|

市場調查報告書

商品編碼

1641895

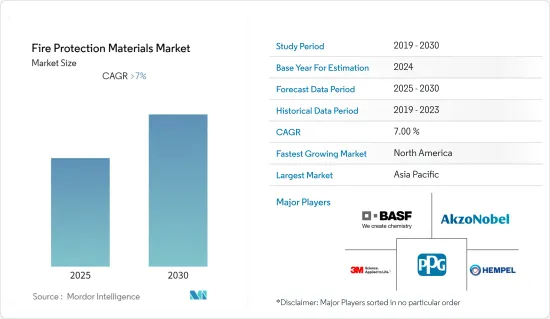

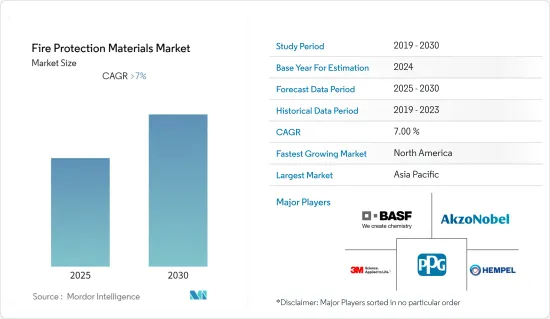

防火材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Fire Protection Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,防火材料市場預計將以超過 7% 的複合年成長率成長。

由於全球範圍內停產、大型建築計劃推遲,新冠疫情嚴重影響了防火材料市場。由於疫情過後建築市場的擴大,預計工業對防火塗料的需求將會增加。

關鍵亮點

- 預計工業化程度的提高和水泥基塗料和防煙塗料的使用將推動市場成長。

- 另一方面,被動防火產品的技術挑戰預計會阻礙市場的成長。

- 無論是在建築物還是電動車中,電器的使用日益增多,預計將在預測期內為市場成長帶來機會。

- 消防產品以亞太地區為主。然而,預計北美在預測期內的複合年成長率最高。

防火材料的市場趨勢

商業應用主導市場

- 出於安全原因,許多商業建築都可以受益於阻燃材料。商業建築使用防火組件來創建“隔間”,防止一個區域發生的火災蔓延到其他區域。被動防火材料可應用於地板、天花板、屋頂和牆壁,以提供最高等級的安全性。

- 根據歐洲公共房地產協會的數據,德國、英國和法國是最大的商業房地產市場,截至 2022 年 12 月,市場規模約為 4.8 兆美元。 2022年,德國將以約1.8兆美元的商業房地產佔有率位居歐洲首位,其次是英國和法國。

- 亞太地區長期以來對商業領域的投資十分巨大。根據中國國家統計局的數據,2021年中國房地產開發商在辦公室的投資為5,974億元人民幣(約930億美元),與前一年同期比較)。。此外,印度品牌資產基金會(IBEF)也在報告中表示,2022年第二季印度房地產領域共獲得7.04億美元的投資。

- 此外,一些重要的公司已經活性化了對商業建築領域的投資。例如2025年世博會將在大阪舉辦。自然災害後的復原和重建是建築業的主要驅動力。這座 37 層樓、230 公尺高的辦公高層建築和 61 層樓、390 公尺高的辦公大樓是東京站高層建築,分別計劃於 2021 年和 2027 年竣工。

- 此外,英國倫敦的Toblerone綜合用途大樓計劃於2021年第四季開工,並於2025年第四季完工。這個耗資 6.62 億美元的計劃預計將改造 1993 年建成的衛生署辦公室、Keyworth Street 無家可歸者宿舍、倫敦南岸大學的佩里圖書館和 Skipton House。

- 在中東,政府推出了多項舉措來促進商業部門的發展,例如沙烏地阿拉伯2030願景和阿布達比2030經濟願景,預計這些措施將大大促進防火材料的消費。

- 此外,全球各地正在進行多項商業房地產建設計劃,這可能會增加市場對安全防火材料的需求。

北美成長最快

- 北美因其建築業的支柱地位而被認為是防火材料市場最占主導地位的地區。美國擁有龐大的建築業,僱用了超過760萬人。美國建築業在商業、工業、機構、住宅和基礎設施建設中發揮著至關重要的作用,對國家經濟做出了重大貢獻。

