至關重要的作用,從而增加了天然氣管道部分的重要性。

- 例如,2023年9月,馬來西亞Bumi Armada與印尼能源公司Pertamina的子公司和天然氣公司PT Davenergy Mulia Perkasa簽署了一項協議。該協議涉及液化天然氣(LNG)的開發和商業化。作為協議的一部分,兩家公司將建立基地,開發和商業化從印尼馬杜拉氣田和鄰近油田開採的液化天然氣。

- 考慮到上述因素,預計預測期內天然氣管道產業將佔據市場主導地位。

印尼將成為最大的地理區域

- 印尼自然資源豐富,特別是石油、天然氣蘊藏量豐富。該國是石油和天然氣的重要生產國,將這些資源有效地運輸到精製、配送中心和出口終端至關重要。巨大的蘊藏量和對新供應源的不斷尋找迫使印尼擴大石油、天然氣和管道基礎設施。

- 根據能源研究所的《世界能源統計評論》,2021 年至 2022 年,印尼的石油消費量增加了 8.5%。 2021年石油消費量為每天146.1萬桶,而2022年為每天158.5萬桶。

- 印尼的戰略地理位置對其在石油和天然氣管道市場佔據主導地位起著關鍵作用。該國由許多島嶼和群島組成,因此需要建造管道以實現高效的能源運輸。特別是天然氣管道,它提供了一種經濟高效且可靠的方式,可以在崎嶇的地形上運輸天然氣,將生產基地與都市區和工業區連接起來。

- 2023 年 1 月,Casakha 宣布將立即在其雅加達辦公室進行設計、工程和計劃管理活動。印尼一家海底和海洋顧問公司計劃於 2023 年進行海上安裝。規定的業務範圍包括連接 LPRO 和 EPRO 平台的 16 英吋(40.6 公分)海上管道的詳細工程設計、安裝、運輸和工程業務。

- 印尼日益成長的能源需求推動了石油和天然氣管道領域的擴張。隨著經濟發展,該國人口不斷增加,對能源資源的需求也隨之增加。滿足這項需求需要對管道計劃進行投資,管道項目是運輸石油和天然氣的主要手段,滿足家庭、企業和工業的能源需求。

- 印尼在石油和天然氣管道市場的優勢在法律規範和政府支持。政府積極推動能源基礎設施發展,並鼓勵管道計劃的投資。監管機構提供的優惠法規和獎勵為管道行業的國內使用和出口成長創造了有利的環境。

- 因此,鑑於上述情況,預計印尼將在預測期內佔據市場主導地位。

東南亞油氣管線產業概況

東南亞石油天然氣管道市場中等細分化。市場的主要企業(不分先後順序)包括 PT Pertamina、PTT Public Company Limited、TechnipFMC PLC、PetroVietnam 和 PT. Connusa Energindo。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 東南亞主要管線計劃清單(管線長度、運輸燃料、業者、總資本支出、開工年份、試運行年份)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 能源需求不斷增加

- 增加出口機會

- 限制因素

- 能源價格波動

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 部署位置

- 土地

- 海上

- 類型

- 原油

- 天然氣

- 國家

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他東南亞國家

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- Companies Profiles

- PT Pertamina

- PTT Public Company Limited

- TechnipFMC PLC

- PetroVietnam

- PT. Connusa Energindo

- 市場佔有率

第7章 市場機會與未來趨勢

- 擴大智慧管道系統引入

簡介目錄

Product Code: 50002037

The South-East Asia Oil And Gas Pipeline Market size is estimated at USD 1.52 billion in 2025, and is expected to reach USD 1.81 billion by 2030, at a CAGR of greater than 3.55% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the increasing energy demand in the region and emerging export opportunities in the area are expected to drive the Southeast Asian oil and gas pipeline market.

- However, the volatility in energy prices is expected to hinder the growth of the market studied in Southeast Asia.

- The increasing deployment of smart pipeline systems, such as monitoring systems, is expected to provide growth opportunities in the forecast period.

- Indonesia is expected to dominate the Southeast Asian oil and gas pipeline market due to the country being the largest energy consumer and the increasing demand for oil and gas in the region during the forecast period.

South-East Asia Oil And Gas Pipeline Market Trends

Gas Pipeline Segment to Dominate the Market

- With the region's burgeoning population and economic expansion, the need for cleaner and more efficient energy sources has intensified. Natural gas, as a relatively cleaner-burning fossil fuel, aligns with environmental concerns and economic growth aspirations. This shift in energy preference toward natural gas drives the development and expansion of gas pipeline infrastructure.

