|

市場調查報告書

商品編碼

1641892

MOOC-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)MOOC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

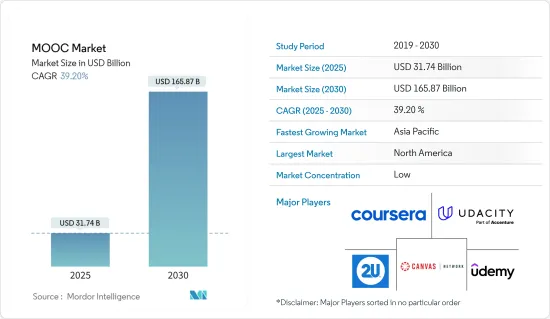

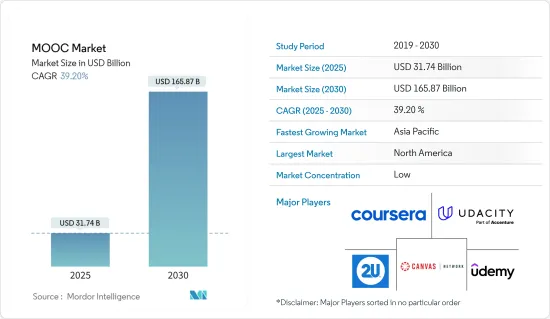

預計 2025 年 MOOC 市場規模為 317.4 億美元,到 2030 年預計將達到 1,658.7 億美元,預測期內(2025-2030 年)的複合年成長率為 39.2%。

關鍵亮點

- 數位化趨勢、智慧型手機的日益普及、網際網路的靈活可訪問性以及對具成本效益教育平台的需求不斷成長,正在推動大規模開放線上課程市場的成長。

- 資訊和通訊科技的進步迫使教育者和學習者克服時間、空間和環境的限制。雖然標準課堂教學是眾所周知的學習系統,但課外教學,尤其是透過大規模開放式線上課程(MOOC)等技術改進的課外教學,近年來取得了顯著成長。

- 由於成本低且無需任何資格限制,MOOC 在知識尋求者中獲得了相當大的吸引力。此外,這些課程可以增加人們獲得更多定性知識和專業知識的機會,從而支持人們的職業轉型。預計這些因素將在未來幾年進一步推動市場發展。

- 此外,數位化學習的轉變正在推動市場成長。隨著世界各地的學生越來越熟悉線上學習,對 MOOC 的需求也日益成長。

- 世界各國政府都在鼓勵大學和學校引入和推廣MOOC,以便為學生提供最大的利益,從而推動對MOOC的需求。

- 在新冠疫情期間,由於許多國家實施封鎖,對 MOOC 的需求激增,世界各地的學生都採用了數位學習平台。自疫情爆發以來,MOOC 的報名人數大幅增加。例如,2023 年,Coursera 發現學習者對 genAI 內容的興趣大幅增加,搜尋與前一年同期比較增加了 4 倍。為了滿足這項需求,知名大學和產業合作者開發了超過 35 個 genAI 課程和計劃,吸引了多達 570,500 名學生。這相當於全年每分鐘就有近一個人在 Coursera 上註冊 genAI 內容。

大型開放式線上課程的市場趨勢

科技領域預計將佔很大佔有率

- 技術領域是市場上成長最快的領域之一。大多數人報名參加這個類別是因為它最容易收益。此外,預測期內各行業預計將擴大採用人工智慧和資料分析等現代技術將推動該領域的成長。

- 技術部分主要包括電腦科學相關課程。 MOOC 課程大綱是根據企業和就業市場使用的最新技術和軟體設計的。在區塊鏈、人工智慧(AI)、智慧城市、加密貨幣、資料科學、資料分析、統計學、機器學習和網路安全等新興領域,MOOC 的報名人數正在增加。

- 根據 Class Central 統計,迄今為止,技術類線上課程進入前 100 名的數量最多。在過去幾年中,科技領域最受歡迎的課程包括「Python 互動程式設計簡介」(萊斯大學,透過 Coursera)、「Python 入門」(密西根大學,透過 Coursera)以及「機器學習」(史丹佛大學,透過Coursera)、「MATLAB 程式設計簡介」(范德堡大學,透過Coursera)、「人工智慧元素」(赫爾辛基大學,透過Independent)、「分而治之」、「排序與搜尋」、「隨機演算法」(史丹佛大學,透過Coursera)

