|

市場調查報告書

商品編碼

1641925

嵌入式分析:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Embedded Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

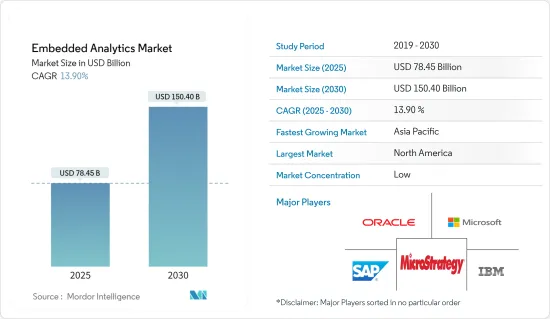

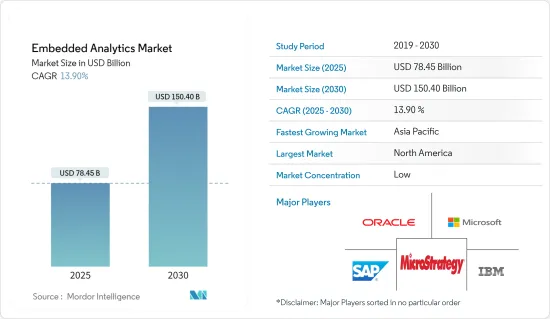

嵌入式分析市場規模預計在 2025 年為 784.5 億美元,預計到 2030 年將達到 1504 億美元,預測期內(2025-2030 年)的複合年成長率為 13.9%。

嵌入式分析是整合到公司軟體程式中的最終用戶 BI 和分析解決方案。嵌入式分析不是獨立於平台的服務,而是一種固有的應用程式元件。這項研究將使用戶能夠處理品質更好的資料並更快地產生報告。

主要亮點

- 推動嵌入式分析市場發展的關鍵因素是企業中巨量資料和物聯網 (IoT) 的擴展、行動裝置和雲端技術的可靠性,以及對資料分析與業務應用程式整合的日益成長的需求。

- 此外,資料量和種類的增加,以及銀行和其他金融機構對金融交易 IT 系統日益成長的需求也推動了嵌入式分析的需求。

- 巨量資料應用的興起將大大促進嵌入式分析的廣泛應用。因此,巨量資料和分析解決方案的收益近年來持續成長。

- 然而,高昂的替換成本以及舊有系統與新 API 的不相容性,增加了資料短缺的風險,預計將在預測期內阻礙市場收益的成長。

- 市場報告指出,COVID-19 疫情為市場創造了成長機會,因為網路購物、食品訂購、數位化支付方式等為企業提供了大量資料。嵌入式分析工具透過產生的數位化資料企業提供了 COVID-19 期間的資料趨勢和見解,從而促進了市場成長。

嵌入式分析市場趨勢

行動裝置和雲端處理技術的使用增加將推動顯著成長

- 雲端技術和行動裝置對於有效利用先進的商業應用程式至關重要。整合嵌入式分析軟體的行動裝置支援即時資料視覺化。

- 由於業務營運的改善和對客戶行為的更深入了解,雲端運算技術的日益普及預計將推動市場收益的成長。

- 此外,對嵌入式分析軟體的需求增加可以提高生產力、節省營運費用並減少審查資料所需的時間。由於這些原因,預計預測期內對嵌入式分析軟體的需求將會增加。

- 雲端處理可以幫助企業整合和更好地了解資料。雲端基礎的資料倉儲提供即時且安全的資訊存取。此外,整合可以透過資料分析實現即時預測模型。

- 許多企業正在採用雲端業務分析,因為它提供了可擴展、有彈性且不需要不斷維護內部基礎設施的經濟實惠的基礎設施。隨著雲端運算越來越普及,企業需要開發一個能夠為託管資料和資料帶來益處的強大平台。