- According to the Energy Institute Statistical Review of World Energy, in 2022, natural gas consumption reached an all-time low in the past decade due to the industrial slowdown in the region. However, consumption is expected to increase in the coming years as most countries in the area focus on reducing fossil fuel consumption and rising natural gas consumption.

- Furthermore, Southeast Asia's geographical characteristics favor the dominance of gas pipelines. The region comprises numerous archipelagos and islands, and maritime transport of oil can be logistically challenging and costly. In contrast, gas pipelines provide a cost-effective and efficient solution for transporting natural gas across these difficult terrains. This geographic advantage contributes to the inclination toward gas pipelines as the preferred mode of energy transportation.

- Southeast Asia is witnessing increased investments in gas infrastructure, including the development of liquefied natural gas (LNG) terminals and associated pipelines. These investments facilitate the import and distribution of LNG, offering a cleaner energy alternative. As natural gas gains prominence as a primary energy source, channels play a pivotal role in transporting LNG from terminals to consumption centers, thereby bolstering the significance of the gas pipeline segment.

- For instance, in September 2023, Malaysia's Bumi Armada made an agreement with a subsidiary of the Indonesian energy company Pertamina and natural gas trading firm PT Davenergy Mulia Perkasa. The agreement pertains to the development and commercialization of liquefied natural gas (LNG). As part of this arrangement, the companies would establish fundamental principles for the development and commercialization of LNG extracted from the Madura Gas Field and the adjacent fields in Indonesia.

- Therefore, according to the points discussed above, the gas pipeline segment is expected to dominate the market studied during the forecast period.

Indonesia expected to be the Largest Geographic Segment

- Indonesia has abundant natural resources, notably its extensive reserves of oil and natural gas. The country is a significant oil and gas producer, and the need to efficiently transport these resources to refineries, distribution points, and export terminals is paramount. The vast reserves and the continuous exploration for new sources create a compelling case for the expansion of oil and gas pipeline infrastructure in Indonesia.

- According to the Energy Institute Statistical Review of World Energy, oil consumption in the country increased by 8.5% between 2021 and 2022. In 2022, oil consumption was 1,585 thousand barrels per day compared to 1,461 thousand barrels per day in 2021.

- Indonesia's strategic geographic location plays a crucial role in its expected dominance in the oil and gas pipeline market. The nation consists of numerous islands and archipelagos, necessitating the construction of pipelines for efficient energy transportation. Gas pipelines, in particular, offer a cost-effective and reliable means of transporting natural gas across challenging terrain, connecting production sites to urban centers and industrial zones.

- In January 2023, Casakha announced that the commencement of design, engineering, and project management activities would take place promptly at its Jakarta offices. The offshore installation is scheduled for 2023, as outlined by the Indonesian subsea and offshore consultancy. The defined scope of work encompasses detailed engineering design, installation, transportation, and engineering tasks related to a 16-inch (40.6 centimeters) offshore pipeline connecting the LPRO and EPRO platforms.

- The growing demand for energy in Indonesia is a driving force behind the expansion of the oil and gas pipeline sector. The country's expanding population, coupled with economic development, fuels the need for energy resources. To meet this demand, investments in pipeline projects are imperative, and these pipelines serve as the primary mode of transporting oil and gas to meet the energy requirements of households, businesses, and industries.

- Indonesia's regulatory framework and government support are instrumental in its dominance in the oil and gas pipeline market. The government actively promotes the development of energy infrastructure and encourages investment in pipeline projects. Favorable regulations and incentives provided by regulatory bodies create an environment conducive to the growth of the pipeline sector, both for domestic use and export.

- Therefore, according to the points discussed above, Indonesia is expected to dominate the market studied during the forecast period.

South-East Asia Oil And Gas Pipeline Industry Overview

The Southeast Asian oil and gas pipeline market is moderately fragmented. Some of the major players in the market (in no particular order) include PT Pertamina, PTT Public Company Limited, TechnipFMC PLC, PetroVietnam, and PT. Connusa Energindo, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 List of Major Upcoming and in Pipeline Projects, Southeast Asia (Length of Pipeline, Transportation Fuel, Operator, Total CAPEX, Year of Start of Construction, and Commissioning Year)

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Energy Demand

- 4.6.1.2 Increasing Export Opportunities

- 4.6.2 Restraints

- 4.6.2.1 Volatility in Energy Prices

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Type

- 5.2.1 Crude Oil

- 5.2.2 Natural Gas

- 5.3 Country

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 PT Pertamina

- 6.3.2 PTT Public Company Limited

- 6.3.3 TechnipFMC PLC

- 6.3.4 PetroVietnam

- 6.3.5 PT. Connusa Energindo

- 6.4 Market Share

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Deployment of Smart Pipeline Systems

02-2729-4219

+886-2-2729-4219