- 市場細分供應商需要不斷升級其課程並推出新的基於技術的課程,以抓住技術細分市場中不斷成長的商機。

- 例如,2024年5月,東京超智慧社會技術學院的線上教育部門宣布將重新推出初學者的隨選程式設計課程。該課程名為“初學者程式設計”,將在麻省理工學院和哈佛大學聯合創辦的著名MOOC平台edX上進行。在本課程中,由工程學院的 Atsushi Takahashi 教授和 MATLAB 助教講授,參與者將學習程式設計的基礎知識。值得注意的是,不需要事先具備程式設計或將棋知識,並且參與者可以透過 MathWorks 的限時許可免費使用課程的主要工具 MATLAB。

- 此外,隨著技術科目的需求不斷增加,市場供應商也不斷推出新課程以抓住機遇,從而引領技術領域。

- 2023 年,CodinGame 報告稱,負責人最需要的技術技能是 Web 開發,其次是 DevOps 和資料庫軟體技能。有趣的是,超過 16% 的負責人主要針對具有網路安全專業知識的候選人。人工智慧/機器學習/深度學習位居第四,約四分之一的受訪者將其列為首要任務。這些趨勢反映了全球開發人員優先考慮的技術技能,尤其是 Web 開發和人工智慧/機器學習/深度學習。

亞太地區:預計市場將大幅成長

- 中國擁有龐大的工作和就學人口,正在採用數位化學習技術來提高教育公平性、品質和效率。此外,政府措施也進一步刺激了中國MOOC的發展。

- 由於數位化、智慧型手機的使用、網際網路的普及以及線上學習者數量的增加,印度和中國等亞太國家對大規模開放線上課程(MOOC)的需求龐大。

- 該地區的 MOOC 市場發展勢頭強勁,網路教育學院、JMOOC、KMOOC、M-MOOC、學堂在線、印度尼西亞的 ThaiMOOC、印度的 SWAYAM 等國家級 MOOC 門戶網站相繼建立並投入營運。

- 2024年2月,印度政府在德里推出了「SWAYAM Plus」平台。該平台與 L&T、微軟、思科等產業合作開發,致力於提升就業能力和專業技能。印度理工學院馬德拉斯分校作為中央 MOOC 平台 Swayam-NPTEL 的創始機構,將繼承其傳統,監督「SWAYAM Plus」的運作。

- 此外,MOOC 正在成為該地區許多國家教育體系的一部分,預計將在未來幾年推動市場發展。

大規模開放式線上課程產業概況

- 世界各國政府都認知到線上教育在實現學習民主化和解決公民技能差距方面的潛力。為 MOOC 平台提供資金、線上課程認證以及政府與教育機構之間的合作等努力正在為 MOOC 市場的發展創造有利環境。

- 政府資助的計畫通常針對服務不足的社區並促進數位素養和學術公平。透過支持線上教育,政府將鼓勵創新,促進合作,促進MOOC生態系統的全面發展。

- MOOC平台為偏遠地區和開發中國家的個人提供了參加頂尖大學和教育機構課程的機會,在全球範圍內實現了教育民主化。這種可訪問性打破了傳統的教育障礙,促進了學習社區的整體性和多樣性。提供多種語言的課程進一步提高了可及性並滿足了多樣化的學習者群體的需求。隨著全球對終身學習的需求不斷成長,MOOC 所提供的可近性繼續推動其採用和普及。

- MOOC市場分散且競爭激烈,主要企業包括Coursera Inc.、edX Inc.(2U)、Udacity Inc.(埃森哲)、Udemy Inc.、Canvas Networks Inc.和FutureLearn Ltd.。從市場佔有率來看,目前少數幾家大公司佔據著市場主導地位。然而,隨著創新教育平台的成長,新參與企業正在增加其市場佔有率並擴大其在新興經濟體的足跡。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 具成本效益教育平台的需求

- 全球培訓需求不斷成長

- 市場限制

- 課程完成率低

- 討論論壇和指導不佳

- 市場機會

第6章 市場細分

- 按類型

- cMOOC

- xMOOC

- 按主題類型

- 科技

- 商業

- 科學

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 西班牙

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Coursera Inc.

