|

市場調查報告書

商品編碼

1641911

低功耗 WAN:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Low-Power WAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

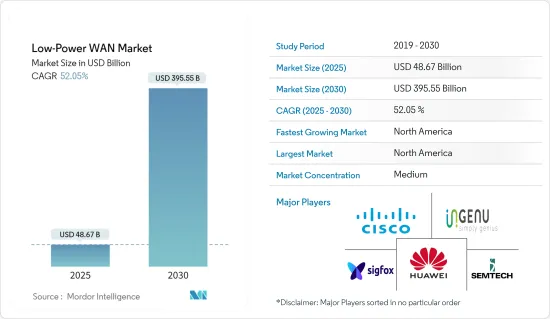

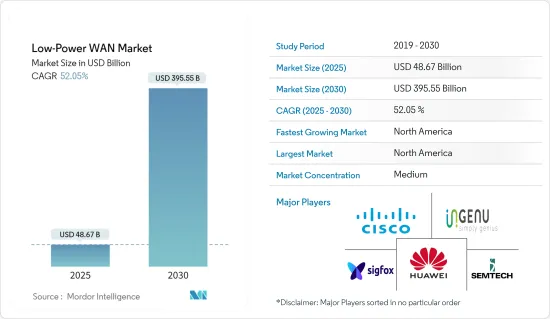

低功耗廣域網路市場規模在 2025 年預計為 486.7 億美元,預計到 2030 年將達到 3955.5 億美元,預測期內(2025-2030 年)的複合年成長率為 52.05%。

主要亮點

- 低功耗廣域網路 (LPWAN) 是一種無線廣域網,可長距離以低位元率遠距低頻寬、電池供電的裝置。物聯網 (IoT) 應用中對低功耗、廣域連接不斷成長的需求預計將在預測期內推動市場成長。

- 鑑於工業應用的關鍵任務性質,工業物聯網 (IIoT) 要求營運商級通訊網路的可靠性。高訊息接收率對於確保關鍵資料可用於及時回應潛在問題非常重要。從資產追蹤和人員存在檢測,到空氣品質監測和漏水檢測,物聯網感測器涵蓋多個行業並收集大量業務關鍵資料。這些資料將提高業務的可見度和效率,降低成本,從而刺激市場成長。

- 在農業領域,這些特徵可以幫助提高生產力並監測作物生長。 LPWAN遠距傳輸少量資料的能力預計將推動市場成長。 LPWAN 的主要應用包括車隊管理、GPS 追蹤、智慧計量、智慧電網管理、家庭自動化、廢棄物管理、製程監控、溫度監控等。

- 然而,未來覆蓋範圍和可擴展性、技術共存以及即時通訊的挑戰可能會阻礙 LPWAN 的廣泛採用和商業化。此外,它還引發了網路安全問題,特別是因為它被認為比直接向端點傳輸資料可靠性更低且更容易受到干擾。

- 儘管面臨這些挑戰,LPWAN 設備仍在工業IoT、智慧城市、智慧家庭和公共產業等領域中得到全球應用。加密閘道器、智慧型裝置和網路伺服器之間通訊的根密鑰可能成為網路攻擊的目標。此類違規行為可能導致 DDoS 攻擊、資料外洩和虛假資料注入,破壞系統並阻礙市場成長。聯邦調查局對過時和未打補丁的設備的警告凸顯了網路犯罪分子利用網路連接設備漏洞的威脅日益增加。

低功耗廣域網路市場趨勢

智慧城市將主導市場

- 都市化進程的加速正在推動全球智慧城市的崛起。聯合國預計,2050年,印度城市人口將增加4.04億,中國和奈及利亞城市人口將分別增加2.92億和2.12億。拉丁美洲作為新興大陸,正經歷全球最快的都市化速度。經合組織預測,2010年至2030年間,全球對智慧城市計畫的投資將達到1.8兆美元。智慧城市發展的浪潮將會刺激市場需求。

- 為了應對城市挑戰,印度政府推出了國家智慧城市計畫(SCM),以改善生活水準並刺激城市發展。這100個城市是透過兩階段競賽選出的。這些城市將使用人工智慧、機器學習和即時政府監控等先進技術來增強其基礎設施。隨著人口成長和都市化進程的推進,城市將採用新技術和網路來解決資源稀缺問題。透過“智慧城市解決方案”,城市政府擴大採用物聯網 (IoT)。

- 該地區處於物聯網革命的前沿,並引領智慧城市平台的發展。物聯網智慧城市的基礎技術為都市區提供了最佳化資源的智慧。這涵蓋了從空氣和水質到交通和能源系統等一系列領域。根據《智慧美國》的報告,美國城市政府計劃在未來 20 年內投資約 41 兆美元來實現基礎設施的現代化並全面擁抱物聯網功能。

- 由於強勁的經濟、先進的基礎設施和有利於創新的市場,美國正經歷智慧城市計畫的激增。美國擁有眾多智慧城市以及從產業巨頭到新興企業的各類參與者,已成為智慧城市活動的熱鬧中心。