- 根據美國人口普查局的數據,2022年12月美國在建築相關支出上花費了18,098億美元。 2022 年 12 月至 2021 年 12 月期間,建築業成長約 7.7%,當時總支出為 1.681 兆美元。防火材料市場將從中受益。

- 截至2022年12月,經季節性已調整的商業領域竣工建築總價值約為1,290億美元,較去年同期成長20%。

- 根據經濟分析局的數據,2022 年前三個季度經季節性已調整的的整個房地產行業年增加價值接近 6 兆美元。 2022年第三季度,房地產產業為整體創造價值貢獻了約2.9兆美元。

- 根據美國建築師協會的數據,美國住宅建築整體預計將在 2022 年成長 3.1%。 2022 年酒店建設預計將成長 8.8%,而辦公大樓建設預計將成長 0.1%。

- 根據加拿大統計局的數據,2022 年 8 月,加拿大的整體建築許可證數量增加了 11.9%,達到 125 億美元。住宅建築意願增加12.0%,非住宅建築意願增加11.8%。因此,民眾對於阻燃材料的需求日益增加。

- 預計所有上述因素都將推動北美市場的成長。

防火材料行業概況

防火材料市場頂部呈現局部整合態勢。部分參與企業(不分先後順序)包括 3M、 BASF SE、AkzoNobel NV、PPG Industries, Inc 和 Hempel A/S。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 工業化程度提高以及水泥基和滲透塗料的使用

- 其他促進因素

- 市場限制

- 被動防火產品的技術挑戰

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第 5 章 市場區隔(以金額為準的市場規模)

- 材料類型

- 被覆劑

- 密封劑和填料

- 砂漿

- 片材/板材

- 噴

- 油灰

- 預成型產品

- 其他材料(如碳泡沫)

- 應用

- 商業的

- 業/設施

- 住宅

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 荷蘭

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- Vendor Tier Analysis

- 主要企業策略

- 公司簡介

- 3M

- AkzoNobel NV

- BASF SE

- Contego International Inc.

- Etex Group

- Fire Protection Coatings Ltd

- Hempel A/S

- Hilti Group

- Isolatek International

- Morgan Advanced Materials

- PPG Industries Inc.

- RectorSeal

- Sika AG

- The Sherwin-Williams Company

- Tremco CPG Inc.

- USG Corporation

- WR Grace & Co.-Conn.

第7章 市場機會與未來趨勢

- 建築物中電器和電動車的使用日益增多

The Fire Protection Materials Market is expected to register a CAGR of greater than 7% during the forecast period.

Due to the production suspension and large construction project postponement all over the world, COVID-19 had a severe effect on the fire protection material market. Nevertheless, the industry's demand for fire protective coatings is anticipated to increase with the expanding building market following the pandemic.

Key Highlights

- Increased industrialization and the use of cementitious and intumescent coatings are expected to enhance the market growth.

- On the flip side, the technical challenges of passive fire protection products are expected to hinder the studied market's growth.

- During the projected period, it is anticipated that the growing use of electrical products, whether in buildings or electric vehicles, will provide an opportunity for market growth.

- Asia-Pacific region dominated the market for fire protection products. However, North America is anticipated to register the greatest CAGR during the forecast period.

Fire Protection Materials Market Trends

Commercial Application to dominate the market

- Many business structures can benefit from fire protection materials for safety reasons. Commercial buildings use fire protection elements to preserve "compartmentation," ensuring that a fire in one area won't spread to another. Passive fire prevention materials can be applied to floors, ceilings, roofs, and walls to offer the best safety level.

- According to the European Public Real Estate Association, Germany, the United Kingdom, and France includes the largest commercial real estate markets, worth approximately USD 4.8 trillion as of December 2022. Germany had an enormous share value of commercial real estate in Europe in 2022, with a total value of approximately USD 1.8 trillion, followed by the United Kingdom and France.

- The Asia-Pacific region witnessed significant investments in the commercial sector for a long time. According to the National Bureau of Statistics of China, real estate developers in China invested CNY 597.4 billion (~USD 93 billion) in office buildings across the whole year of 2021, a drop of around CNY 52 billion (~USD 8 billion) compared to the previous year. Moreover, the Indian Brand Equity Foundation (IBEF) also stated in its report that a total of USD 704 million had been invested in the real estate sector in India in the second quarter of 2022.