- edX Inc.(2U)

- Udacity Inc.(Accenture)

- Udemy Inc.

- Canvas Networks Inc.

- FutureLearn Ltd(Global University Systems)

- openSAP(SAP SE)

- 360training.com Inc.

- Iversity Inc.(Springer Nature)

- Miriadax(Telefonica Learning Services SLU)

- Blackboard Inc.(Providence Equity Partners)

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 61498

The MOOC Market size is estimated at USD 31.74 billion in 2025, and is expected to reach USD 165.87 billion by 2030, at a CAGR of 39.2% during the forecast period (2025-2030).

Key Highlights

- The growing trend of digitalization, growing penetration of smartphones, and the flexible accessibility of the internet, associated with increasing demand for cost-effective education platforms, are boosting the growth of the massive open online course market.

- The advances in information and communication technologies are forcing educators and learners to move past time, space, and environmental constraints. While standard classroom education has been a well-known learning system, education outside the classrooms, especially the one improved through technologies such as massive open online courses (MOOCs), has grown enormously over the past few years.

- MOOCs are gaining considerable traction among knowledge seekers owing to their low cost and lack of eligibility requirements. Additionally, these courses can sustain people in transitioning their careers by acquiring further qualitative knowledge and expertise and enhancing their opportunities. Such factors are further anticipated to drive the market in the coming years.

- Moreover, the shift toward digital learning has increased the growth of the market. Students worldwide are now used to online learning, increasing the need for the MOOC market.

- Governments across countries are urging universities and schools to adopt and promote MOOCs to provide maximum benefits to students, driving the need for MOOCs.

- During the COVID-19 pandemic, owing to lockdowns in many countries, the demand for MOOCs surged, with students worldwide adopting digital learning platforms. Enrollment in MOOCs has increased significantly since the pandemic. For instance, in 2023, Coursera witnessed a significant surge in interest from learners pursuing genAI content, with searches spiking four times compared to the previous year. Responding to this demand, prominent university and industry collaborators rolled out over 35 genAI courses and projects, attracting a staggering 570,500 enrollments. This translated to an enrollment rate of nearly one person per minute for genAI content on Coursera throughout the year.

Massive Open Online Course Market Trends

The Technology Segment is Expected to Hold a Major Share

- The technology segment is one of the most developed in the market. Most people enroll in this category as it is the easiest to monetize. Also, the growing adoption of the latest technologies, like AI and data analytics, across multiple industries is expected to boost the segment's growth over the forecast period.

- The technology segment mainly consists of courses related to computer science. The syllabus of MOOCs is designed around the latest technologies and software used in companies and on the job market. MOOCs see more enrollments in emerging areas like blockchain, artificial intelligence (AI), smart cities, cryptocurrency, data science, data analytics, statistics, machine learning, and cybersecurity.

- According to Class Central, among the top 100 online courses until now, technology holds the most significant number. Some of the most enrolled courses in the technology segments in the last few years include Introduction to Interactive Programming in Python (Rice University via Coursera), Getting Started with Python (the University of Michigan via Coursera), Machine Learning (Stanford University via Coursera), Introduction to Programming with MATLAB (Vanderbilt University via Coursera), Elements of AI (the University of Helsinki via Independent), and Divide and Conquer, Sorting and Searching, and Randomized Algorithms (Stanford University via Coursera).

- In order to capture the growing opportunity in the technology segment, market vendors must continuously upgrade their courses and launch new courses on technology subjects.

- For instance, in May 2024, the Tokyo Tech Academy for Super-Smart Society, under its Online Education wing, announced the re-launch of a beginner-friendly, on-demand programming course. Titled "Programming for beginners: Learning basics with computer Shogi," this course is hosted on edX, a prominent MOOC platform jointly founded by MIT and Harvard. The course, led by Professor Atsushi Takahashi and MATLAB TAs from the School of Engineering, trains participants in programming fundamentals. Notably, no prior programming or Shogi knowledge is necessary, and participants can access MATLAB, the course's primary tool, for free via a limited-time license from MathWorks.