預計北美將佔據主要佔有率

- 與其他地區相比,北美各終端用戶行業的資料現代化技術採用率最高,這被認為是推動該地區採用嵌入式分析等各種分析解決方案的關鍵因素。該地區是蘋果、Facebook、IBM 和谷歌等許多大公司的所在地,因此在 ICT 行業中保持領先地位。

- 此外,先進技術的採用、對適當技術基礎設施的需求不斷成長、對嵌入式分析工具的需求成長以及全部區域大量公司的存在正在推動嵌入式分析軟體市場的成長。

- 醫療保健、BFSI 和製造業等終端用戶產業大量採用了嵌入式分析等分析解決方案,在該地區佔據主導地位。因此,預計預測期內該地區嵌入式分析解決方案的採用將大幅成長。

- 該地區在雲端服務應用也佔據主導地位。因此,該國的分析提供者正在透過雲端領域的合作夥伴關係和協作進行創新。

嵌入式分析產業概覽

嵌入式分析市場競爭激烈,有 IBM 公司、SAP SE 和微軟等全球性公司參與。隨著許多新興國家的中小企業從傳統經營模式轉向數位化和資料主導的模式,企業正在尋求新興市場以獲得競爭優勢。

- 2022 年 7 月 - TIBCO Software 宣布對 TIBCO Cloud Integration(TIBCO Cloud 推出的業界認可的 iPaaS)進行重大改進。這擴大了混合環境中應用程式、資料和設備整合的可能性,幫助客戶應對動盪的環境,加速業務成果。 TIBCO Cloud Integration 大幅加速了整個企業的業務流程自動化和數位資產的整合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 對高階商業資料分析技術的需求不斷增加

- 資料驅動型組織的崛起

- 行動商業智慧和巨量資料分析的採用日益增多

- 行動裝置和雲端運算技術的使用日益增多

- 市場限制

- 許可挑戰和相關成本上升

第6章 市場細分

- 按解決方案

- 軟體

- 服務

- 按組織規模

- 中小企業

- 大型企業

- 按部署

- 雲

- 本地

- 按行業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 零售

- 能源與公共產業

- 製造業

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- MicroStrategy Incorporated

- Oracle Corporation

- Tableau Software(Sales Force, Inc.)

- TIBCO Software, Inc.

- Birst, Inc.(Infor Inc.)

- Logi Analytics, Inc

- QlikTech International AB

- Sisense Inc.

- Information Builders, Inc.

- OpenText Corp.

- Yellowfin International Pty Ltd

- GoodData Corporation

- Izenda, Inc.

- Vertica Systems, Inc.(HPE)

- WNS Global Services SA(Pty)Ltd

- Exago, Inc.

第8章投資分析

第9章:市場的未來

The Embedded Analytics Market size is estimated at USD 78.45 billion in 2025, and is expected to reach USD 150.40 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

Embedded analytics is a BI and analytics solution aimed at end users that are integrated into company software programs. Embedded analytics is a component of the intrinsic application rather than a platform-independent service. This study enables users to work with higher-quality data and generate reports quickly.

Key Highlights

- The primary factors driving the embedded analytics market are big data and the Internet of Things (IoT) expansion in businesses, the dependability of mobile devices and cloud technologies, and the rising demand for data analytics integration with business applications.

- In addition, the increase in volume and variety of data and the growing demand for IT systems for financial transactions in banks and other financial institutes are also driving the need for embedded analytics.

- An increase in big data applications would significantly contribute to the acceptance of embedded analytics. Thus, there has been consistent growth in big data and analytics solutions' revenue in recent years.

- However, high replacement costs and legacy systems are incompatible with new APIs, which increases the risk of data insufficiency, which is expected to hamper the market revenue growth during the forecast period.

- The market report finds that the COVID-19 pandemic created growth opportunities for the market as Online shopping, food ordering, and digitized payment methods provided a data pool to businesses. Embedded analytic tools provided companies with data trends and insights during COVID-19 through the generated digitized data, which boosted market growth.

Embedded Analytics Market Trends

Increasing Use of Mobile Devices and Cloud Computing Technologies to Witness Significant Growth

- To effectively use advanced business applications, cloud technologies and mobile devices are crucial. Mobile devices integrated with embedded analytics software support real-time data visualization.