- 截至 2024 年 3 月,Nomad List 將倫敦列為數位遊牧者的首選目的地,約佔全球旅行的 2.3%。 Viavision 進一步指出,到 2023 年 4 月,美國將以 503 個城市接入 5G 成為全球第一,超過中國的 356 個城市。網路普及率的提高將成為智慧城市物聯網連結的支柱,並對建立智慧城市平台至關重要。

北美佔有最大市場佔有率

- 北美處於智慧城市機芯和工業物聯網的前沿,正快速普及 LPWAN(低功率廣域網路)。該地區正在努力實現智慧城市擴張,這將推動LPWAN的存在。

- 擴大 LPWAN 的應用,例如智慧計量、家庭能源管理、建築自動化和安全照明,對於推動需求至關重要。 LPWAN 在 1GHz 以下和 3GHz 以下等未經授權的頻寬運行,可確保資料傳輸的可存取性和安全性。這項功能引發了人們對物聯網設備安全性的擔憂,並使得加密通訊成為必要。

- 地方政府正積極資助和推動從傳統電錶到智慧電錶的轉變。一個顯著的例子是西孟菲斯,該市於 2023 年獲得了 285 萬美元的津貼,用於將家庭和企業中的 9,000 多台模擬水錶升級為先進的智慧版本。

- 對智慧農業的投資正在幫助該地區利用數位技術和自動化來加強低功耗廣域網路市場。作為美國政府「糧食安全未來」舉措的一部分,美國國際開發署(USAID)承諾於 2023 年 12 月投資 1 億美元,用於氣候智慧型農業創新。

- 主要企業正在建立戰略夥伴關係以支持 5G 連接。一個典型的例子是諾基亞 2023 年 8 月與酵母合作為加拿大的 5G 網路提供支援。透過利用諾基亞節能的 AirScale 產品組合(包括 5G RAN), 酵母有望實現更快的速度、更好的效能和更大的網路容量,並輔以新建設和站點升級。

低功耗廣域網路產業概覽

低功耗廣域網路市場比較分散。隨著物聯網生態系統的興起,LPWAN 等各種技術不斷發展,推動參與者投資市場。而且,各參與者也隨著技術升級而逐步進入市場。主要參與者包括思科系統公司、Sigfox SA、美國電話電報公司、沃達豐集團、Semtech 公司、華為技術有限公司和 Ingenu 公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 設備之間遠距連接的需求日益增加

- 5G 技術推動市場成長

- 市場限制

- 隱私和安全問題

第6章 市場細分

- 按類型

- LoRaWAN

- NB-IoT

- LTE-M

- 其他類型(Sigfox、Weightless 等)

- 按服務

- 專業服務

- 託管服務

- 按最終用戶

- 石油和天然氣

- 消費性電子產品

- 衛生保健

- 製造業

- 物流與旅遊

- 其他最終用戶

- 按應用

- 智慧城市

- 智慧家庭/建築

- 智慧農業

- 其他應用

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Semtech Corporation

- Sigfox SA

- Huawei Technologies Co. Ltd

- Ingenu Inc.

- Cisco Systems Inc.

- AT&T Inc.

- Vodafone Group PLC

- Loriot AG

第8章投資分析

第9章 市場機會與未來趨勢

The Low-Power WAN Market size is estimated at USD 48.67 billion in 2025, and is expected to reach USD 395.55 billion by 2030, at a CAGR of 52.05% during the forecast period (2025-2030).

Key Highlights

- A low-power WAN (LPWAN) is a wireless wide-area network that connects low-bandwidth, battery-operated devices over vast distances at low bit rates. As the demand for low-power, wide-area connectivity in Internet of Things (IoT) applications continues to rise, the market is expected to grow during the forecast period.

- Given the mission-critical nature of industrial applications, the Industrial Internet of Things (IIoT) demands carrier-grade communication network reliability. High message ingestion rates are crucial, ensuring vital data is available for timely responses to potential issues. IoT sensors, spanning industries from asset tracking and human presence detection to air quality monitoring and leak detection, gather vast amounts of business-critical data. This data enhances operational visibility and efficiency and reduces cost, fueling market growth.

- In agriculture, these capabilities can double productivity and assist in monitoring crop development. LPWAN's ability to transmit small data volumes over long distances is expected to bolster market growth. Key applications of LPWAN include fleet management, GPS tracking, smart meters, smart grid management, home automation, waste management, process monitoring, and temperature oversight.

- However, future coverage and scalability challenges, technological coexistence, and real-time communication could impede LPWAN's widespread adoption and commercialization. Moreover, network security concerns arise, especially since it is deemed less reliable than direct data transmission to endpoints and may be susceptible to interference.

- Despite these challenges, LPWAN devices find global applications in sectors like industrial IoT, smart cities, smart homes, and utilities. Yet, vulnerabilities persist: root keys for encrypting communications between gateways, smart devices, and network servers can be targets for cyber-attacks. Such breaches can lead to DDoS attacks, data leakage, and false data injection, disrupting systems and hindering market growth. The FBI has warned about unpatched and outdated devices, highlighting the growing threat of cybercriminals exploiting vulnerabilities in internet-connected devices.