- Further, as the need for technology subjects grows, market vendors continuously launch new courses to capture the opportunity, thus driving the technology segment.

- In 2023, CodinGame conveyed that web development stood out as the most sought-after tech skill among recruiters, followed by DevOps and database software skills. Interestingly, over 16 percent of recruiters mainly targeted candidates with cybersecurity expertise. AI/machine learning/deep learning secured the fourth spot, with about a quarter of respondents highlighting it as their top priority. These trends mirror the tech skills that developers globally prioritize, notably web development and AI/machine learning/deep learning.

Asia-Pacific Expected to Witness Significant Market Growth

- Due to its enormous working and studying population, China uses digital learning technology to enhance education equity, quality, and efficiency. Moreover, government efforts are further fostering the growth of MOOCs in China.

- Asia-Pacific countries such as India and China are witnessing significant demand for massive open online courses (MOOCs) owing to increasing digitization, smartphone use, internet penetration, and the number of online learners.

- The MOOC market is gaining momentum in the region due to the establishment and functioning of national MOOC portals, such as Indonesia's Cyber Education Institute, JMOOCs, KMOOCs, M-MOOCs, XuetangX, ThaiMOOC, and India's SWAYAM.

- In February 2024, the Government of India launched the 'SWAYAM Plus' platform in Delhi. This platform, developed in collaboration with industries such as L&T, Microsoft, and CISCO, focuses on enhancing employability and professional skills. The Indian Institute of Technology Madras will oversee the operations of 'SWAYAM Plus,' building on its heritage as a founding institution of Swayam-NPTEL, a central MOOC platform.

- Additionally, in many countries in the region, MOOCs are becoming a part of the education system, which is expected to boost the market in the coming years.

Massive Open Online Course Industry Overview

- Governments are increasingly acknowledging online education's potential to democratize access to learning and address skill gaps in their populations. Initiatives such as funding for MOOC platforms, accreditation of online courses, and partnerships between governments and educational institutions complete an enabling environment for growing the MOOC market.

- Government-sponsored programs often target underserved communities, promoting digital literacy and academic equity. By championing online education, governments encourage innovation, foster cooperation, and boost the prevailing development of the MOOC ecosystem.

- MOOC platforms provide opportunities for individuals in remote areas or developing countries to engage with courses from prestigious universities and institutions, democratizing education on a global scale. This accessibility fosters inclusivity and diversity within the learning community, breaking traditional educational barriers. The availability of courses in multiple languages further enhances accessibility, catering to a diverse audience of learners. As demand for lifelong learning grows globally, the accessibility offered by MOOCs continues to drive their widespread adoption and popularity.

- The MOOC market is fragmented and competitive and has significant players such as Coursera Inc., edX Inc. (2U), Udacity Inc. (Accenture), Udemy Inc., Canvas Networks Inc., and FutureLearn Ltd. In terms of market share, some of the major players currently dominate the market. However, with the growth of the innovative educational platform, new players are increasing their market presence and expanding their footprint across emerging economies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Cost Effective Education Platforms

- 5.1.2 Increasing Requirement of Global Training

- 5.2 Market Restraints

- 5.2.1 Low Course Completion Rate

- 5.2.2 Poor Discussion Forum and Mentoring

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 cMOOC

- 6.1.2 xMOOC

- 6.2 By Subject Type

- 6.2.1 Technology

- 6.2.2 Business

- 6.2.3 Science

- 6.2.4 Other Subject Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.2.4 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Mexico

- 6.3.5.3 Argentina

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coursera Inc.

- 7.1.2 edX Inc. (2U)

- 7.1.3 Udacity Inc. (Accenture)

- 7.1.4 Udemy Inc.

- 7.1.5 Canvas Networks Inc.

- 7.1.6 FutureLearn Ltd (Global University Systems)

- 7.1.7 openSAP (SAP SE)

- 7.1.8 360training.com Inc.

- 7.1.9 Iversity Inc. (Springer Nature)

- 7.1.10 Miriadax (Telefonica Learning Services S.L.U.)

- 7.1.11 Blackboard Inc. (Providence Equity Partners)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219