- Several significant businesses also boosted their investments in the commercial construction sector. For instance, the 2025 World Expo will be held in Osaka. Recovery from natural calamities and redevelopment are the main forces behind the construction. A 37-story, 230m-tall office skyscraper and a 61-story, 390m-tall office tower are two high-rise towers for Tokyo Stations expected to be finished in 2021 and 2027, respectively.

- Also starting in the fourth quarter of 2021 and scheduled to be finished in the fourth quarter of 2025 is the Toblerone Mixed-Use Towers project in London, United Kingdom. The USD 662 million projects is anticipated to transform the 1993-built Department of Health offices, Keyworth Street Hostel for the Homeless, Perry Library at London South Bank University, and Skipton House.

- In the Middle East, several government initiatives to bolster commercial sector development, such as Saudi Arabia Vision 2030 and Abu Dhabi Economic Vision 2030, are likely to substantially contribute to driving fire protection material consumption.

- Several other commercial real estate construction projects are underway all across the globe, which would, in turn, increase the demand for fire protection materials in the market for safety purposes.

North America to Witness the Fastest Growth

- North America is considered the most dominating fire protection materials market region, owing to its foothold in the construction industry. The United States boasts a colossal construction sector with over 7.6 million employees. The United States construction sector significantly contributes to the country's economy by playing a prominent role in commercial, industrial, institutional, residential, and infrastructure construction.

- According to the US Census Bureau, the United States spent USD 1,809.8 billion on construction-related costs in December 2022. The construction sector increased by about 7.7% between December 2022 and December 2021, when the total amount spent was USD 1,681.0 billion. The market for fire protection materials would subsequently be benefited from this.

- As of December 2022, the total construction value put in place according to the seasonally adjusted rate in the commercial sector was about USD 129 billion, 20% more than the previous year's value for the same period.

- According to the Bureau of Economic Analysis, the value added at the seasonally adjusted annual rates by the overall real estate industry in the first three quarters of 2022 was close to USD 6 trillion. The third quarter of 2022 contributed around USD 2.9 trillion to the overall value created by the real estate sector.

- According to the American Institute of Architects, overall non-residential building construction in the United States is expected to grow to 3.1% in 2022. The construction of hotels is expected to rise by 8.8% in 2022, and office spaces by 0.1%.

- Even in Canada, the overall value of building permits grew by 11.9% to USD 12.5 billion in August 2022, according to Statistics Canada. Residential construction intentions increased by 12.0%, while non-residential construction intentions increased by 11.8%. It is, hence raising the nation's need for fire protection materials.

- All the abovementioned factors will likely drive market growth in the North American region.

Fire Protection Materials Industry Overview

The fire protection materials market is partially consolidated at the top. Some players (not in any particular order) include 3M, BASF SE, AkzoNobel N.V., PPG Industries, Inc, and Hempel A/S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Industrialization and Increased Use of Cementitious and Intumescent Coatings

- 4.1.2 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Technical Challenges of Passive Fire Protection Products

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Coatings

- 5.1.2 Sealants and Fillers

- 5.1.3 Mortar

- 5.1.4 Sheets/Boards

- 5.1.5 Sprays

- 5.1.6 Putty

- 5.1.7 Preformed Devices

- 5.1.8 Other Material Types (Carbon Foam, etc.)

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Industrial/Institutional

- 5.2.3 Residential

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Netherlands

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Tier Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M

- 6.3.2 AkzoNobel N.V.

- 6.3.3 BASF SE

- 6.3.4 Contego International Inc.

- 6.3.5 Etex Group

- 6.3.6 Fire Protection Coatings Ltd

- 6.3.7 Hempel A/S

- 6.3.8 Hilti Group

- 6.3.9 Isolatek International

- 6.3.10 Morgan Advanced Materials

- 6.3.11 PPG Industries Inc.

- 6.3.12 RectorSeal

- 6.3.13 Sika AG

- 6.3.14 The Sherwin-Williams Company

- 6.3.15 Tremco CPG Inc.

- 6.3.16 USG Corporation

- 6.3.17 W. R. Grace & Co.-Conn.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of Electric Products in Buildings and Electric Vehicles