- Increased use of cloud computing technology improves business operations and provides better insight into customer behavior, which is anticipated to drive market revenue growth.

- Additionally, the growing requirement for embedded analytics software will boost productivity, save operating expenses, and save time when reviewing data. The demand for embedded analytics software is anticipated to increase due to these reasons over the forecast period.

- Businesses can combine data and improve the comprehension of their data with the help of cloud computing. Through a cloud-based data warehouse, information may be instantly and securely accessible. Additionally, consolidation makes real-time prediction models possible through data analysis.

- Numerous businesses employ cloud business analytics because it provides scalable, elastic, and affordable infrastructure that doesn't require ongoing maintenance of internal infrastructure. The rising popularity of cloud computing pushes enterprises to develop a solid platform that can benefit both hosted and on-premise data.

North America is Expected to Hold Major Share

- The adoption of data modernization technologies across various end-user industries in the North America region is the highest, compared to other regions; it is the major factor driving the adoption of various analytical solutions, like embedded analytics in the region. The region maintains its position in the ICT industry, as it is home to many large corporations, such as Apple, Facebook, IBM, and Google.

- Moreover, The implementation of advanced technology, Increasing demand for Adequate technology infrastructure, the subsequent growth in the demand for embedded analytics tools, and the presence of a large number of enterprises across the region drive the Embedded Analytics software market to grow.

- Several end-user industries, like healthcare, BFSI, and manufacturing, among others, with significant adoption of analytics solutions, such as embedded analytics, hold a dominant position in the region. Hence, the adoption of embedded analytics solutions, in the region, is expected to grow significantly during the forecast period.

- Also, the region is a dominant player in the cloud services applications. Therefore, the analytics providers in the country are innovating by entering partnerships and collaborations in the caloud space.

Embedded Analytics Industry Overview

The embedded analytics market is highly competitive because of the the presence of global corporations like IBM Corporation, SAP SE,Microsoft Corporation, Companies pursue emerging markets to obtain competitive advantages since many small and medium-sized businesses in developing countries switch from traditional business models to digital and data-driven ones.

- July 2022 - TIBCO software has announced significant enhancements to TIBCO cloud integration, its industry-recognized iPaaS offering by TIBCO cloud, which expands the potential for integration of applications, data, and devices across hybrid environments, assisting customers grappling in a volatile to accelerate business outcomes. TIBCO Cloud Integration delivers remarkably faster automation of business processes and integration of digital assets across the enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Advanced Analytical Techniques for Business Data

- 5.1.2 Increasing number of Data Driven Organizations

- 5.1.3 Increasing Adoption of Mobile BI and Big Data Analytics

- 5.1.4 Increasing Use of Mobile Devices and Cloud Computing Technologies

- 5.2 Market Restraints

- 5.2.1 Licensing Challenges and Higher Associated Costs

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Size of Organisation

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT and Telecommunication

- 6.4.3 Healthcare

- 6.4.4 Retail

- 6.4.5 Energy and Utilities

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 SAP SE

- 7.1.4 SAS Institute Inc.

- 7.1.5 MicroStrategy Incorporated

- 7.1.6 Oracle Corporation

- 7.1.7 Tableau Software (Sales Force, Inc.)

- 7.1.8 TIBCO Software, Inc.

- 7.1.9 Birst, Inc. (Infor Inc.)

- 7.1.10 Logi Analytics, Inc

- 7.1.11 QlikTech International AB

- 7.1.12 Sisense Inc.

- 7.1.13 Information Builders, Inc.

- 7.1.14 OpenText Corp.

- 7.1.15 Yellowfin International Pty Ltd

- 7.1.16 GoodData Corporation

- 7.1.17 Izenda, Inc.

- 7.1.18 Vertica Systems, Inc. (HPE)

- 7.1.19 WNS Global Services SA (Pty) Ltd

- 7.1.20 Exago, Inc.