Low-Power WAN Market Trends

Smart Cities Hold a Significant Share of the Market

- As urbanization accelerates, smart cities are emerging globally. The United Nations predicts that by 2050, India will see an increase of 404 million urban residents, while China and Nigeria will each experience an influx of 292 million and 212 million urban residents, respectively. Latin America, an emerging continent, is witnessing the fastest urbanization rates worldwide. The OECD forecasts that global investments in smart city initiatives will approach USD 1.8 trillion from 2010 to 2030, encompassing all metropolitan infrastructure projects. This surge in smart city developments is set to boost demand in the market.

- In response to urban challenges, the Government of India launched the National Smart Cities Mission (SCM) to uplift urban living standards and stimulate growth. A two-stage competition selected 100 cities for this initiative. These cities will leverage advanced technologies to enhance infrastructure, including artificial intelligence, machine learning, and real-time governmental monitoring. As populations swell and urbanization intensifies, cities turn to modern technologies and networks to address resource shortages. Through "smart city solutions," urban governments are increasingly adopting the Internet of Things (IoT).

- This region is spearheading the IoT revolution, leading the way in the development of smart city platforms. The technology powering IoT smart cities endows urban areas with the intelligence to optimize resources. This spans various domains, from air and water quality to transportation and energy systems. Smart America reports that US city governments plan to invest about USD 41 trillion over the next 20 years to modernize infrastructure and fully leverage IoT capabilities.

- The United States is witnessing a surge in smart city initiatives strengthened by a robust economy, advanced infrastructure, and a market that champions innovation. With numerous smart cities and a diverse range of players, from industry giants to startups, the United States is a bustling hub for smart city activities.

- As of March 2024, Nomad List highlighted London as the top destination for digital nomads, representing about 2.3% of global trips. Additionally, viavision noted that in April 2023, the United States led globally with 5G access in 503 cities, outpacing China's 356 cities. Rising internet penetration is pivotal for establishing intelligent city platforms, forming the backbone for IoT connections in smart cities.

North America Holds Largest Market Share

- North America, at the forefront of the smart city movement and the Industrial Internet of Things, is witnessing a surge in LPWAN (low power wide area network) adoption. The region's strides toward smart city expansion are set to amplify LPWAN's prominence.

- LPWAN's growing applications, spanning smart meters, home energy management, building automation, and security lighting, are pivotal in driving demand. Operating on unlicensed spectrum bands, such as the sub-1 GHz or sub-3 GHz range, LPWANs ensure data transmission is accessible yet secure. This capability addresses rising concerns over IoT device security and the imperative for encrypted communication.

- Regional governments are actively funding the transition from traditional to smart meters to modernize. A notable example is West Memphis, which secured a USD 2.85 million grant in 2023 to upgrade over 9,000 analog water meters to advanced smart versions in homes and businesses.

- Investing in smart agriculture, the region is harnessing digital technologies and automation, bolstering the low-power WAN market. Highlighting this commitment, USAID (United States Agency for International Development) pledged a USD 100 million investment in December 2023, targeting climate-smart agriculture innovations as part of the US government's Feed the Future initiative.

- Key industry players are forging strategic partnerships to support 5G connectivity. A prime example is the August 2023 collaboration between Nokia and Eastlink to enhance Canada's 5G network. Leveraging Nokia's energy-efficient AirScale portfolio, including 5G RAN, Eastlink anticipates faster speeds, better performance, and heightened network capacity, complemented by new constructions and site upgrades.

Low-Power WAN Industry Overview

The low-power WAN market is fragmented. With the increase in the IoT ecosystem, various technologies, such as LPWAN, are evolving, which drives the players to invest in the market. Moreover, the players are gradually entering the market with technological upgrades. Some key players include Cisco Systems Inc., Sigfox SA, AT&T Inc., Vodafone Group PLC, Semtech Corporation, Huawei Technologies Co. Ltd, and Ingenu Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need of Long Range Connectivity Between Devices

- 5.1.2 5G Technology to Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LoRaWAN

- 6.1.2 NB-IoT

- 6.1.3 LTE-M

- 6.1.4 Other Types (Sigfox, Weightless, etc.)

- 6.2 By Service

- 6.2.1 Professional Service

- 6.2.2 Managed Service

- 6.3 By End User

- 6.3.1 Oil and Gas

- 6.3.2 Consumer Electronics

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Logistics and Travelling

- 6.3.6 Other End Users

- 6.4 By Application

- 6.4.1 Smart Cities

- 6.4.2 Smart Homes/Buildings

- 6.4.3 Smart Agriculture

- 6.4.4 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Semtech Corporation

- 7.1.2 Sigfox SA

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Ingenu Inc.

- 7.1.5 Cisco Systems Inc.

- 7.1.6 AT&T Inc.

- 7.1.7 Vodafone Group PLC

- 7.1.8 Loriot AG